NatWest Settles With Nigel Farage Over Account Closure

Table of Contents

The Details of the Settlement

The terms of the settlement reached between NatWest and Nigel Farage remain partially confidential, respecting the agreement reached between both parties. However, several key aspects have been made public.

-

Summary of the apology issued by NatWest: NatWest issued a public apology to Mr. Farage, acknowledging that the decision to close his account was flawed and did not align with their stated policies. The apology marked a significant concession and indicated a willingness to address criticisms regarding their de-banking practices.

-

Mention any financial compensation or other concessions made by the bank: While the exact financial details remain undisclosed, it is understood that Mr. Farage received some form of compensation for the inconvenience and reputational damage caused by the account closure. Further concessions may also be part of the settlement but remain unpublicised.

-

Note any public statements released by either party following the settlement: Following the settlement, both NatWest and Mr. Farage released statements. Mr. Farage expressed his satisfaction with the outcome, while NatWest reiterated its commitment to reviewing its policies. This suggests a mutual desire to move forward, yet the implications of the "Farage NatWest agreement" are likely to resonate across the banking sector for the foreseeable future. Keywords such as "NatWest settlement" and "de-banking compensation" aptly describe this part of the ongoing discussion.

The Background of the Account Closure

The closure of Nigel Farage's NatWest account was preceded by a series of events that sparked considerable public debate and political controversy.

-

Timeline of events: The account was closed in 2022, with NatWest initially citing concerns related to their anti-money laundering policies and reputational risk as the reason. The timing of the closure, occurring amidst significant public and political activity related to Mr. Farage's activities, fueled speculation and criticism.

-

Mention any public outcry or political controversy surrounding the closure: The closure immediately generated significant public outcry, with many accusing NatWest of political bias and violating Mr. Farage's freedom of expression. The case rapidly escalated into a major political controversy, prompting inquiries from government officials and debates in Parliament. The "NatWest account closure" quickly transformed into a wider discussion about freedom of expression and banking practices.

-

Highlight any previous criticisms leveled against NatWest's policies: This incident was not an isolated case. NatWest has faced previous criticisms regarding its policies and practices, particularly concerning its approach to de-banking individuals or entities deemed high-risk. The "Farage de-banking" episode served to amplify existing concerns about potential inconsistencies and the lack of transparency in these policies. The keywords "NatWest policy" and "political controversy" appropriately encapsulate the climate of this period.

The Wider Implications of De-banking

The NatWest Nigel Farage case highlights the complex and contentious issue of de-banking. The debate involves multiple facets of freedom, responsibility, and risk mitigation.

-

Explore the arguments for and against de-banking: Proponents of de-banking emphasize the crucial role banks play in preventing financial crime, including money laundering and terrorist financing. Opponents argue that de-banking can be used to suppress dissent and limit freedom of expression, creating a chilling effect on political and social activism. This point of contention creates a tension between the "de-banking debate" and "financial freedom".

-

Mention similar cases and their outcomes, referencing relevant legal precedents: While the NatWest case is high-profile, it's not unique. Several similar cases have emerged in recent years, involving individuals and organizations with controversial viewpoints. The outcomes of these cases vary widely, highlighting the lack of clear legal precedents and consistent application of banking policies.

-

Discuss the potential impact on small businesses and individuals who may hold controversial views: The implications extend beyond high-profile individuals. The practice of de-banking could disproportionately affect small businesses and individuals who may hold unpopular or controversial views, potentially undermining financial inclusion and freedom of enterprise. This potential impact contributes to the complexity of the ongoing "de-banking debate".

Future Outlook and Potential Regulatory Changes

The settlement between NatWest and Nigel Farage will likely have significant long-term implications for the banking sector and regulatory landscape.

-

Will this settlement influence future de-banking decisions by other banks? The settlement sets a precedent, potentially encouraging greater caution and more robust internal review processes within banks before making decisions about account closures. This could shift banking policy and practices in a measurable way.

-

Could this lead to regulatory changes or increased scrutiny of bank policies? The controversy surrounding the case is likely to lead to increased regulatory scrutiny of banks' de-banking practices and a potential review of existing regulations. New legislation or stricter guidelines may be introduced to ensure fairness and transparency. The "future of de-banking" hangs heavily on these considerations.

-

What are the potential implications for customer rights and bank responsibilities? The case raises fundamental questions about customer rights and the responsibilities of financial institutions in balancing their risk management obligations with the protection of fundamental freedoms. This ultimately contributes to a clarification of customer rights and bank responsibilities. The keywords "banking regulations" and "financial regulation" capture the key focus of future potential impacts.

Conclusion

The NatWest settlement with Nigel Farage marks a significant point in the ongoing discussion surrounding de-banking and the responsibilities of financial institutions. While the settlement brings a resolution to this specific case, the broader implications regarding freedom of expression and financial inclusion remain to be seen. The case has highlighted the need for a balanced approach that ensures responsible banking practices while safeguarding fundamental rights.

Call to Action: Stay informed on the evolving landscape of banking regulations and the ongoing debate surrounding the NatWest Nigel Farage account closure and similar cases by following [link to relevant news source or blog]. Understanding the implications of de-banking is crucial for both businesses and individuals.

Featured Posts

-

Sudden Temperature Drop In West Bengal Weather Forecast And Advisory

May 04, 2025

Sudden Temperature Drop In West Bengal Weather Forecast And Advisory

May 04, 2025 -

Anna Kendrick And Blake Lively A Tense Moment At The A Simple Favor Screening

May 04, 2025

Anna Kendrick And Blake Lively A Tense Moment At The A Simple Favor Screening

May 04, 2025 -

Kolkata Weather Alert Me T Department Predicts Thunderstorms

May 04, 2025

Kolkata Weather Alert Me T Department Predicts Thunderstorms

May 04, 2025 -

Blake Lively And Anna Kendricks Subtle Style Showdown At The Premiere

May 04, 2025

Blake Lively And Anna Kendricks Subtle Style Showdown At The Premiere

May 04, 2025 -

How Rising Oil Prices Are Impacting Airlines And Passengers

May 04, 2025

How Rising Oil Prices Are Impacting Airlines And Passengers

May 04, 2025

Latest Posts

-

Ufc 314 Complete Results Volkanovski Vs Lopes Fight Card Analysis

May 04, 2025

Ufc 314 Complete Results Volkanovski Vs Lopes Fight Card Analysis

May 04, 2025 -

Ufc 314 Volkanovski Vs Lopes Full Fight Card And Ppv Details

May 04, 2025

Ufc 314 Volkanovski Vs Lopes Full Fight Card And Ppv Details

May 04, 2025 -

Volkanovski Vs Lopes Ufc 314 Results Winners And Losers

May 04, 2025

Volkanovski Vs Lopes Ufc 314 Results Winners And Losers

May 04, 2025 -

Ufc 314 Fight Card Volkanovski Vs Lopes Ppv Event Breakdown

May 04, 2025

Ufc 314 Fight Card Volkanovski Vs Lopes Ppv Event Breakdown

May 04, 2025 -

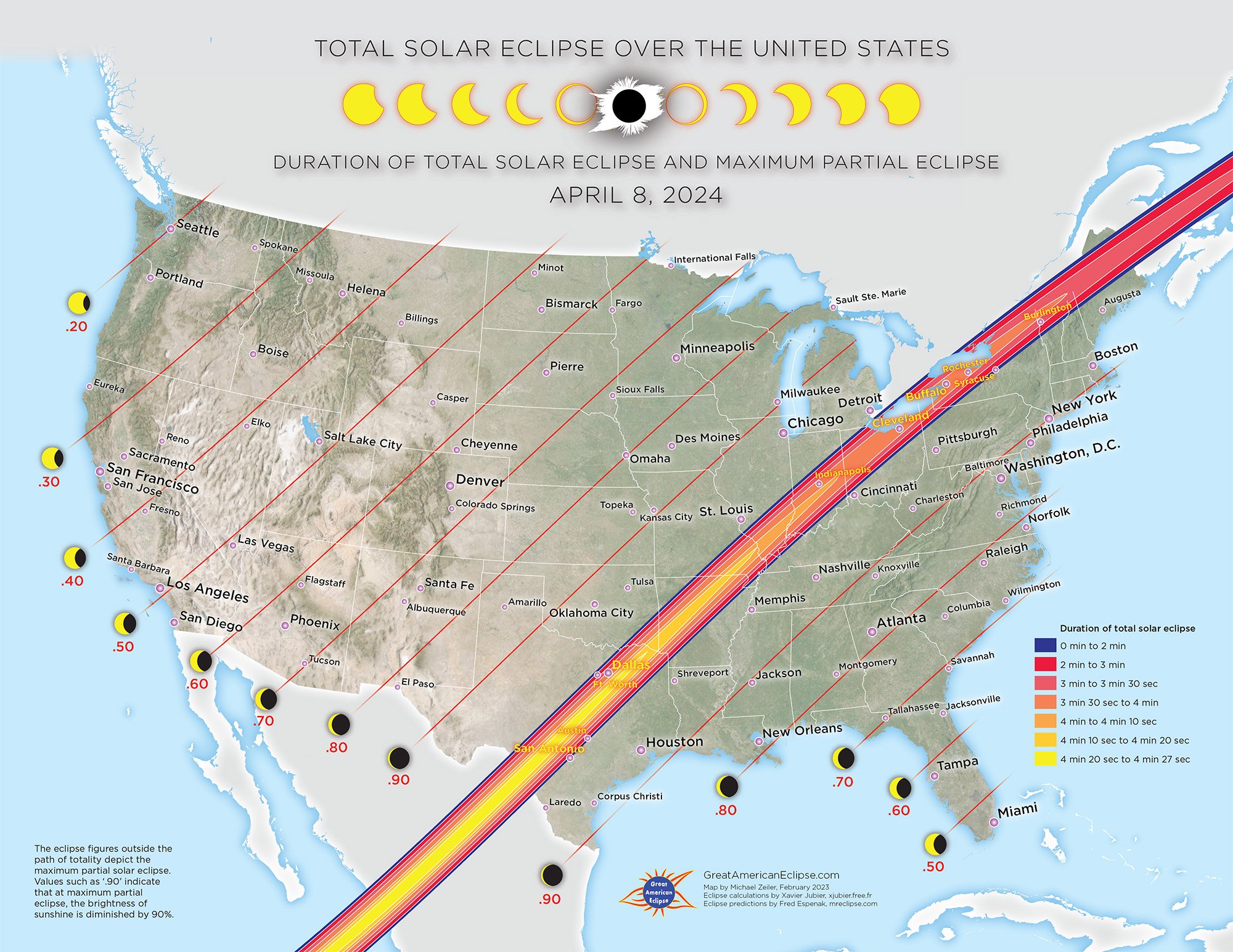

Saturdays Partial Solar Eclipse Time And Viewing Tips For New York City

May 04, 2025

Saturdays Partial Solar Eclipse Time And Viewing Tips For New York City

May 04, 2025