Nicolai Tangen And The Impact Of Trump's Tariffs On Global Investment

Table of Contents

Trump's Tariffs: A Seismic Shift in Global Trade

The Trump administration's imposition of tariffs, primarily targeting China but also affecting numerous other countries, dramatically altered the global trade landscape. These tariffs, intended to protect domestic industries and address trade imbalances, ultimately resulted in a complex web of unintended consequences. The intended outcome was to boost domestic manufacturing and reduce the US trade deficit. However, the reality was far more nuanced.

- Increased costs for businesses importing goods: Tariffs directly increased the cost of imported goods, squeezing profit margins and impacting consumer prices. This ripple effect extended throughout supply chains, affecting businesses across various sectors.

- Retaliatory tariffs from other countries: The imposition of tariffs triggered retaliatory measures from affected countries, escalating the trade war and further disrupting global supply chains. This tit-for-tat response amplified the negative economic consequences.

- Disruption of global supply chains: The uncertainty surrounding tariffs forced businesses to rethink their global supply chains, leading to increased costs, delays, and a search for alternative sourcing options. This disruption had a cascading effect on global production and distribution networks.

- Uncertainty in the global market: The constant threat of new tariffs and retaliatory measures created a climate of uncertainty, making it difficult for businesses to plan for the future and hindering investment decisions. This unpredictability was detrimental to long-term economic stability.

Keywords: Trump administration, trade war, tariff impact, global trade disruption, import costs.

The Norges Bank Investment Management (NBIM) and its Global Portfolio

Norges Bank Investment Management (NBIM), responsible for managing Norway's Government Pension Fund Global, is a behemoth in the world of sovereign wealth funds. With trillions of dollars in assets under management, its investment decisions significantly impact global markets. NBIM's investment strategy is predicated on long-term value creation, employing a globally diversified portfolio across a range of asset classes.

- Size of NBIM's assets under management: NBIM's vast assets under management give it immense influence in global markets, making its reactions to macroeconomic events highly significant.

- Investment strategy focused on long-term value creation: NBIM's long-term perspective means it typically avoids short-term speculative investments, focusing instead on building a robust and diversified portfolio.

- Geographic distribution of investments: NBIM's portfolio is spread across numerous countries and regions, mitigating risk associated with any single market or geopolitical event.

- Investment sectors (Equities, Fixed Income, Real Estate, etc.): NBIM invests across a diverse range of asset classes, providing further diversification and resilience to market fluctuations.

Keywords: Norges Bank Investment Management, NBIM, sovereign wealth fund, global investment portfolio, asset allocation.

Navigating the Turbulent Waters: Tangen's Response to Tariffs

Nicolai Tangen, appointed CEO of NBIM in 2020, inherited a fund already grappling with the challenges posed by Trump's tariffs. His leadership involved navigating the increased market volatility and uncertainty stemming from these trade disputes. While specific details of NBIM's internal portfolio adjustments are not publicly available due to confidentiality reasons, the fund's overall strategy likely reflected a cautious approach.

- Changes in asset allocation: It's likely NBIM adjusted its asset allocation, potentially reducing exposure to sectors heavily impacted by the tariffs or shifting investments to less vulnerable regions.

- Increased focus on specific sectors or geographies: NBIM might have strategically increased investments in sectors less susceptible to trade wars or geographic regions with greater economic stability.

- Risk management strategies implemented: Enhanced risk management strategies, such as hedging and diversification, were likely implemented to mitigate the impact of market volatility caused by the trade war.

- Public statements by Tangen regarding the tariffs' impact: While direct public statements about specific portfolio adjustments are unlikely, Tangen's public pronouncements likely reflected the challenges of navigating this period of global trade uncertainty.

Keywords: Nicolai Tangen, investment strategy, risk management, portfolio adjustment, market volatility.

The Broader Impact on Global Investment Flows

Trump's tariffs had far-reaching consequences beyond the immediate impact on specific industries. The increased uncertainty significantly impacted global investment flows, leading to several notable shifts.

- Reduced foreign direct investment (FDI): The trade war discouraged foreign direct investment, as businesses hesitated to commit capital to markets facing unpredictable trade policies.

- Increased capital flight to safer havens: Investors sought refuge in safer assets, such as government bonds and precious metals, leading to capital flight from riskier markets.

- Impact on emerging markets: Emerging markets were particularly vulnerable to the effects of the tariffs, facing reduced investment and slower economic growth.

- Long-term effects on global economic growth: The trade war's long-term impact on global economic growth remains a subject of ongoing debate, with many economists pointing to a period of slower expansion.

Keywords: foreign direct investment (FDI), capital flows, global economic growth, emerging markets, investment trends.

Conclusion

Trump's tariffs created significant uncertainty in global markets, forcing investors like Nicolai Tangen and Norges Bank Investment Management to adapt their strategies. The analysis reveals that the impact extended far beyond specific industries, affecting global investment flows and economic growth. The response of NBIM, while not explicitly detailed due to confidentiality, undoubtedly involved careful risk management and strategic adjustments to its massive global portfolio. Understanding the complexities of these changes is vital for comprehending the dynamics of global finance. To further understand the impact of Trump's tariffs on global investment, explore resources dedicated to international trade policy and the activities of major sovereign wealth funds like NBIM under Nicolai Tangen's leadership. Analyzing Nicolai Tangen's responses to trade policy offers valuable insights into navigating future economic uncertainties.

Featured Posts

-

Lizzo Concert Tickets In Real Life Tour Prices

May 05, 2025

Lizzo Concert Tickets In Real Life Tour Prices

May 05, 2025 -

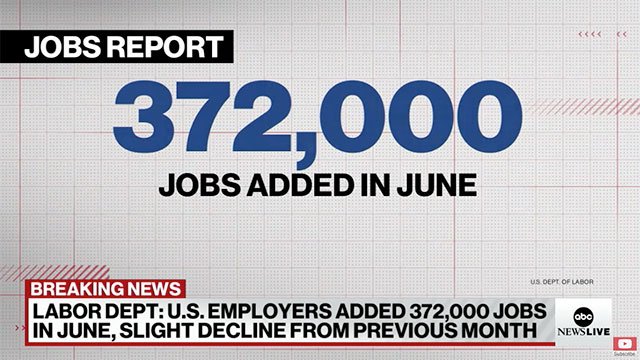

177 000 Jobs Added In April U S Unemployment Remains At 4 2

May 05, 2025

177 000 Jobs Added In April U S Unemployment Remains At 4 2

May 05, 2025 -

Marvels Quality Control Addressing Criticisms Of Its Films And Series

May 05, 2025

Marvels Quality Control Addressing Criticisms Of Its Films And Series

May 05, 2025 -

Lizzo Drops A Scorching New Single

May 05, 2025

Lizzo Drops A Scorching New Single

May 05, 2025 -

Ev Mandate Backlash Car Dealerships Increase Resistance

May 05, 2025

Ev Mandate Backlash Car Dealerships Increase Resistance

May 05, 2025

Latest Posts

-

West Bengal Weather Four Districts Face Extreme Heat Warning

May 05, 2025

West Bengal Weather Four Districts Face Extreme Heat Warning

May 05, 2025 -

Heatwave Alert In West Bengal Four Districts On High Alert

May 05, 2025

Heatwave Alert In West Bengal Four Districts On High Alert

May 05, 2025 -

1 2 Inches Of Spring Snow Possible Tomorrow In Select Nyc Suburbs

May 05, 2025

1 2 Inches Of Spring Snow Possible Tomorrow In Select Nyc Suburbs

May 05, 2025 -

Darjeeling Tea Industry A Look At Current Concerns

May 05, 2025

Darjeeling Tea Industry A Look At Current Concerns

May 05, 2025 -

Unexpected Spring Snow 1 2 Inches Possible In Some Nyc Suburbs

May 05, 2025

Unexpected Spring Snow 1 2 Inches Possible In Some Nyc Suburbs

May 05, 2025