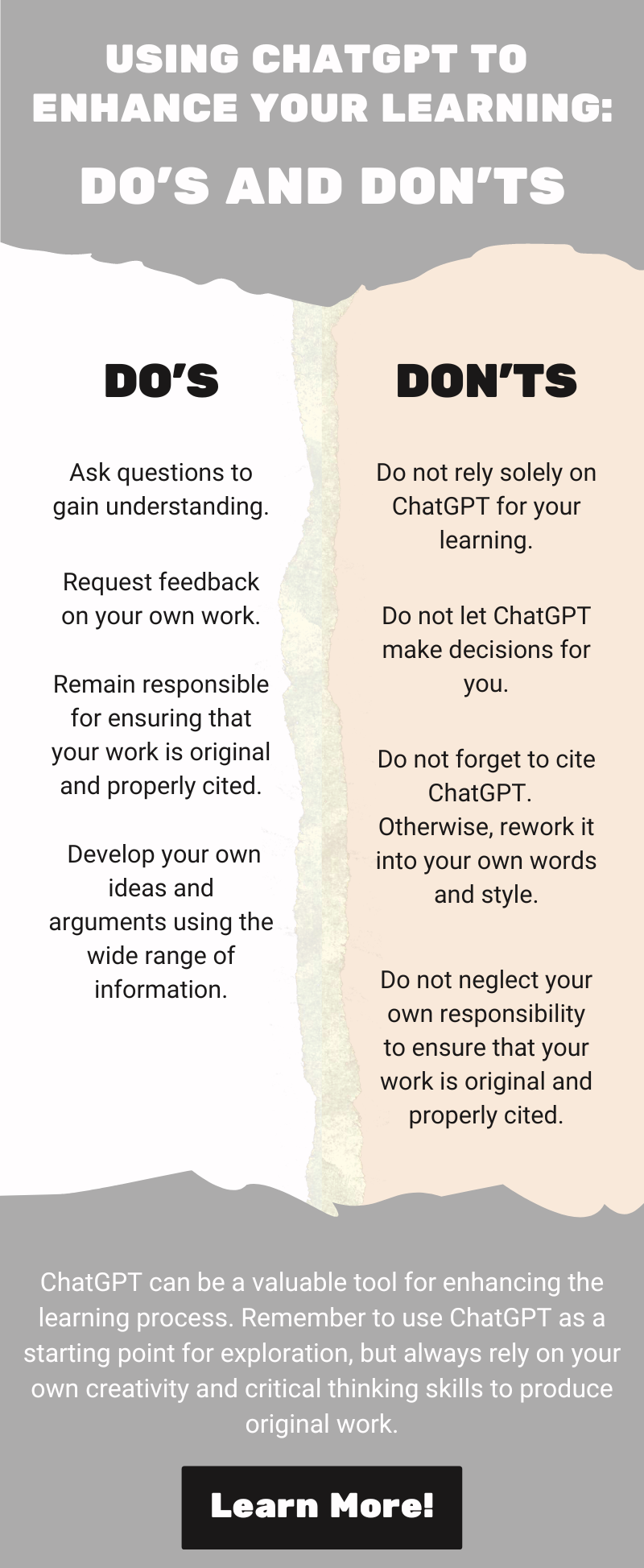

Navigate The Private Credit Boom: 5 Dos And Don'ts

Table of Contents

Do Your Due Diligence: Thorough Research is Key in Private Credit

Investing in private credit requires meticulous due diligence. Before committing your capital, you must thoroughly investigate both the fund manager and the borrower. This process is critical for mitigating risk and maximizing your chances of a successful investment.

Understand the Fund Manager's Track Record

A fund manager's past performance is a strong indicator of their future success. Don't rely solely on marketing materials; perform your own independent research.

- Analyze historical performance: Examine performance data across various market cycles, looking for consistency and resilience.

- Assess investment strategies: Understand their approach to credit analysis, risk management, and portfolio construction.

- Review portfolio composition: Analyze the types of borrowers and industries the fund invests in. Is the portfolio diversified enough?

- Examine manager compensation structure: Understand how the fund managers are incentivized. Are their interests aligned with yours?

- Check regulatory compliance: Ensure the fund is operating within the bounds of all applicable laws and regulations.

Delving into these details will give you a comprehensive understanding of the fund manager's capabilities and risk management approach. Don't be afraid to ask tough questions and push for transparency.

Scrutinize the Borrower's Financial Health

A thorough assessment of the borrower's financial health is paramount. This involves a detailed analysis of their financial statements and operational capabilities.

- Review financial statements: Analyze income statements, balance sheets, and cash flow statements to identify trends and assess financial health.

- Assess debt-to-equity ratios: Understand the borrower's leverage and its impact on their ability to service debt.

- Evaluate credit ratings (if available): Independent credit ratings provide valuable insight into the borrower's creditworthiness.

- Analyze collateral value: If collateral is involved, assess its value and marketability.

- Perform sensitivity analysis on key assumptions: Test the borrower's ability to repay under various economic scenarios.

Understanding the borrower's business model, competitive landscape, and management team is critical for assessing the overall risk. A thorough financial analysis should form the bedrock of your investment decision.

Don't Overlook Liquidity Risks in Private Credit Markets

Private credit investments are inherently less liquid than publicly traded securities. Understanding and managing this liquidity risk is crucial.

Illiquidity and its Implications

Private credit investments are typically illiquid; you can't easily sell them when needed. This illiquidity significantly impacts your investment strategy.

- Private credit investments are typically illiquid: Meaning they cannot be easily sold on a secondary market.

- Consider your investment horizon and risk tolerance: Only invest in private credit if you can tolerate the illiquidity risk for the expected investment period.

- Diversification can help mitigate this risk, but it's not a complete solution: Spreading your investments across multiple borrowers and strategies can help but does not eliminate illiquidity risk.

- Understand the fund's liquidity management policies: Know how the fund intends to manage liquidity within its portfolio.

Building a Diversified Portfolio

Diversification is key to mitigating risk in private credit. Don't put all your eggs in one basket.

- Diversify across different borrowers: Spread your investments across various companies to reduce your exposure to any single borrower's default.

- Diversify across industries and geographies: Reduce your exposure to sector-specific or geographic risks.

- Consider various private credit strategies (e.g., direct lending, distressed debt, mezzanine financing): Each strategy carries a different risk-reward profile. Diversification across strategies can optimize your portfolio.

- Allocate a portion of your portfolio to liquid assets: This will provide flexibility if you need to access your capital quickly.

Do Understand the Fees and Expenses Involved

Private credit investments often involve significant fees. Transparency and understanding of these fees are crucial for making informed investment decisions.

Transparency is Paramount

Be sure to thoroughly examine all associated fees and expenses.

- Carefully review all fees: Including management fees, performance fees, transaction fees, and other expenses.

- Compare fees across different funds: Ensure you're receiving competitive terms and not overpaying.

- Understand the fee structure's impact on your overall return: Calculate your net return after deducting all fees to accurately assess profitability.

Don't Neglect Due Diligence on the Legal and Regulatory Aspects

Navigating the legal and regulatory landscape of private credit is crucial to avoid potential pitfalls.

Navigating the Legal and Regulatory Landscape

Ensure compliance with all relevant laws and regulations.

- Review the legal documents carefully: Including loan agreements, fund documents, and partnership agreements.

- Ensure compliance with all applicable regulations and laws: Understand the rules and regulations governing private credit investments in your jurisdiction.

- Understand the implications of tax rules related to private credit investments: Seek professional tax advice to minimize your tax liability.

- Seek legal and tax advice if needed: Don't hesitate to consult with legal and tax professionals to ensure you're making informed decisions and complying with all regulations.

Do Develop a Clear Investment Strategy and Risk Management Plan

A well-defined investment strategy and risk management plan are essential for success in private credit.

Defining Your Investment Goals and Tolerance

Establishing clear objectives and managing risk are crucial.

- Establish clear investment objectives: Including your desired return, time horizon, and risk tolerance.

- Align your private credit investments with your overall portfolio strategy: Ensure your private credit investments complement your overall investment goals.

- Implement risk management procedures: To monitor and control potential losses throughout the investment lifecycle.

Conclusion

The private credit boom presents lucrative opportunities, but careful navigation is crucial. By following these dos and don'ts – conducting thorough due diligence, understanding liquidity risks, analyzing fees, adhering to legal and regulatory requirements, and establishing a clear investment strategy – you can significantly improve your chances of success. Remember, successful private credit investing requires a proactive and informed approach. Start planning your private credit strategy today and capitalize on this exciting market.

Featured Posts

-

Boulangerie Normande Un Cadeau Chocolate Pour Le Premier Bebe De L Annee

May 01, 2025

Boulangerie Normande Un Cadeau Chocolate Pour Le Premier Bebe De L Annee

May 01, 2025 -

Cadeau Exceptionnel Le Poids En Chocolat Offert Par Une Boulangerie Normande

May 01, 2025

Cadeau Exceptionnel Le Poids En Chocolat Offert Par Une Boulangerie Normande

May 01, 2025 -

Robinson Nuclear Plant Passes Safety Inspection License Renewal Could Extend To 2050

May 01, 2025

Robinson Nuclear Plant Passes Safety Inspection License Renewal Could Extend To 2050

May 01, 2025 -

Massive Power Outage In Breda 30 000 Affected

May 01, 2025

Massive Power Outage In Breda 30 000 Affected

May 01, 2025 -

Amy Irvings Mother Actress Priscilla Pointer Dead At 100

May 01, 2025

Amy Irvings Mother Actress Priscilla Pointer Dead At 100

May 01, 2025

Latest Posts

-

Peace Bridge Duty Free Shop In Receivership Impact Of Reduced Travel

May 01, 2025

Peace Bridge Duty Free Shop In Receivership Impact Of Reduced Travel

May 01, 2025 -

Plummeting Travel Impacts Peace Bridge Duty Free Leading To Receivership

May 01, 2025

Plummeting Travel Impacts Peace Bridge Duty Free Leading To Receivership

May 01, 2025 -

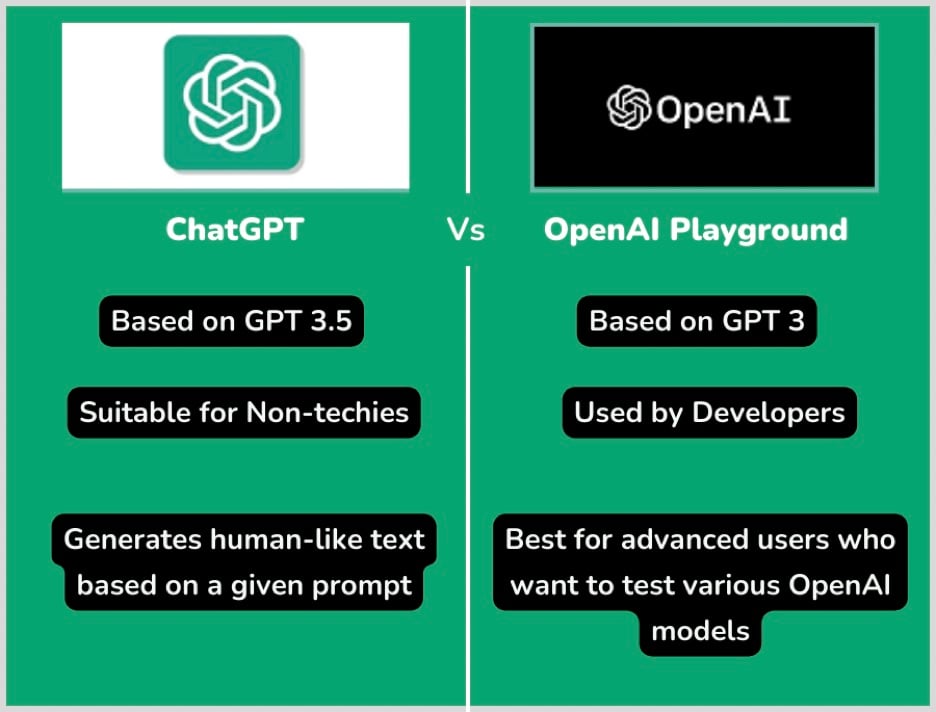

Shopping With Chat Gpt Open Ais Direct Challenge To Google Search

May 01, 2025

Shopping With Chat Gpt Open Ais Direct Challenge To Google Search

May 01, 2025 -

Car Dealerships Double Down On Resistance To Electric Vehicle Regulations

May 01, 2025

Car Dealerships Double Down On Resistance To Electric Vehicle Regulations

May 01, 2025 -

Prioritizing Economic Issues A Mandate For Canadas Next Prime Minister

May 01, 2025

Prioritizing Economic Issues A Mandate For Canadas Next Prime Minister

May 01, 2025