Navan Secures Banks For Upcoming US Initial Public Offering

Table of Contents

Key Banks Involved in the Navan IPO

The selection of investment banks for a major IPO is crucial, reflecting the company's financial health and future prospects. Navan has wisely chosen a group of leading financial institutions known for their expertise in tech IPOs and their strong networks within the investment community.

-

The Banks: While specific names may not be publicly released until later stages of the process, it's understood that several top-tier investment banks, including firms with a proven track record in guiding tech companies through successful IPOs, are involved. These banks will play a pivotal role in pricing the IPO, managing the offering process, and attracting investors.

-

Track Record: The chosen banks boast extensive experience in managing successful tech IPOs, possessing a deep understanding of the market dynamics and investor expectations within the SaaS and travel technology sectors. Their expertise in navigating the complexities of the IPO process will be invaluable to Navan.

-

Sector Expertise: Beyond general tech IPO expertise, the selected firms possess a strong understanding of the travel and expense management industry, a crucial factor for a successful Navan IPO. Their knowledge of the target market and competitive landscape will contribute significantly to the offering’s success.

Implications of Bank Selection for Navan's IPO Success

The strategic selection of these investment banks carries significant implications for Navan's IPO success. Their involvement translates to various advantages:

-

Increased Investor Confidence: The association with reputable investment banks significantly boosts investor confidence. These firms conduct rigorous due diligence, and their involvement signals their belief in Navan's potential for future growth.

-

Enhanced Market Reach and Exposure: These banks possess extensive networks within the investment community, enabling Navan to reach a wider pool of potential investors, both institutional and individual. This broader reach increases the likelihood of a successful IPO.

-

Access to a Wider Pool of Potential Investors: The banks' global reach and established relationships with high-net-worth individuals and institutional investors will help Navan attract a diverse range of investors.

-

Potential for a Higher IPO Valuation: The strategic guidance and market access provided by these leading banks could positively influence the final valuation of Navan, potentially leading to a more favorable outcome for the company and its shareholders.

Navan's Current Market Position and Growth Prospects

Navan's decision to pursue an IPO is underpinned by its strong current market position and promising growth trajectory.

-

Market Leadership: Navan holds a significant market share in the integrated travel and expense management sector, consistently outperforming competitors. Their innovative platform offers a seamless user experience, streamlining expense reporting and travel booking for businesses of all sizes.

-

Key Features and Benefits: Navan's platform integrates various functionalities including travel booking, expense tracking, policy compliance, and reporting. This all-in-one solution provides businesses with significant efficiency gains and cost savings.

-

Recent Growth Figures: While precise financial data might be limited before the IPO, Navan has reported strong revenue growth and increasing customer adoption in recent years, demonstrating its market traction and scalability.

-

Future Growth Projections: The company's expansion plans include investing in product innovation, expanding its global reach, and forging strategic partnerships to further solidify its market leadership.

Expected Timeline and Valuation for the Navan IPO

While specific details remain confidential, some information regarding the anticipated timeline and valuation for the Navan IPO has surfaced.

-

Estimated IPO Date: The exact date for the Navan IPO is yet to be confirmed, however, reports suggest a timeline within [Insert Time Frame, e.g., the next six months to a year].

-

Projected Valuation: Various sources have estimated the potential valuation of Navan's IPO; however, it's crucial to remember that these are just estimations and should be treated with caution. These valuations reportedly range from [Insert Range, e.g., $X billion to $Y billion].

-

IPO Process Steps: The IPO process will involve several key stages, including regulatory filings with the SEC (Securities and Exchange Commission), roadshows to meet with potential investors, and the final pricing and allocation of shares.

Analyst Opinions and Market Reaction to the Navan IPO News

The announcement of Navan securing prominent investment banks for its IPO has generated considerable interest from market analysts and investors.

-

Analyst Comments: Early analyst reactions have been generally positive, citing Navan's strong market position, innovative product, and the potential for significant growth in the travel and expense management sector.

-

Market Reaction: The news has been well-received, reflecting a positive sentiment towards the potential of the Navan IPO and the company's future prospects.

-

Positive and Negative Perspectives: While largely positive, some analysts have expressed caution, noting the inherent risks associated with IPOs and the competitive landscape of the tech industry.

Conclusion

Navan's securing of top-tier investment banks for its upcoming US IPO represents a major milestone. This strategic move underscores significant confidence in Navan's potential for growth and success within the corporate travel and expense management market. The selection of these leading financial institutions significantly enhances the prospects of a successful IPO, paving the way for a strong market debut and accelerating the expansion of Navan's innovative solutions.

Call to Action: Stay tuned for updates on the Navan IPO. Follow Navan's social media and website for the latest news and insights. Learn more about Navan and its innovative approach to travel and expense management by visiting [link to Navan's website]. Don't miss the opportunity to be a part of the Navan IPO story!

Featured Posts

-

Liverpool In Pole Position E60m Transfer Bid And Determination To Win

May 14, 2025

Liverpool In Pole Position E60m Transfer Bid And Determination To Win

May 14, 2025 -

Temoignage Sur Gaza Un Algerien Sous Oqtf En France

May 14, 2025

Temoignage Sur Gaza Un Algerien Sous Oqtf En France

May 14, 2025 -

Analiza Dokovic I Federerovi Oboreni Rekordi

May 14, 2025

Analiza Dokovic I Federerovi Oboreni Rekordi

May 14, 2025 -

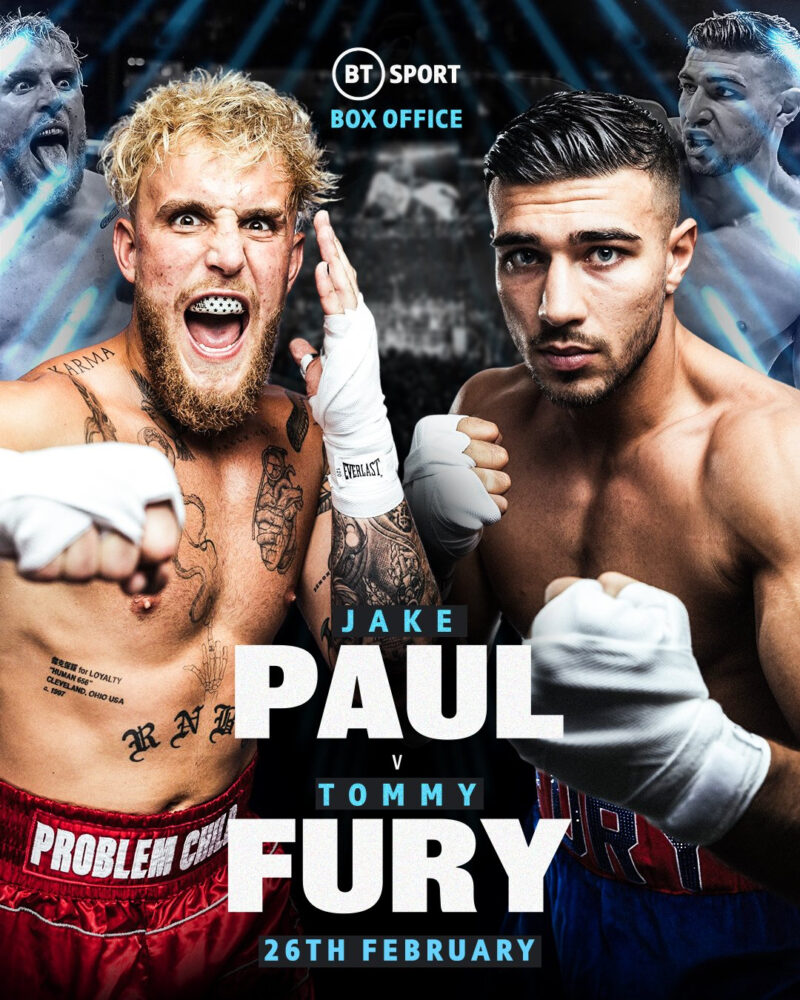

Jake Paul Vs Tommy Fury The Hit The Pub Diss And Its Aftermath

May 14, 2025

Jake Paul Vs Tommy Fury The Hit The Pub Diss And Its Aftermath

May 14, 2025 -

Sigue El Celta Vs Sevilla La Liga Espanola En Vivo

May 14, 2025

Sigue El Celta Vs Sevilla La Liga Espanola En Vivo

May 14, 2025