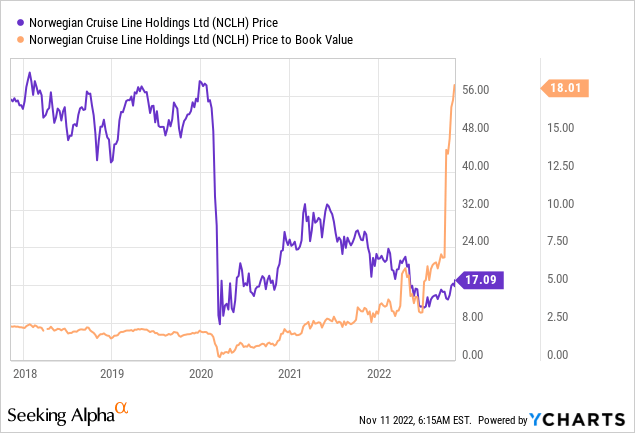

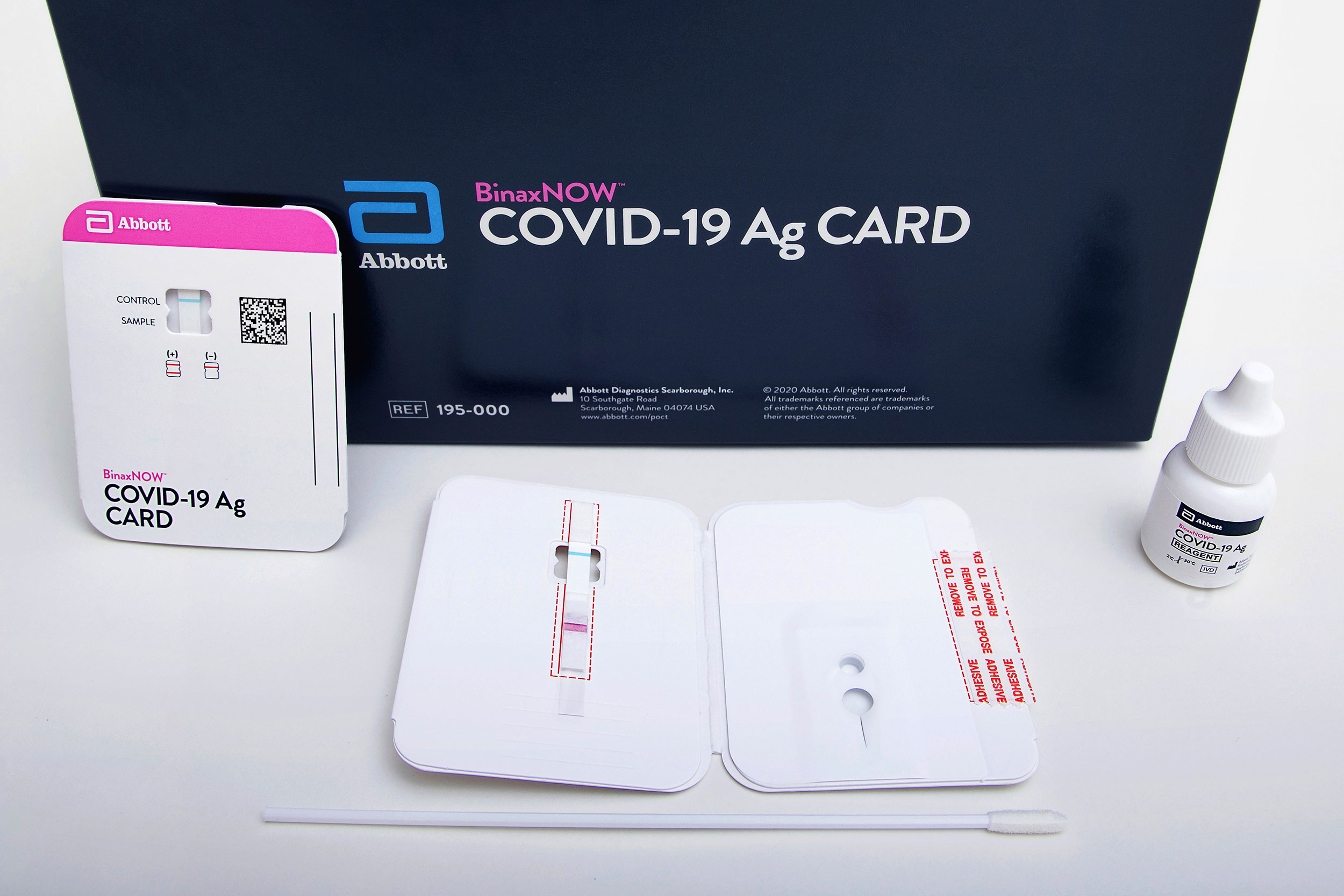

Norwegian Cruise Line Holdings (NCLH) Outperforms Expectations, Stock Prices Rise

Table of Contents

Stronger-Than-Expected Bookings Fuel NCLH Growth

A primary driver of NCLH's success is the unexpectedly strong surge in bookings. The company has reported significantly higher-than-anticipated demand for its cruises, a trend surpassing even pre-pandemic levels. This robust booking performance indicates a strong rebound in consumer confidence and a significant appetite for travel experiences. Several factors contribute to this trend:

- Increased demand for specific itineraries and cruise ships: Certain itineraries, particularly those to popular destinations and on newer, more luxurious ships, are experiencing exceptionally high demand. This suggests a shift in consumer preferences toward premium experiences.

- Successful marketing campaigns and promotions: NCLH's targeted marketing initiatives and attractive promotional offers have clearly resonated with potential customers, stimulating bookings across various demographics.

- Effective pricing strategies: A strategic approach to pricing, balancing affordability with value-added services, has likely played a role in attracting a broad range of passengers.

- Successful partnerships and collaborations: Collaborations with other travel companies or tourism boards might have broadened NCLH's reach and boosted its bookings.

Improved Operational Efficiency and Cost Management at NCLH

Beyond strong bookings, NCLH's improved operational efficiency and cost management have significantly contributed to its financial success. The company has implemented various strategies to streamline its operations and reduce expenses, leading to enhanced profitability.

- Fuel efficiency improvements: Investments in fuel-efficient technologies and optimized routes have reduced fuel consumption, a significant cost factor in the cruise industry.

- Crew management strategies: Efficient crew management practices, focusing on training and retention, have minimized labor costs and maximized productivity.

- Supply chain optimization: Streamlining the supply chain has reduced procurement costs and improved the timely delivery of essential goods and services.

- Technological advancements: Implementing advanced technologies in various areas, from navigation to onboard services, has increased efficiency and reduced operational costs.

Positive Investor Sentiment and Market Confidence in NCLH

The strong financial results reported by NCLH have been met with overwhelmingly positive investor sentiment. The surge in the NCLH stock price reflects growing market confidence in the company's future prospects.

- Increased investment from institutional investors: Large institutional investors are increasingly showing interest in NCLH, indicating a belief in its long-term growth potential.

- Positive media coverage: Favorable media coverage has further bolstered investor confidence, highlighting the company's strong performance and future outlook.

- Superior competitor performance: NCLH's performance has outpaced some of its competitors in the cruise sector, strengthening its market position and attracting more investor attention.

- Credit rating upgrades: Positive credit rating upgrades, if any, would further reinforce investor confidence and attract investment.

Future Outlook and Potential Challenges for NCLH

While the outlook for NCLH is currently positive, several potential challenges need consideration. Sustained growth will depend on various factors, and understanding potential risks is crucial.

- Long-term growth projections: While current projections are optimistic, maintaining this momentum requires ongoing adaptation to changing market conditions.

- Expansion plans and new ship launches: Successful implementation of expansion plans and the timely launch of new ships are critical for continued growth.

- Potential impact of geopolitical events: Geopolitical instability and global events can significantly impact the travel industry and potentially affect NCLH's performance.

- Sustainability initiatives: Increasingly important to investors and consumers, NCLH's commitment to sustainability will significantly shape its long-term success and reputation.

Conclusion: Investing in the Future of NCLH – A Promising Outlook

In summary, Norwegian Cruise Line Holdings' (NCLH) recent outperformance is a result of a confluence of factors: stronger-than-expected bookings, improved operational efficiency, and positive investor sentiment. The company's positive trajectory, characterized by robust growth and strategic cost management, paints a promising picture. While challenges remain, the current outlook for NCLH is positive. We encourage readers to conduct thorough research into NCLH, potentially consulting a financial advisor before making any investment decisions. Keep a close eye on the NCLH stock price, and refer to NCLH's financial reports and investor relations materials for more detailed information on Norwegian Cruise Line Holdings stock and NCLH investment opportunities.

Featured Posts

-

Coronation Street Fans Floored By Daisys Pre Soap Career

Apr 30, 2025

Coronation Street Fans Floored By Daisys Pre Soap Career

Apr 30, 2025 -

Update On The Owen Siblings From Our Yorkshire Farm Reubens News

Apr 30, 2025

Update On The Owen Siblings From Our Yorkshire Farm Reubens News

Apr 30, 2025 -

L Innocenza Di Becciu L Appello Inizia Il 22 Settembre

Apr 30, 2025

L Innocenza Di Becciu L Appello Inizia Il 22 Settembre

Apr 30, 2025 -

Iwd 2024 How Schneider Electric Is Empowering Women In Nigeria

Apr 30, 2025

Iwd 2024 How Schneider Electric Is Empowering Women In Nigeria

Apr 30, 2025 -

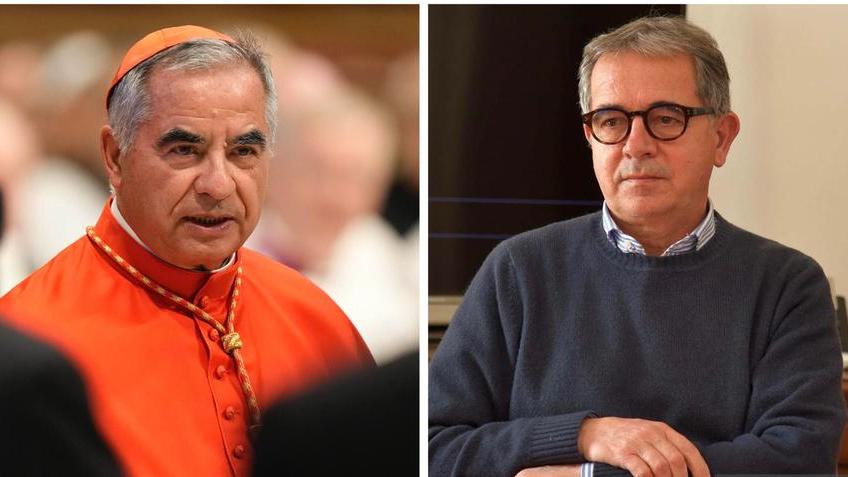

Pandemic Fraud Lab Owner Convicted For False Covid Test Reports

Apr 30, 2025

Pandemic Fraud Lab Owner Convicted For False Covid Test Reports

Apr 30, 2025

Latest Posts

-

Ponants 1 500 Flight Credit Incentive For Paul Gauguin Cruise Sales

May 01, 2025

Ponants 1 500 Flight Credit Incentive For Paul Gauguin Cruise Sales

May 01, 2025 -

Gaslek Roden Melding Blijkt Loos Alarm

May 01, 2025

Gaslek Roden Melding Blijkt Loos Alarm

May 01, 2025 -

Roden Melding Gaslucht Was Loos Alarm

May 01, 2025

Roden Melding Gaslucht Was Loos Alarm

May 01, 2025 -

Gaslucht Roden Vals Alarm

May 01, 2025

Gaslucht Roden Vals Alarm

May 01, 2025 -

Melding Gaslucht In Roden Loos Alarm

May 01, 2025

Melding Gaslucht In Roden Loos Alarm

May 01, 2025