Navigate The Private Credit Boom: 5 Key Do's And Don'ts For Job Seekers

Table of Contents

The private credit industry is experiencing explosive growth, attracting ambitious professionals seeking lucrative and challenging careers. However, breaking into this competitive field requires careful strategy and a keen understanding of the market. This article outlines five crucial do's and don'ts to help job seekers successfully navigate the private credit boom and secure their ideal role in private debt, direct lending, or alternative credit strategies.

Do: Network Strategically within the Private Credit Industry

Networking is paramount for success in the private credit industry. Building relationships with key players can significantly increase your chances of landing your dream job.

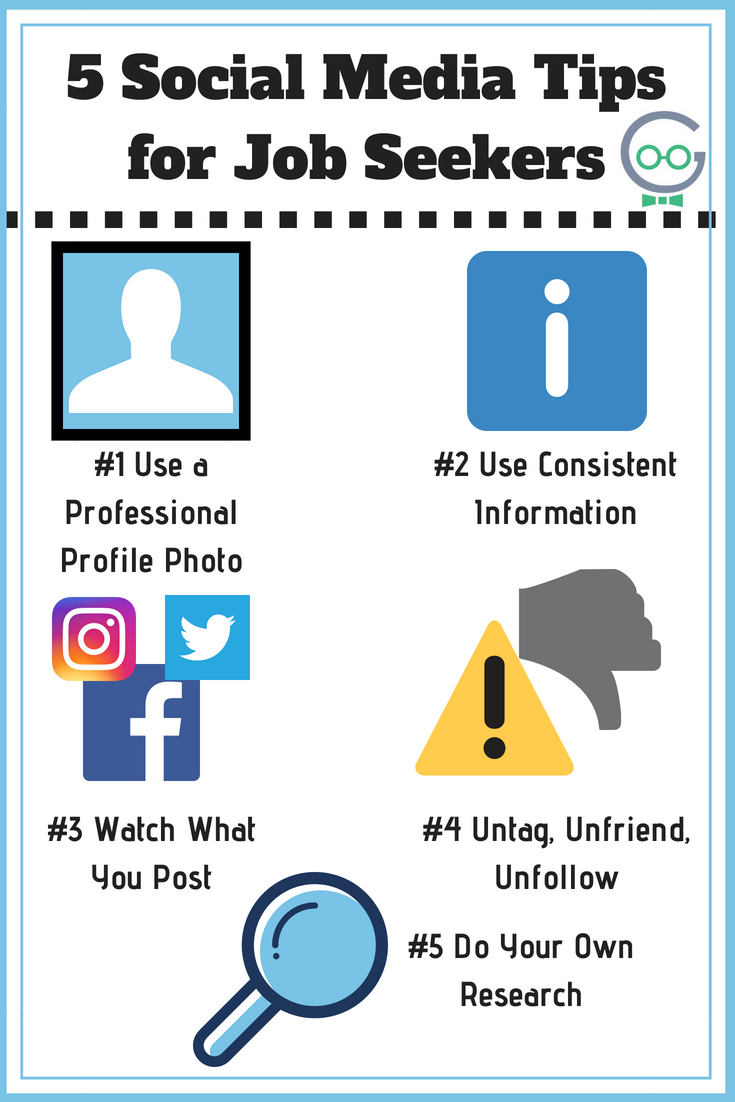

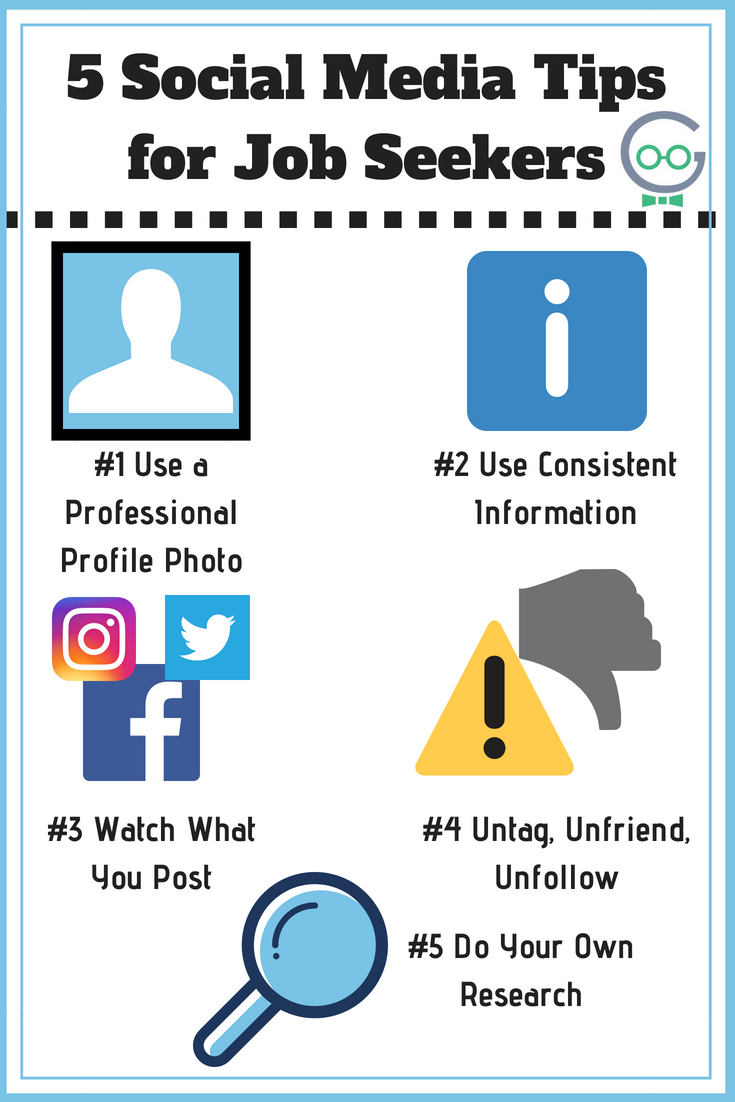

Leverage LinkedIn Effectively:

- Optimize your profile: Use keywords like "private credit," "direct lending," "alternative credit," "fund management," "private debt," "distressed debt," "real estate finance," "structured credit," and any relevant specializations. Highlight your experience in areas like underwriting, portfolio management, or financial modeling.

- Engage actively: Comment thoughtfully on posts by industry leaders and influencers. Join relevant LinkedIn groups, participate in discussions, and share insightful articles.

- Connect strategically: Connect with recruiters specializing in private credit placements and individuals working at firms that interest you.

Attend Industry Events:

- Target relevant events: Attend conferences, seminars, and workshops focused on private credit, alternative investments, private equity, and related financial sectors.

- Prepare your pitch: Develop a concise and engaging introduction that highlights your skills and experience relevant to private credit.

- Follow up effectively: Send personalized thank-you notes or emails after networking events to maintain connections.

Informational Interviews:

- Reach out proactively: Contact professionals working in private credit for informational interviews. Express your genuine interest and desire to learn more about their roles and career paths.

- Prepare insightful questions: Ask thoughtful questions demonstrating your understanding of the industry and their specific area of expertise.

- Express your ambitions: Clearly articulate your career goals and seek advice on how to achieve them within the private credit space.

Do: Highlight Relevant Skills and Experience in Your Application Materials

Your resume and cover letter are your first impression. Make them count by showcasing the skills and experience most valued in the private credit industry.

Tailor Your Resume and Cover Letter:

- Customize for each application: Tailor your resume and cover letter to each specific job description, highlighting the skills and experience most relevant to the role.

- Quantify your achievements: Use metrics and data to demonstrate the impact of your past work. For example, quantify your contributions to portfolio performance or cost savings.

- Use industry keywords: Incorporate keywords related to private credit, financial modeling, portfolio management, credit analysis, due diligence, underwriting, and relevant software (e.g., Bloomberg Terminal, Argus, PitchBook).

Showcase Financial Acumen:

- Highlight relevant skills: Demonstrate your proficiency in financial modeling, valuation, credit analysis, and understanding of capital structures.

- Show experience: Highlight any experience with due diligence, underwriting, portfolio management, or loan origination within private credit or related fields.

- Emphasize analytical skills: Emphasize your strong analytical and problem-solving skills, and your ability to work with complex financial data.

Do: Prepare for Behavioral and Technical Interviews

Preparation is key to success in private credit interviews. Both behavioral and technical questions will assess your suitability for the role.

Practice Common Interview Questions:

- Prepare answers: Prepare thoughtful answers to common behavioral interview questions, such as "Tell me about a time you failed," "Why are you interested in private credit?", and "Describe a challenging situation and how you overcame it."

- Develop impactful responses: Craft concise and impactful responses that showcase your skills, experience, and personality.

- Practice aloud: Practice answering questions aloud to build confidence and refine your delivery.

Master Technical Interview Questions:

- Anticipate technical questions: Prepare for technical questions related to financial modeling, valuation, credit analysis, leveraged buyouts, distressed debt strategies, and market trends within private credit.

- Brush up on your knowledge: Review fundamental financial concepts, industry terminology, and relevant accounting principles.

- Prepare case studies: Prepare case studies to demonstrate your analytical and problem-solving skills in a private credit context.

Don't: Neglect Soft Skills and Networking

While technical skills are essential, soft skills are equally crucial in private credit. Networking remains a powerful tool for career advancement.

- Highlight soft skills: Actively highlight your communication, teamwork, problem-solving, and interpersonal skills in your application materials and interviews. These skills are highly valued in collaborative environments.

- Prioritize networking: Continue to network actively throughout your job search. Attend industry events, connect with people on LinkedIn, and pursue informational interviews. Don't underestimate the power of building relationships.

Don't: Underestimate the Importance of Due Diligence

Before applying for any private credit role, thoroughly research the firm. Demonstrate your knowledge and interest.

- Research firms thoroughly: Research each private credit firm's investment strategies, portfolio composition, company culture, and recent transactions.

- Show genuine interest: Demonstrate your understanding of the firm's investment approach and its place within the broader private credit market. A well-researched application shows genuine interest and commitment.

Conclusion:

Navigating the private credit boom requires a multifaceted approach. By following these do's and don'ts—strategically networking, showcasing relevant skills, preparing thoroughly for interviews, and conducting thorough research—you significantly increase your chances of landing your dream job in this dynamic industry. Don't delay; begin leveraging these tips to navigate the exciting world of private credit job opportunities today! Start your successful private credit job search now!

Featured Posts

-

Innovative Tariff Model Dutch Utilities Experiment With Solar Powered Price Reductions

May 04, 2025

Innovative Tariff Model Dutch Utilities Experiment With Solar Powered Price Reductions

May 04, 2025 -

Le Parc De Batteries D Eneco A Au Roeulx Une Avancee Majeure Pour Le Stockage D Energie En Belgique

May 04, 2025

Le Parc De Batteries D Eneco A Au Roeulx Une Avancee Majeure Pour Le Stockage D Energie En Belgique

May 04, 2025 -

Rain Alert West Bengals North Bengal Region To Expect Heavy Downpour

May 04, 2025

Rain Alert West Bengals North Bengal Region To Expect Heavy Downpour

May 04, 2025 -

Australia Votes Labor Holds Early Lead In Election

May 04, 2025

Australia Votes Labor Holds Early Lead In Election

May 04, 2025 -

Nhl Com Q And A Wolf Discusses Calgarys Playoff Outlook And Calder Contention

May 04, 2025

Nhl Com Q And A Wolf Discusses Calgarys Playoff Outlook And Calder Contention

May 04, 2025

Latest Posts

-

Ufc 314 Ppv Changes And Implications Of Prates Vs Neal Bout Cancellation

May 04, 2025

Ufc 314 Ppv Changes And Implications Of Prates Vs Neal Bout Cancellation

May 04, 2025 -

Ufc 314 Major Ppv Card Alterations Following Prates Neal Cancellation

May 04, 2025

Ufc 314 Major Ppv Card Alterations Following Prates Neal Cancellation

May 04, 2025 -

Ufc 314 Ppv Card Changes Prates Vs Neal Fight Cancelled

May 04, 2025

Ufc 314 Ppv Card Changes Prates Vs Neal Fight Cancelled

May 04, 2025 -

Volkanovski Vs Lopes Ufc 314 A Comprehensive Look At The Winners And Losers

May 04, 2025

Volkanovski Vs Lopes Ufc 314 A Comprehensive Look At The Winners And Losers

May 04, 2025 -

Ufc 314 Volkanovski Lopes Headliner And Complete Fight Card Analysis

May 04, 2025

Ufc 314 Volkanovski Lopes Headliner And Complete Fight Card Analysis

May 04, 2025