New Manufacturing Tax Credit Incentives Expected In Ontario Budget

Table of Contents

Anticipated Types of New Manufacturing Tax Credits in Ontario

The Ontario government is expected to announce several new or improved manufacturing tax credits in the upcoming budget, designed to stimulate growth and investment within the sector. These could include:

-

Investment Tax Credits: These credits will likely incentivize capital investments in modernizing facilities and boosting productivity. Expect to see credits offered for purchases of new equipment, machinery, and advanced technologies. Potential percentage rates could range from 5% to potentially higher percentages for specific technologies or investments in underserved regions. Eligible expenses may include software, robotics, and automation systems. Look for details on specific eligible equipment categories in the final budget release.

-

Research and Development (R&D) Tax Credits: Ontario already offers R&D tax credits, but enhancements are anticipated. These credits reward companies that invest in innovation and technological advancement. This could include funding for research projects leading to new products, processes, or technologies within the manufacturing sector. The increased rates or expanded eligibility for existing programs would significantly boost manufacturing innovation in Ontario.

-

Hiring Tax Credits: To address labor shortages, new or expanded hiring tax credits are anticipated. These incentives aim to encourage the creation of new jobs in manufacturing, particularly for skilled workers and apprentices. Potential tax breaks could be tied to the wage levels of newly hired employees, incentivizing the hiring of highly skilled individuals. Expect details on wage thresholds and the types of roles eligible for these credits.

-

Green Manufacturing Tax Credits: Given Ontario's commitment to environmental sustainability, new incentives for green manufacturing practices are highly probable. These could reward companies adopting eco-friendly technologies, reducing carbon emissions, and improving energy efficiency. Qualifying initiatives might include investments in renewable energy sources, waste reduction programs, and the adoption of cleaner production technologies. Details on qualifying green initiatives and the amount of the tax credit will be crucial to assess.

Eligibility Criteria and Application Process for Ontario Manufacturing Tax Credits

While the specific details await the budget announcement, certain general eligibility criteria are likely to apply to the Ontario manufacturing tax credits:

-

Business Size: Eligibility may vary depending on the size of the manufacturing business (small, medium, or large enterprise). Specific thresholds defining each size category will be detailed in the official announcement.

-

Industry Type: The new credits will likely target specific sectors within the manufacturing industry. This might include automotive manufacturing, food processing, advanced manufacturing, and other key sectors identified as priorities for economic growth in Ontario.

-

Location: Some tax credit programs may offer additional incentives to businesses located in specific regions of Ontario, aiming to encourage economic development in less-prosperous areas.

-

Application Procedures: The application process will likely involve completing a detailed application form, submitting supporting documentation (financial statements, invoices, etc.), and potentially undergoing an audit. Once the budget is released, the relevant government websites will provide application forms and detailed instructions. Keep an eye on the websites of the Ontario Ministry of Finance and the relevant ministry responsible for economic development for the latest updates.

Potential Economic Impact of New Ontario Manufacturing Tax Credits

The anticipated Ontario manufacturing tax credits have the potential to significantly impact the Ontario economy:

-

Job Creation: Increased investment spurred by these tax credits can lead to significant job creation within the manufacturing sector, boosting employment rates and reducing unemployment.

-

Investment Attraction: Attracting both domestic and international investment into the manufacturing sector will be a key outcome. This will lead to increased competitiveness and innovation.

-

Regional Development: Targeted incentives for specific regions could revitalize local economies and boost manufacturing activity in less-developed areas of Ontario.

-

Competitiveness: The implementation of these incentives would enhance Ontario's competitiveness relative to other provinces and jurisdictions, attracting businesses and retaining existing ones.

Preparing Your Business for the New Ontario Manufacturing Tax Credits

To maximize the potential benefits of the new Ontario manufacturing tax credits, businesses should:

-

Financial Planning: Carefully review your financial statements to identify potential investments in equipment, technology, or personnel that align with the anticipated tax credit programs.

-

Consultations: Consult with a qualified tax professional and relevant government agencies to discuss your eligibility for the various tax credits and explore ways to optimize your claim.

-

Record Keeping: Maintain meticulous records of all eligible expenses and investments to ensure a smooth and efficient application process. Detailed and accurate record-keeping is paramount for a successful claim.

Conclusion

The anticipated announcement of new Ontario manufacturing tax credits presents a significant opportunity for businesses in the manufacturing sector. By understanding the potential types of incentives, eligibility criteria, and application processes, manufacturers can effectively position themselves to benefit from these initiatives. Don't miss out on this chance to boost your profitability and competitiveness. Take action today by researching the specific details of the upcoming Ontario budget and preparing your application for these potentially game-changing Ontario manufacturing tax credits. Consult with a tax advisor to ensure your business is fully prepared to leverage these incentives and unlock the full potential of these valuable tax benefits.

Featured Posts

-

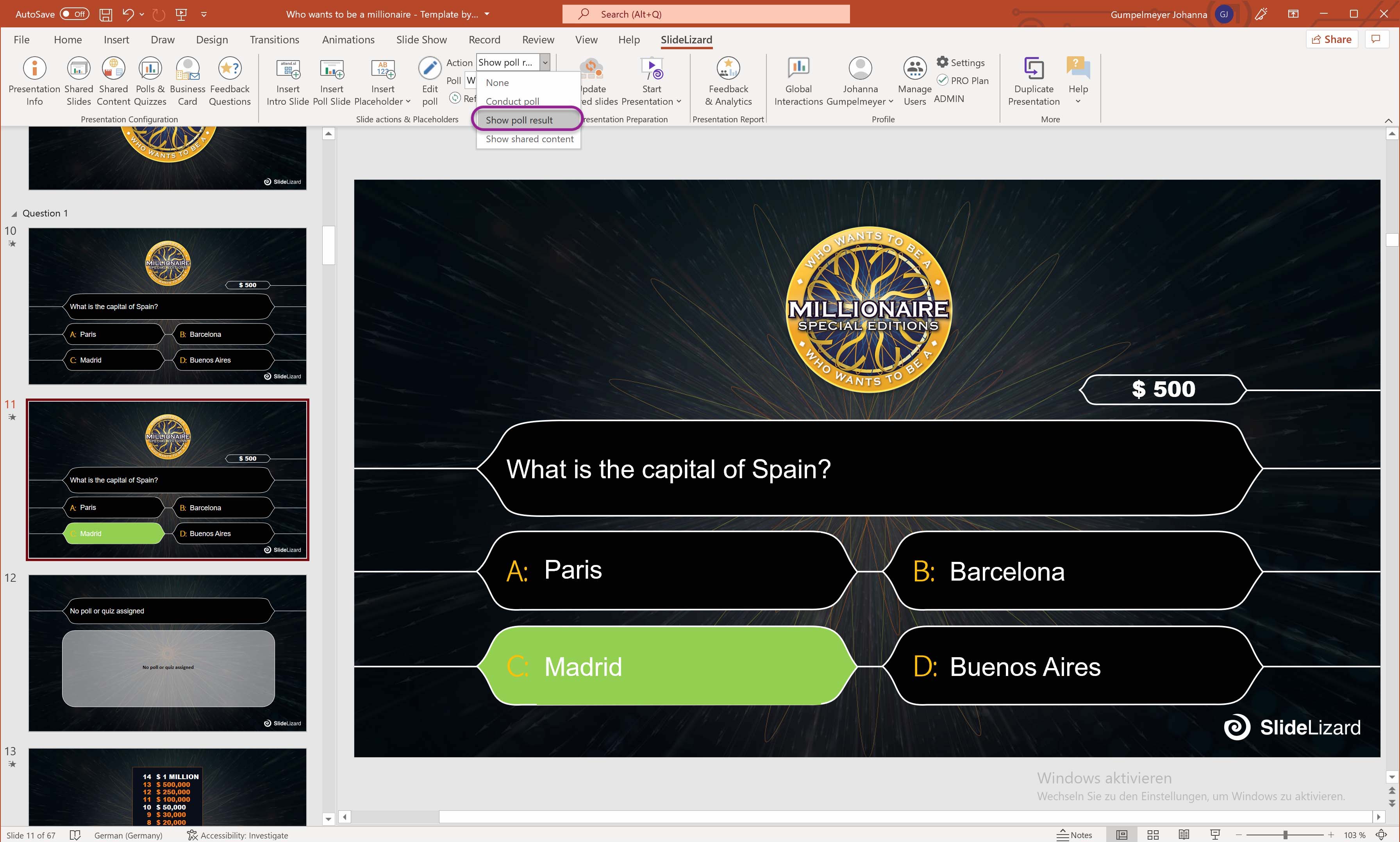

Who Wants To Be A Millionaire Controversy Easy Question Slow Answer Angry Fans

May 07, 2025

Who Wants To Be A Millionaire Controversy Easy Question Slow Answer Angry Fans

May 07, 2025 -

Fotosessiya Rianny Rozovoe Kruzhevo I Strast

May 07, 2025

Fotosessiya Rianny Rozovoe Kruzhevo I Strast

May 07, 2025 -

Xrp Whales Massive 20 M Token Buy A Big Bet On Ripple

May 07, 2025

Xrp Whales Massive 20 M Token Buy A Big Bet On Ripple

May 07, 2025 -

The Significance Of History Why A Warriors Blowout Loss Shouldnt Cause Concern

May 07, 2025

The Significance Of History Why A Warriors Blowout Loss Shouldnt Cause Concern

May 07, 2025 -

John Wick 5 Debunking The Myth Of John Wicks Return After Death

May 07, 2025

John Wick 5 Debunking The Myth Of John Wicks Return After Death

May 07, 2025

Latest Posts

-

Etf

May 08, 2025

Etf

May 08, 2025 -

Bitcoin Price Golden Cross What It Means For Investors

May 08, 2025

Bitcoin Price Golden Cross What It Means For Investors

May 08, 2025 -

Pasadena Star News Mike Trouts Two Home Runs Insufficient In Angels Loss To Giants

May 08, 2025

Pasadena Star News Mike Trouts Two Home Runs Insufficient In Angels Loss To Giants

May 08, 2025 -

Giants Defeat Angels Despite Mike Trouts Power Display

May 08, 2025

Giants Defeat Angels Despite Mike Trouts Power Display

May 08, 2025 -

Angels Fall To Giants Despite Mike Trouts Two Home Runs

May 08, 2025

Angels Fall To Giants Despite Mike Trouts Two Home Runs

May 08, 2025