New HMRC Letters: Guidance For UK Households

Table of Contents

Identifying Genuine HMRC Letters: Spotting Scams and Fraud

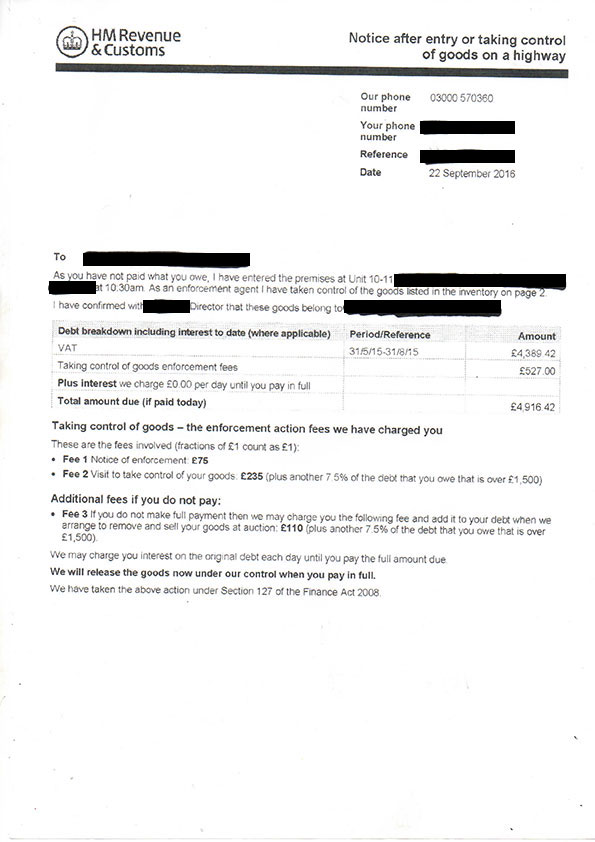

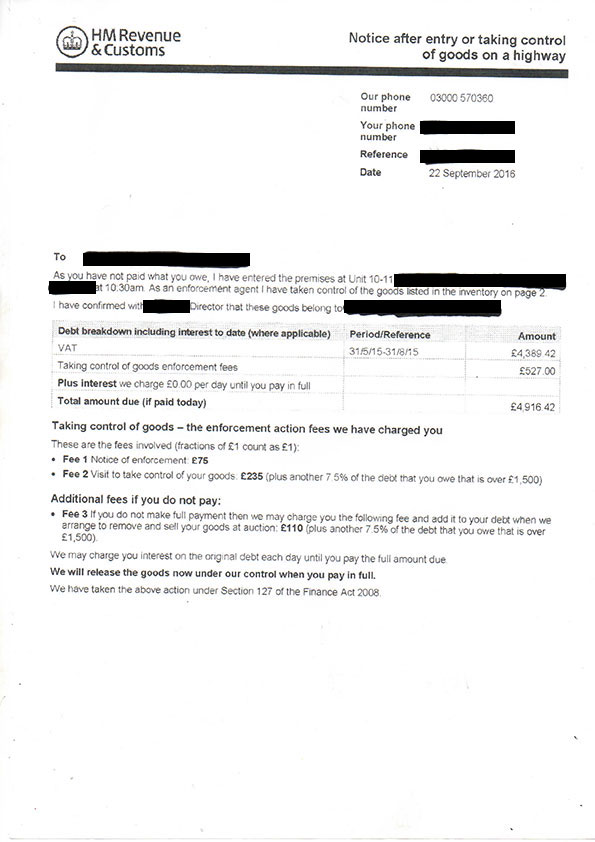

One of the first concerns when receiving an HMRC letter is verifying its authenticity. Unfortunately, tax scams are prevalent, with fraudsters attempting to steal personal and financial information. Learning to identify genuine HMRC communications is crucial to protect yourself from falling victim to these scams.

How to Identify Authentic HMRC Communications:

Genuine HMRC letters will always display specific features:

- Official HMRC branding and letterhead: Look for the official HMRC logo and letterhead, which are easily verifiable online.

- Unique reference numbers: Every official HMRC communication will include a unique reference number. This number allows you to track your correspondence and verify its authenticity.

- Correct contact details: The letter should include accurate HMRC contact details, readily available on the official HMRC website. Never rely on contact details provided within the letter itself if you suspect it may be fraudulent.

Examples of Fraudulent HMRC Letters:

Fraudulent letters often include:

- Threats of immediate legal action: HMRC will rarely threaten immediate legal action without prior communication.

- Urgent requests for payment: Legitimate HMRC communications clearly outline payment deadlines, rarely using aggressive or threatening language.

- Suspicious email addresses or website links: Always check the sender's email address carefully and never click links in suspicious emails.

Key Actions to Take:

- Check for official HMRC branding and letterhead.

- Verify the contact details against the official HMRC website (www.gov.uk/government/organisations/hm-revenue-customs).

- Never click on links in suspicious emails or letters.

- Report suspicious communications to Action Fraud (0300 123 2040) or via their online reporting tool.

Common Types of HMRC Letters and Their Implications

HMRC sends various letters for different reasons. Understanding the type of letter you've received is crucial for a prompt and appropriate response. Here are some common types of HMRC correspondence:

- Tax assessment letters: These letters outline your tax liability for a given tax year. Carefully review the details to ensure accuracy. If you disagree with the assessment, you have the right to appeal.

- Payment reminder letters: These letters remind you of an outstanding tax payment. Responding promptly and making the payment on time is crucial to avoid penalties.

- Penalty letters: If you fail to pay your tax on time, you'll receive a penalty letter outlining the amount owed. You can sometimes appeal penalties under specific circumstances.

- Investigation notices: These letters indicate HMRC is investigating your tax affairs. Cooperate fully with the investigation and provide all requested information.

Understanding Your Tax Liability: Tax assessment letters may be complex. Seek professional advice if you require clarification.

Avoiding Late Payment Penalties: Always meet payment deadlines to avoid incurring penalties.

Appealing Penalties: If you believe a penalty is unjustified, follow the appeals process outlined in the letter.

Cooperating with HMRC Inquiries: Respond promptly and provide accurate information during any investigation.

Responding to HMRC Letters: A Step-by-Step Guide

Responding to HMRC letters requires a structured approach:

- Read the letter carefully: Understand the request and the deadline for responding.

- Gather relevant documents and information: Collect all necessary paperwork, such as payslips, invoices, and bank statements, to support your response.

- Respond within the specified timeframe: Timely responses are essential. Missing deadlines can lead to further complications.

- Use the appropriate communication method: You can respond online via your HMRC online account, by phone, or by post. Choose the method indicated in the letter or the method most suitable to your situation.

- Keep records of all communications: Maintain a copy of all correspondence and proof of any payments made.

Responding to HMRC Online: Using the HMRC online portal is usually the quickest and most efficient method.

Contacting HMRC by Phone: HMRC provides a helpline for general inquiries, but wait times can be long.

Responding by Post: Ensure you send your response using recorded or tracked delivery to obtain proof of posting.

Seeking Help and Further Advice on HMRC Letters

Navigating HMRC correspondence can be challenging. Several resources offer support:

- HMRC's website: The official HMRC website (www.gov.uk/hmrc) provides comprehensive information on tax regulations and procedures.

- HMRC helpline: While wait times can be lengthy, the helpline can offer assistance with specific queries.

- Tax advisors and accountants: A qualified tax professional can provide tailored advice and support.

- Citizens Advice: This charity offers free, impartial guidance on various issues, including tax-related matters.

Conclusion: Taking Control of Your HMRC Correspondence

Understanding and responding to HMRC letters effectively is crucial for managing your tax affairs. This guide emphasizes identifying genuine letters to avoid scams, understanding different types of correspondence, and responding promptly. Proactive communication with HMRC will minimize potential issues and ensure compliance. Don't let HMRC letters cause unnecessary stress. Use this guide to confidently manage your UK tax correspondence and understand your rights with HMRC letters. For more information, visit the official HMRC website: [link to HMRC website].

Featured Posts

-

The Ultimate Guide To Solo Travel Tips Tricks And Inspiration

May 20, 2025

The Ultimate Guide To Solo Travel Tips Tricks And Inspiration

May 20, 2025 -

Officieel Jennifer Lawrence Verwelkomt Tweede Kind

May 20, 2025

Officieel Jennifer Lawrence Verwelkomt Tweede Kind

May 20, 2025 -

Ferrari Lekler I Khemilton Spornaya Diskvalifikatsiya Posle Gonki

May 20, 2025

Ferrari Lekler I Khemilton Spornaya Diskvalifikatsiya Posle Gonki

May 20, 2025 -

Ofitsialno Potvrzhdenie Dzhenifr Lorns Otnovo E Mayka

May 20, 2025

Ofitsialno Potvrzhdenie Dzhenifr Lorns Otnovo E Mayka

May 20, 2025 -

Analyzing Giorgos Giakoumakis Reduced Appeal To Mls Clubs

May 20, 2025

Analyzing Giorgos Giakoumakis Reduced Appeal To Mls Clubs

May 20, 2025