Moody's Downgrade: Dow Futures And Dollar React - Live Updates

Table of Contents

Immediate Market Reactions to Moody's Downgrade

The announcement of the Moody's downgrade has sparked immediate and dramatic reactions across global financial markets. The impact is clearly visible in both the futures market and the foreign exchange market.

Dow Futures Plunge

Following the downgrade announcement, Dow futures experienced a sharp percentage drop. Specifically, the September Dow Jones Industrial Average futures contract (YM) saw a significant decline of [insert percentage and point value here] within the first [ timeframe ] of trading. This dramatic fall reflects the heightened sensitivity of futures contracts to major economic news. These contracts act as a barometer of investor sentiment and expectations, and this negative news has sent a clear signal of concern.

- Sharp decline in pre-market trading: The initial drop indicated a widespread negative reaction among investors.

- Increased volatility observed: Trading volumes surged, highlighting the uncertainty and anxiety in the market.

- Investor sentiment negatively impacted: The downgrade fueled fears about the US economy's future trajectory.

US Dollar Volatility

The impact on the US dollar, often considered a safe-haven asset, is complex. While initially, one might expect a strengthening of the dollar due to its safe-haven status, the actual market response has shown [state whether dollar strengthened or weakened, e.g., a slight weakening]. This can be attributed to [explain the reasons, e.g., a combination of factors, including concerns about the US fiscal outlook and the potential for reduced investor confidence in US assets].

- Fluctuations in the USD/EUR and USD/JPY pairs: The dollar’s movement against major currencies like the Euro and Japanese Yen reflects the uncertainty in the market.

- Potential flight to safety (or lack thereof) driving dollar movement: While the dollar is often seen as a safe haven, the severity of the downgrade and its implications might be overshadowing this typical effect.

- Impact on international trade: Dollar fluctuations directly impact international trade and could lead to increased costs for US importers and exporters.

Global Market Response

The Moody's downgrade wasn't isolated to the US; ripples quickly spread across global markets. European markets, reflected in indices like the FTSE 100 and DAX, experienced [describe the reactions], while Asian markets [describe the reactions]. This interconnectedness highlights the global nature of financial systems.

- Impact on other major indices (e.g., FTSE, DAX): Mention specific percentage changes or directions.

- Reactions in emerging markets: Discuss the potential impact on developing economies.

- Global investor confidence: The downgrade has undoubtedly shaken investor confidence worldwide.

Reasons Behind Moody's Downgrade

Moody's cited several key reasons for the downgrade, all pointing to significant fiscal challenges facing the US. These include the persistently high national debt, political gridlock hindering necessary fiscal reforms, and concerns over the long-term economic outlook.

- Rising national debt: The unsustainable trajectory of the US national debt is a major concern.

- Political gridlock hindering fiscal reforms: The inability to reach bipartisan consensus on fiscal policy exacerbates the problem.

- Concerns over long-term economic outlook: The downgrade reflects anxieties about the country's future economic stability.

Implications and Outlook

The long-term consequences of the Moody's downgrade could be significant. Increased borrowing costs for the US government will likely translate into higher interest rates across the board, potentially impacting consumer spending and economic growth. Inflationary pressures could also increase as a result.

- Impact on US government borrowing costs: Higher interest rates will increase the cost of servicing the national debt.

- Potential inflationary pressures: Increased borrowing costs can contribute to inflation.

- Investment strategies for mitigating risk: Investors may need to re-evaluate their portfolios and consider strategies to protect against potential market downturns, such as diversifying investments and potentially increasing holdings of safe-haven assets.

Conclusion

The Moody's downgrade has undeniably shaken markets, causing significant volatility in Dow futures and the US dollar. We've explored the immediate reactions, the underlying reasons for the downgrade, and the potential implications for the future. Understanding the intricacies of this situation is crucial for investors and economic stakeholders alike.

Call to Action: Stay tuned for further live updates on this evolving situation regarding the Moody's downgrade and its impact on Dow futures and the US dollar. Continue to monitor our site for the latest analysis and insights into this critical market event. For in-depth analysis and expert commentary on the Moody's downgrade and its implications for your investments, subscribe to our premium service.

Featured Posts

-

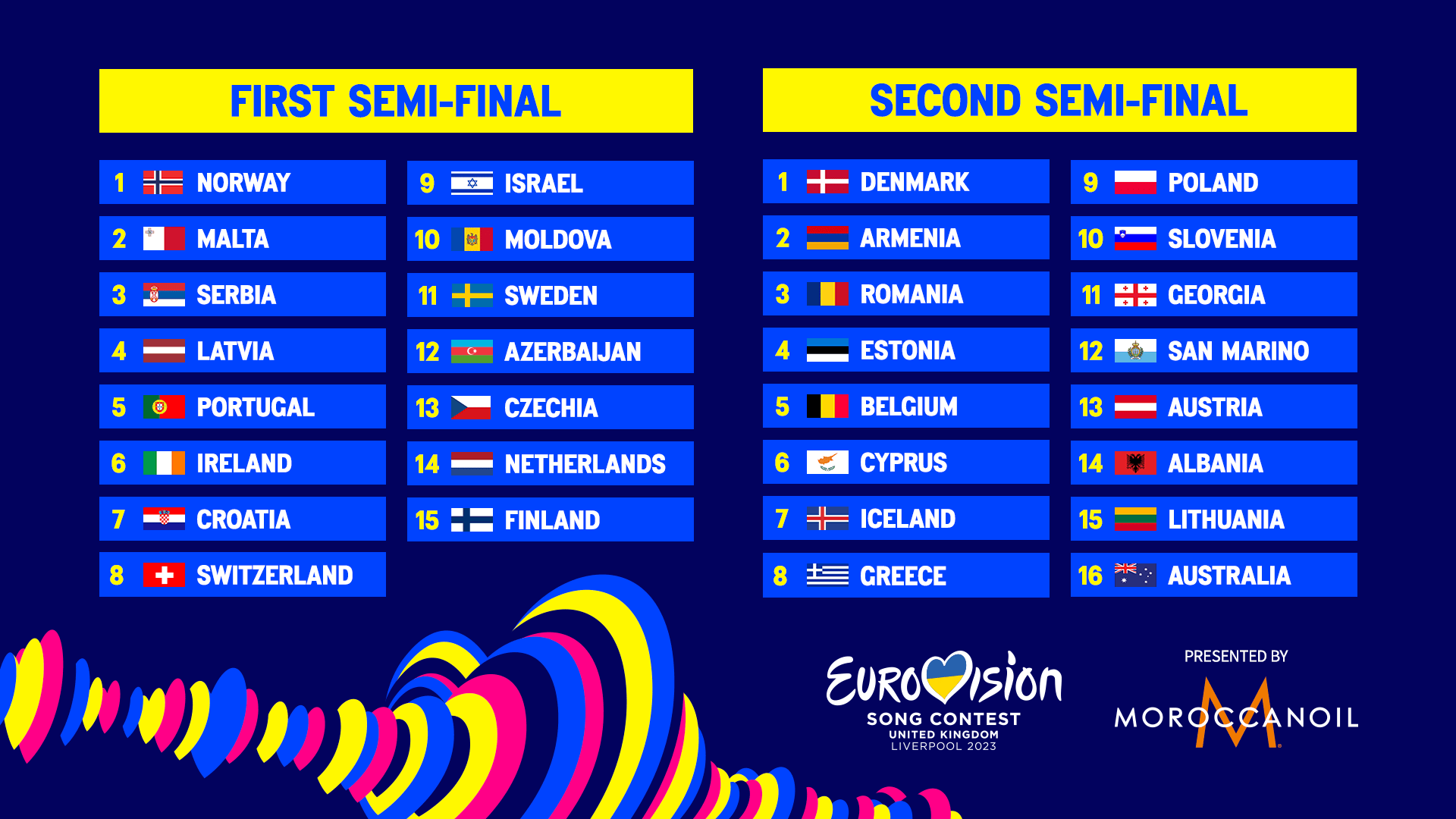

Eurovision 2025 Ranking The Finalists Best To Worst

May 20, 2025

Eurovision 2025 Ranking The Finalists Best To Worst

May 20, 2025 -

Biarritz Le Bo Cafe Renait Sous La Houlette De Nouveaux Gerants

May 20, 2025

Biarritz Le Bo Cafe Renait Sous La Houlette De Nouveaux Gerants

May 20, 2025 -

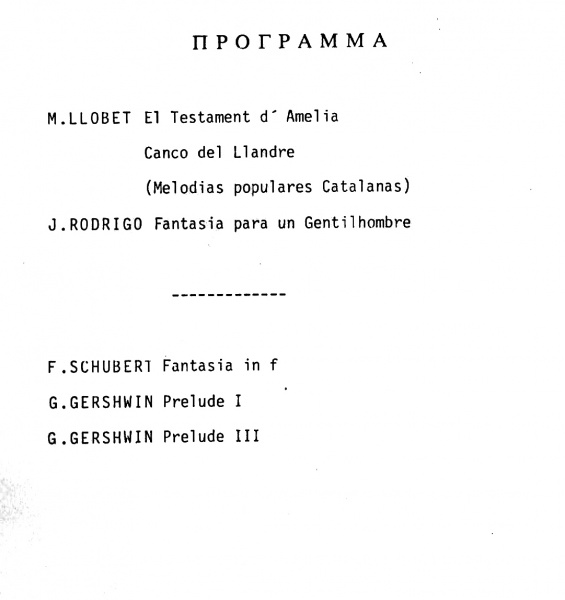

Dimotiko Odeio Rodoy Synaylia Ton Kathigiton Sti Dimokratiki

May 20, 2025

Dimotiko Odeio Rodoy Synaylia Ton Kathigiton Sti Dimokratiki

May 20, 2025 -

Asbh A Biarritz Pro D2 Le Mental Cle De La Victoire

May 20, 2025

Asbh A Biarritz Pro D2 Le Mental Cle De La Victoire

May 20, 2025 -

Mondays D Wave Quantum Qbts Stock Rally Understanding The Factors

May 20, 2025

Mondays D Wave Quantum Qbts Stock Rally Understanding The Factors

May 20, 2025