Navigating Geopolitical Uncertainty: Nvidia's Challenges

Table of Contents

US-China Tech Cold War and its Impact on Nvidia

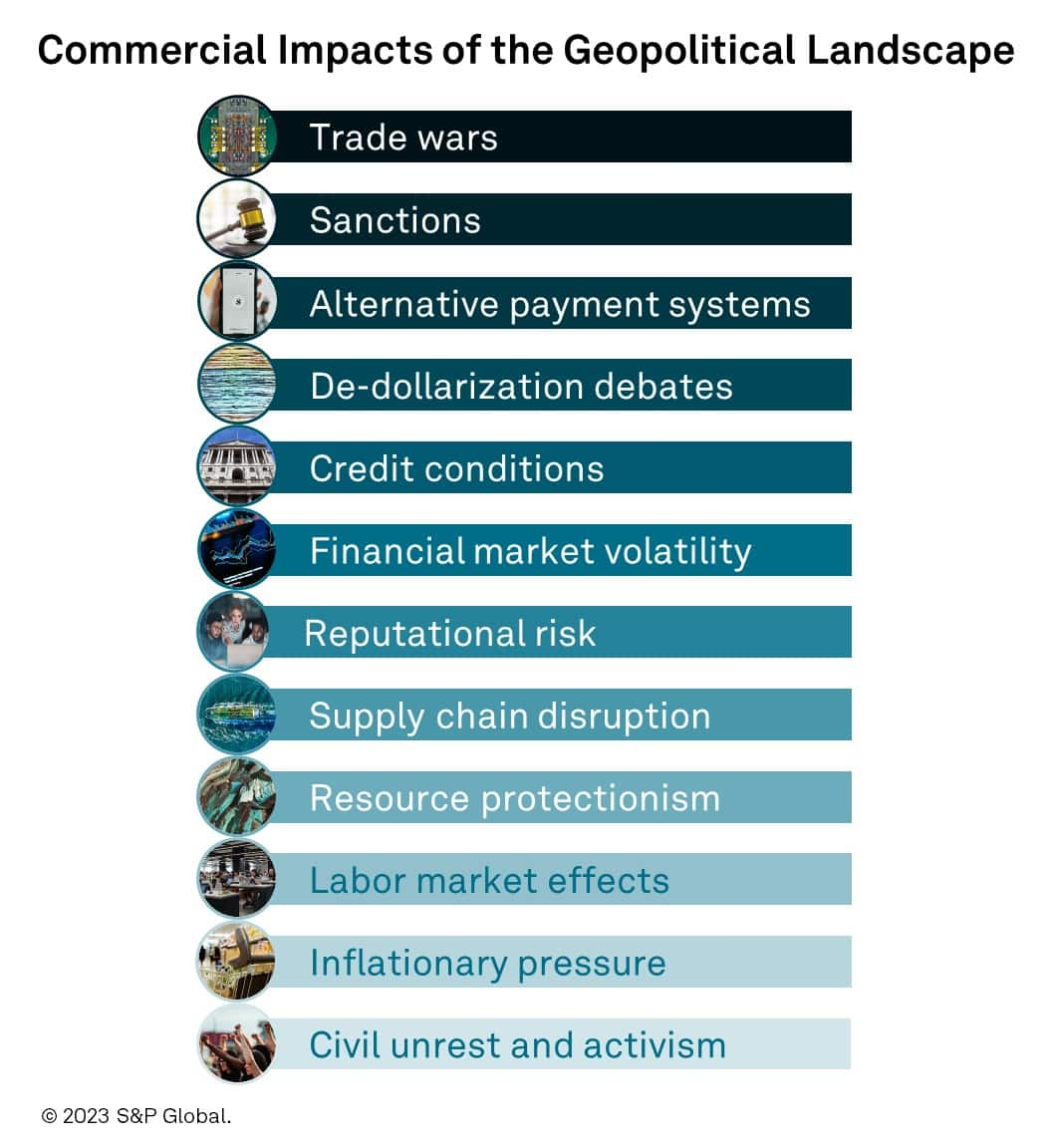

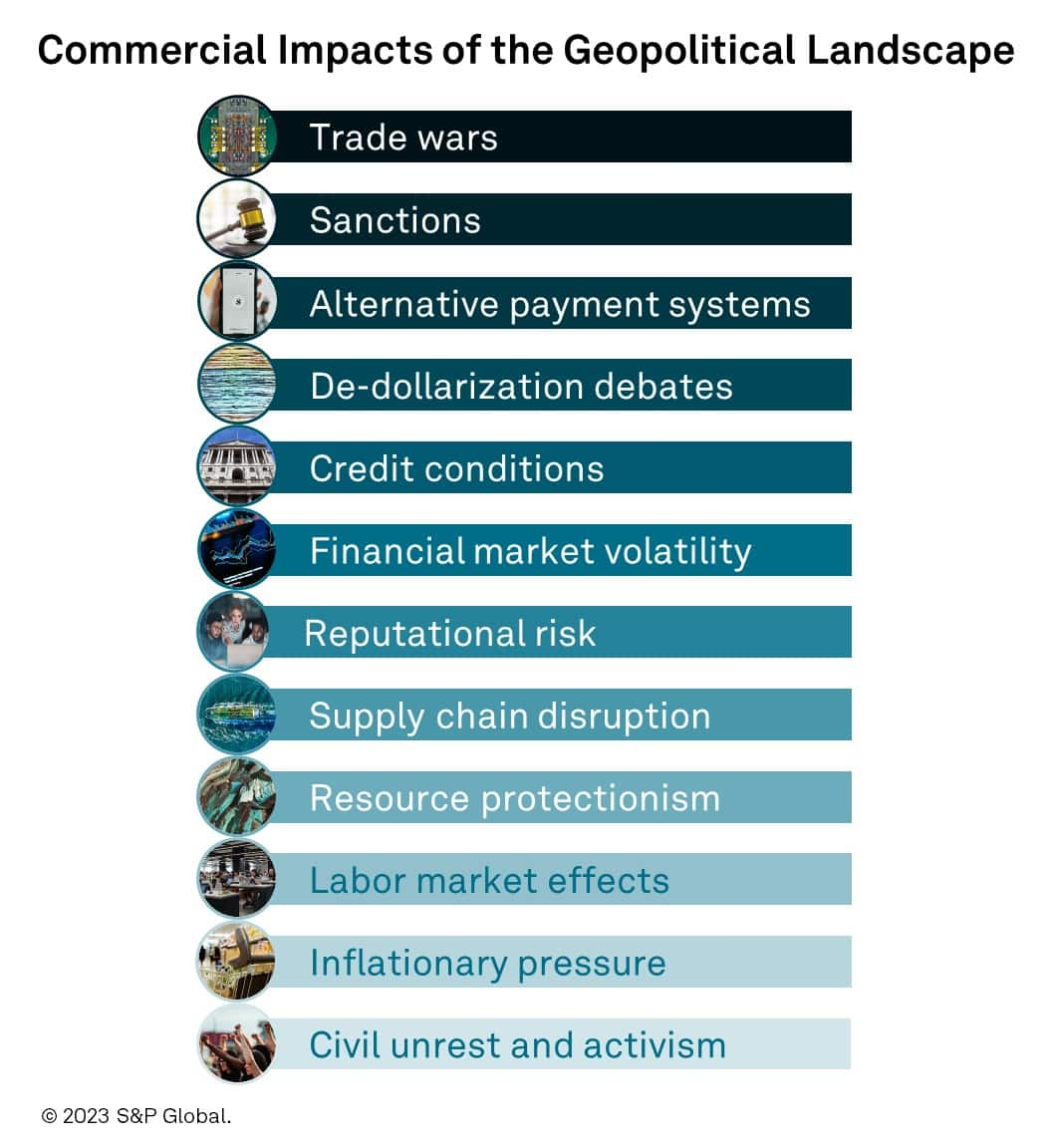

The escalating US-China technological rivalry presents a significant challenge for Nvidia, impacting its operations and future growth prospects. This "Nvidia Geopolitical Risk" manifests in several key areas.

Export Controls and Supply Chain Disruptions

The US government's imposition of export controls on advanced chips, particularly those with applications in high-performance computing (HPC) and artificial intelligence (AI), directly impacts Nvidia's ability to sell its most advanced GPUs to the Chinese market. This constitutes a major component of Nvidia Geopolitical Risk.

- Restrictions on exporting advanced GPUs to China limit Nvidia's market access: This significantly reduces potential revenue streams and market share in a crucial region for AI development and adoption.

- This necessitates developing alternative supply chains, potentially increasing costs: Diversifying manufacturing and sourcing locations adds complexity and expense.

- Diversification strategies and regional manufacturing become essential: Nvidia must invest in establishing production facilities outside of China to mitigate future disruptions.

- Potential impact on revenue and market share needs close monitoring: Analysts must closely track Nvidia's financial performance to assess the actual impact of these restrictions.

Increased Scrutiny and Regulatory Hurdles

Beyond export controls, Nvidia faces increased regulatory scrutiny in both the US and China. This adds another layer to the Nvidia Geopolitical Risk assessment.

- Antitrust investigations and concerns about market dominance: Nvidia's dominant position in the GPU market attracts antitrust attention in various jurisdictions.

- Data security and national security concerns impacting approvals: Governments are increasingly scrutinizing the use of advanced chips in critical infrastructure and sensitive applications, leading to delays and potential roadblocks for Nvidia.

- Navigating complex regulatory landscapes across various jurisdictions: Compliance with differing regulations across multiple countries adds significant administrative and legal burdens.

- Increased legal and compliance expenses: The cost of navigating these regulatory complexities represents a substantial financial burden for the company.

Global Supply Chain Vulnerabilities and Resilience

Nvidia's global supply chain, while efficient, is inherently vulnerable to geopolitical instability. This vulnerability is a crucial element of Nvidia Geopolitical Risk.

Geopolitical Instability and Resource Dependence

Nvidia relies on a complex network of suppliers across the globe for raw materials, components, and manufacturing. This dependence exposes the company to various risks.

- Dependence on specific regions for crucial raw materials and manufacturing: Disruptions in any key region can have a cascading effect on Nvidia's production capabilities.

- Impact of natural disasters and political instability on production: Events like earthquakes, floods, or political unrest can severely disrupt the supply chain.

- Need for resilient supply chains with diversified sourcing and manufacturing locations: Building redundancy into the supply chain is essential for mitigating risk.

- Strategies for mitigating supply chain risks through partnerships and redundancy: Strong partnerships and alternative sourcing options are crucial for resilience.

Logistics and Transportation Challenges

Geopolitical tensions often create logistical bottlenecks, increasing costs and delays. This aspect further complicates Nvidia Geopolitical Risk.

- Increased shipping costs and delays due to sanctions and trade restrictions: Trade wars and sanctions can significantly impact shipping costs and delivery times.

- Port congestion and other transportation disruptions: Global events can cause port congestion and other disruptions to the transportation network.

- Potential for supply chain disruptions due to geopolitical instability: Political instability in key transit regions can lead to significant supply chain delays.

- Need for efficient and flexible logistics management: Nvidia needs to adapt its logistics strategies to respond to these dynamic challenges.

Geopolitical Risk Management Strategies at Nvidia

Nvidia is actively implementing strategies to mitigate the Nvidia Geopolitical Risk it faces.

Diversification and Regionalization

To reduce dependence on specific regions, Nvidia is pursuing diversification and regionalization strategies.

- Investments in manufacturing facilities in various countries: Expanding manufacturing capacity across multiple countries reduces reliance on any single location.

- Strategic partnerships with regional players: Collaborating with local partners helps to establish stronger supply chains and navigate regulatory complexities.

- Development of alternative sourcing for critical components: Identifying and developing alternative suppliers ensures a more resilient supply chain.

- Reducing dependence on any single geographical location: This overall strategy is designed to minimize the impact of geopolitical events.

Lobbying and Regulatory Engagement

Nvidia actively engages with governments and regulatory bodies to influence policy and address concerns.

- Proactive engagement with policymakers to influence legislation: Nvidia actively participates in shaping policies that impact its business.

- Building strong relationships with regulatory bodies: Maintaining strong relationships with regulatory agencies helps to navigate complex approval processes.

- Transparent communication and advocacy: Open communication builds trust with stakeholders and mitigates potential negative impacts.

- Managing reputational risks and building trust with stakeholders: A strong reputation is crucial for navigating the complex geopolitical landscape.

Conclusion

Nvidia's success hinges on effectively navigating complex geopolitical landscapes. The US-China tech rivalry, global supply chain vulnerabilities, and evolving regulatory environments present significant challenges, contributing to substantial Nvidia Geopolitical Risk. However, Nvidia's proactive approach to diversification, regionalization, and regulatory engagement demonstrates a commitment to mitigating these risks. Continued monitoring of Nvidia geopolitical risk and the company's strategies for addressing these challenges are crucial for investors and industry observers. By understanding the intricacies of Nvidia's geopolitical challenges, we can better predict its future performance and the broader implications for the semiconductor industry. Staying informed about Nvidia geopolitical risk is essential for informed decision-making.

Featured Posts

-

The Backlash Against Michael Sheens Charitable Documentary

May 01, 2025

The Backlash Against Michael Sheens Charitable Documentary

May 01, 2025 -

Dragons Den A Guide To Success On The Show

May 01, 2025

Dragons Den A Guide To Success On The Show

May 01, 2025 -

Zdravko Colic I Njegova Prva Ljubav Detalji O Pesmi Kad Sam Se Vratio

May 01, 2025

Zdravko Colic I Njegova Prva Ljubav Detalji O Pesmi Kad Sam Se Vratio

May 01, 2025 -

Canadian Dollar Election Outcomes And Currency Predictions

May 01, 2025

Canadian Dollar Election Outcomes And Currency Predictions

May 01, 2025 -

Cruise Line Complaints Will You Be Banned

May 01, 2025

Cruise Line Complaints Will You Be Banned

May 01, 2025

Latest Posts

-

Alqdae Yudyn Ryys Shbab Bn Jryr Tfasyl Alhkm Wtdaeyath

May 01, 2025

Alqdae Yudyn Ryys Shbab Bn Jryr Tfasyl Alhkm Wtdaeyath

May 01, 2025 -

Tien Linh Dai Su Tinh Nguyen Binh Duong Hanh Trinh Lan Toa Yeu Thuong

May 01, 2025

Tien Linh Dai Su Tinh Nguyen Binh Duong Hanh Trinh Lan Toa Yeu Thuong

May 01, 2025 -

Passo In Avanti Per La Flaminia Ripescaggio Dalla Quinta Alla Seconda Posizione

May 01, 2025

Passo In Avanti Per La Flaminia Ripescaggio Dalla Quinta Alla Seconda Posizione

May 01, 2025 -

Atff Nin Stuttgart Taki Bueyuek Futbol Altyapi Projesi

May 01, 2025

Atff Nin Stuttgart Taki Bueyuek Futbol Altyapi Projesi

May 01, 2025 -

Almanya Da Futbol Hayali Stuttgart Atff Secmeleriyle Baslayin

May 01, 2025

Almanya Da Futbol Hayali Stuttgart Atff Secmeleriyle Baslayin

May 01, 2025