Navigating The Stock Market In The Shadow Of 'Liberation Day' Tariffs

Table of Contents

Understanding the Impact of 'Liberation Day' Tariffs on the Stock Market

The 'Liberation Day' tariffs, let's assume for the purpose of this example, are a significant increase in import duties on certain goods, impacting several sectors. Their intended consequence is to protect domestic industries, but unintended consequences such as trade wars and economic slowdown are often the result.

-

Bullet Point 1: Sectors Most Affected: Industries heavily reliant on imported goods or exporting to specific countries will feel the brunt of these tariffs. This could include technology companies dependent on foreign components, manufacturers using imported raw materials, and agricultural businesses exporting produce. The technology sector, in particular, may see increased costs and reduced competitiveness. Companies like XYZ Corp (a hypothetical example), heavily reliant on imported chips from Country A, could face significant profit margin squeezes.

-

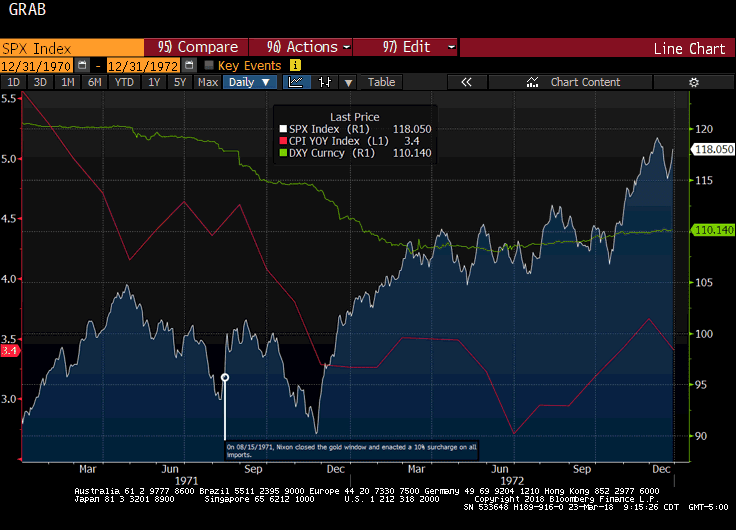

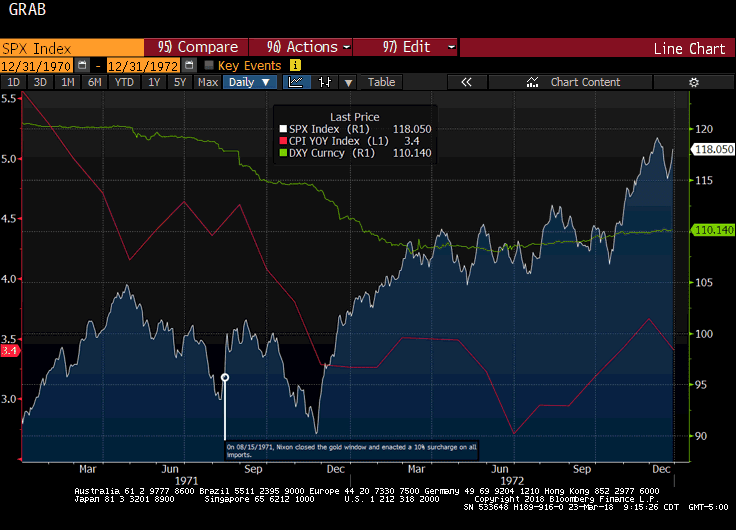

Bullet Point 2: Inflationary Pressures: Increased tariffs directly translate to higher prices for consumers. This can lead to increased inflation, eroding purchasing power and potentially impacting stock valuations. Companies unable to pass on these increased costs to consumers might see reduced profits and share prices.

-

Bullet Point 3: Currency Fluctuations: Tariffs can significantly impact currency exchange rates. A weakening domestic currency can make imports more expensive, while a strengthening currency can hurt exports. This creates volatility in international investments and further complicates market predictions.

The macroeconomic impact of these 'Liberation Day' tariffs is far-reaching. They can disrupt trade balances, potentially slowing economic growth and impacting consumer confidence. For example, a significant decrease in exports from Country B due to tariffs could negatively affect the GDP of that country and impact companies with operations there. Conversely, domestic companies producing substitutes for imported goods might see a boost.

Risk Mitigation Strategies in a Tariff-Affected Market

Navigating the stock market during periods of tariff uncertainty requires a proactive approach to risk management.

-

Diversification: A well-diversified portfolio is your first line of defense. Spreading your investments across different asset classes (stocks, bonds, real estate), sectors, and geographies minimizes your exposure to any single risk factor.

-

Hedging: Hedging strategies can help mitigate risks associated with currency fluctuations and inflation. For example, using futures contracts or options can help offset potential losses from currency movements. Inflation-protected securities can help preserve capital during inflationary periods.

-

Defensive Investing: Shifting towards defensive investments during periods of economic uncertainty can help protect your portfolio. These investments, typically less sensitive to economic downturns, include:

-

Bullet Point 1: Examples of Defensive Stocks: Companies in the consumer staples (food, beverages, household goods) and utility sectors are often considered defensive investments. Think of established brands like ABC Foods (hypothetical example) or DEF Utilities (hypothetical example).

-

Bullet Point 2: Analyzing Company Resilience: When evaluating companies, look at their supply chain diversification, pricing power, and ability to absorb increased costs. A company with strong domestic sourcing and a loyal customer base is better positioned to withstand tariff impacts.

-

Bullet Point 3: Understanding Your Risk Tolerance: Before making any major investment decisions, assess your personal risk tolerance. A conservative investor might favor a more defensive strategy, while a more aggressive investor might seek out higher-risk, higher-reward opportunities.

-

Identifying Potential Opportunities Amidst Uncertainty

While 'Liberation Day' tariffs present challenges, they also create opportunities for savvy investors.

-

Undervalued Stocks: Sectors negatively impacted by tariffs might present opportunities to buy undervalued stocks with strong long-term potential. Thorough research is crucial to identify companies with sound fundamentals and the potential to recover.

-

Emerging Markets: Emerging markets less directly affected by the tariffs might offer attractive growth prospects. These markets could benefit from the redirection of trade flows.

-

Innovation and Adaptation: Companies adapting to the new tariff landscape through innovation and diversification are also attractive investment prospects.

-

Bullet Point 1: Examples of Adapting Companies: Companies successfully navigating the challenges might include those developing substitute products or shifting their supply chains. GHI Manufacturing (hypothetical example), for example, might be successfully transitioning to domestically-sourced materials.

-

Bullet Point 2: Researching Adaptation Strategies: Analyze companies' financial reports, news articles, and analyst reports to assess their strategies for adapting to the tariff environment.

-

Bullet Point 3: Due Diligence: Thorough due diligence is paramount. Before investing in any company, carefully assess its financial health, competitive landscape, and management team.

-

Conclusion

The impact of 'Liberation Day' tariffs on the stock market is multifaceted. While they present risks, including increased inflation and currency fluctuations, they also offer opportunities for investors willing to adapt. Risk mitigation strategies such as diversification and hedging are crucial, while identifying undervalued stocks and companies adapting to the new landscape can lead to potentially lucrative investments.

Navigating the stock market in the shadow of 'Liberation Day' tariffs requires careful planning and a strategic approach. By understanding the potential impacts, diversifying your portfolio, and proactively identifying opportunities, you can effectively manage your investments and potentially even profit in this evolving landscape. Conduct thorough research and consider seeking professional financial advice before making any investment decisions related to the 'Liberation Day' tariffs and their impact on the stock market. Remember, this information is for educational purposes only and not financial advice.

Featured Posts

-

Gm Accused Of Using Us Tariffs To Reduce Canadian Operations Auto Analyst Report

May 08, 2025

Gm Accused Of Using Us Tariffs To Reduce Canadian Operations Auto Analyst Report

May 08, 2025 -

Did Saturday Night Live Change Everything For Counting Crows A Retrospective

May 08, 2025

Did Saturday Night Live Change Everything For Counting Crows A Retrospective

May 08, 2025 -

Chart Of The Week Bitcoins Potential 10x Wall Street Impact

May 08, 2025

Chart Of The Week Bitcoins Potential 10x Wall Street Impact

May 08, 2025 -

Expanding Globally Psg Opens State Of The Art Labs In Doha

May 08, 2025

Expanding Globally Psg Opens State Of The Art Labs In Doha

May 08, 2025 -

Universal Credit Overpayments Could You Be Owed Money

May 08, 2025

Universal Credit Overpayments Could You Be Owed Money

May 08, 2025