Nike Q3 Results: Jefferies Predicts Impact On Foot Locker's Short-Term Performance

Table of Contents

Jefferies' recent analysis of Nike's Q3 results casts a shadow on Foot Locker's short-term performance. This article delves into the key findings and explores how this prediction could significantly impact Foot Locker's stock and overall market position within the athletic footwear retail sector. We'll examine the specific factors contributing to Jefferies' forecast and assess the potential implications for Foot Locker investors. Understanding the interplay between these two retail giants is crucial for navigating the current dynamics of the athletic footwear market.

Jefferies' Key Findings on Nike Q3 Earnings

Jefferies' report on Nike's Q3 earnings highlighted several key areas impacting the brand's performance, and consequently, its retail partners. These findings have significant implications for Foot Locker, heavily reliant on Nike products for a substantial portion of its revenue.

Nike's Inventory Levels and Their Impact

Nike's Q3 results revealed elevated inventory levels, a concern that immediately impacts future profitability. This overstocking could force Nike to implement significant markdowns to clear excess merchandise.

- Increased Inventory: Jefferies' report detailed a specific percentage increase in Nike's inventory compared to the previous year, indicating a potential oversupply.

- Markdown Implications: To move excess inventory, Nike may need to reduce prices, directly affecting profit margins. This strategy, while necessary to manage stock, could negatively impact Nike's overall profitability in the short term.

- Impact on Future Orders: Retailers like Foot Locker may reduce their future orders from Nike due to concerns about potential markdowns impacting their own profit margins.

Impact of Changing Consumer Spending Habits

The current economic climate plays a significant role in consumer spending habits. Jefferies' analysis suggests that shifts in consumer preferences and a potential slowdown in discretionary spending are impacting demand for athletic footwear.

- Economic Slowdown: Concerns about inflation and potential recession are causing consumers to be more cautious about discretionary purchases, impacting demand for high-priced athletic shoes.

- Shifting Preferences: Consumer preferences are evolving, with potential shifts toward alternative brands or product categories. This shift could reduce the overall demand for Nike products.

- Impact on Foot Locker Sales: Foot Locker's heavy reliance on Nike products makes it particularly vulnerable to any slowdown in Nike's sales.

Nike's Future Growth Projections and Their Correlation with Foot Locker

Jefferies' report included predictions for Nike's future growth, painting a somewhat cautious picture for the short term. This has direct implications for Foot Locker, given their strong partnership.

- Slower Growth Forecast: Jefferies may have predicted a slower-than-expected growth rate for Nike in the coming quarters, impacting investor sentiment.

- Foot Locker's Dependence on Nike: Foot Locker generates a substantial portion of its revenue through Nike sales. A slowdown in Nike's growth directly impacts Foot Locker's bottom line.

- Partnership Dynamics: The close relationship between Nike and Foot Locker means that Nike's performance directly influences Foot Locker's ability to achieve its own financial targets.

Potential Short-Term Impacts on Foot Locker

The Jefferies report's findings have significant implications for Foot Locker's short-term performance, influencing both its stock price and overall investor sentiment.

Stock Price Volatility and Investor Sentiment

The release of the Jefferies report is likely to cause volatility in Foot Locker's stock price. Investor confidence might decline based on concerns about Nike's performance and its impact on Foot Locker’s revenue.

- Negative Investor Sentiment: The report’s negative outlook could lead to decreased investor confidence in Foot Locker's stock.

- Stock Price Fluctuations: Expect short-term volatility in Foot Locker's stock price as investors react to the news and reassess their investment strategies.

- Analyst Ratings: Following the report, other financial analysts may adjust their ratings and recommendations for Foot Locker stock.

Foot Locker's Strategies to Mitigate the Impact

Foot Locker isn't passive; the company will likely implement several strategies to offset the potential negative impact of Jefferies' predictions.

- Diversification of Brands: Foot Locker can lessen its dependence on Nike by expanding its offerings to include a broader range of athletic footwear brands.

- Promotional Campaigns: Targeted promotional campaigns and discounts could help stimulate sales and clear inventory.

- Improved Inventory Management: Refining inventory management practices to avoid future overstocking scenarios is crucial.

Long-Term Outlook for Foot Locker

Despite the short-term challenges presented by Jefferies' analysis, Foot Locker retains long-term potential. The company's adaptability and resilience in the face of past market challenges suggest a path to sustained growth.

- Brand Loyalty: Foot Locker enjoys a degree of brand loyalty, potentially cushioning the impact of short-term challenges.

- Evolving Customer Behavior: Adapting to evolving customer behaviors and preferences will be key for Foot Locker's long-term success.

- Market Recovery: The athletic footwear market is cyclical, and a recovery in consumer spending could positively impact Foot Locker's future performance.

Conclusion:

Jefferies' analysis of Nike's Q3 results presents a concerning, yet potentially temporary, challenge for Foot Locker's short-term performance. While the impact of Nike's inventory levels and changing consumer spending habits cannot be ignored, Foot Locker's long-term prospects remain dependent on its ability to adapt and diversify. Staying informed about Nike Q3 results and their ripple effects on key retailers like Foot Locker is crucial for investors and industry observers alike. Continue monitoring future reports and analyses to make informed decisions regarding investments in the athletic footwear retail sector. Understanding the future implications of these Nike Q3 results will be key to navigating the evolving landscape of the athletic footwear market.

Featured Posts

-

Wwii Veterans Sherman Tank Crushes Tesla 98 Year Olds Remarkable Feat

May 16, 2025

Wwii Veterans Sherman Tank Crushes Tesla 98 Year Olds Remarkable Feat

May 16, 2025 -

Strassensperrung Berlin And Brandenburg Tram Unfall Verursacht Erhebliche Ausfaelle

May 16, 2025

Strassensperrung Berlin And Brandenburg Tram Unfall Verursacht Erhebliche Ausfaelle

May 16, 2025 -

Millions Exposed A New Report On Contaminated Drinking Water In America

May 16, 2025

Millions Exposed A New Report On Contaminated Drinking Water In America

May 16, 2025 -

Creatine 101 A Guide To Understanding And Using Creatine

May 16, 2025

Creatine 101 A Guide To Understanding And Using Creatine

May 16, 2025 -

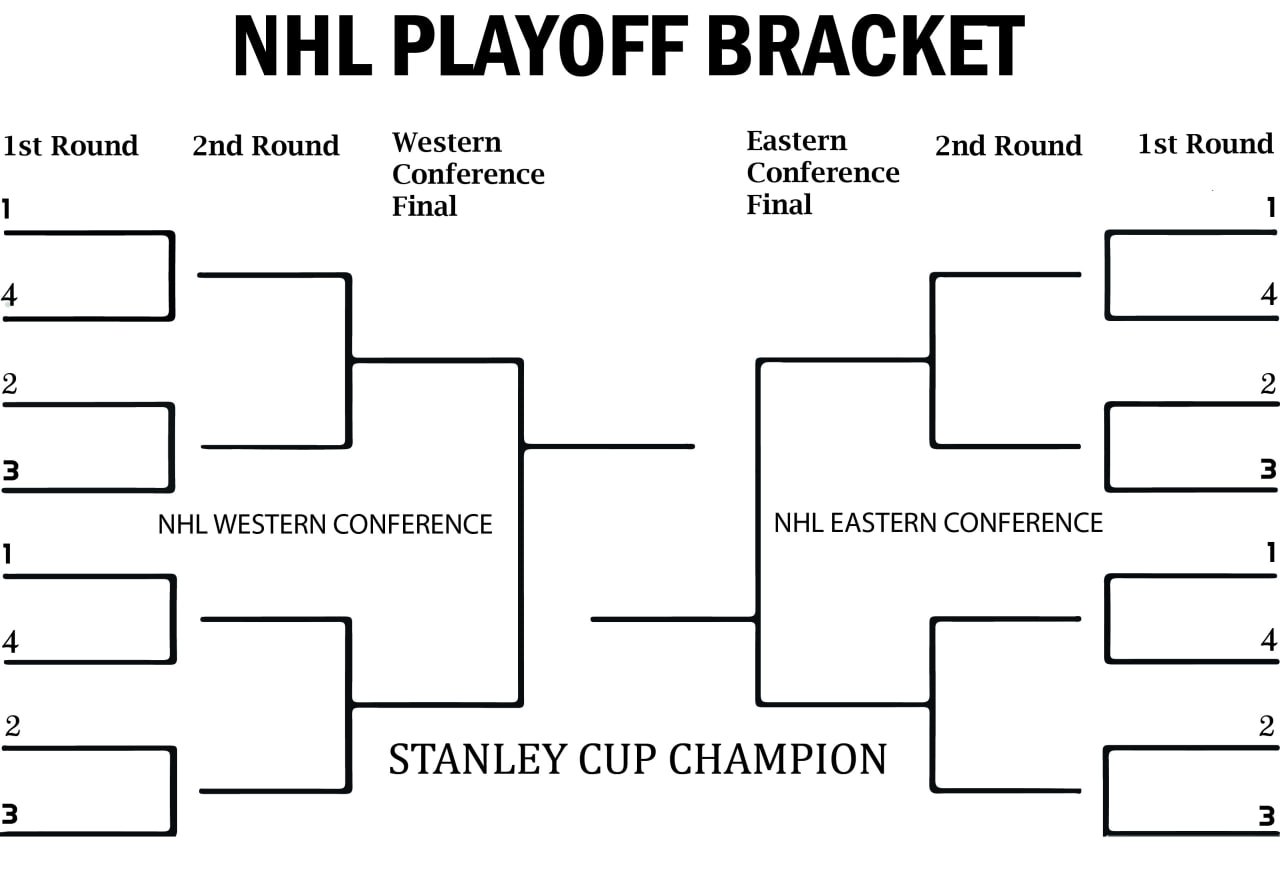

Nhl Playoffs 2024 The Ultimate Guide To Watching Every Game

May 16, 2025

Nhl Playoffs 2024 The Ultimate Guide To Watching Every Game

May 16, 2025