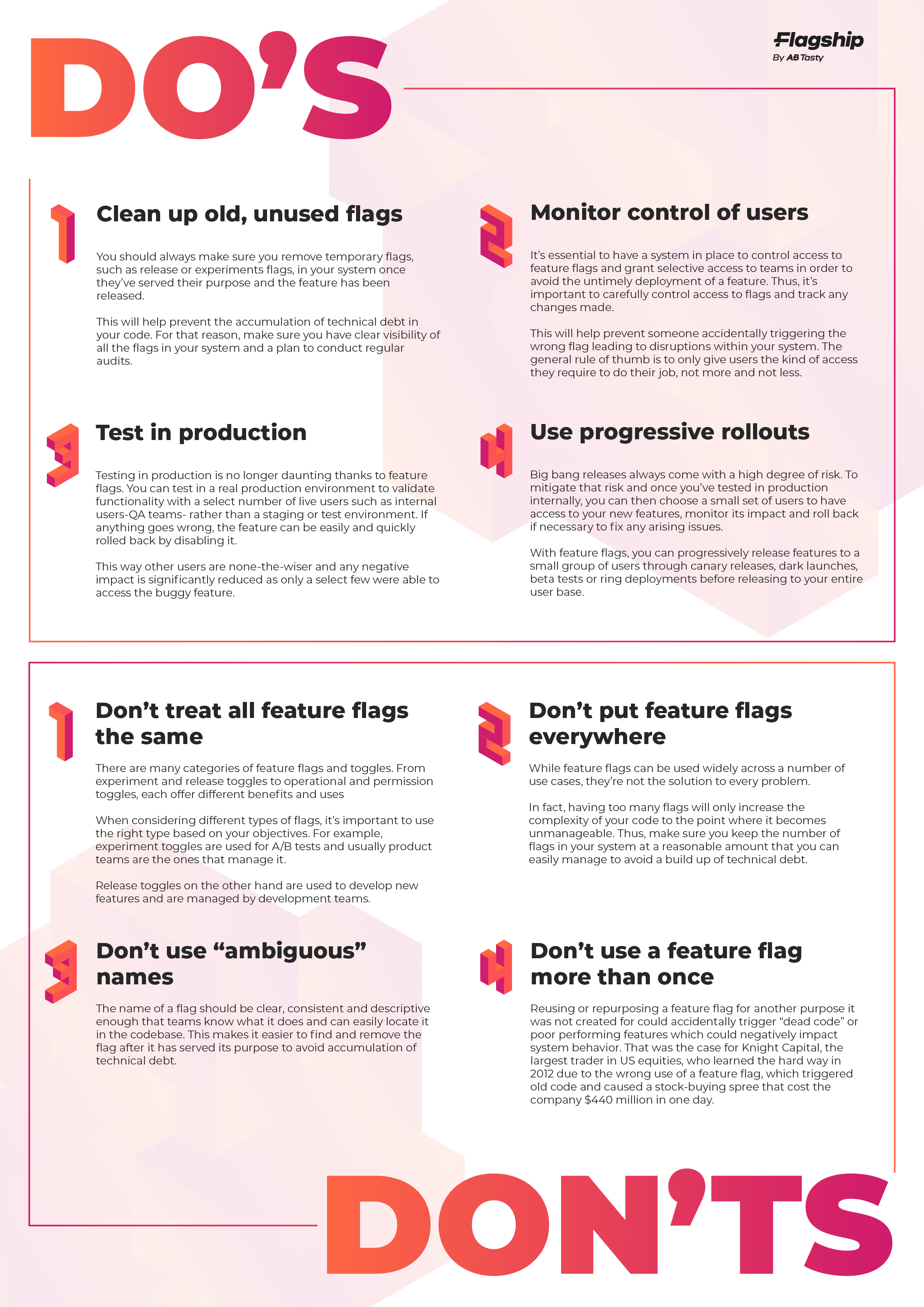

Navigate The Private Credit Job Market: 5 Key Dos And Don'ts

Table of Contents

DO: Network Strategically within the Private Credit Industry

Building a strong network is crucial for success in the private credit job market. This isn't about collecting contacts; it's about building genuine relationships with individuals who can offer valuable insights and potential opportunities.

Leverage LinkedIn Effectively:

- Optimize your profile: Use relevant keywords such as "private credit," "direct lending," "private debt," "structured finance," "leveraged finance," "mezzanine financing," "distressed debt," "collateralized loan obligations (CLOs)," and "leveraged buyouts." Tailor your experience descriptions to highlight your skills within the context of private credit.

- Engage actively: Don't just passively consume content. Comment thoughtfully on posts by industry leaders, share insightful articles, and participate in relevant discussions. This demonstrates your knowledge and interest.

- Join relevant groups: Participate in LinkedIn groups focused on private credit, alternative investments, finance, and specific niches within the industry. Engage in conversations and contribute valuable insights.

Attend Industry Events and Conferences:

- Target key events: Attend conferences like SuperReturn, ACG conferences, and smaller, niche industry events. These provide invaluable networking opportunities.

- Prepare your pitch: Craft a concise and compelling elevator pitch that highlights your skills and career goals within private credit. Practice delivering it confidently.

- Follow up diligently: After networking events, follow up with meaningful connections via email or LinkedIn, reinforcing your interest and sharing any relevant information.

Informational Interviews:

- Reach out strategically: Identify professionals working in private credit whose careers interest you and request informational interviews. Be respectful of their time.

- Prepare insightful questions: Demonstrate your knowledge of the industry by asking well-researched questions that showcase your genuine interest. This will leave a positive impression.

DON'T: Neglect Your Financial Modeling Skills

Private credit roles demand exceptional financial modeling skills. Employers prioritize candidates who can build accurate and efficient models quickly and effectively.

Master Excel and Financial Modeling Software:

- Excel proficiency: Develop advanced Excel skills, including VBA programming for automation. This is a non-negotiable requirement for most roles.

- Industry-standard software: Gain familiarity with financial modeling software such as Argus, Bloomberg Terminal, and other tools commonly used in the private credit industry.

- Targeted practice: Practice building financial models relevant to private credit, such as leveraged buyout models, distressed debt analysis, and real estate finance models.

Underestimate the Importance of Accuracy and Efficiency:

- Accuracy is paramount: Errors in financial modeling can have significant consequences in private credit. Strive for meticulous accuracy in your work.

- Time management is key: Demonstrate your ability to build models efficiently while maintaining accuracy. This showcases your ability to manage workloads effectively.

DO: Tailor Your Resume and Cover Letter to Each Private Credit Role

Generic applications rarely succeed in a competitive market like private credit. Each application needs to showcase your understanding of the specific role and the firm's investment strategy.

Highlight Relevant Skills and Experience:

- Quantify your achievements: Use numbers and data to demonstrate the impact you've had in previous roles. Instead of saying "improved efficiency," say "improved efficiency by 15%."

- Keyword optimization: Use keywords from the job description to highlight your relevant experience. Applicant Tracking Systems (ATS) often scan for these keywords.

- Targeted resumes: Tailor your resume to each specific job description, emphasizing the skills and experience most relevant to that particular role.

Showcase Your Understanding of Private Credit:

- Demonstrate your knowledge: Clearly articulate your understanding of different private credit strategies, including direct lending, mezzanine financing, and distressed debt investing.

- Highlight relevant experience: Mention any relevant coursework, certifications, internships, or projects that demonstrate your knowledge of the private credit sector.

DON'T: Undersell Your Strengths and Achievements

Confidence is key in the private credit job market. Don't be afraid to highlight your accomplishments and demonstrate your value proposition.

Confidently Highlight Your Accomplishments:

- Articulate your contributions: Clearly and confidently articulate your contributions and their impact in previous roles. Don't be shy about your successes.

- Strong action verbs: Use strong action verbs to describe your accomplishments, showcasing your proactive approach.

- Quantifiable results: Whenever possible, focus on quantifiable results to demonstrate the value you've added.

Be Prepared to Discuss Your Salary Expectations:

- Research salary ranges: Conduct thorough research to understand the typical salary range for similar roles in your target location and experience level.

- Negotiate confidently: Be prepared to discuss your salary expectations confidently and professionally, while demonstrating your understanding of the market value of your skills.

DO: Prepare for Behavioral and Technical Interview Questions

Private credit interviews assess both your technical skills and your soft skills. Thorough preparation is critical for success.

Practice Answering Common Interview Questions:

- Behavioral questions: Prepare answers to common behavioral interview questions, such as "Tell me about a time you failed," "Describe a time you worked under pressure," and "Describe your strengths and weaknesses." Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Technical questions: Practice answering technical questions related to financial modeling, valuation, credit analysis, and private credit strategies. Be prepared to walk through your thought process.

- Company research: Research the firm and the interviewers beforehand. Prepare insightful questions to demonstrate your interest and engagement.

Conclusion

Securing a position in the competitive private credit job market requires dedication and a well-defined strategy. By following these five key dos and don'ts – networking strategically, mastering financial modeling, tailoring your application materials, confidently showcasing your strengths, and preparing thoroughly for interviews – you will significantly improve your chances of success. Don't delay; start navigating the private credit job market today and unlock your potential in this exciting and lucrative field!

Featured Posts

-

1 Mayis Kocaeli Kutlama Alaninda Cikan Arbede Hakkinda Bilgiler

May 03, 2025

1 Mayis Kocaeli Kutlama Alaninda Cikan Arbede Hakkinda Bilgiler

May 03, 2025 -

Fans Accuse Christina Aguilera Of Excessive Photoshopping

May 03, 2025

Fans Accuse Christina Aguilera Of Excessive Photoshopping

May 03, 2025 -

Des Annees Apres Leur Mariage Emmanuel Macron Parle De Son Intimite Avec Brigitte

May 03, 2025

Des Annees Apres Leur Mariage Emmanuel Macron Parle De Son Intimite Avec Brigitte

May 03, 2025 -

Souness On Arsenal Champions League Contenders Poised For A Difficult Challenge

May 03, 2025

Souness On Arsenal Champions League Contenders Poised For A Difficult Challenge

May 03, 2025 -

Ai Driven Podcast Creation Transforming Repetitive Documents Into Compelling Audio

May 03, 2025

Ai Driven Podcast Creation Transforming Repetitive Documents Into Compelling Audio

May 03, 2025

Latest Posts

-

Survey Shows 93 Trust In South Carolinas Election Process

May 03, 2025

Survey Shows 93 Trust In South Carolinas Election Process

May 03, 2025 -

Maines Groundbreaking Post Election Audit A Detailed Look

May 03, 2025

Maines Groundbreaking Post Election Audit A Detailed Look

May 03, 2025 -

The 2024 Election Lessons From Florida And Wisconsin Voter Turnout

May 03, 2025

The 2024 Election Lessons From Florida And Wisconsin Voter Turnout

May 03, 2025 -

Sc Elections Public Trust Reaches 93 In New Survey

May 03, 2025

Sc Elections Public Trust Reaches 93 In New Survey

May 03, 2025 -

Post Election Audit Pilot Program Begins In Maine

May 03, 2025

Post Election Audit Pilot Program Begins In Maine

May 03, 2025