Negotiations On De Minimis Tariffs For Chinese Imports: A G-7 Perspective

Table of Contents

Understanding De Minimis Tariffs and Their Impact

Defining De Minimis

De minimis tariffs refer to the value threshold below which imported goods are exempt from customs duties. This "duty-free threshold," also known as a customs exemption, significantly impacts low-value imports. The specific amount varies considerably across countries and significantly influences trade flows and consumer purchasing behavior. Understanding these varying thresholds is crucial to analyzing the complexities of international trade policy. Related terms such as "low-value consignment relief" and "small package exemptions" further illustrate the nuances of this area.

The Current Landscape

Currently, de minimis thresholds for Chinese imports differ significantly across G-7 countries. This inconsistency creates an uneven playing field for businesses and contributes to complexities in international trade. These variations in tariff rates and import regulations reflect differing national priorities and economic strategies. For example, some countries may maintain lower thresholds to encourage small businesses and e-commerce, while others might opt for higher thresholds to protect domestic industries.

- Historical Context: These thresholds have evolved over time, often reflecting changes in global trade patterns, technological advancements (particularly in e-commerce), and evolving domestic economic policies.

- Economic Implications: Raising or lowering these thresholds has significant economic consequences. Lower thresholds can increase revenue for governments but may also discourage small businesses and hinder e-commerce growth. Conversely, higher thresholds can stimulate online retail but may negatively impact domestic industries.

- Impact on Consumers and Businesses: Consumers benefit from lower prices when thresholds are high, while businesses face challenges adjusting to fluctuating import costs. Small businesses, especially, are affected by these changes.

G-7 Perspectives on De Minimis Tariffs for Chinese Imports

Individual Nation Positions

Each G-7 member holds a unique position on de minimis tariffs for Chinese imports. These positions are shaped by a variety of factors including domestic economic priorities, political considerations, and the specific nature of their bilateral trade relationship with China.

- US-China trade relations: The US has historically taken a more protectionist stance, often using tariffs as a tool in its trade negotiations with China.

- Canada's import policy: Canada, with its significant trade relationship with the US, might adopt a similar approach to align with regional trade dynamics.

- European Union (EU) Member States: The EU, encompassing France, Germany, and Italy, tends towards a more unified approach in international trade negotiations, though internal differences exist.

- Japan's approach: Japan's stance reflects its own economic interests and the strength of its trade relationship with China.

- United Kingdom's post-Brexit strategy: The UK, after Brexit, is forging its independent trade policies, possibly leading to different de minimis thresholds than those of other EU nations.

Areas of Agreement and Disagreement

While some common ground exists among G-7 nations regarding the need for a transparent and predictable system, significant disagreements exist concerning the appropriate levels for de minimis tariffs. The negotiations are fraught with complexities, balancing the need for revenue generation, consumer benefits, and protection of domestic industries.

- Collaborative Action vs. Individual Strategies: The G-7 may pursue a collaborative approach, aiming for a coordinated policy. However, individual countries might prioritize their national interests, potentially leading to divergent strategies.

- Domestic Political Pressures: Domestic political pressure from various stakeholder groups—ranging from consumers and businesses to domestic industries—influences the negotiation positions of each country.

- Role of International Trade Organizations: The WTO and other multilateral organizations play a significant role in shaping the framework for these negotiations, influencing the legality and fairness of proposed de minimis tariff levels.

Economic Implications and Future Outlook

Impact on Global Trade

Adjusting de minimis tariffs on Chinese imports has far-reaching global implications. Changes affect global supply chains, influencing the cost and availability of goods worldwide. The impact on global trade is significant, impacting economic growth and competitiveness.

- Global Supply Chains: These adjustments can disrupt established supply chains, potentially leading to increased costs and delays for businesses.

- International Trade: Changes impact the overall flow of goods and services, potentially exacerbating existing trade imbalances.

- Economic Growth: The long-term effects on economic growth remain uncertain and depend largely on the magnitude and nature of the tariff adjustments.

Potential for Future Trade Agreements

Future trade agreements, such as bilateral or plurilateral agreements, have the potential to significantly influence de minimis tariff levels. Negotiations might lead to harmonized thresholds, reducing inconsistencies and fostering greater predictability in international trade.

- Specific Industry Impacts: Certain industries, such as e-commerce and small businesses, will experience a greater impact than others.

- Potential Retaliatory Measures: China may respond with retaliatory measures if it perceives the changes to be unfair or discriminatory.

- Long-Term Sustainability: The long-term sustainability of any agreed-upon de minimis tariff level hinges on its ability to balance competing interests and adapt to changing global trade dynamics.

Conclusion

Negotiations on de minimis tariffs for Chinese imports are complex, reflecting the diverse interests of G-7 nations. The varied perspectives and potential economic impacts necessitate ongoing monitoring and informed discussion. These negotiations demonstrate the intricate interplay between national interests, global trade, and the need for a fair and predictable international trading system. Understanding the nuances of de minimis tariffs and their implications is crucial for businesses, consumers, and policymakers alike. Stay informed about de minimis tariff negotiations and follow the latest developments in Chinese import regulations to understand the implications for your business and the broader global economy.

Featured Posts

-

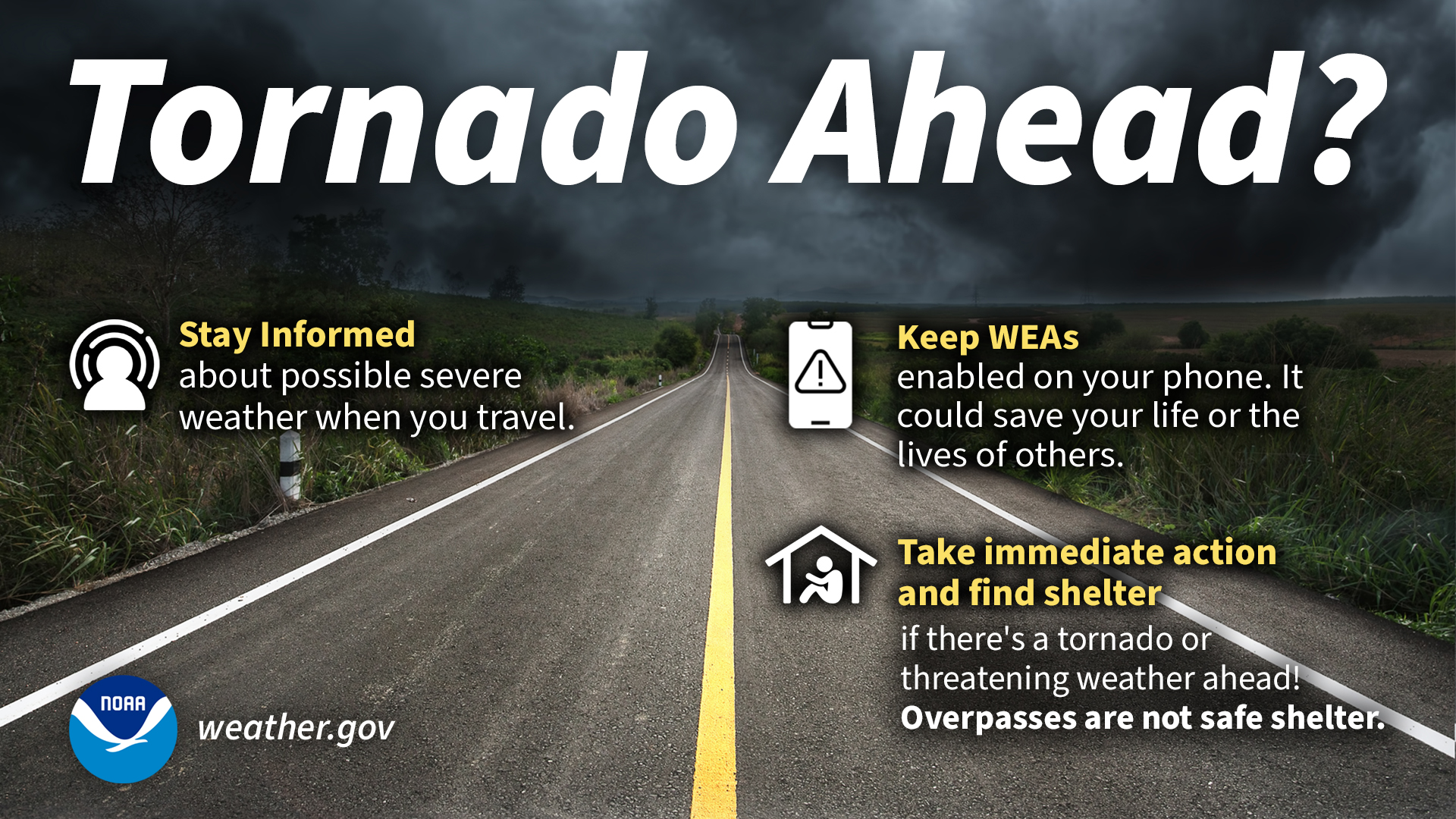

Understanding Flood Risks Your Guide To Flood Safety On Severe Weather Awareness Week Day 5

May 26, 2025

Understanding Flood Risks Your Guide To Flood Safety On Severe Weather Awareness Week Day 5

May 26, 2025 -

Released Photo Shows Wounds On Kidnapped Idf Soldier Matan Angrest

May 26, 2025

Released Photo Shows Wounds On Kidnapped Idf Soldier Matan Angrest

May 26, 2025 -

Pogacars Dominant Tour Of Flanders Victory

May 26, 2025

Pogacars Dominant Tour Of Flanders Victory

May 26, 2025 -

F1 Drivers Press Conference A Deep Dive Into The Post Race Interviews

May 26, 2025

F1 Drivers Press Conference A Deep Dive Into The Post Race Interviews

May 26, 2025 -

Alshrtt Alfrnsyt Tkshf Ghmwd Jrymt Qtl Eayly Bshet Tfasyl Sadmt

May 26, 2025

Alshrtt Alfrnsyt Tkshf Ghmwd Jrymt Qtl Eayly Bshet Tfasyl Sadmt

May 26, 2025

Latest Posts

-

Trumps Plan To Divert Harvard Funds To Trade Schools Explained

May 28, 2025

Trumps Plan To Divert Harvard Funds To Trade Schools Explained

May 28, 2025 -

The Trump Administration And Harvard A Funding Dispute

May 28, 2025

The Trump Administration And Harvard A Funding Dispute

May 28, 2025 -

Harvards Future Funding Uncertain Amidst Trumps Trade School Proposal

May 28, 2025

Harvards Future Funding Uncertain Amidst Trumps Trade School Proposal

May 28, 2025 -

Harvard Faces Funding Cuts Trumps Trade School Push

May 28, 2025

Harvard Faces Funding Cuts Trumps Trade School Push

May 28, 2025 -

Trumps Harvard Funding Threat A Shift To Trade Schools

May 28, 2025

Trumps Harvard Funding Threat A Shift To Trade Schools

May 28, 2025