Net Asset Value (NAV) Of Amundi MSCI All Country World UCITS ETF USD Acc: Explained

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

The Net Asset Value (NAV) represents the net worth of an ETF's holdings. It's calculated by subtracting the ETF's total liabilities from its total assets, then dividing by the number of outstanding shares. For ETFs, this calculation is relatively straightforward and transparent, providing investors with a clear picture of the fund's underlying value.

- Assets: This includes the market value of all the securities held within the ETF, such as stocks, bonds, and other assets. The valuation of these assets is typically done daily using closing market prices.

- Liabilities: These are the fund's expenses, including management fees, operating costs, and any outstanding payable amounts.

- Calculation: (Total Assets - Total Liabilities) / Number of Outstanding Shares = NAV per Share

The NAV is calculated daily, usually at the end of the trading day, reflecting the closing prices of the underlying assets. This daily NAV is then published by the ETF provider, ensuring transparency for investors. Keywords used here include NAV calculation, ETF asset valuation, ETF liability, and daily NAV.

Factors Affecting the NAV of Amundi MSCI All Country World UCITS ETF USD Acc

Several factors influence the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc. Understanding these factors is essential for interpreting NAV fluctuations and making informed investment decisions.

- Underlying Asset Price Fluctuations: The primary driver of NAV changes is the performance of the underlying assets within the ETF. As the prices of the stocks and other assets in the MSCI All Country World Index fluctuate, so too will the ETF's NAV.

- Currency Exchange Rates (USD Acc): Because this is a USD-denominated accumulating ETF ("USD Acc"), fluctuations in exchange rates between the USD and the currencies of the underlying assets can impact the NAV. A strengthening USD against other currencies will generally increase the NAV, and vice versa.

- Dividends and Other Income: Dividends received from the underlying companies are typically reinvested within the ETF (accumulating class), directly increasing the total assets and thus the NAV. Other income sources, like interest, contribute similarly.

- ETF Expenses: The ETF's expense ratio, which covers management fees and other operational costs, slightly reduces the NAV. While this impact is generally small, it's still a relevant factor. Keywords used here include: currency exchange rate impact, dividend reinvestment, ETF expense ratio, and underlying asset performance.

How to Find the NAV of Amundi MSCI All Country World UCITS ETF USD Acc

Finding the daily NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is straightforward. Reliable sources include:

- Amundi Website: The official website of Amundi, the ETF provider, is the most accurate source for the daily NAV.

- Financial News Sources: Major financial news websites and data providers (e.g., Bloomberg, Yahoo Finance) usually publish ETF NAV data.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the platform will typically display the current NAV.

When interpreting NAV data, ensure you understand the reporting time and currency. Keywords: Amundi website, financial news, ETF data providers, NAV lookup.

The Importance of NAV for Investment Decisions

Monitoring the NAV is vital for effective investment management.

- Investment Performance Tracking: By comparing the NAV over time, you can track the performance of your investment in the Amundi MSCI All Country World UCITS ETF USD Acc.

- ETF Benchmark Comparison: The NAV allows you to compare the ETF's performance against its benchmark index (MSCI All Country World Index) to assess its relative success.

- Buy/Sell Signals (in conjunction with other factors): While not the sole determinant, NAV can inform investment decisions, especially when considered alongside broader market trends and your personal investment strategy. Keywords used here include: investment performance tracking, ETF benchmark comparison, buy/sell signals, and investment strategy.

Conclusion: Mastering the Net Asset Value (NAV) of Your Amundi MSCI All Country World UCITS ETF USD Acc Investment

Understanding the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is crucial for tracking your investment's performance and making informed decisions. Remember that the NAV is influenced by various factors, including the performance of underlying assets, currency exchange rates, dividends, and expenses. Regularly checking the NAV, available through various sources, empowers you to monitor your investment and adjust your strategy as needed. We encourage you to regularly monitor the Amundi MSCI All Country World UCITS ETF USD Acc NAV to make the most of your investment. Start monitoring your Amundi MSCI All Country World UCITS ETF USD Acc NAV today!

Featured Posts

-

Duisburg Essen Skandal Um Notenmanipulation Aufgedeckt

May 24, 2025

Duisburg Essen Skandal Um Notenmanipulation Aufgedeckt

May 24, 2025 -

Tathyr Atfaq Washntn Wbkyn Ela Mwshr Daks Qfzt Ila 24 Alf Nqtt

May 24, 2025

Tathyr Atfaq Washntn Wbkyn Ela Mwshr Daks Qfzt Ila 24 Alf Nqtt

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Net Asset Value Nav

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Net Asset Value Nav

May 24, 2025 -

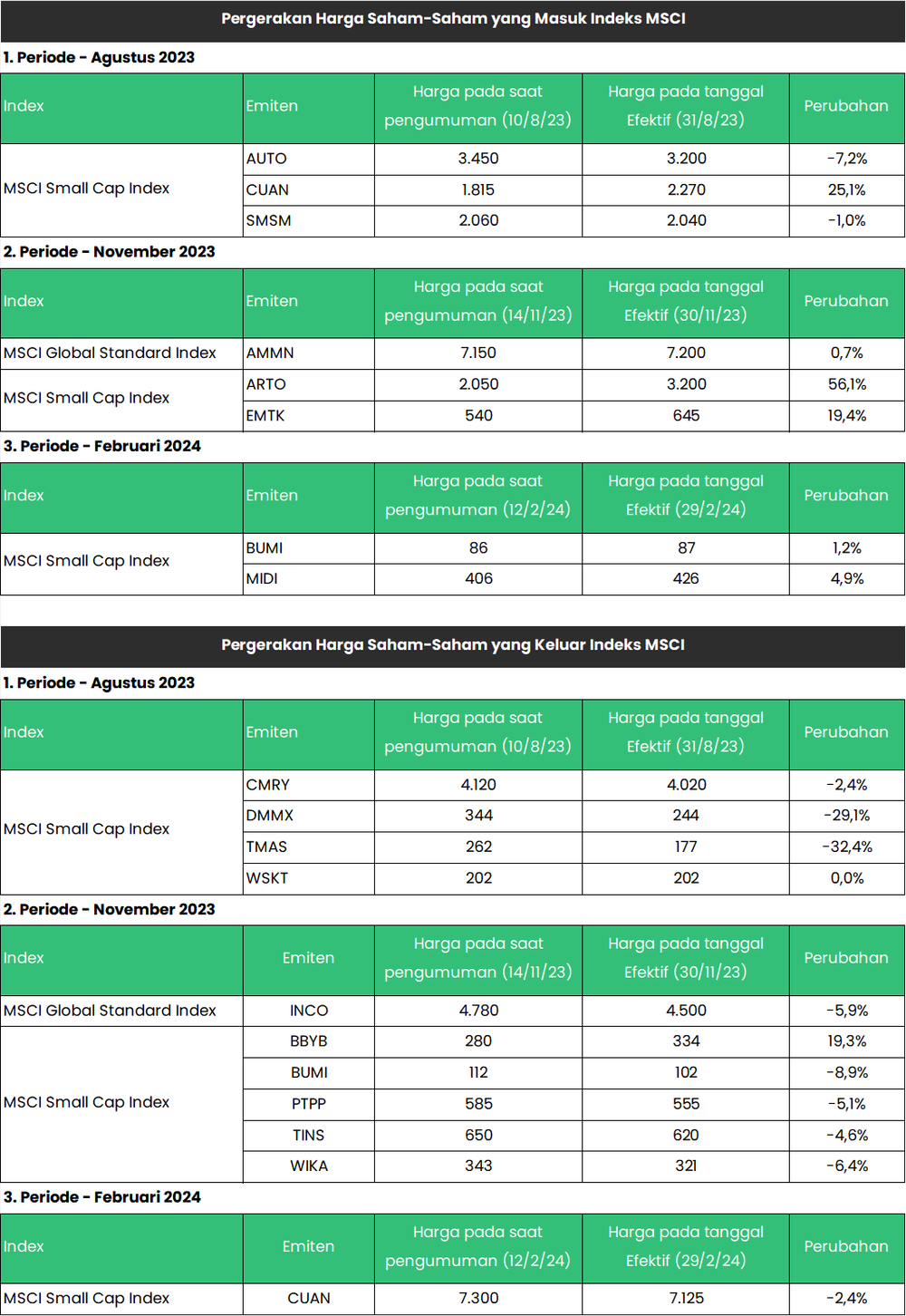

Strategi Investasi Pasca Penambahan Mtel And Mbma Ke Msci Small Cap Index

May 24, 2025

Strategi Investasi Pasca Penambahan Mtel And Mbma Ke Msci Small Cap Index

May 24, 2025 -

Nemecke Firmy A Hromadne Prepustanie Aktualny Prehlad A Dosledky

May 24, 2025

Nemecke Firmy A Hromadne Prepustanie Aktualny Prehlad A Dosledky

May 24, 2025

Latest Posts

-

Dramatic Refueling During 90mph Police Chase Astonishing Footage

May 24, 2025

Dramatic Refueling During 90mph Police Chase Astonishing Footage

May 24, 2025 -

90mph Refuel The Extraordinary Escape During A Police Helicopter Pursuit

May 24, 2025

90mph Refuel The Extraordinary Escape During A Police Helicopter Pursuit

May 24, 2025 -

High Speed Police Chase Astonishing Refueling Moment At 90mph

May 24, 2025

High Speed Police Chase Astonishing Refueling Moment At 90mph

May 24, 2025 -

M56 Motorway Incident Car Accident Results In Casualty Paramedic Treatment

May 24, 2025

M56 Motorway Incident Car Accident Results In Casualty Paramedic Treatment

May 24, 2025 -

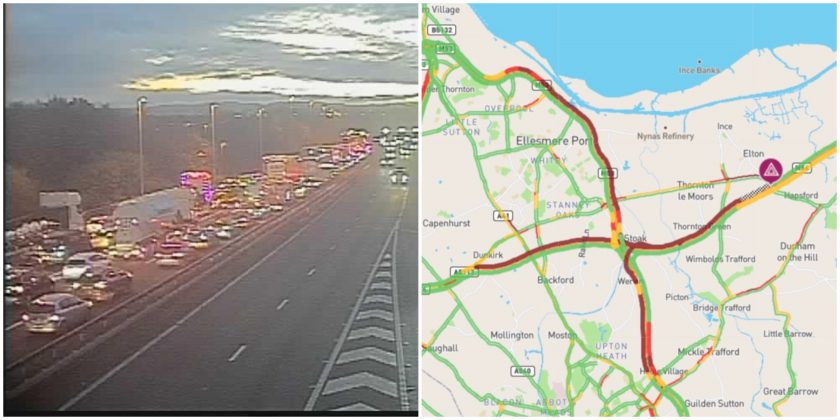

Severe Delays On M56 Following Collision Cheshire Deeside Area

May 24, 2025

Severe Delays On M56 Following Collision Cheshire Deeside Area

May 24, 2025