Navigate The Private Credit Boom: 5 Job Hunting Do's & Don'ts

Table of Contents

Do's for Securing Private Credit Jobs

1. Network Strategically

Building relationships is paramount in the private credit industry. It's not just about what you know, but who you know.

- Attend industry conferences and events: Networking events like the Private Equity International (PEI) conferences, industry-specific workshops, and even smaller, more intimate gatherings offer invaluable opportunities to connect with professionals.

- Leverage LinkedIn to connect with professionals in private credit firms: Actively engage with posts, join relevant groups, and personalize your connection requests. Show genuine interest in their work and the firm.

- Informational interviews are crucial for gaining insights and making connections: Reach out to people working in private credit roles to learn about their experiences and gain valuable advice.

- Join relevant professional organizations focused on finance and private credit: Membership in organizations like the CFA Institute or industry-specific groups can provide access to networking events and resources.

2. Highlight Relevant Skills

Your resume and cover letter need to showcase the specific skills and experience that private credit firms value.

- Showcase financial modeling expertise: Demonstrate your proficiency in Excel, financial modeling software, and your ability to build complex financial models.

- Demonstrate experience in credit analysis, underwriting, or portfolio management: Quantify your achievements, emphasizing your contributions to successful deals.

- Highlight your understanding of financial statements and valuation techniques: Demonstrate your ability to analyze financial statements, perform valuations, and assess credit risk.

- Quantify your accomplishments whenever possible to demonstrate impact: Instead of simply stating your duties, focus on the results you achieved – e.g., "Improved portfolio performance by 15%."

- Mention any experience with alternative investments or private equity: Even tangential experience in these areas can be highly relevant and demonstrate transferable skills.

3. Tailor Your Resume and Cover Letter

Generic applications rarely succeed. Each application must be meticulously crafted for the specific firm and role.

- Research the specific firm and its investment strategy: Understand their investment focus, recent deals, and the firm's culture.

- Adjust your resume and cover letter to highlight relevant experiences and skills: Don't just copy and paste – tailor your materials to match the job description's keywords and requirements.

- Use keywords found in the job description: This helps Applicant Tracking Systems (ATS) identify your application as a strong match.

- Demonstrate a clear understanding of the firm's investment focus: Show that you've done your homework and understand their investment thesis.

- Showcase your passion for private credit: Express your genuine interest in the industry and the specific firm.

4. Master the Interview Process

Preparation is key to acing a private credit interview.

- Practice answering common private credit interview questions: Prepare for questions about your experience, your understanding of the market, and your approach to problem-solving.

- Research the interviewers and the firm's recent activities: Demonstrate your knowledge of the firm and the individuals you're meeting.

- Prepare insightful questions to ask the interviewers: This shows your genuine interest and engagement.

- Demonstrate your understanding of market trends in private credit: Stay up-to-date on industry news and current events.

- Project confidence and enthusiasm: Your personality and demeanor are just as important as your qualifications.

5. Leverage Your Network

Your network can be your most valuable asset in your job search.

- Reach out to your contacts for advice and potential leads: Let your network know you're looking for private credit jobs.

- Let your network know you are actively seeking private credit opportunities: Be proactive and let people know you're looking.

- Attend networking events specifically focused on private credit: Target events where you're most likely to meet people in your desired field.

- Follow up with contacts after meetings and interviews: Maintain relationships and express gratitude for their time and assistance.

Don'ts for Private Credit Job Searches

1. Don't Neglect Your Online Presence

Your online presence reflects your professionalism and can significantly impact your job search.

- Update your LinkedIn profile with relevant keywords and accomplishments: Use keywords related to private credit, such as "credit analysis," "underwriting," "portfolio management," etc.

- Ensure your resume is easily accessible online (e.g., through a professional website): Make it easy for recruiters to find you.

- Be mindful of your social media presence; maintain a professional image: Review your social media profiles and remove any content that might be inappropriate for a professional context.

- Remove any inappropriate content from your online profiles: Clean up your online presence to reflect a professional image.

2. Don't Submit Generic Applications

Mass applications without personalization are ineffective. Each application should be tailored to the specific job and firm.

- Each application should be tailored to the specific job description and firm: Avoid using a generic cover letter or resume.

- Demonstrate genuine interest in each firm and its investment strategy: Show you've researched the firm and understand their business.

- Avoid generic cover letters that can be easily detected: Personalize your cover letter to address the specific needs and requirements of each job.

- Show your research and understanding of the specific opportunity: Demonstrate your knowledge of the firm's investment strategy and recent activities.

3. Don't Underestimate the Importance of Soft Skills

Private credit roles require strong interpersonal and communication skills.

- Private credit requires strong communication and collaboration skills: Highlight your ability to work effectively with teams and communicate complex information clearly.

- Demonstrate your ability to work effectively in a team environment: Provide examples of successful teamwork experiences.

- Highlight your problem-solving skills and ability to handle pressure: Demonstrate your ability to think critically and make sound decisions under pressure.

- Show your ability to build rapport and trust: Emphasize your interpersonal skills and ability to build relationships.

4. Don't Rush the Process

The job search takes time and patience.

- The job search can take time; don't get discouraged: Stay persistent and keep applying for jobs.

- Continue networking and applying for positions: Don't give up easily.

- Follow up on applications and interviews: Show initiative and follow-up on your applications.

- Stay positive and persistent throughout the process: Maintain a positive attitude and don't be afraid to reach out to people in your network.

5. Don't Forget to Negotiate

Negotiating salary and benefits is crucial to securing a fair compensation package.

- Research industry salary ranges for your experience level: Use online resources like Glassdoor or Salary.com to research salary ranges.

- Be prepared to discuss your salary expectations: Know your worth and be confident in your negotiation.

- Negotiate for benefits that are important to you: Consider factors such as health insurance, retirement plans, and paid time off.

- Don't undervalue your skills and experience: Be assertive in your negotiation and don't sell yourself short.

Conclusion

The private credit job market offers excellent opportunities for skilled professionals. By following these do's and don'ts, you can significantly increase your chances of landing your dream role. Remember to network strategically, highlight your skills, tailor your applications, master the interview process, and leverage your network to secure a position in this thriving sector. Start your successful private credit job hunt today! Don't miss out on this boom – begin your search for private credit jobs now! Find your perfect private credit career and unlock your potential in this exciting field.

Featured Posts

-

Hear Willie Nelsons Latest The Oh What A Beautiful World Album

Apr 29, 2025

Hear Willie Nelsons Latest The Oh What A Beautiful World Album

Apr 29, 2025 -

Louisvilles Early 2025 Disaster A Confluence Of Snow Tornadoes And Floods

Apr 29, 2025

Louisvilles Early 2025 Disaster A Confluence Of Snow Tornadoes And Floods

Apr 29, 2025 -

Willie Nelson Celebrates His Roadies Legacy In Upcoming Documentary

Apr 29, 2025

Willie Nelson Celebrates His Roadies Legacy In Upcoming Documentary

Apr 29, 2025 -

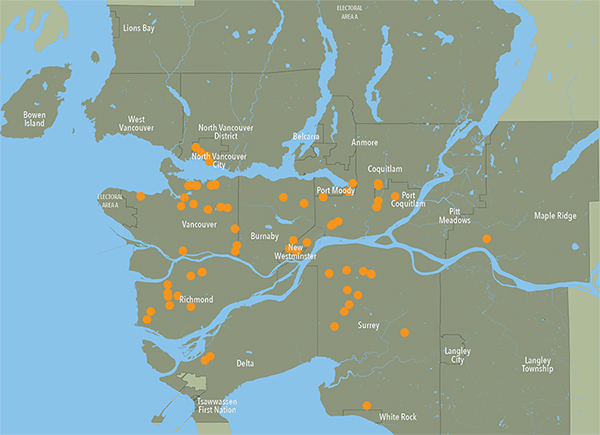

Metro Vancouver Housing Rent Increase Slowdown But Costs Still Climbing

Apr 29, 2025

Metro Vancouver Housing Rent Increase Slowdown But Costs Still Climbing

Apr 29, 2025 -

Social Medias Role In Spreading Misinformation After D C Air Crash

Apr 29, 2025

Social Medias Role In Spreading Misinformation After D C Air Crash

Apr 29, 2025

Latest Posts

-

Pete Rose Pardon Trumps Statement And Its Implications

Apr 29, 2025

Pete Rose Pardon Trumps Statement And Its Implications

Apr 29, 2025 -

Trump To Pardon Pete Rose After His Death Examining The Announcement

Apr 29, 2025

Trump To Pardon Pete Rose After His Death Examining The Announcement

Apr 29, 2025 -

Will Pete Rose Receive A Posthumous Pardon From Trump Analysis And Reactions

Apr 29, 2025

Will Pete Rose Receive A Posthumous Pardon From Trump Analysis And Reactions

Apr 29, 2025 -

Pete Rose Pardon Trumps Post Presidency Plans

Apr 29, 2025

Pete Rose Pardon Trumps Post Presidency Plans

Apr 29, 2025 -

Johnny Damon And Donald Trump Agree Pete Rose Should Be In Baseball Hall Of Fame

Apr 29, 2025

Johnny Damon And Donald Trump Agree Pete Rose Should Be In Baseball Hall Of Fame

Apr 29, 2025