Net Asset Value (NAV) Of Amundi MSCI World Catholic Principles UCITS ETF Acc: Key Insights

Table of Contents

Defining Net Asset Value (NAV)

The Net Asset Value (NAV) represents the total value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. In simpler terms, it reflects the net worth of each share in the Amundi MSCI World Catholic Principles UCITS ETF Acc. This value is calculated daily, providing a snapshot of the fund's current worth based on the market prices of its holdings. This is crucial because it directly impacts the value of your investment in this Amundi ETF. Understanding the NAV is fundamental to tracking your investment’s performance within this MSCI World Catholic Principles focused fund.

The Amundi MSCI World Catholic Principles UCITS ETF Acc is a UCITS ETF that invests in companies adhering to Catholic social principles. This means it screens companies based on factors like environmental sustainability, human rights, and fair labor practices, aligning investments with ethical values. Understanding the NAV of this specific ETF allows you to track the performance of your ethically-conscious investments.

Factors Influencing the NAV of Amundi MSCI World Catholic Principles UCITS ETF Acc

Several factors influence the daily fluctuations in the Net Asset Value (NAV) of Amundi MSCI World Catholic Principles UCITS ETF Acc. These factors are interconnected and contribute to the overall value of your investment.

Market Performance of Underlying Assets

The most significant factor affecting the NAV is the performance of the companies held within the ETF portfolio.

- Market Fluctuations: Broad market movements (bull or bear markets) directly impact the prices of the underlying stocks, consequently influencing the NAV.

- Sector Performance: The performance of specific sectors (e.g., technology, healthcare) within the portfolio will also affect the overall NAV. If the technology sector, heavily represented in the ETF, performs poorly, the NAV will likely decrease.

- Individual Company Performance: The success or failure of individual companies within the portfolio significantly influences the overall NAV. A strong performance by a major holding will positively impact the NAV, while underperformance will have the opposite effect.

For example, a positive market trend generally leads to an increase in the NAV, while a market downturn usually results in a decrease.

Currency Fluctuations

Because the Amundi MSCI World Catholic Principles UCITS ETF Acc likely holds assets denominated in various currencies, exchange rate fluctuations between these currencies and the ETF's base currency (likely EUR) can impact the NAV.

- Currency Appreciation: If the base currency (EUR) strengthens against the currencies of the underlying assets, the NAV will generally decrease (as the foreign assets are worth less in EUR terms).

- Currency Depreciation: Conversely, a weakening of the base currency against the currencies of the underlying assets typically increases the NAV.

Amundi may employ hedging strategies to mitigate some of this currency risk, but fluctuations still impact the NAV to some extent.

Dividend Distributions

Dividend payouts from the underlying companies affect the NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc.

- Ex-Dividend Date: On the ex-dividend date, the NAV is adjusted downwards to reflect the dividend payment. This is because the ETF no longer holds the entitlement to those dividends.

- Dividend Reinvestment: If the ETF reinvests dividends into purchasing more shares of its underlying assets, this can contribute to NAV growth over time, although this growth is not immediate.

How to Access the NAV of Amundi MSCI World Catholic Principles UCITS ETF Acc

Finding the daily NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc is straightforward. Reliable sources are key to avoid misinformation.

Official Sources

- Amundi Website: The official Amundi website is the most reliable source for NAV data. [Insert Link to Amundi Website Here – replace with actual link]

- Financial News Websites: Reputable financial news websites (e.g., Bloomberg, Yahoo Finance) often provide ETF NAV data. Always verify the source's reliability.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the platform will usually display the current NAV.

Frequency of NAV Updates

The NAV is typically calculated and published daily, often at the end of the trading day. However, there might be slight delays due to factors such as market closures or data processing.

Understanding NAV vs. Market Price

The NAV and the market price of the ETF are not always identical. The market price reflects the price at which the ETF is currently trading, which can deviate from the NAV due to several factors:

- Trading Volume: Low trading volume can cause larger price discrepancies.

- Bid-Ask Spreads: The difference between the buying and selling prices contributes to the gap between NAV and market price.

- Market Sentiment: Investor sentiment and speculation can also influence the market price independently of the NAV.

Utilizing NAV Information for Investment Decisions

Monitoring the NAV is crucial for informed investment decisions.

Performance Tracking

- Calculating Returns: Track the NAV over time to calculate your returns on investment.

- Benchmarking: Compare the ETF's NAV performance against relevant benchmarks (e.g., the MSCI World Index) to assess its relative performance.

- Identifying Trends: Analyze NAV trends to identify long-term performance patterns and potential shifts in investment strategy.

Buy and Sell Decisions

While NAV is important, it shouldn't be the sole factor influencing buy/sell decisions. Consider:

- Investment Goals: Align your buy/sell decisions with your overall financial goals and risk tolerance.

- Market Conditions: Evaluate prevailing market conditions before making any transactions.

- Risk Tolerance: Understand your risk profile and make decisions accordingly.

Comparing to Similar ETFs

Use the NAV to compare the Amundi MSCI World Catholic Principles UCITS ETF Acc's performance with other ethically focused ETFs, such as those focused on ESG (environmental, social, and governance) principles. This comparative analysis allows you to make more informed choices about where to allocate your investments. For example, you could compare its NAV performance to similar ETFs with different investment strategies.

Conclusion: Making Informed Decisions with the Net Asset Value of Amundi MSCI World Catholic Principles UCITS ETF Acc

The Net Asset Value (NAV) of Amundi MSCI World Catholic Principles UCITS ETF Acc is a critical indicator reflecting the underlying value of your investment in this ethically-focused fund. Understanding the factors that influence the NAV, how to access this information from reliable sources like the Amundi website, and how to utilize this data in conjunction with other market indicators are key to making informed investment decisions. Regularly monitor the Net Asset Value (NAV) of Amundi MSCI World Catholic Principles UCITS ETF Acc and other relevant performance metrics to ensure your ethical investments align with your financial goals. For more information on this and other Amundi ETFs, visit the Amundi website: [Insert Link to Amundi Website Here – replace with actual link].

Featured Posts

-

Unfall In Stemwede Auto Prallt Gegen Baum Fahrer Aus Bad Essen Verletzt

May 24, 2025

Unfall In Stemwede Auto Prallt Gegen Baum Fahrer Aus Bad Essen Verletzt

May 24, 2025 -

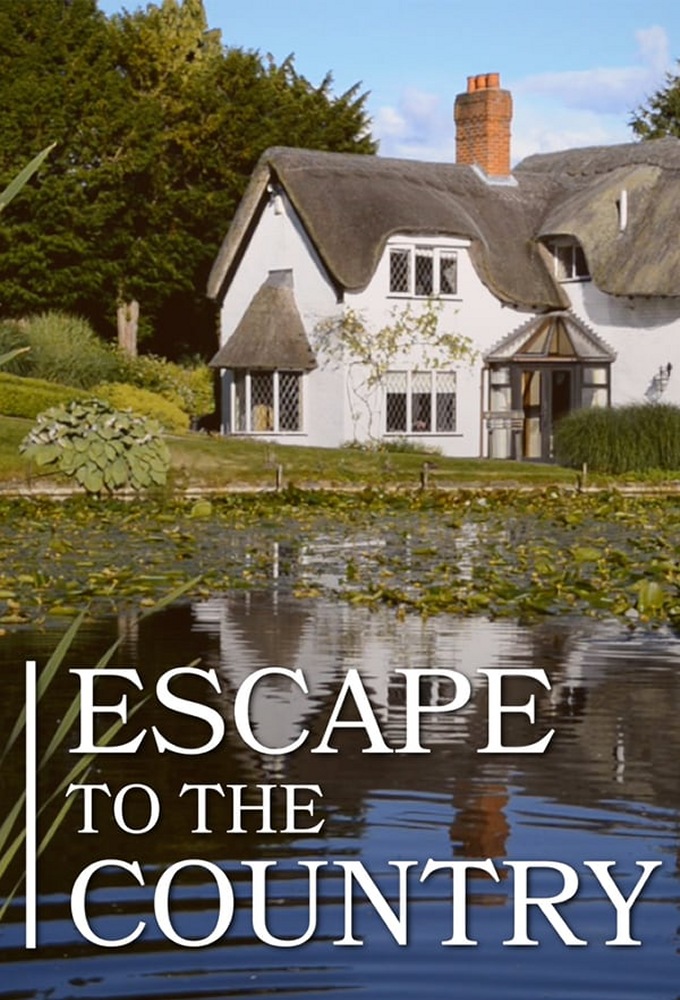

The Ultimate Guide To An Escape To The Country

May 24, 2025

The Ultimate Guide To An Escape To The Country

May 24, 2025 -

Escape To The Country Top Destinations For A Tranquil Life

May 24, 2025

Escape To The Country Top Destinations For A Tranquil Life

May 24, 2025 -

Your Dream Country Escape Awaits A Step By Step Planning Guide

May 24, 2025

Your Dream Country Escape Awaits A Step By Step Planning Guide

May 24, 2025 -

Annie Kilners Public Statements After Kyle Walker Incident

May 24, 2025

Annie Kilners Public Statements After Kyle Walker Incident

May 24, 2025

Latest Posts

-

Planned M62 Westbound Closure For Resurfacing Impact On Drivers From Manchester To Warrington

May 24, 2025

Planned M62 Westbound Closure For Resurfacing Impact On Drivers From Manchester To Warrington

May 24, 2025 -

M56 Traffic Delays Live Updates Following Serious Collision

May 24, 2025

M56 Traffic Delays Live Updates Following Serious Collision

May 24, 2025 -

M62 Westbound Closure Manchester To Warrington Resurfacing Works

May 24, 2025

M62 Westbound Closure Manchester To Warrington Resurfacing Works

May 24, 2025 -

M56 Motorway Closure Serious Crash Causes Major Delays Live Updates

May 24, 2025

M56 Motorway Closure Serious Crash Causes Major Delays Live Updates

May 24, 2025 -

M56 Road Closure Live Traffic Updates And Diversion Routes

May 24, 2025

M56 Road Closure Live Traffic Updates And Diversion Routes

May 24, 2025