NCLH: Earnings Beat And Raised Guidance Drive Stock Higher

Table of Contents

NCLH Q3 Earnings Results Exceed Expectations

Norwegian Cruise Line Holdings' Q3 earnings report significantly outperformed analysts' predictions, fueling the impressive rise in NCLH stock. The company delivered exceptional results across several key financial metrics, showcasing a robust recovery and a positive outlook for the cruise industry.

- EPS: NCLH reported an EPS of [Insert Actual EPS Figure], exceeding the consensus analyst estimate of [Insert Analyst Estimate] by [Insert Percentage Difference]%. This substantial beat highlights the company's strong operational performance and effective cost management.

- Revenue: Revenue for the quarter reached [Insert Revenue Figure], representing a [Insert Percentage] year-over-year growth. This impressive figure underscores the increasing demand for cruises and NCLH's ability to capitalize on it.

- Occupancy: Occupancy rates were significantly higher than anticipated, reaching [Insert Occupancy Percentage], further demonstrating the strong demand for NCLH's services. This success can be attributed to a combination of effective marketing campaigns, attractive pricing strategies, and pent-up demand following the pandemic.

The positive results are primarily driven by a resurgence in travel demand, successful cost-cutting measures implemented throughout the pandemic, and effective marketing strategies that attracted a large number of bookings.

Raised Guidance Fuels Investor Confidence

Adding to the positive sentiment surrounding NCLH stock, the company also raised its guidance for the remainder of the year. This upward revision reflects the continued strength of the cruise market and the company's confidence in its future performance.

- Previous Guidance: Prior to the earnings announcement, NCLH's guidance projected an EPS of [Insert Previous EPS Guidance] and revenue of [Insert Previous Revenue Guidance].

- Revised Guidance: The updated guidance now anticipates an EPS of [Insert Revised EPS Guidance] and revenue of [Insert Revised Revenue Guidance].

- Reasons for Improvement: The improved outlook is primarily attributed to stronger-than-expected booking trends, effective pricing strategies enabling NCLH to maintain strong margins, and continued cost-cutting measures.

This optimistic revision significantly boosted investor confidence, contributing substantially to the NCLH stock price increase. The market reacted favorably to the demonstrably improved financial outlook.

Market Reaction and Stock Price Movement

The market's response to NCLH's impressive earnings report and raised guidance was immediate and significant.

- Pre-Announcement Stock Price: Before the release, NCLH stock traded at [Insert Pre-Announcement Stock Price].

- Post-Announcement Peak: Following the announcement, the stock price reached a peak of [Insert Peak Stock Price], representing a [Insert Percentage Change] increase.

- Trading Volume: Trading volume experienced a substantial surge during this period, indicating a high level of investor interest and activity. [Optional: Include a chart illustrating the stock price movement].

The overall investor and analyst sentiment towards NCLH's future prospects is overwhelmingly positive, driven by the strong Q3 performance and the confident outlook provided by the raised guidance.

Analysis of Contributing Factors

Several key factors contributed to NCLH's exceptional Q3 earnings and positive future outlook:

- Pent-up Demand: The sustained recovery in travel demand, particularly for cruises, played a significant role in driving strong booking numbers and higher occupancy rates.

- Effective Marketing: Targeted marketing campaigns successfully attracted new customers and generated strong interest in NCLH's cruise offerings.

- Operational Efficiencies: The implementation of cost-cutting measures and operational improvements contributed to higher profit margins. This includes [mention specific examples, if known].

- New Itineraries and Ships: (If applicable) The introduction of new cruise ships or exciting itineraries may have also contributed to increased demand.

However, it's crucial to acknowledge potential risks, including fluctuating fuel prices, geopolitical instability, and the possibility of unforeseen economic downturns which could impact future bookings.

Conclusion

NCLH's Q3 earnings report significantly exceeded expectations, leading to a substantial increase in its stock price. The upward revision of guidance further cemented investor confidence in the company's future performance. Strong booking trends, effective cost management, and a resurgence in travel demand all contributed to this positive outcome. While risks remain, the current outlook for NCLH is undeniably positive. To stay updated on NCLH stock performance, future earnings reports, and detailed NCLH investment outlook, follow us on [website/social media]. Stay informed on the latest NCLH stock analysis and Norwegian Cruise Line Holdings stock forecast to make informed investment decisions.

Featured Posts

-

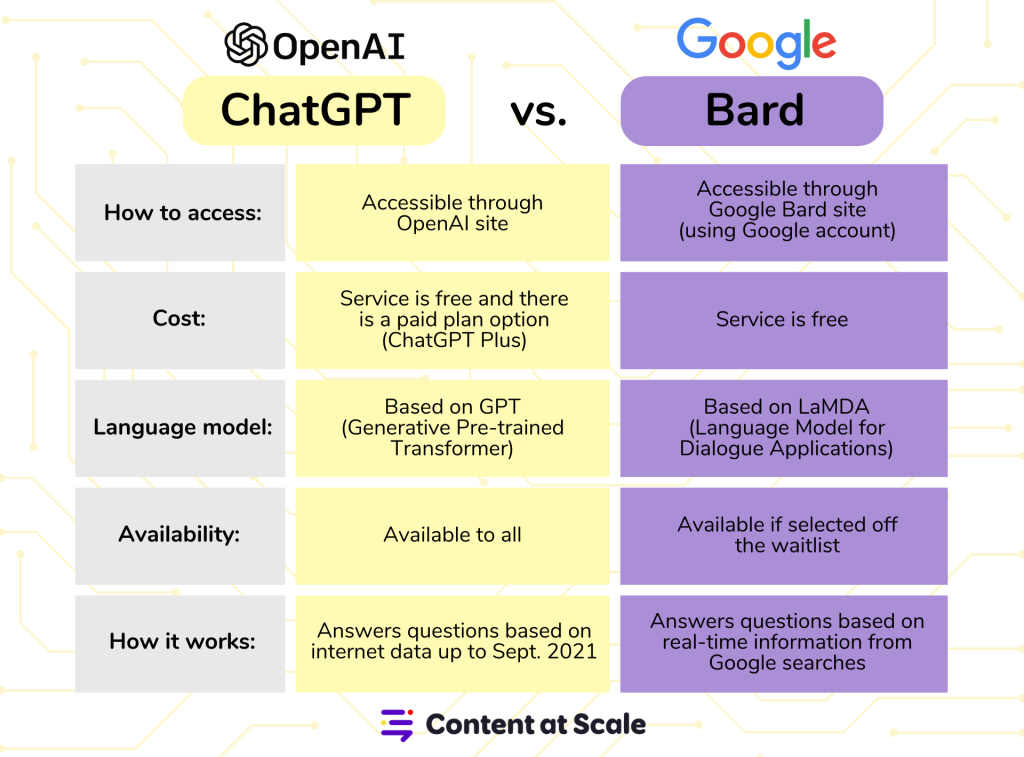

Chat Gpt Vs Google Shopping Open Ais New Retail Challenge

Apr 30, 2025

Chat Gpt Vs Google Shopping Open Ais New Retail Challenge

Apr 30, 2025 -

Compliance With The Latest Cnil Ai Guidelines A Step By Step Guide

Apr 30, 2025

Compliance With The Latest Cnil Ai Guidelines A Step By Step Guide

Apr 30, 2025 -

Understanding And Implementing The Updated Cnil Ai Guidelines

Apr 30, 2025

Understanding And Implementing The Updated Cnil Ai Guidelines

Apr 30, 2025 -

Rekord Ovechkina Kinopoisk Pozdravlyaet Novorozhdennykh Eksklyuzivnymi Soskami

Apr 30, 2025

Rekord Ovechkina Kinopoisk Pozdravlyaet Novorozhdennykh Eksklyuzivnymi Soskami

Apr 30, 2025 -

Remember Monday A Deeper Look At The Uks Eurovision Entry And Its Impact

Apr 30, 2025

Remember Monday A Deeper Look At The Uks Eurovision Entry And Its Impact

Apr 30, 2025

Latest Posts

-

Prva Ljubav I Gubitak Analiza Pesme Kad Sam Se Vratio Zdravka Colica

May 01, 2025

Prva Ljubav I Gubitak Analiza Pesme Kad Sam Se Vratio Zdravka Colica

May 01, 2025 -

Kad Sam Se Vratio Ti Si Se Udala Istina Iza Coliceve Balade

May 01, 2025

Kad Sam Se Vratio Ti Si Se Udala Istina Iza Coliceve Balade

May 01, 2025 -

Zbog Cega Se Udala Neispricana Prica O Zdravku Colicu I Njegovoj Prvoj Ljubavi

May 01, 2025

Zbog Cega Se Udala Neispricana Prica O Zdravku Colicu I Njegovoj Prvoj Ljubavi

May 01, 2025 -

Zdravkove Prve Ljubavi Prica O Pesmi Kad Sam Se Vratio

May 01, 2025

Zdravkove Prve Ljubavi Prica O Pesmi Kad Sam Se Vratio

May 01, 2025 -

Bila Je Prva Ljubav Zdravka Colica Kad Sam Se Vratio Ti Si Se Udala

May 01, 2025

Bila Je Prva Ljubav Zdravka Colica Kad Sam Se Vratio Ti Si Se Udala

May 01, 2025