Moody's US Downgrade: Impact On Dow Futures And The Dollar

Table of Contents

Understanding the Moody's Downgrade and its Rationale

The Credit Rating Agency's Decision

Moody's lowered the US government's credit rating from AAA to Aa1, citing a significant deterioration in fiscal strength over the next few years. This decision wasn't made lightly; it reflects deep concerns about the country's escalating debt burden, persistent political gridlock, and a weakening governance capacity. The agency highlighted the ongoing fiscal challenges, including repeated debt ceiling showdowns and a projected increase in the debt-to-GDP ratio.

- Rising Debt Levels: The US national debt has reached unprecedented levels, with projections showing a continued upward trajectory.

- Political Gridlock: Persistent partisan divides and the inability to reach bipartisan consensus on fiscal policy have contributed to the downgrade.

- Erosion of Governance Strength: The repeated near-defaults on US debt, coupled with increasing political polarization, signaled a weakening of the government's capacity to manage its fiscal responsibilities.

Historical Context of US Credit Rating Downgrades

While rare, this isn't the first time the US credit rating has faced scrutiny. Previously, Standard & Poor's downgraded the US rating in 2011, causing market volatility. However, the current situation differs in several key respects. The current downgrade reflects a more protracted period of fiscal deterioration, compounded by increasingly polarized political discourse.

- 2011 Downgrade: The 2011 downgrade was primarily linked to concerns about the debt ceiling debate and the perceived lack of a long-term fiscal plan.

- Current Situation: The current downgrade reflects a more fundamental concern about the long-term sustainability of the US fiscal trajectory, exacerbated by political gridlock and the erosion of governance strength.

Impact on Dow Futures: Immediate and Projected Effects

Immediate Market Reactions

The announcement of the Moody's downgrade triggered immediate volatility in Dow Futures. The market experienced a sharp drop in prices, reflecting investor anxiety and uncertainty. Trading volume surged as investors reacted swiftly to the news.

- Percentage Changes: Dow Futures experienced a significant percentage drop immediately following the announcement (Specific percentage should be inserted here based on actual market data).

- Trading Volume Spikes: Trading volume in Dow Futures contracts increased dramatically, indicating heightened investor activity and uncertainty.

- Investor Sentiment Indicators: Various investor sentiment indicators, such as VIX (volatility index), showed a marked increase, reflecting heightened market fear.

Long-Term Implications for Dow Futures

The long-term implications for Dow Futures remain uncertain, contingent on several factors. Lower investor confidence could lead to sustained declines, while government action to address fiscal concerns might mitigate the negative impact. Further interest rate hikes by the Federal Reserve could also exacerbate the situation.

- Impact on Sectors: Different sectors of the market are likely to be affected differently. Sectors highly sensitive to interest rate changes might experience more significant declines.

- Scenarios: Depending on future government policies and economic data, the long-term impact could range from a moderate correction to a more significant market downturn.

The Dollar's Response to the Downgrade: Strengthening or Weakening?

Safe-Haven Status of the Dollar

Despite the downgrade, the US dollar initially exhibited some strength, partly driven by its traditional safe-haven status. Investors often flock to the dollar during times of global economic uncertainty, seeking a relatively stable asset. However, this effect might be temporary.

- Flight-to-Safety: The initial strengthening of the dollar reflected a flight-to-safety phenomenon, as investors sought refuge in a relatively stable currency.

- Competing Forces: The dollar's value will continue to be influenced by competing forces, including concerns about US economic stability and the broader global economic outlook.

Impact on International Trade and Investment

Fluctuations in the dollar's value due to the downgrade will have significant implications for international trade and investment. A stronger dollar could make US exports more expensive and imports cheaper, potentially impacting the trade balance.

- US Exports: A stronger dollar can make US exports less competitive in global markets, potentially leading to a decline in export revenues.

- US Imports: A stronger dollar makes imports cheaper, potentially leading to increased imports and a wider trade deficit.

- Foreign Investment: The dollar's value influences foreign investment flows into and out of the US. Uncertainty might reduce foreign investment in the short term.

Analyzing the Interplay Between Dow Futures, the Dollar, and the Downgrade

The Moody's downgrade, Dow Futures, and the US dollar are inextricably linked. The downgrade affects investor confidence, impacting Dow Futures. Changes in Dow Futures influence investor sentiment, affecting the demand for the dollar as a safe-haven asset. This creates a complex feedback loop with cascading effects on the global economy. (Include a chart or graph here illustrating the interconnectedness).

Conclusion: Navigating the Aftermath of Moody's US Downgrade

The Moody's downgrade of the US credit rating has had a significant and multifaceted impact on Dow Futures and the US dollar, highlighting the interconnectedness of global financial markets. The uncertainty surrounding future market movements underscores the need for careful monitoring and informed decision-making. The long-term consequences of this downgrade will depend heavily on the actions taken by the US government to address its fiscal challenges and restore investor confidence.

Call to action: Stay informed about the ongoing developments related to the Moody's US downgrade, Dow Futures, and the US dollar by following reputable financial news sources. Consider consulting with a qualified financial advisor to discuss your investment strategy and how to navigate this period of uncertainty. Understanding the implications of this significant event is crucial for making informed financial decisions in the weeks and months ahead.

Featured Posts

-

Understanding The Recent D Wave Quantum Qbts Stock Market Rally

May 21, 2025

Understanding The Recent D Wave Quantum Qbts Stock Market Rally

May 21, 2025 -

Analyzing Ftv Lives Hell Of A Run A Deep Dive Into Broadcast News Reporting

May 21, 2025

Analyzing Ftv Lives Hell Of A Run A Deep Dive Into Broadcast News Reporting

May 21, 2025 -

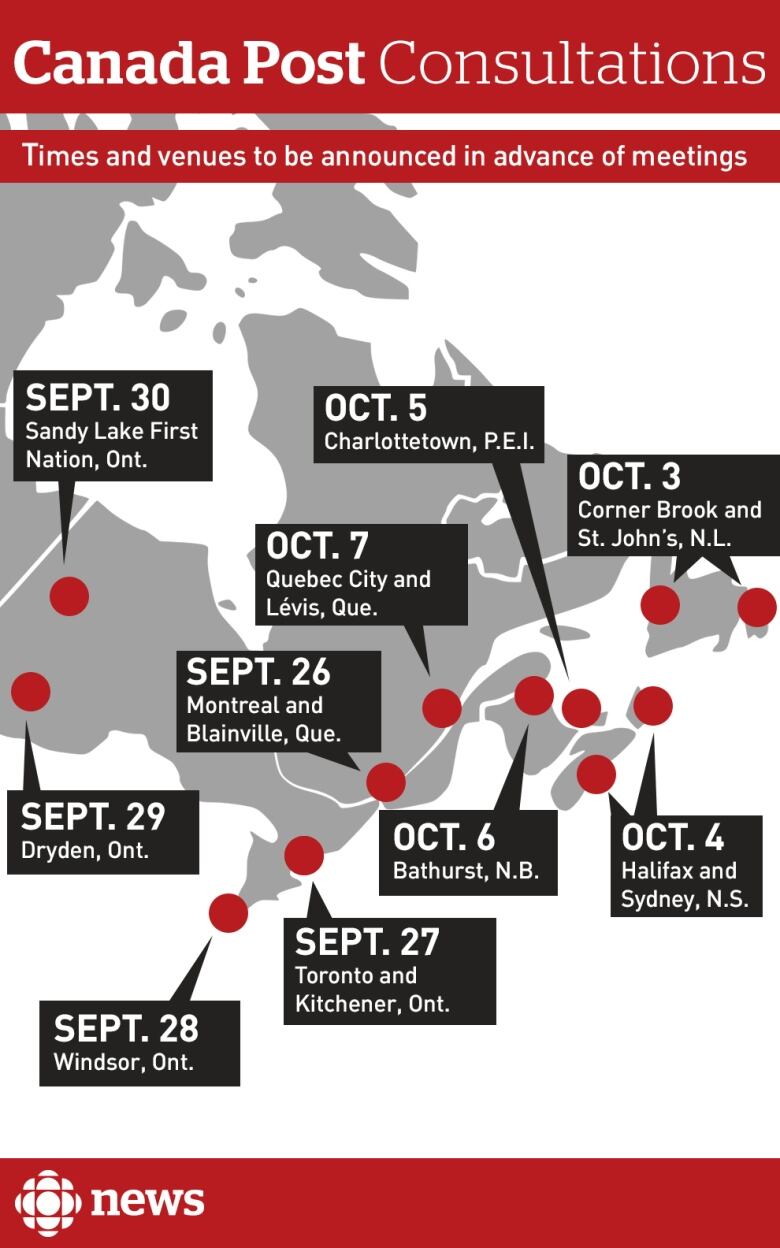

Canada Post Door To Door Delivery Commission Recommends Phase Out

May 21, 2025

Canada Post Door To Door Delivery Commission Recommends Phase Out

May 21, 2025 -

Abn Amro Dutch Central Bank Eyes Potential Fine Over Bonuses

May 21, 2025

Abn Amro Dutch Central Bank Eyes Potential Fine Over Bonuses

May 21, 2025 -

Synaylia Kathigites Dimotikoy Odeioy Rodoy Stin Dimokratiki

May 21, 2025

Synaylia Kathigites Dimotikoy Odeioy Rodoy Stin Dimokratiki

May 21, 2025

Latest Posts

-

Penn Relays 2024 Allentown Boys Sub 43 4x100m Relay Triumph

May 22, 2025

Penn Relays 2024 Allentown Boys Sub 43 4x100m Relay Triumph

May 22, 2025 -

A Familys Passion The Traverso Legacy In Cannes Film Festival Photography

May 22, 2025

A Familys Passion The Traverso Legacy In Cannes Film Festival Photography

May 22, 2025 -

Allentowns Historic Penn Relays 4x100m A Sub 43 School Record

May 22, 2025

Allentowns Historic Penn Relays 4x100m A Sub 43 School Record

May 22, 2025 -

Through Generations The Traverso Familys Enduring Presence At Cannes

May 22, 2025

Through Generations The Traverso Familys Enduring Presence At Cannes

May 22, 2025 -

Cannes Film Festival The Traverso Familys Photographic Legacy

May 22, 2025

Cannes Film Festival The Traverso Familys Photographic Legacy

May 22, 2025