Net Asset Value (NAV) Explained: Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities. It's a crucial indicator of the underlying value of each ETF share. The calculation is straightforward:

Assets (market value of holdings) – Liabilities = NAV

Let's break down the components:

- Assets: This encompasses the market value of all the securities held within the ETF's portfolio. For the Amundi Dow Jones Industrial Average UCITS ETF, this would primarily include shares of the 30 companies that make up the Dow Jones Industrial Average. The value fluctuates daily based on market movements.

- Liabilities: These are the ETF's expenses, including management fees, administrative costs, and any other outstanding obligations.

Example:

Imagine the Amundi Dow Jones Industrial Average UCITS ETF holds assets worth $10 million and has liabilities of $100,000. The NAV would be calculated as: $10,000,000 - $100,000 = $9,900,000. If there are 1,000,000 shares outstanding, the NAV per share would be $9.90. This simplified example demonstrates the basic NAV calculation; real-world calculations are significantly more complex. Keywords used here include: NAV calculation, ETF assets, ETF liabilities, market value, portfolio valuation.

NAV's Role in Amundi Dow Jones Industrial Average UCITS ETF Pricing

Ideally, the market price of an ETF share should closely reflect its NAV. However, several factors can cause deviations:

- Bid-Ask Spread: The difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask) creates a spread. This spread can temporarily cause the market price to differ from the NAV.

- Trading Volume: High trading volume generally results in a market price closer to the NAV, while low volume can lead to larger discrepancies.

- Premium and Discount: Sometimes, the market price trades at a premium (above NAV) or a discount (below NAV) to the NAV. This can be influenced by investor sentiment, supply and demand, and market expectations. A persistent premium or discount might signal market inefficiencies or other underlying factors affecting the ETF. Keywords: ETF pricing, NAV and share price, bid-ask spread, trading volume, premium, discount.

Accessing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

The daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF is typically available on Amundi's official website. You can also find this information on major financial news websites and through dedicated ETF data providers. The NAV is usually updated at the end of the trading day, reflecting the closing market values of the ETF's holdings.

To interpret the information, look for clear labeling of the date and the NAV per share. Understanding the frequency of updates is important to ensure you are using the most current data for your investment analysis. Keywords: NAV data, daily NAV, Amundi website, financial news, data sources, ETF information.

The Importance of NAV for Investment Decisions

NAV is a critical tool for various investment decisions:

- Tracking ETF Performance: By comparing the NAV over time, you can track the ETF's performance and assess its growth or decline.

- Evaluating Fund Management: Consistent underperformance relative to the NAV can indicate potential issues with the ETF's management strategy.

- Comparing ETFs: NAV allows you to compare the performance and value of different ETFs within the same asset class, aiding in informed selection. Keywords: ETF performance, investment analysis, fund management, ETF comparison.

Conclusion: Using Net Asset Value (NAV) to Make Informed Decisions about the Amundi Dow Jones Industrial Average UCITS ETF

Net Asset Value is a fundamental concept for understanding and evaluating ETF investments. Its relationship to the Amundi Dow Jones Industrial Average UCITS ETF's price, along with the availability of daily NAV data, empowers investors to make more informed decisions. Remember to regularly check the NAV and consider it alongside other factors when analyzing the ETF's performance and making investment choices. To learn more about Net Asset Value and its application to your investment strategy, we encourage you to further research the Amundi Dow Jones Industrial Average UCITS ETF and other ETFs that interest you. [Link to Amundi's Website] [Link to relevant financial news source].

Featured Posts

-

Kuda Propali Pobediteli Evrovideniya Poslednie 10 Let

May 24, 2025

Kuda Propali Pobediteli Evrovideniya Poslednie 10 Let

May 24, 2025 -

Ai In Healthcare Key Findings From The Philips Future Health Index 2025

May 24, 2025

Ai In Healthcare Key Findings From The Philips Future Health Index 2025

May 24, 2025 -

Bbc Radio 1s Big Weekend Full Lineup Featuring Jorja Smith Biffy Clyro And Blossoms

May 24, 2025

Bbc Radio 1s Big Weekend Full Lineup Featuring Jorja Smith Biffy Clyro And Blossoms

May 24, 2025 -

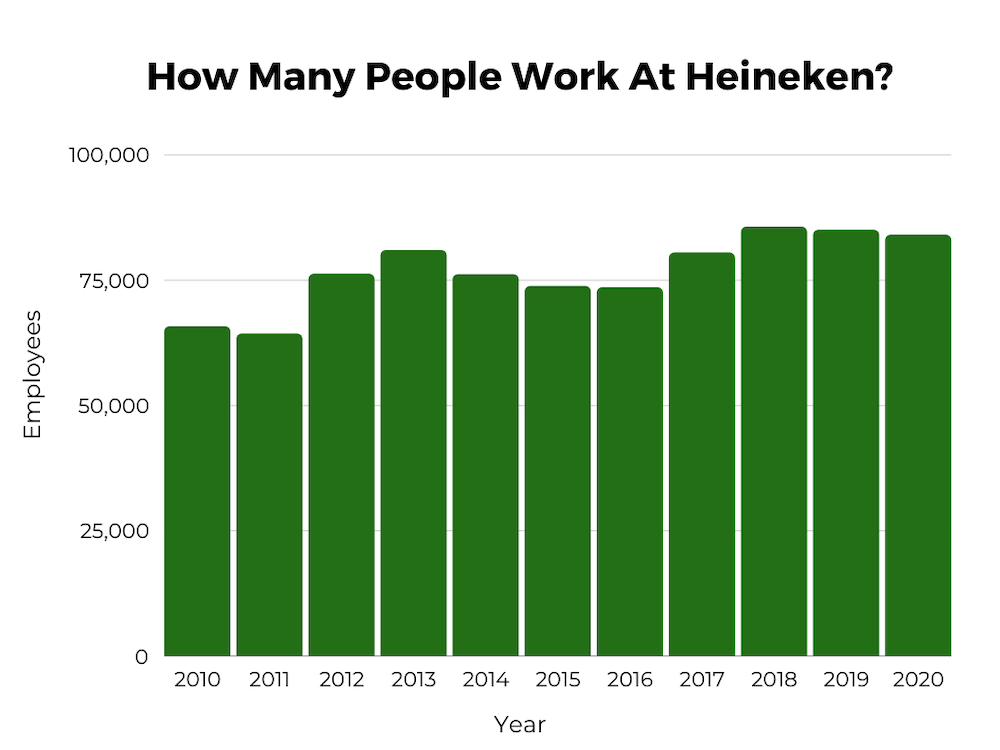

Heineken Revenue Beats Estimates Company Confirms Future Outlook

May 24, 2025

Heineken Revenue Beats Estimates Company Confirms Future Outlook

May 24, 2025 -

Czy Porsche Cayenne Gts Coupe To Suv Marzen Moja Opinia Po Tescie

May 24, 2025

Czy Porsche Cayenne Gts Coupe To Suv Marzen Moja Opinia Po Tescie

May 24, 2025

Latest Posts

-

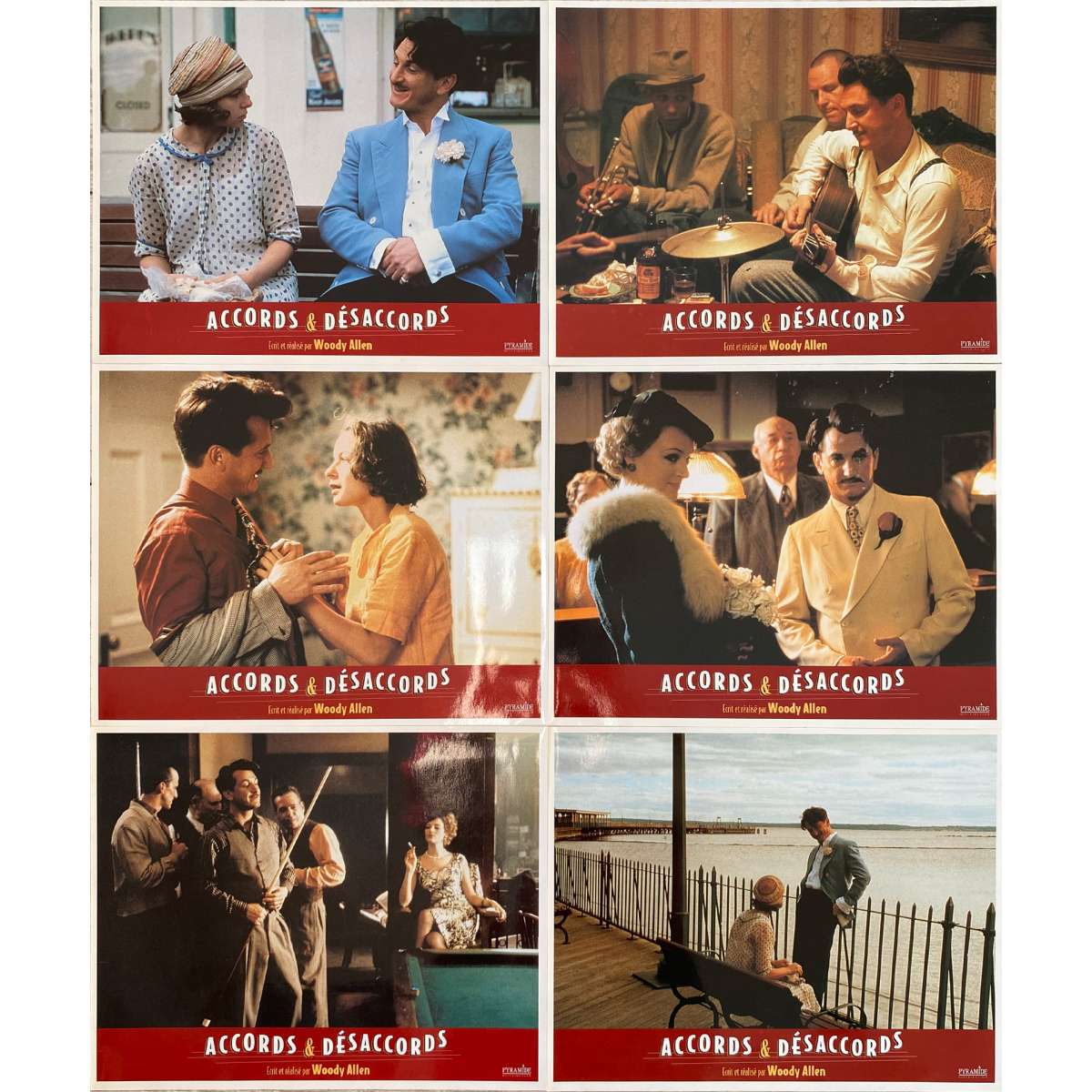

Sean Penns Allegiance To Woody Allen A Persistent Me Too Issue

May 24, 2025

Sean Penns Allegiance To Woody Allen A Persistent Me Too Issue

May 24, 2025 -

Sean Penn And Woody Allen Examining A Continued Me Too Blind Spot

May 24, 2025

Sean Penn And Woody Allen Examining A Continued Me Too Blind Spot

May 24, 2025 -

Sean Penns Support Of Woody Allen A Me Too Blind Spot

May 24, 2025

Sean Penns Support Of Woody Allen A Me Too Blind Spot

May 24, 2025 -

Exploring New Avenues Bangladesh And Europe Partner For Mutual Growth

May 24, 2025

Exploring New Avenues Bangladesh And Europe Partner For Mutual Growth

May 24, 2025 -

Re Energizing Relations Bangladeshs Focus On Growth Through European Collaboration

May 24, 2025

Re Energizing Relations Bangladeshs Focus On Growth Through European Collaboration

May 24, 2025