Navigating High Stock Market Valuations: Insights From BofA

Table of Contents

Factors Contributing to High Stock Market Valuations

Several interconnected factors have contributed to the elevated stock market valuations we're currently witnessing. Understanding these drivers is crucial for informed investment decisions.

Low Interest Rates

Historically low interest rates have played a significant role in boosting stock market valuations. When interest rates are low, bonds become less attractive investments, as their yields are comparatively lower. This pushes capital towards equities, increasing demand and driving up prices.

- Increased demand for equities: Low interest rates make stocks a more appealing alternative for investors seeking higher returns.

- Compression of yield spreads: The difference between the returns of bonds and stocks narrows, making equities more competitive.

- Effect on discounted cash flow models: Lower discount rates used in valuation models result in higher present values for future earnings, inflating valuations. This is a key aspect of how low interest rates impact equity valuation from a fundamental perspective. Understanding discounted cash flow (DCF) analysis is essential for investors navigating high valuation environments.

Keywords: low interest rates, bond yields, equity valuations, discounted cash flow, interest rate risk

Strong Corporate Earnings

Robust corporate earnings have also supported elevated stock prices, despite concerns about valuations. The post-pandemic economic recovery, coupled with strong consumer spending and technological advancements, has fueled significant profit growth for many companies.

- Impact of post-pandemic recovery: The rebound in economic activity has boosted demand and revenue for many businesses.

- Strong consumer spending: Increased consumer confidence and spending have driven sales growth across various sectors.

- Technological advancements: Innovation and technological disruptions continue to create new growth opportunities for businesses, contributing to higher earnings.

Keywords: corporate earnings, profit growth, consumer spending, technological innovation, earnings growth

Inflationary Pressures

Inflation introduces complexity to the valuation picture. While inflation can initially boost nominal earnings, it also impacts interest rate expectations and can erode real earnings growth if not managed effectively.

- Impact on interest rate expectations: Rising inflation often leads to expectations of future interest rate hikes by central banks, potentially impacting stock valuations.

- Effect on consumer spending: High inflation can dampen consumer spending, impacting corporate revenues and earnings.

- Potential for earnings erosion: Companies may face increased costs due to inflation, potentially squeezing profit margins and hindering earnings growth.

Keywords: inflation, interest rate hikes, consumer price index, earnings growth, inflationary pressures

Assessing the Risks of High Valuations

While strong earnings and low interest rates have fueled market gains, high valuations present inherent risks. Understanding these risks is paramount for effective risk management.

Potential for Market Corrections

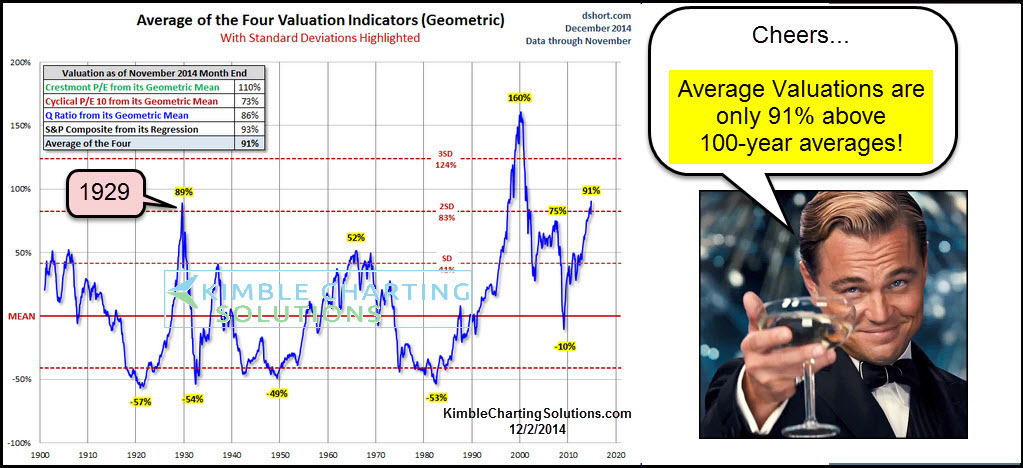

Given current valuation multiples, the risk of a significant market correction or downturn remains a significant concern. History shows that periods of high valuations are often followed by periods of consolidation or decline.

- Valuation multiples: Metrics like the price-to-earnings ratio (P/E ratio) and other valuation multiples are currently elevated compared to historical averages for many sectors.

- Historical comparisons: Analyzing historical market cycles reveals patterns that may suggest an increased likelihood of a correction.

- Potential triggers for a correction: Unforeseen economic shocks, abrupt shifts in monetary policy, or geopolitical instability could act as catalysts for a market correction.

Keywords: market correction, market downturn, valuation multiples, price-to-earnings ratio, risk assessment, market volatility

Interest Rate Sensitivity

High-growth stocks, often valued based on projected future cash flows, are particularly vulnerable to rising interest rates. Higher interest rates increase the discount rate used in valuation models, reducing the present value of those future cash flows.

- Impact on future cash flows: Higher interest rates can make future earnings less valuable in today's terms.

- Discounted cash flow analysis: This valuation method is heavily influenced by interest rate changes.

- Sector-specific vulnerabilities: Some sectors are more sensitive to interest rate changes than others. Understanding this sector-specific sensitivity is crucial for risk mitigation.

Keywords: interest rate risk, rising interest rates, high-growth stocks, discounted cash flow analysis

Geopolitical Uncertainty

Global events and geopolitical uncertainty can significantly impact market stability and valuations. Unforeseen global disruptions can create volatility and trigger investor risk aversion.

- Examples of geopolitical risks: International conflicts, trade wars, and political instability can all negatively impact market sentiment.

- Impact on investor sentiment: Geopolitical events can trigger shifts in investor sentiment, leading to market fluctuations.

- Market volatility: Geopolitical uncertainty frequently leads to increased market volatility, posing risks to investors.

Keywords: geopolitical risk, global uncertainty, market volatility, investor sentiment

Strategies for Navigating High Stock Market Valuations

Navigating high stock market valuations requires a well-defined investment strategy that incorporates several key elements.

Diversification

Diversification remains a cornerstone of effective risk management. Spreading investments across different asset classes and sectors helps to reduce overall portfolio risk.

- Asset allocation strategies: A well-defined asset allocation strategy that aligns with your risk tolerance and investment goals is essential.

- Reducing overall portfolio risk: Diversification helps mitigate the impact of losses in any single asset class.

- Benefits of diversification: It reduces volatility and potentially improves long-term returns.

Keywords: portfolio diversification, asset allocation, risk management, portfolio optimization

Value Investing

Value investing focuses on identifying undervalued stocks or sectors, offering potential upside while mitigating some of the risks associated with overvalued markets.

- Identifying undervalued companies: Thorough fundamental analysis is key to identifying companies trading below their intrinsic value.

- Fundamental analysis: This involves examining a company's financial statements, business model, and competitive landscape.

- Long-term investment strategy: Value investing is typically a long-term strategy, focusing on the underlying value of companies rather than short-term market fluctuations.

Keywords: value investing, fundamental analysis, undervalued stocks, long-term investment

Tactical Asset Allocation

Tactical asset allocation involves adjusting your portfolio's asset allocation based on prevailing market conditions. This requires careful market analysis and potentially involves some market timing considerations.

- Market timing considerations: While perfect market timing is impossible, strategic adjustments can improve risk-adjusted returns.

- Dynamic asset allocation strategies: These strategies involve actively shifting allocations based on market forecasts and changing economic conditions.

- Risk tolerance: The level of tactical allocation should align with your risk tolerance and investment goals.

Keywords: tactical asset allocation, dynamic asset allocation, market timing, risk tolerance

Conclusion

Successfully navigating high stock market valuations requires a well-defined investment strategy and careful consideration of the risks. BofA's analysis highlights the interplay of low interest rates, strong corporate earnings, and inflationary pressures in shaping current market conditions. Potential risks include market corrections, interest rate sensitivity, and geopolitical uncertainty. Mitigating these risks requires diversification, value investing, and potentially, tactical asset allocation. By understanding the factors influencing current market conditions and employing the strategies outlined, you can make informed decisions and work towards achieving your financial goals. Learn more about effectively managing your investments in this complex market by researching further into BofA’s analysis and exploring other resources on navigating high stock market valuations.

Featured Posts

-

Anchor Brewing Company Closes After 127 Years The End Of An Era

Apr 25, 2025

Anchor Brewing Company Closes After 127 Years The End Of An Era

Apr 25, 2025 -

You Tube Dominance Exploring Its Reach And Impact

Apr 25, 2025

You Tube Dominance Exploring Its Reach And Impact

Apr 25, 2025 -

Sky Sports Source Confirms Arsenals Pursuit Of Premier League Title Winner

Apr 25, 2025

Sky Sports Source Confirms Arsenals Pursuit Of Premier League Title Winner

Apr 25, 2025 -

Palisades Fire A List Of Celebrities Who Lost Their Homes

Apr 25, 2025

Palisades Fire A List Of Celebrities Who Lost Their Homes

Apr 25, 2025 -

Top Coachella 2025 Performer Merchandise To Buy On Amazon

Apr 25, 2025

Top Coachella 2025 Performer Merchandise To Buy On Amazon

Apr 25, 2025

Latest Posts

-

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025 -

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025 -

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025 -

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025 -

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Auto Brands

Apr 26, 2025

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Auto Brands

Apr 26, 2025