NCLH Stock: Is It Worth The Investment According To Hedge Funds?

Table of Contents

Hedge Fund Interest in NCLH Stock

Understanding hedge fund activity surrounding NCLH stock is crucial for assessing its investment potential. These sophisticated investors often possess significant resources and expertise, and their actions can offer valuable insights.

Identifying Key Hedge Fund Investors

Several prominent hedge funds have shown interest in NCLH, although precise portfolio holdings are often not publicly disclosed due to confidentiality reasons. Identifying specific funds requires extensive research into SEC filings and financial news sources. This research may reveal which hedge funds have recently bought or sold NCLH shares, indicating their sentiment towards the stock.

- Example 1: (Insert hypothetical example: "XYZ Capital increased its NCLH holdings by 15% in Q2 2024, according to a recent 13F filing.") [Link to hypothetical source]

- Example 2: (Insert hypothetical example: "ABC Investments reduced its NCLH stake by 10% in Q3 2024, possibly due to concerns about rising fuel costs.") [Link to hypothetical source]

Analyzing these activities and the timing of the transactions provides clues about the prevailing market sentiment and the hedge funds' outlook for NCLH's future performance. For example, a significant increase in holdings may suggest a bullish outlook, while a decrease might indicate caution or profit-taking.

Analyzing Hedge Fund Portfolio Allocation

Determining the precise percentage of hedge fund portfolios allocated to NCLH is challenging due to the lack of complete public data. However, analyzing available information from SEC filings and news reports can provide a general understanding.

- Data Point 1: (Insert hypothetical data: "Based on available data, NCLH represents an average of X% of the portfolios of the top 10 hedge funds invested in the cruise industry.") [Link to hypothetical source]

- Data Point 2: (Insert hypothetical data: "This allocation represents a [significant/insignificant] investment for these funds, suggesting a [bullish/neutral/bearish] outlook on NCLH’s prospects.")

A high portfolio allocation generally signals strong confidence in the company's future performance, while a low allocation could suggest a more cautious approach. The significance of the allocation should be assessed within the context of the overall hedge fund portfolio and its investment strategy.

NCLH Stock Performance and Financial Health

Analyzing NCLH's financial health and performance is crucial to understanding hedge fund interest and evaluating investment viability.

Recent Financial Performance Review

NCLH's recent financial performance, including revenue, profitability, debt levels, and cash flow, provides vital information about its financial stability and growth potential.

- Key Metric 1: (Insert hypothetical data: "Q3 2024 Revenue: $X Billion, showing a Y% increase/decrease compared to Q3 2023.") [Link to NCLH financial reports]

- Key Metric 2: (Insert hypothetical data: "Net Income/Loss: $X Million, reflecting [positive/negative] growth compared to the previous year.") [Link to NCLH financial reports]

- Key Metric 3: (Insert hypothetical data: "Debt-to-Equity Ratio: X, indicating [high/moderate/low] financial leverage.") [Link to NCLH financial reports]

Analyzing these metrics and comparing them to industry benchmarks helps assess NCLH's financial health and its prospects for future growth. Consistent profitability and strong revenue growth are positive indicators.

Industry Trends and Competitive Landscape

Understanding the broader cruise industry landscape and NCLH’s competitive position is vital.

- Industry Trend 1: (Example: Rising fuel costs impacting profitability across the cruise sector)

- Industry Trend 2: (Example: Increased passenger demand post-pandemic)

- Competitive Factor 1: (Example: Competition from other major cruise lines like Carnival and Royal Caribbean)

- Competitive Factor 2: (Example: NCLH's innovative ship designs and itineraries)

These factors significantly influence NCLH's stock value and the decisions of hedge fund managers. A strong competitive position and favorable industry trends generally translate to higher stock valuations.

Risk Assessment and Potential Returns

Investing in NCLH, like any stock, involves risks. Understanding these risks and assessing the potential for future returns is critical.

Assessing the Risks Involved in Investing in NCLH

Several factors could negatively impact NCLH's stock price:

- Market Volatility: Overall market downturns can negatively affect even fundamentally strong companies.

- Economic Downturns: Recessions can reduce consumer spending, impacting demand for cruises.

- Industry-Specific Risks: Geopolitical instability, pandemics, or environmental disasters can significantly disrupt the cruise industry.

- Fuel Costs: Fluctuations in fuel prices can significantly impact profitability.

Hedge funds may mitigate these risks through diversification, hedging strategies, and sophisticated risk management techniques.

Evaluating Potential for Future Growth and Returns

Several factors could drive future growth and returns for NCLH:

- New Ship Deployments: Introducing new and innovative ships can attract more passengers.

- Expansion into New Markets: Reaching new demographics and geographical areas can increase revenue streams.

- Improved Operational Efficiency: Streamlining operations can increase profitability.

The potential for future growth is directly linked to hedge fund activity. If hedge funds are increasing their holdings, it suggests they anticipate significant growth and higher returns.

Conclusion: Should You Invest in NCLH Stock?

Our analysis of hedge fund activity and NCLH's financial performance reveals a complex picture. While some hedge funds have shown a bullish outlook, others have adopted a more cautious approach. NCLH's financial health and future prospects depend on factors such as industry trends, economic conditions, and its ability to navigate competitive pressures.

Recommendation: The decision of whether or not to invest in NCLH stock should be made after careful consideration of the inherent risks and potential rewards. This analysis provides valuable insights, but it's not a substitute for thorough due diligence.

Call to Action: While this analysis provides insights into hedge fund sentiment towards NCLH stock, further due diligence is crucial before making any investment decisions. Continue your research on NCLH stock and determine if it aligns with your investment strategy and risk tolerance. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Escape To Little Tahiti Italys Dream Beach Destination

May 01, 2025

Escape To Little Tahiti Italys Dream Beach Destination

May 01, 2025 -

Omni Secures Dragons Den Funding Plant Based Dog Food Takes Center Stage

May 01, 2025

Omni Secures Dragons Den Funding Plant Based Dog Food Takes Center Stage

May 01, 2025 -

Celtic Championship A Star Studded Homestand Test

May 01, 2025

Celtic Championship A Star Studded Homestand Test

May 01, 2025 -

Michael Sheens Million Pound Giveaway Details Revealed

May 01, 2025

Michael Sheens Million Pound Giveaway Details Revealed

May 01, 2025 -

Tongas Victory A Setback For Samoas Olympic Bid

May 01, 2025

Tongas Victory A Setback For Samoas Olympic Bid

May 01, 2025

Latest Posts

-

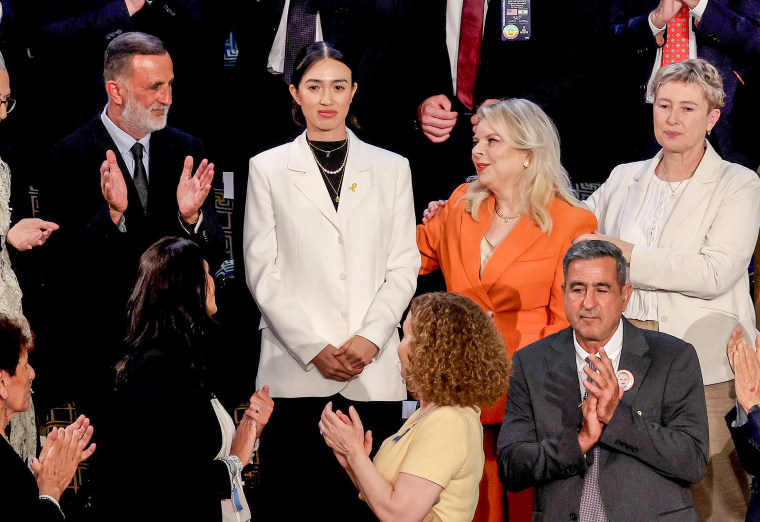

Noa Argamani From Hamas Hostage To Times 100 Most Influential

May 01, 2025

Noa Argamani From Hamas Hostage To Times 100 Most Influential

May 01, 2025 -

Kamala Harris On Her Political Comeback Timing And Plans

May 01, 2025

Kamala Harris On Her Political Comeback Timing And Plans

May 01, 2025 -

Noa Argamanis Time Gala Address A Call To Action For Hostage Release

May 01, 2025

Noa Argamanis Time Gala Address A Call To Action For Hostage Release

May 01, 2025 -

Time Gala Argamani Calls For Safe Return Of Israeli Hostages

May 01, 2025

Time Gala Argamani Calls For Safe Return Of Israeli Hostages

May 01, 2025 -

Israel News Argamanis Emotional Appeal For Hostage Return

May 01, 2025

Israel News Argamanis Emotional Appeal For Hostage Return

May 01, 2025