Navigating The Private Credit Boom: 5 Do's And Don'ts To Secure Your Role

Table of Contents

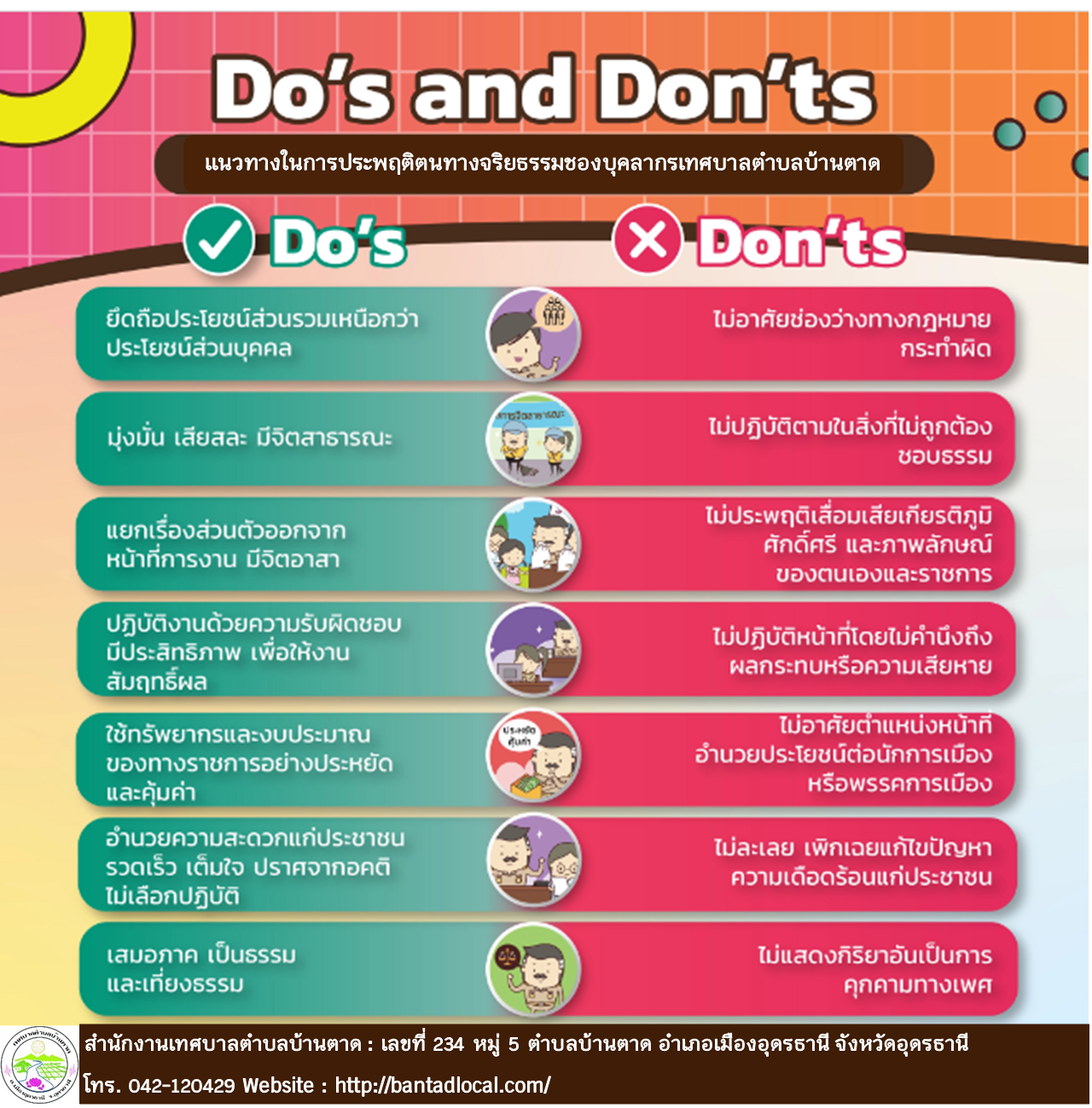

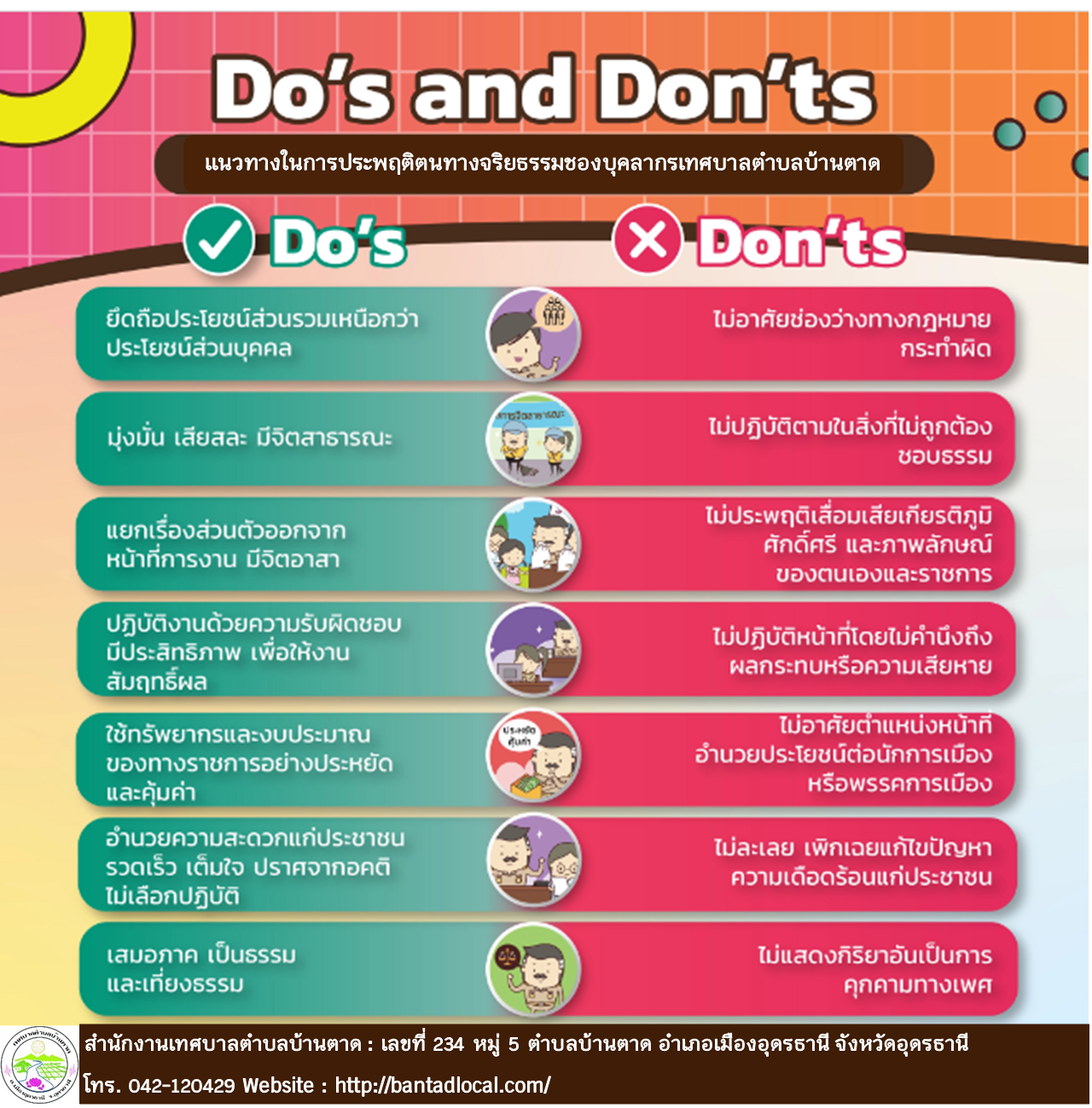

Do's: Maximize Your Chances in the Private Credit Boom

1. Develop Specialized Skills and Knowledge

The private credit boom demands more than general finance knowledge. To stand out, you need specialized skills. This includes a deep understanding of the intricacies of private credit transactions.

- Master financial modeling specific to private credit: This includes LBO modeling, distressed debt analysis, and cash flow projections for various credit structures (e.g., unitranche, senior secured). Proficiency in these models is crucial for evaluating investment opportunities and structuring deals.

- Develop a strong understanding of legal documentation: Familiarize yourself with credit agreements, security agreements, and other legal documents common in private credit transactions. Understanding the legal intricacies will allow you to identify potential risks and opportunities.

- Gain proficiency in due diligence processes: Master the process of thoroughly investigating potential investments, including financial statement analysis, legal review, and operational assessments. This is crucial for mitigating risks and making informed investment decisions.

- Understand credit risk assessment, underwriting, and portfolio management techniques: Develop expertise in analyzing credit risk, evaluating borrower creditworthiness, and managing a portfolio of private credit investments effectively.

- Stay updated on industry trends, regulations, and market cycles: The private credit market is constantly evolving. Stay informed about regulatory changes (e.g., Dodd-Frank Act implications), market cycles, and emerging trends through industry publications, conferences, and networking.

2. Build a Strong Network

Networking is paramount in the competitive private credit landscape. Building relationships with key players can open doors to unadvertised opportunities.

- Attend industry conferences and networking events: These events provide excellent opportunities to meet professionals, learn about industry trends, and make connections. Target conferences specifically focused on private credit, leveraged finance, or distressed debt.

- Actively engage on professional platforms like LinkedIn: Optimize your profile to showcase your skills and experience in private credit. Connect with professionals in the field, participate in relevant groups, and share insightful content.

- Conduct informational interviews: Reach out to professionals in private credit for informational interviews. These conversations provide valuable insights into the industry and help you build relationships.

- Leverage your existing network: Inform your contacts about your career goals in private credit. You never know who might have a connection that could lead to an opportunity.

- Participate in industry-specific professional organizations: Joining organizations like the CFA Institute or industry-specific private credit associations provides access to networking events, educational resources, and industry leaders.

3. Tailor Your Resume and Cover Letter

Your application materials are your first impression. Make it count by tailoring them to each specific opportunity.

- Highlight relevant experience: Even if your background isn't directly in private credit, highlight transferable skills from corporate finance, accounting, or other related fields. Emphasize experiences demonstrating analytical and problem-solving abilities.

- Quantify your achievements: Use numbers to demonstrate your impact in previous roles. Instead of saying "improved efficiency," say "improved efficiency by 15%."

- Use keywords related to private credit: Incorporate relevant keywords throughout your resume and cover letter, such as "underwriting," "due diligence," "credit analysis," "syndicated loan," "mezzanine financing," and "distressed debt."

- Customize your resume and cover letter: Don't send generic applications. Tailor each one to the specific job description and the firm's culture. Research the firm thoroughly and highlight how your skills and experience align with their needs.

- Showcase strong analytical and problem-solving skills: Private credit requires strong analytical skills. Highlight examples in your resume and cover letter where you demonstrated these skills.

4. Ace the Interview Process

The interview is your chance to showcase your personality, skills, and knowledge. Preparation is key.

- Practice behavioral interview questions: Prepare examples that demonstrate your teamwork, problem-solving, and ethical decision-making skills. The STAR method (Situation, Task, Action, Result) is a useful framework.

- Prepare detailed examples of your experience: Be ready to discuss specific examples of your experience in financial analysis, deal structuring, and credit risk assessment. Quantify your accomplishments whenever possible.

- Demonstrate your understanding of the private credit market: Showcase your knowledge of the current market landscape, key players, and recent trends.

- Research the firm and interviewer: Thoroughly research the firm's investment strategy, portfolio companies, and the interviewer's background. This demonstrates your genuine interest.

- Ask insightful questions: Asking thoughtful questions shows initiative and engagement. Prepare a few questions in advance to demonstrate your interest and understanding of the firm and the role.

Don'ts: Avoid These Pitfalls in the Private Credit Market

1. Neglecting Industry-Specific Knowledge

Don't assume general finance knowledge is sufficient. The private credit boom requires specialized expertise.

- Don't underestimate the need for specialized knowledge: Areas like distressed debt, mezzanine financing, and different credit structures require in-depth understanding.

- Avoid relying solely on general finance knowledge: Private credit involves unique legal, regulatory, and operational considerations.

- Don't undervalue the importance of understanding legal and regulatory aspects: A strong grasp of legal documentation and regulatory compliance is critical.

2. Ignoring Networking Opportunities

Networking is not optional; it's essential for success in the competitive private credit market.

- Don't underestimate the power of networking: Building relationships can lead to unadvertised opportunities and mentorship.

- Don't be passive in your job search: Actively seek out networking opportunities and build relationships with professionals in the field.

- Avoid relying solely on online applications: Networking can significantly increase your chances of securing a role.

3. Submitting Generic Applications

Each application should be tailored to the specific role and firm.

- Don't send generic resumes and cover letters: Demonstrate your understanding of the specific firm and role by customizing your application materials.

- Avoid using outdated or irrelevant information: Ensure your resume and cover letter are up-to-date and reflect your current skills and experience.

- Don't overlook the importance of proofreading and editing: Errors in your application materials can make a negative impression.

4. Underestimating the Interview

The interview is a crucial step in the process. Thorough preparation is essential.

- Don't underestimate the importance of thorough preparation: Practice your answers, research the firm, and prepare insightful questions.

- Avoid appearing unprepared or uninterested: Demonstrate your enthusiasm and knowledge throughout the interview.

- Don't neglect asking thoughtful questions: This shows your interest and initiative.

Conclusion

The private credit boom presents a unique window of opportunity for ambitious professionals. By following these "do's" and avoiding the "don'ts," you significantly increase your chances of securing a fulfilling and rewarding role in this dynamic sector. Remember to hone your specialized skills, build a robust network, and present yourself effectively. Don't delay – start navigating the private credit boom today and seize the opportunities that await!

Featured Posts

-

Did Elon Musk Father Amber Heards Twins A Look At The Recent Claims

May 16, 2025

Did Elon Musk Father Amber Heards Twins A Look At The Recent Claims

May 16, 2025 -

Miami Heats Butler Suffers Pelvic Contusion Recovery Timeline Unknown

May 16, 2025

Miami Heats Butler Suffers Pelvic Contusion Recovery Timeline Unknown

May 16, 2025 -

Eau Du Robinet Polluee Solutions De Filtration Et Amelioration De La Qualite

May 16, 2025

Eau Du Robinet Polluee Solutions De Filtration Et Amelioration De La Qualite

May 16, 2025 -

Ohtanis Home Run And The Meaningful Celebration He Shared

May 16, 2025

Ohtanis Home Run And The Meaningful Celebration He Shared

May 16, 2025 -

Foot Locker Appoints Franklin Bracken As President

May 16, 2025

Foot Locker Appoints Franklin Bracken As President

May 16, 2025