Monday's D-Wave Quantum (QBTS) Stock Plunge: Exploring The Causes

Table of Contents

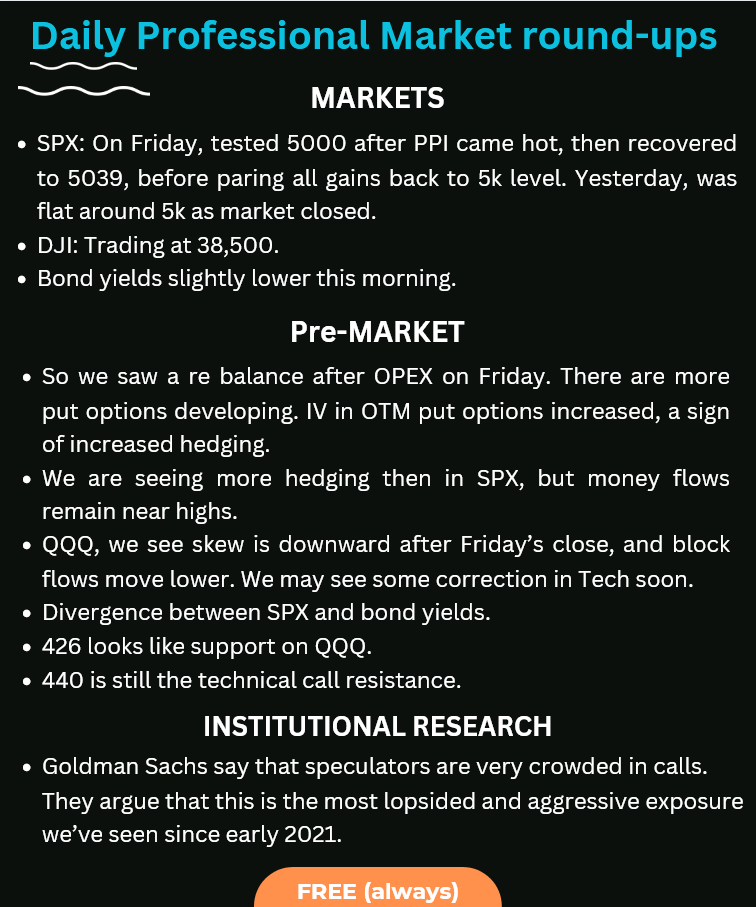

Market Sentiment and the Broader Tech Downturn

The D-Wave Quantum (QBTS) stock plunge didn't occur in a vacuum. It coincided with a broader negative sentiment sweeping the technology sector, particularly impacting high-growth, speculative stocks. This overall market downturn played a significant role in QBTS's decline.

- Broader Market Indicators: On the day of the QBTS drop, major market indices like the Nasdaq Composite and the S&P 500 also experienced significant declines, indicating a general risk-off sentiment among investors.

- Negative Tech News: Several pieces of negative news affecting the tech sector as a whole contributed to the overall negative sentiment. This included concerns about rising interest rates, inflation, and potential recessionary pressures. These macroeconomic factors often disproportionately impact growth stocks like QBTS.

- Risk Aversion: The prevailing risk aversion in the market led investors to shed assets perceived as riskier, including those in the still-developing quantum computing sector. This flight to safety contributed significantly to the QBTS stock price decline.

The correlation between the overall market trends and the QBTS plunge is undeniable. The negative sentiment across the tech sector amplified the impact of any company-specific news, exacerbating the D-Wave Quantum (QBTS) stock plunge.

D-Wave Quantum's Recent Financial Performance and Announcements

Examining D-Wave Quantum's recent financial performance and any announcements made around the time of the stock drop is crucial to understanding the plunge. While specific financial details may require further research based on the actual timing of the event, the principle remains the same.

- Earnings Reports and Financial Updates: Any earnings reports or financial updates released before or around the stock drop should be carefully analyzed. Disappointing revenue figures or lowered future forecasts would negatively impact investor confidence.

- Revenue and Forecasts: If D-Wave released disappointing revenue figures or significantly lowered its revenue forecasts, it would likely trigger a sell-off. Investors react negatively to signs of underperformance compared to expectations.

- Management Changes and Strategy Shifts: Any unexpected changes in management or significant alterations in company strategy could also contribute to investor uncertainty and a stock price drop. Uncertainty breeds risk aversion in the market.

Connecting financial news directly to the stock price movement requires a careful examination of the timing and content of any announcements made by D-Wave Quantum. Negative financial news, even if not explicitly connected to the quantum computing technology itself, can have a significant impact on investor sentiment and the stock price.

Competitive Landscape and Technological Advancements

The quantum computing industry is fiercely competitive, and advancements by competitors can significantly impact investor sentiment towards individual companies. This competitive landscape played a role in the D-Wave Quantum (QBTS) stock plunge.

- Key Competitors and Advancements: Companies like IBM, Google, and IonQ are major players in the quantum computing field. Significant breakthroughs announced by these competitors could overshadow D-Wave's progress, leading to a reassessment of D-Wave's market position.

- Impact on Investor Confidence: Positive news from competitors, especially regarding technological advancements or securing significant funding, could negatively impact investor confidence in D-Wave and lead to a sell-off. Investors might shift their investments to companies perceived as more promising.

- Technological Disruptions: Breakthroughs in related technologies, even those not directly competing with D-Wave's specific approach to quantum computing, could indirectly influence investor perceptions and the QBTS stock price.

Market share concerns and the perception of technological disruption significantly influence the valuation of companies in rapidly evolving industries like quantum computing. The D-Wave Quantum (QBTS) stock plunge might reflect concerns about its competitive positioning and the potential for disruptive technologies.

Analyst Ratings and Investor Sentiment

Analyst ratings and overall investor sentiment contribute significantly to stock price fluctuations. Changes in these areas can trigger significant shifts in the market.

- Downgrades and Negative Comments: Downgrades by financial analysts or negative comments from influential figures in the investment community can negatively affect investor confidence and lead to a sell-off.

- Social Media Sentiment: Social media chatter and news reports can influence investor sentiment, amplifying existing concerns and potentially contributing to a downward price trend. Negative narratives can quickly spread and impact stock prices.

- Sell-Off Recommendations: Recommendations from analysts to sell QBTS stock can trigger a significant sell-off, accelerating the downward price movement.

The interplay between analyst ratings and investor sentiment can create a feedback loop, further amplifying the impact of other factors contributing to the D-Wave Quantum (QBTS) stock plunge.

Conclusion

This article explored several potential factors contributing to Monday's sharp decline in D-Wave Quantum (QBTS) stock. These factors include the overall negative market sentiment in the tech sector, D-Wave's own financial performance and announcements (if any), the competitive landscape in quantum computing, and shifts in analyst ratings and investor sentiment. Understanding these interwoven elements provides valuable insight into the volatility of the quantum computing investment market.

Call to Action: While the reasons behind the D-Wave Quantum (QBTS) stock plunge are complex, staying informed about market trends, company developments, and competitive advancements is crucial for successfully navigating future investments in the exciting, yet volatile, world of quantum computing. Continue your research on D-Wave Quantum (QBTS) stock and other quantum computing investments to make well-informed decisions. Understanding the risks associated with QBTS and the broader quantum computing market is vital for any investor.

Featured Posts

-

L Alfa Romeo Junior 1 2 Turbo Speciale Selon Le Matin Auto Performances Et Sensations

May 21, 2025

L Alfa Romeo Junior 1 2 Turbo Speciale Selon Le Matin Auto Performances Et Sensations

May 21, 2025 -

Giakoymakis Sto Mls Oi Elpides Kai Oi Amfivolies Ton Amerikanon Opadon

May 21, 2025

Giakoymakis Sto Mls Oi Elpides Kai Oi Amfivolies Ton Amerikanon Opadon

May 21, 2025 -

Stephane La Conquete Parisienne D Une Chanteuse Suisse

May 21, 2025

Stephane La Conquete Parisienne D Une Chanteuse Suisse

May 21, 2025 -

How To Watch Peppa Pig Cartoons Online Free Streaming Services

May 21, 2025

How To Watch Peppa Pig Cartoons Online Free Streaming Services

May 21, 2025 -

Original Sin Season 1 A Deeper Look At Dexters Debra Morgan Error

May 21, 2025

Original Sin Season 1 A Deeper Look At Dexters Debra Morgan Error

May 21, 2025

Latest Posts

-

Athena Calderones Milestone Birthday A Roman Extravaganza

May 22, 2025

Athena Calderones Milestone Birthday A Roman Extravaganza

May 22, 2025 -

Late Goal Secures Draw For Lazio Against Reduced Juventus

May 22, 2025

Late Goal Secures Draw For Lazio Against Reduced Juventus

May 22, 2025 -

Lazio And Juventus Draw In Tense Serie A Match

May 22, 2025

Lazio And Juventus Draw In Tense Serie A Match

May 22, 2025 -

Wife Of Tory Politician Remains Imprisoned For Anti Migrant Outburst In Southport

May 22, 2025

Wife Of Tory Politician Remains Imprisoned For Anti Migrant Outburst In Southport

May 22, 2025 -

8 6 Thriller Tigers Prove Doubters Wrong Against Rockies

May 22, 2025

8 6 Thriller Tigers Prove Doubters Wrong Against Rockies

May 22, 2025