Monday's Market Downturn: Why D-Wave Quantum (QBTS) Stock Fell

Table of Contents

The Impact of Broader Market Trends on QBTS Stock

Overall Market Sentiment

Monday's overall market sentiment played a significant role in QBTS's decline. A general downturn in the stock market often impacts even seemingly strong performers like D-Wave. The Nasdaq and S&P 500, key indicators of overall market health, experienced notable decreases.

- Rising interest rates: Increased interest rates make borrowing more expensive for companies, potentially slowing growth and impacting investor confidence.

- Inflation concerns: Persistent inflation erodes purchasing power and can lead to investor caution, resulting in selling pressure across the board.

- Geopolitical instability: Global uncertainties and geopolitical tensions create volatility and risk aversion in the market.

The Nasdaq Composite, for example, fell by X% on Monday, indicating a broader negative market trend. This wider market weakness likely contributed to the selling pressure observed in QBTS.

Sector-Specific Performance

While the overall market contributed, it's crucial to examine the performance of the quantum computing sector specifically. Did other quantum computing stocks suffer similar drops? A sector-wide downturn would suggest a more focused impact on QBTS.

- Comparison with IonQ (IONQ) and Rigetti Computing (RGTI): A comparison of the percentage change in these competitor stocks on Monday provides valuable context. If these stocks also experienced significant declines, it points towards sector-specific headwinds.

- Data points: If IonQ (IONQ) fell by Y% and Rigetti Computing (RGTI) by Z%, this would show whether the QBTS drop was isolated or part of a wider trend in the quantum computing sector.

Company-Specific News and Announcements Affecting QBTS

Absence of Positive News

The absence of positive news or announcements from D-Wave itself might have disappointed investors and triggered selling pressure. Positive catalysts such as large contract wins, technological breakthroughs, or partnerships can significantly influence stock prices. Their absence can have the opposite effect.

- Lack of major contract wins: Without new significant contracts, investors might have concerns about revenue generation and future growth.

- Delays in product development: Delays in bringing new quantum computing technologies to market can raise questions about D-Wave's competitiveness and timeline.

Any official statements or press releases from D-Wave regarding these points should be carefully considered.

Analyst Ratings and Predictions

Changes in analyst ratings and predictions for QBTS stock can significantly influence investor sentiment. Downgrades or lowered price targets can lead to selling pressure, accelerating the price decline.

- Mention specific analyst firms: Highlight the specific analyst firms that issued ratings or predictions and their rationale.

- Data points: Include specific rating changes (e.g., from "Buy" to "Hold" or a reduction in the price target) and their timing relative to the QBTS stock price drop. This provides a clear link between analyst sentiment and market reaction.

Investor Sentiment and Trading Activity

Increased Selling Pressure

Analyzing trading volume and patterns can provide insights into investor behavior. Increased selling volume on Monday suggests heightened pressure to offload QBTS shares.

- Profit-taking: Investors who had made profits might have decided to sell, contributing to increased selling pressure.

- Fear and uncertainty: Negative news or market trends can create fear and uncertainty, prompting investors to sell shares to reduce risk.

Visualizing this data with charts and graphs showing trading volume and price fluctuations on Monday would reinforce this analysis.

Social Media Sentiment

While not a primary source for financial analysis, social media sentiment can offer a glimpse into the overall perception of QBTS among investors. However, it's crucial to treat social media data with caution.

- Prevalent negative opinions: Increased negative comments or discussions about QBTS on platforms like Twitter or StockTwits might indicate a shift in investor sentiment. It’s important to note if these are coming from influential figures or are widely shared.

Conclusion: Analyzing the Fall of D-Wave Quantum (QBTS) Stock

The decline in QBTS stock price on Monday was likely a confluence of factors. Broader market weakness, the absence of positive company news, analyst sentiment, increased selling pressure, and potentially social media sentiment all played a role. The interplay between these elements created a negative feedback loop contributing to the significant price drop.

Key Takeaways: The QBTS stock decline highlights the interconnectedness of macro-economic conditions, company performance, and investor psychology. Understanding these dynamics is crucial for navigating the volatile quantum computing sector.

Call to Action: Stay informed about future developments in the D-Wave Quantum (QBTS) stock and the broader quantum computing market. Regularly check reputable financial news sources and analyst reports to make well-informed investment decisions. Analyzing QBTS price fluctuations requires continuous monitoring of both company-specific and macro-economic factors.

Featured Posts

-

Nyt Mini Crossword Clues And Answers March 20 2025

May 20, 2025

Nyt Mini Crossword Clues And Answers March 20 2025

May 20, 2025 -

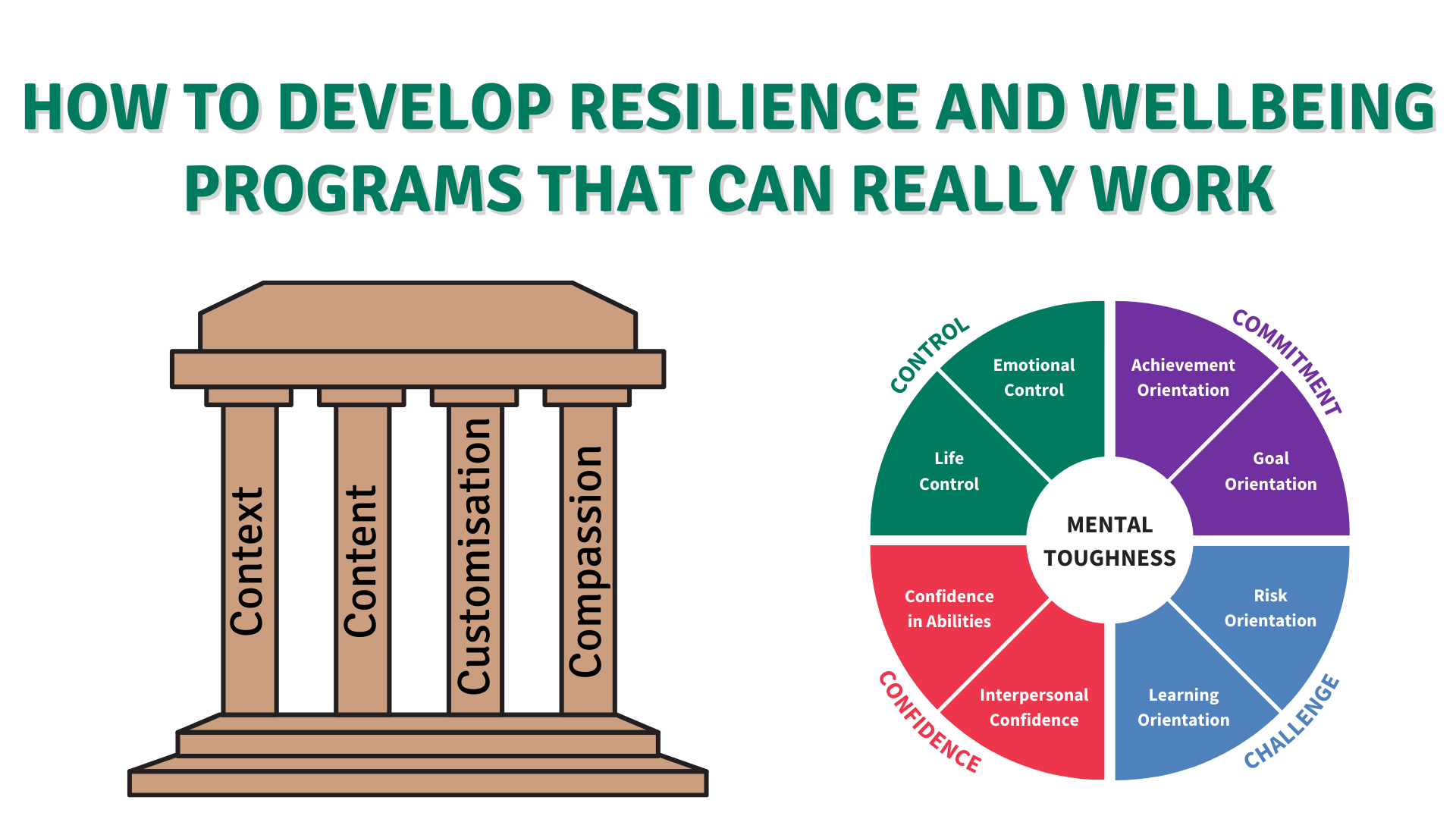

Finding Resilience A Guide To Mental Wellbeing

May 20, 2025

Finding Resilience A Guide To Mental Wellbeing

May 20, 2025 -

Avauskokoonpano Julkistettu Glen Kamara Ja Teemu Pukki Sivussa Jacob Friisin Johdolla

May 20, 2025

Avauskokoonpano Julkistettu Glen Kamara Ja Teemu Pukki Sivussa Jacob Friisin Johdolla

May 20, 2025 -

I Los Antzeles Psaxnei Ton Giakoymaki

May 20, 2025

I Los Antzeles Psaxnei Ton Giakoymaki

May 20, 2025 -

Robert Pattinson And Suki Waterhouse Script Reading Session

May 20, 2025

Robert Pattinson And Suki Waterhouse Script Reading Session

May 20, 2025