Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF Dist: A Comprehensive Guide

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the net worth of a fund's assets. It's a crucial indicator of an investment fund's intrinsic value. Essentially, it's the total value of a fund's assets minus its liabilities. For the Amundi MSCI World II UCITS ETF Dist, this includes the market value of its underlying holdings (a diversified portfolio of global stocks) less any expenses, such as management fees.

- Definition of NAV in simple terms: The value of a fund's assets after deducting its liabilities.

- Explanation of assets included: This primarily comprises the market value of stocks and bonds held within the Amundi MSCI World II UCITS ETF Dist's portfolio, reflecting its investment in the global equity market.

- Explanation of liabilities included: Liabilities include management fees, administrative costs, and other operational expenses associated with running the fund.

- The formula for calculating NAV: NAV = (Total Asset Value - Total Liabilities) / Number of Outstanding Shares

How NAV Affects the Amundi MSCI World II UCITS ETF Dist Price

While the NAV is a critical indicator, it's important to understand that the ETF's market price and its NAV aren't always identical. The market price, what you see when buying or selling the ETF, fluctuates based on supply and demand in the market.

- Explanation of why NAV and market price may differ: Differences arise due to market forces; high demand can push the market price above the NAV, while low demand can depress it below the NAV. Trading volume also plays a role.

- Factors influencing the market price: Besides supply and demand, market sentiment, investor expectations about future performance, and overall market trends significantly influence the ETF's market price.

- The implications of price discrepancies for investors: Price discrepancies can present opportunities. When the market price is below the NAV, it might signal a potential buy opportunity, while a price above the NAV may suggest a sell opportunity. However, always consider the broader market context.

Where to Find the Daily NAV of Amundi MSCI World II UCITS ETF Dist

Access to the daily NAV of the Amundi MSCI World II UCITS ETF Dist is readily available through various reliable channels.

- The Amundi website as a primary source: Amundi, the fund manager, publishes the daily NAV on their official website. This is the most accurate and up-to-date source.

- Reputable financial news sources and data providers: Many reputable financial news websites and data providers, such as Bloomberg or Yahoo Finance, also provide this information.

- Steps to locate the NAV on these platforms: Typically, you'll find this information on the ETF's fact sheet or dedicated page. Look for terms like "Net Asset Value," "NAV," or "unit price."

Understanding the Amundi MSCI World II UCITS ETF Dist's Portfolio and its Impact on NAV

The Amundi MSCI World II UCITS ETF Dist invests in a broad range of global equities, aiming for diversification across different sectors and market capitalizations. The performance of these underlying assets directly impacts the NAV. Positive performance generally leads to an increase in NAV, while poor performance leads to a decrease. Analyzing the portfolio's holdings and sector exposure can help anticipate NAV fluctuations. Understanding the asset allocation within the fund is crucial for anticipating how the NAV might respond to various market conditions.

Using NAV to Make Informed Investment Decisions in Amundi MSCI World II UCITS ETF Dist

Understanding the NAV is critical for making informed investment decisions regarding the Amundi MSCI World II UCITS ETF Dist.

- Using NAV trends to identify potential investment opportunities: Tracking the NAV over time can help you identify trends and potential investment opportunities. Consistent upward trends might suggest strong performance, while downward trends might warrant further investigation.

- Comparing NAV to historical data for trend analysis: Comparing the current NAV to its historical data provides valuable context and helps determine whether the current NAV is high or low relative to its past performance.

- Considering NAV alongside other investment factors (e.g., market trends): NAV shouldn't be the sole factor in your decision-making process. Consider broader market trends, economic conditions, and your personal investment goals.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF Dist is fundamental for successful investing. By regularly monitoring the NAV and understanding its relationship to the market price and underlying portfolio performance, you can make more informed decisions about buying, selling, or holding this ETF. Remember that NAV is just one piece of the puzzle; consider other investment factors for a holistic approach to risk management. Stay informed about your Amundi MSCI World II UCITS ETF Dist investments by regularly checking its Net Asset Value. For the most accurate and up-to-date information, visit the official Amundi website.

Featured Posts

-

Pengalaman Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 25, 2025

Pengalaman Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 25, 2025 -

Manny Garcias Lego Masterclass At Veterans Memorial Elementary School A Photo Recap

May 25, 2025

Manny Garcias Lego Masterclass At Veterans Memorial Elementary School A Photo Recap

May 25, 2025 -

Us Band Hints At Glastonbury Performance Unconfirmed But Buzzy

May 25, 2025

Us Band Hints At Glastonbury Performance Unconfirmed But Buzzy

May 25, 2025 -

Ferraris 10 Fastest Production Cars Lap Time Showdown

May 25, 2025

Ferraris 10 Fastest Production Cars Lap Time Showdown

May 25, 2025 -

Outrage At Hamilton Ferrari Chiefs Strong Reaction To Comments

May 25, 2025

Outrage At Hamilton Ferrari Chiefs Strong Reaction To Comments

May 25, 2025

Latest Posts

-

Get Your Bbc Radio 1 Big Weekend Tickets The Ultimate Guide

May 25, 2025

Get Your Bbc Radio 1 Big Weekend Tickets The Ultimate Guide

May 25, 2025 -

Securing Your Bbc Radio 1 Big Weekend Tickets Tips And Strategies

May 25, 2025

Securing Your Bbc Radio 1 Big Weekend Tickets Tips And Strategies

May 25, 2025 -

Bbc Radio 1 Big Weekend A Ticket Buyers Guide

May 25, 2025

Bbc Radio 1 Big Weekend A Ticket Buyers Guide

May 25, 2025 -

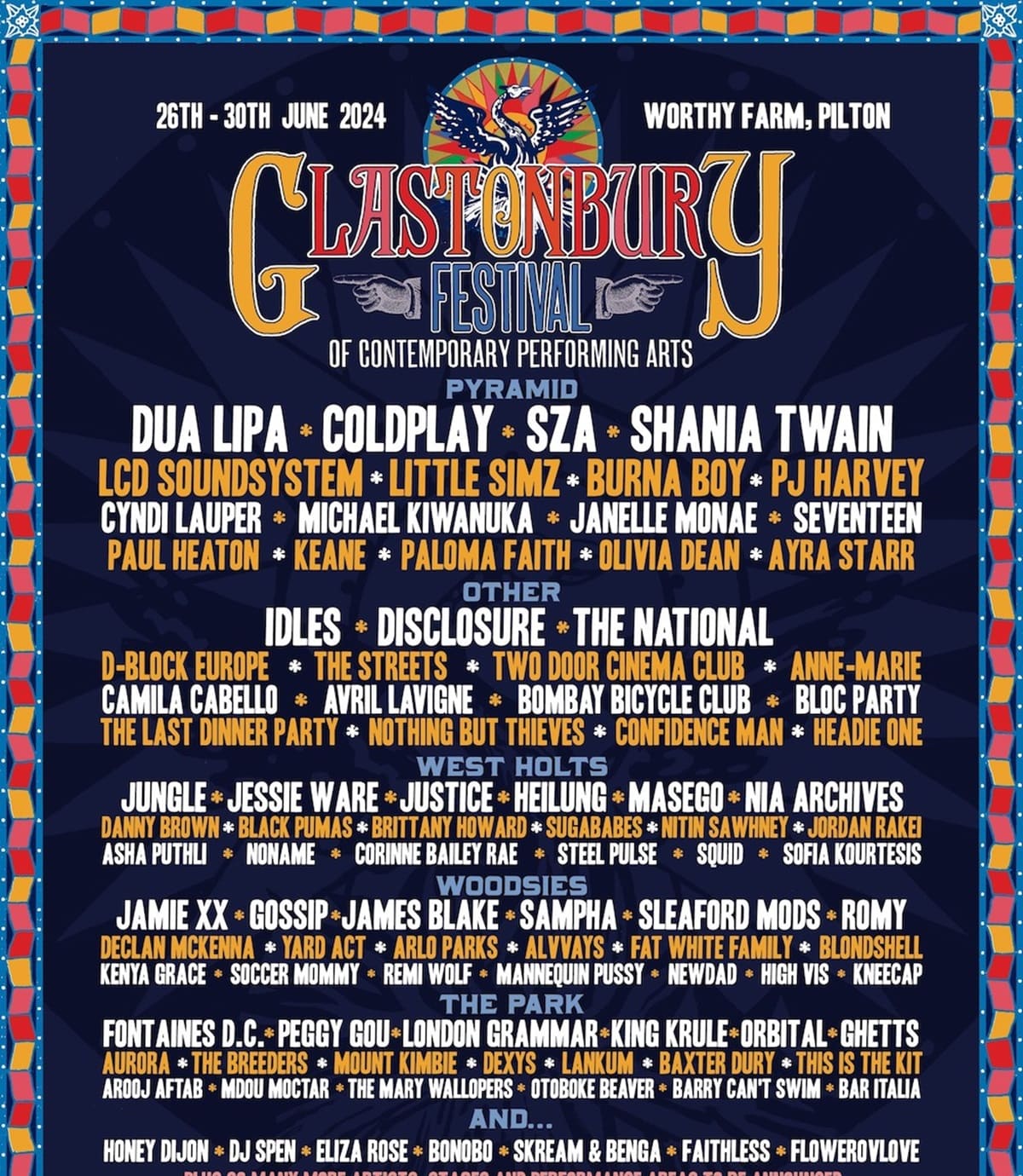

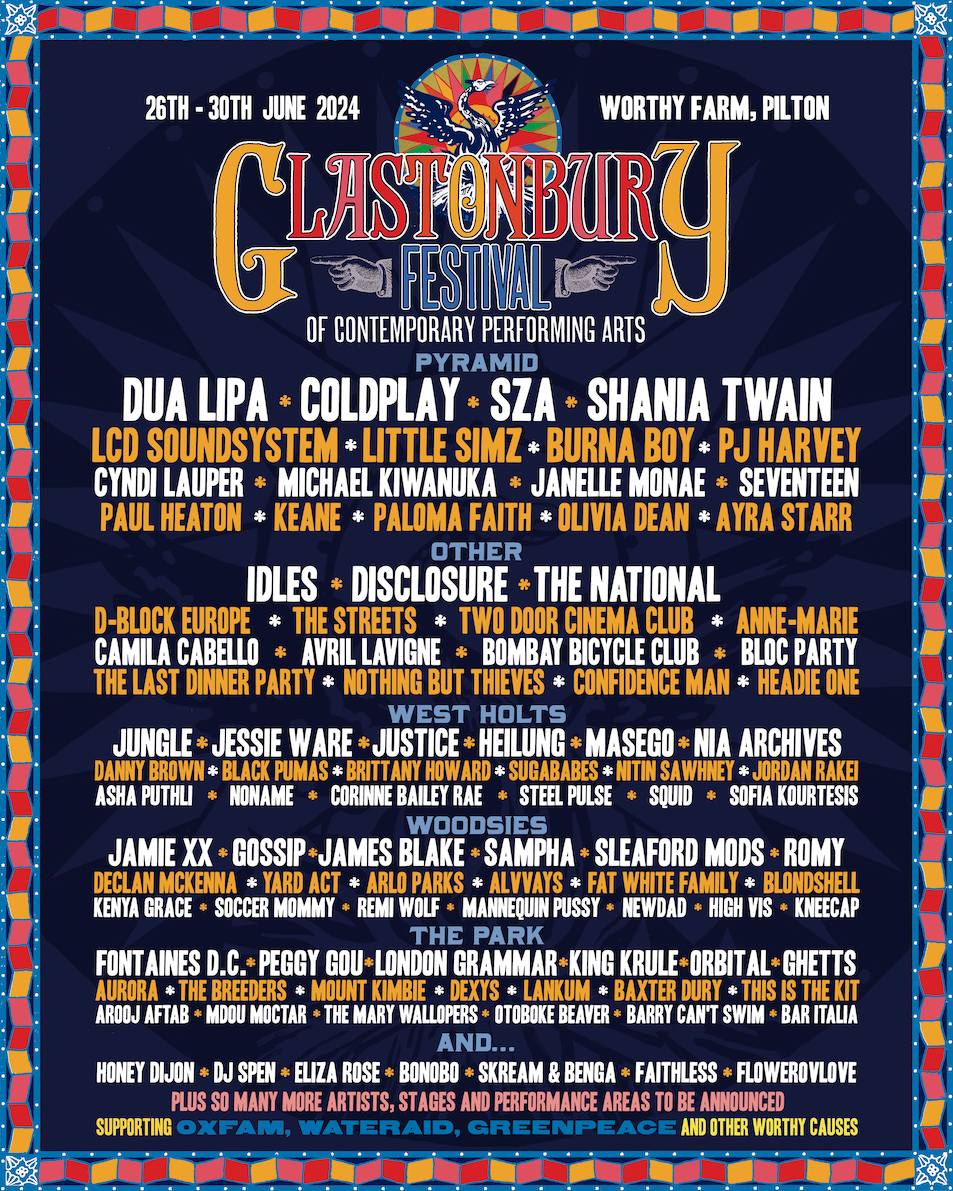

Glastonbury Festival 2025 Complete Lineup And Ticket Purchase Guide Following Leak

May 25, 2025

Glastonbury Festival 2025 Complete Lineup And Ticket Purchase Guide Following Leak

May 25, 2025 -

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 25, 2025

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 25, 2025