Negative Inflation In Thailand: Further Monetary Policy Easing Likely

Table of Contents

Thailand's economy is facing a concerning trend: negative inflation. This unexpected downturn raises significant questions about the future trajectory of the Thai economy and the potential for further monetary policy easing by the Bank of Thailand (BOT). This article delves into the factors contributing to this negative inflation and explores the likelihood of additional measures to stimulate economic growth.

Understanding Negative Inflation in Thailand

Defining Deflation and its Impacts

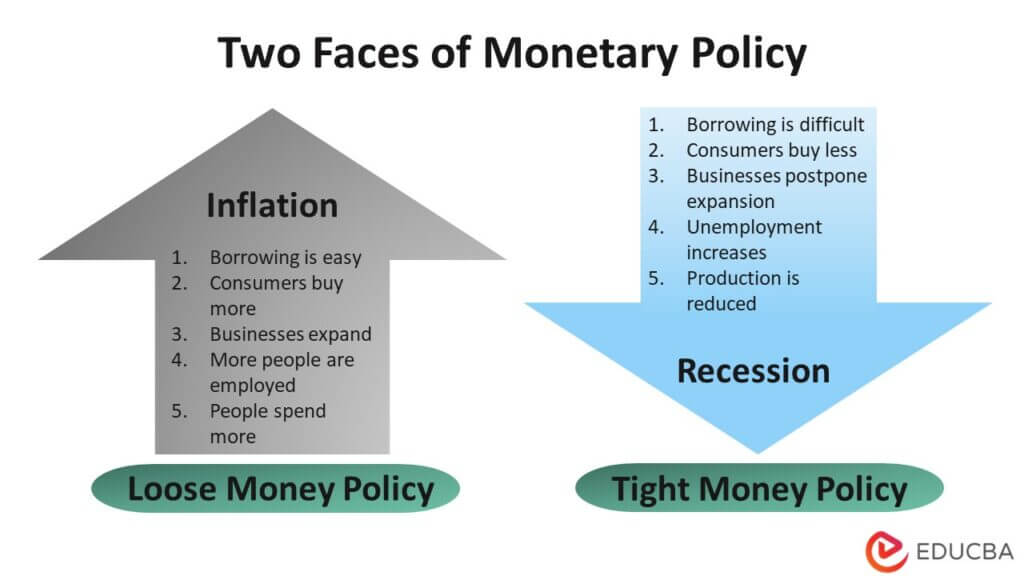

Negative inflation, or deflation, occurs when the general price level of goods and services in an economy decreases over time. While seemingly positive, deflation poses serious risks. It can lead to decreased consumer spending as people delay purchases expecting further price drops. Businesses postpone investments due to falling revenues and profit margins, leading to reduced economic activity. Furthermore, deflation increases the real value of debt, placing a heavier burden on borrowers and potentially triggering defaults.

- Impact on consumer confidence: Deflation erodes consumer confidence, leading to reduced spending and a weakening of aggregate demand.

- Effect on businesses: Businesses face falling prices for their products, squeezed profit margins, and decreased investment returns.

- Risk of deflationary spiral: A deflationary spiral can occur, where falling prices lead to lower demand, further price drops, and a vicious cycle of economic contraction.

Current Economic Indicators in Thailand

Recent data paints a concerning picture of the Thai economy. The inflation rate has dipped into negative territory, reflecting falling prices across various sectors. GDP growth remains sluggish, indicating weak domestic demand. Unemployment figures, while not alarmingly high, show a lack of significant job creation. Consumer sentiment surveys reveal a pessimistic outlook among consumers.

- Specific data points on inflation: (Insert recent data from reputable sources like the Bank of Thailand or the National Statistical Office of Thailand. For example: "The headline inflation rate in Q3 2023 was -0.5%, marking the third consecutive quarter of negative inflation.")

- GDP figures: (Insert recent GDP growth data. For example: "GDP growth for 2023 is projected to be X%, significantly lower than previous years.")

- Unemployment rates: (Insert unemployment rate data. For example: "The unemployment rate currently stands at Y%, showing a lack of significant job creation.")

- Consumer spending data: (Insert data on consumer spending patterns. For example: "Consumer spending has decreased by Z% in the past quarter.")

Factors Contributing to Negative Inflation in Thailand

Weak Domestic Demand

Weak domestic demand is a primary driver of Thailand's negative inflation. Subdued consumer confidence, stemming from uncertainty about future economic prospects and job security, plays a significant role. Reduced investment, both private and public, further dampens demand.

- Causes of weak consumer confidence: Concerns about global economic slowdown, political uncertainty, and high household debt contribute to weak consumer confidence.

- Impact of global economic slowdown: The global economic slowdown directly impacts Thailand's export-oriented economy, reducing income and employment opportunities.

- Government spending analysis: Government spending needs to be more effectively targeted to boost demand and stimulate the economy.

Global Economic Slowdown

The global economic slowdown significantly impacts Thailand's export-oriented economy. Reduced global demand for Thai goods, particularly in key export markets, puts downward pressure on prices and contributes to deflationary pressures.

- Impact of global recession risks: The threat of a global recession further exacerbates the challenges faced by Thailand's export sector.

- Decreased export demand: Lower export demand directly impacts Thai businesses, leading to reduced production and employment.

- Weakening of the baht: While a weaker baht could boost exports, its current strength is making Thai goods less competitive internationally.

Impact of the Strong Baht

The relatively strong baht, compared to other regional currencies, contributes to deflationary pressures. A strong baht makes Thai exports less competitive in international markets, leading to lower export revenues and prices.

- Exchange rate fluctuations: Fluctuations in the baht's value against major currencies impact the competitiveness of Thai exports.

- Impact on export competitiveness: A strong baht makes Thai products more expensive for foreign buyers, reducing demand.

- Trade balance implications: The strong baht can lead to a trade deficit if export revenues fall significantly.

The Bank of Thailand's Response and Likely Future Monetary Policy

Current Monetary Policy Stance

The Bank of Thailand (BOT) has already taken some steps to address the deflationary pressures. This includes cutting interest rates to stimulate borrowing and investment.

- Past interest rate cuts: (Mention specific instances of interest rate cuts by the BOT.)

- Quantitative easing measures: (Discuss any quantitative easing measures undertaken.)

- Other stimulus initiatives: (Mention other initiatives, such as liquidity injections into the banking system.)

Likelihood of Further Easing

Given the persistence of negative inflation and sluggish economic growth, further monetary policy easing by the BOT is highly likely. However, there are limitations and risks associated with further cuts.

- Arguments for further interest rate cuts: Low inflation and weak economic growth provide strong arguments for further interest rate reductions.

- Potential limitations of monetary policy: Extremely low interest rates may have diminishing returns and may not be enough to stimulate a significant economic recovery.

- Risks associated with further easing: Excessive easing could potentially fuel asset bubbles or lead to other unintended consequences.

Alternative Policy Options

Beyond interest rate cuts, the Thai government needs to consider fiscal stimulus measures to boost aggregate demand.

- Government spending initiatives: Increased government spending on infrastructure projects or social programs could stimulate economic activity.

- Tax cuts: Targeted tax cuts could boost consumer spending and business investment.

- Investment incentives: Incentives to attract foreign and domestic investment could create jobs and boost economic growth.

Conclusion

Negative inflation in Thailand is a serious concern, driven by weak domestic demand, a global economic slowdown, and a strong baht. The Bank of Thailand's response has involved interest rate cuts, but further monetary policy easing is likely. However, a multifaceted approach incorporating fiscal stimulus measures is crucial for a sustainable economic recovery. The ongoing impact of negative inflation on the Thai economy warrants close monitoring.

Call to Action: Stay informed about the evolving economic situation in Thailand and the Bank of Thailand's actions regarding negative inflation. Monitor future policy announcements to understand the ongoing impact on the Thai economy and investment strategies. Continue to research the implications of negative inflation in Thailand for informed decision-making.

Featured Posts

-

Panstwowa Spolka Zada 100 Tys Zl Od Dziennikarzy Onetu

May 07, 2025

Panstwowa Spolka Zada 100 Tys Zl Od Dziennikarzy Onetu

May 07, 2025 -

Pittsburgh Steelers Pickens Trade Decision An Insiders Explanation

May 07, 2025

Pittsburgh Steelers Pickens Trade Decision An Insiders Explanation

May 07, 2025 -

How Julius Randles Physicality Affects The Lakers Success

May 07, 2025

How Julius Randles Physicality Affects The Lakers Success

May 07, 2025 -

The Much Anticipated Return Of Lewis Capaldi Two Years In The Making

May 07, 2025

The Much Anticipated Return Of Lewis Capaldi Two Years In The Making

May 07, 2025 -

Las Vegas Aces Waive Forward During Training Camp

May 07, 2025

Las Vegas Aces Waive Forward During Training Camp

May 07, 2025

Latest Posts

-

Xrps Potential Record High The Impact Of The Grayscale Etf Application

May 07, 2025

Xrps Potential Record High The Impact Of The Grayscale Etf Application

May 07, 2025 -

Xrps Legal Battle Understanding The Secs Commodity Claim

May 07, 2025

Xrps Legal Battle Understanding The Secs Commodity Claim

May 07, 2025 -

Xrp Etfs Potential For 800 M In Week 1 Inflows Upon Approval

May 07, 2025

Xrp Etfs Potential For 800 M In Week 1 Inflows Upon Approval

May 07, 2025 -

Sec Review Of Grayscale Etf Could Send Xrp Price To New Heights

May 07, 2025

Sec Review Of Grayscale Etf Could Send Xrp Price To New Heights

May 07, 2025 -

Xrp Recovery Slowed The Role Of The Derivatives Market

May 07, 2025

Xrp Recovery Slowed The Role Of The Derivatives Market

May 07, 2025