Norwegian Cruise Line (NCLH): A Hedge Fund Perspective On Investment

Table of Contents

NCLH's Financial Performance and Valuation

Analyzing NCLH's financial performance requires a thorough examination of key metrics over several years. While the company faced substantial headwinds during the pandemic, its post-pandemic recovery provides valuable insights for investors. Key factors to consider include revenue growth, profit margins (both operating and net), debt levels, and cash flow. Comparing these figures to pre-pandemic levels offers a crucial benchmark. Furthermore, a comparative analysis of NCLH's valuation against its main competitors, Carnival Corporation & plc (CCL) and Royal Caribbean Group (RCL), is essential. This involves assessing metrics like the Price-to-Earnings (P/E) ratio and the Price-to-Book (P/B) ratio to gauge relative value.

- Specific financial data points (Source: Company filings, financial news websites): For example, you might compare NCLH's revenue growth from 2019 to 2023, highlighting fluctuations and the recovery trajectory. Debt-to-equity ratios and interest coverage ratios should also be analyzed to understand the company's financial leverage and risk profile.

- Comparison charts: Visual representations comparing NCLH's key financial metrics to CCL and RCL are vital for a quick understanding of relative performance and valuation.

- Debt structure analysis: A detailed look into NCLH's debt maturity schedule and interest rates is critical for assessing its long-term financial sustainability. The impact of potential interest rate hikes on NCLH's debt servicing capacity needs careful consideration.

External factors like fuel prices and broader economic downturns significantly impact NCLH's financials. Analyzing the correlation between these macroeconomic factors and NCLH's performance helps predict future earnings and assess risk.

Industry Trends and Competitive Landscape

The cruise industry's future growth trajectory is a critical factor in assessing NCLH's investment potential. Factors influencing this trajectory include global economic growth, disposable income levels, and travel trends. While the industry has shown resilience, understanding future market size and growth projections is vital.

NCLH competes with Carnival and Royal Caribbean, each with its own strengths and weaknesses. A competitive analysis matrix that compares market share, brand recognition, fleet size, and pricing strategies is essential. NCLH's focus on a younger demographic and its innovative Freestyle Cruising concept represent key differentiators.

- Market size and growth projections: Research reports from reputable market analysis firms provide valuable data on the projected growth of the cruise industry in various regions.

- Competitive analysis matrix: This matrix visually compares NCLH against its key competitors based on multiple criteria, facilitating a comprehensive comparison.

- Technological disruptions: The impact of emerging technologies, such as AI-powered customer service and improved onboard connectivity, should be carefully assessed. The adoption of sustainable cruising practices and their impact on operational costs and customer preferences also need consideration.

Risk Assessment and Mitigation Strategies

Investing in NCLH carries inherent risks. Economic downturns, geopolitical instability, health crises (like pandemics), and regulatory changes are all potential threats. A comprehensive risk assessment is crucial for any hedge fund considering an investment.

- Potential risks: This section should list potential risks, including operational risks (e.g., accidents, port closures), financial risks (e.g., fluctuating fuel costs, currency exchange rate volatility), and reputational risks.

- Hedging strategies: A hedge fund could mitigate these risks using various hedging techniques, such as options contracts (e.g., purchasing put options to protect against price declines), currency hedging, and diversification across different asset classes.

- ESG (Environmental, Social, and Governance) factors: Growing awareness of ESG factors impacts the cruise industry. NCLH's environmental sustainability efforts and its social responsibility initiatives are crucial elements to consider.

Potential Investment Strategies for Hedge Funds

Hedge funds can employ various strategies when investing in NCLH.

- Long-term investment: A buy-and-hold strategy, suitable for investors with a long-term horizon, focuses on capital appreciation.

- Short-term trading: This strategy capitalizes on short-term price fluctuations, potentially benefiting from market volatility.

- Arbitrage: Exploiting price discrepancies between different markets or securities.

Quantitative analysis and predictive modeling are crucial for informed investment decisions. These techniques can assess the impact of various factors on NCLH's stock price and help predict future performance. Alpha generation through active management, identifying inefficiencies in the market, is a primary objective for hedge funds.

- Detailed explanations of each strategy: This section needs to clearly outline the assumptions, advantages, and disadvantages of each investment approach.

- Examples of quantitative models: Mention models commonly used in the financial industry to assess risk and predict returns.

- Factors influencing alpha generation: Discuss market timing, stock selection, and risk management capabilities as key contributors to superior returns.

Conclusion: Investing in Norwegian Cruise Line (NCLH) – A Hedge Fund Perspective

Investing in Norwegian Cruise Line (NCLH) presents a complex proposition for hedge funds. While the company's financial health and the industry's growth potential offer attractive opportunities, inherent risks need careful consideration. Thorough due diligence, employing robust risk mitigation strategies, and leveraging sophisticated investment approaches are critical for successful investment in NCLH. A deep understanding of the company's financial performance, industry trends, competitive landscape, and the application of suitable hedging techniques are essential. While investing in Norwegian Cruise Line (NCLH) involves inherent risks, a thorough understanding of the company's financials, the cruise industry, and appropriate risk mitigation strategies can offer attractive returns for sophisticated investors. Conduct further due diligence before making any investment decisions.

Featured Posts

-

Tarykh Srf Rwatb Abryl 2025 Dlyl Shaml Llmwatnyn

Apr 30, 2025

Tarykh Srf Rwatb Abryl 2025 Dlyl Shaml Llmwatnyn

Apr 30, 2025 -

Doubt Cast On Court Experts Vitals Inquiry Testimony Oath Recall Failure

Apr 30, 2025

Doubt Cast On Court Experts Vitals Inquiry Testimony Oath Recall Failure

Apr 30, 2025 -

Beyonce And Jay Z Keeping Sir Carter Out Of The Spotlight

Apr 30, 2025

Beyonce And Jay Z Keeping Sir Carter Out Of The Spotlight

Apr 30, 2025 -

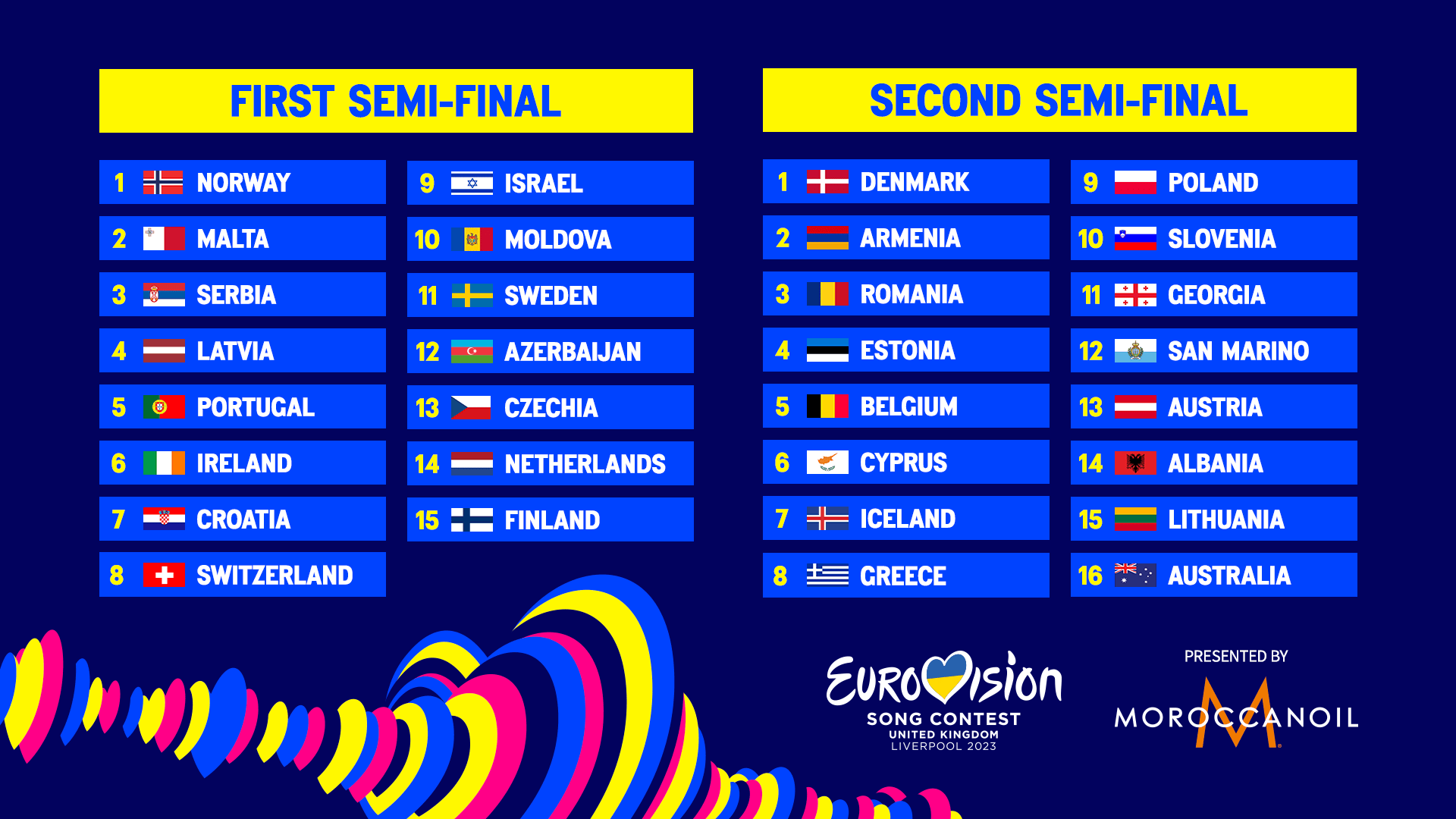

Eurovision 2025 Full Semi Final Running Order Breakdown

Apr 30, 2025

Eurovision 2025 Full Semi Final Running Order Breakdown

Apr 30, 2025 -

Kareena Kapoor On Aging Embracing Lines And Cosmetic Surgery Struggles

Apr 30, 2025

Kareena Kapoor On Aging Embracing Lines And Cosmetic Surgery Struggles

Apr 30, 2025

Latest Posts

-

Embark On Arc Raiders Second Public Test Dates And Details

May 01, 2025

Embark On Arc Raiders Second Public Test Dates And Details

May 01, 2025 -

Frances Six Nations Triumph Mauvakas Mistakes And Lions Implications

May 01, 2025

Frances Six Nations Triumph Mauvakas Mistakes And Lions Implications

May 01, 2025 -

Arc Raiders Second Public Test What To Expect This Month

May 01, 2025

Arc Raiders Second Public Test What To Expect This Month

May 01, 2025 -

Six Nations Takeaways Frances Victory And Lions Squad Selection

May 01, 2025

Six Nations Takeaways Frances Victory And Lions Squad Selection

May 01, 2025 -

Arc Raider Tech Test 2 Coming This Month Console And Pc Participation

May 01, 2025

Arc Raider Tech Test 2 Coming This Month Console And Pc Participation

May 01, 2025