Negotiations Falter: GOP Tax Overhaul Faces Resistance From Conservatives

Table of Contents

Core Conservative Concerns Fueling Opposition

The GOP tax overhaul is not without its detractors within the party itself. Deep-seated concerns among conservatives are fueling significant opposition, threatening to fracture party unity and jeopardize the bill's passage. These concerns fall into several key areas:

Spending Levels and the National Debt

A primary source of conservative resistance stems from worries about increased spending and its impact on the national debt. Many fiscal conservatives believe the proposed tax cuts, even if revenue-neutral in theory, will lead to larger deficits in the long run.

- Concerns about future deficits: Conservative critics argue the tax plan lacks sufficient mechanisms to control future spending growth, potentially exacerbating the already substantial national debt.

- Calls for fiscal responsibility: Prominent conservative voices are calling for greater fiscal restraint and a more balanced approach to tax reform that prioritizes debt reduction.

- Disagreements over spending caps: The proposed tax cuts are seen by some as conflicting with efforts to maintain or enforce existing spending caps, leading to internal disagreements within the party.

Specific proposed increases in defense spending, coupled with concerns about the long-term impact of reduced tax revenue, are fueling these anxieties. Conservative commentators have pointed to projections showing a significant rise in the national debt over the next decade if the tax plan is enacted without corresponding spending cuts. This fuels their opposition to the current version of the GOP tax overhaul.

Tax Cuts for Corporations and the Wealthy

Another significant point of contention is the perceived disproportionate benefit to corporations and high-income earners. Critics argue that the tax plan favors the wealthy at the expense of the middle class, exacerbating income inequality.

- Arguments for fairer tax distribution: Conservatives argue for a more equitable distribution of tax cuts, ensuring that the benefits extend to all income brackets, not just the wealthiest Americans.

- Concerns about income inequality: The widening income gap is a major concern for many, and some conservatives believe the current tax plan will only worsen the situation.

- Analysis of tax cut beneficiaries: Independent analyses of the tax plan’s projected effects show a disproportionate benefit accruing to corporations and high-income individuals, further fueling conservative opposition.

Data from the Tax Policy Center, for instance, highlights a significant disparity in tax cuts across income brackets, with the top 1% receiving a considerably larger share of the benefits than the middle class. This finding has been widely cited by conservative critics as evidence of the tax plan’s inherent unfairness.

Lack of Transparency and Hasty Process

The speed and perceived lack of transparency in the legislative process have further eroded conservative trust. Many believe the process has been rushed, with insufficient debate and public input.

- Concerns about insufficient debate: Conservatives argue that the bill lacked adequate scrutiny and debate before being brought to a vote, hindering efforts to address their concerns.

- Lack of public input: The limited opportunity for public comment and feedback has fueled anxieties that the interests of ordinary citizens were not sufficiently considered.

- Rushed legislative process: The rapid pace of the legislative process has fueled suspicions that certain interests were prioritized over careful consideration of the long-term consequences.

Conservative lawmakers have openly criticized the limited time allocated for discussion and amendment, leading to accusations that the process was designed to minimize dissent and push the bill through rapidly. This lack of transparency has increased conservative skepticism and resistance to the GOP tax overhaul.

Potential Impact on the GOP's Legislative Agenda

The internal divisions sparked by the tax overhaul are not limited to this single issue; they carry significant implications for the GOP's broader legislative agenda.

Internal Divisions Weaken Party Unity

The deep fissures within the Republican Party threaten to undermine its ability to enact its other legislative priorities. The inability to unite behind the tax bill signals a weakening of party unity and could foreshadow similar struggles on other key issues.

- Impact on other bills: The failure to pass the tax overhaul could embolden opponents of other Republican initiatives, making future legislative successes more challenging.

- Potential for legislative gridlock: The internal disagreements within the GOP could lead to further legislative gridlock, hindering the party's ability to pass any significant legislation.

- Weakening of the party's image: The public perception of a fractured and internally divided party could severely damage the GOP's image and hurt its chances in upcoming elections.

The struggle over the tax bill demonstrates the difficulty the GOP faces in balancing the needs of its various factions. This inability to present a unified front undermines the party's effectiveness and could have lasting consequences.

Political Fallout in the Midterm Elections

The failure to pass the tax overhaul could have significant repercussions for the GOP in the upcoming midterm elections. Voters may perceive the party as dysfunctional and unable to deliver on its promises, leading to decreased voter turnout and potential loss of seats.

- Impact on voter turnout: Disappointment and disillusionment among Republican voters could lead to decreased turnout in the midterm elections.

- Potential loss of seats: The negative political fallout could cost the GOP seats in Congress, potentially shifting the balance of power.

- Impact on presidential approval ratings: The failure to deliver on a key campaign promise could negatively affect President Trump's approval ratings, potentially impacting Republican candidates down the ballot.

Polling data already shows a decline in Republican support amongst key demographics, and the ongoing struggle over the tax plan is likely to exacerbate this trend. This poses a significant risk to the Republican Party’s prospects in the crucial midterm elections.

Potential Compromise and Paths Forward

Despite the considerable challenges, potential paths forward remain. Negotiating concessions and exploring alternative legislative strategies could still lead to a resolution, albeit possibly a modified one.

Negotiating Concessions and Finding Common Ground

Finding common ground might require the GOP to make concessions to appease conservative factions. This could involve modifying the tax plan to address concerns about spending, tax distribution, or the legislative process itself.

- Possible modifications to the tax plan: Adjusting tax rates, altering deductions, or adding provisions to address specific concerns could potentially garner broader support.

- Strategies for addressing conservative concerns: Open dialogue, incorporating conservative proposals, and offering assurances about fiscal responsibility are crucial for finding compromises.

- Potential compromises: A scaled-down version of the tax plan or focusing on certain aspects while delaying others might be viable options.

Targeted outreach to conservative lawmakers and incorporating their feedback into the bill could be a key step towards building consensus.

Alternative Legislative Strategies

If negotiations fail to produce a consensus, the GOP might consider alternative legislative strategies. This could involve modifying the bill substantially, delaying the vote, or even abandoning the tax overhaul entirely.

- Modifying the bill: Significant changes to the bill could be necessary to garner sufficient support. This might involve substantial cuts to certain tax breaks or alterations in the structure of the tax cuts.

- Delaying the vote: Postponing the vote might allow for more time to negotiate and build consensus, although this also carries political risks.

- Abandoning the tax overhaul entirely: This is a last resort, signifying a major setback for the Republican agenda and potentially devastating consequences for the party's image.

Each of these options carries potential benefits and drawbacks, and the choice will depend on a careful assessment of the political landscape and the potential consequences.

Conclusion

The GOP tax overhaul faces significant challenges due to resistance from within its own ranks. Conservative concerns about spending levels, the perceived unfair distribution of tax cuts, and the rushed legislative process threaten to derail the bill. The internal divisions within the party have broader implications for its legislative agenda and its political standing in the upcoming midterm elections. The failure to pass the tax overhaul could be seen as a major setback for the Republican Party, damaging its credibility and potentially affecting its electoral fortunes.

The future of the GOP tax overhaul remains uncertain. The ongoing negotiations and the potential compromises will be crucial to determining the final outcome. Stay informed on the evolving political dynamics surrounding this crucial piece of legislation and the ongoing efforts to overcome the conservative resistance. Continue to follow our coverage for the latest updates on the GOP tax overhaul and its implications for the future of American fiscal policy.

Featured Posts

-

Trump Willing To Travel To China For Talks With Xi Jinping

May 18, 2025

Trump Willing To Travel To China For Talks With Xi Jinping

May 18, 2025 -

Syggnomi Apo Ton Kanye West Pros Ton Jay Z Kai Tin Beyonce Meta Apo Diloseis Toy

May 18, 2025

Syggnomi Apo Ton Kanye West Pros Ton Jay Z Kai Tin Beyonce Meta Apo Diloseis Toy

May 18, 2025 -

Netflix Series Reveals Key Phone Call In Bin Laden Capture

May 18, 2025

Netflix Series Reveals Key Phone Call In Bin Laden Capture

May 18, 2025 -

2 2011

May 18, 2025

2 2011

May 18, 2025 -

Swim With Mike A Support Network For Trojan Swimmers

May 18, 2025

Swim With Mike A Support Network For Trojan Swimmers

May 18, 2025

Latest Posts

-

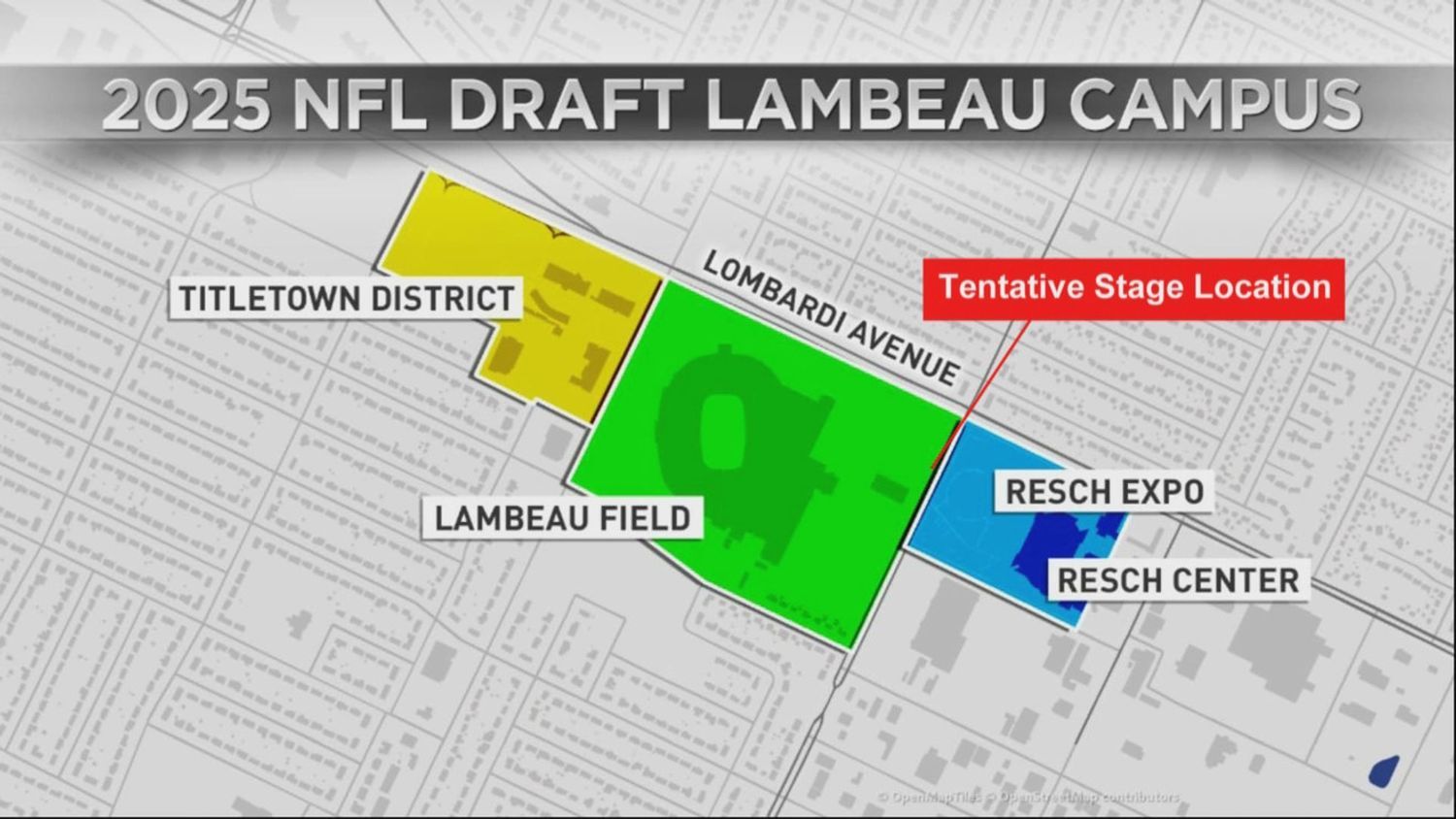

Post 2025 Nfl Draft Analysts Take On The New England Patriots

May 18, 2025

Post 2025 Nfl Draft Analysts Take On The New England Patriots

May 18, 2025 -

Patriots Future Nfl Analyst Weighs In On Post 2025 Draft Outlook

May 18, 2025

Patriots Future Nfl Analyst Weighs In On Post 2025 Draft Outlook

May 18, 2025 -

Nfl Analysts Bold Prediction Patriots Post 2025 Draft Identity

May 18, 2025

Nfl Analysts Bold Prediction Patriots Post 2025 Draft Identity

May 18, 2025 -

Great Wolf Lodge Suffolk Boy Hailed A Hero For Saving Drowning Child

May 18, 2025

Great Wolf Lodge Suffolk Boy Hailed A Hero For Saving Drowning Child

May 18, 2025 -

Suffolk Teen Praised For Bravery After Drowning Rescue At Great Wolf Lodge

May 18, 2025

Suffolk Teen Praised For Bravery After Drowning Rescue At Great Wolf Lodge

May 18, 2025