Note To Mr. Carney: Why Canadians Shun 10-Year Mortgages

Table of Contents

The Fear of Rising Interest Rates and Rate Lock-In

One of the primary reasons Canadians hesitate to commit to 10-year mortgages is the inherent risk associated with locking into a specific interest rate for an extended period. The Canadian mortgage market, like global markets, is subject to fluctuations. Locking into a 10-year mortgage rate means accepting that rate, regardless of whether interest rates rise or fall during that decade.

- Potential for higher rates in the future: If interest rates increase significantly during the 10-year term, homeowners will be paying a higher rate than they might have secured with a shorter-term mortgage renewed at a lower rate.

- Difficulty in refinancing: If interest rates drop considerably, refinancing a 10-year mortgage can be challenging and expensive, potentially locking homeowners into a less favorable rate for years. Breaking a 10-year mortgage often involves significant penalties.

- Psychological impact: The psychological burden of a long-term commitment, particularly in a volatile market like the Canadian housing market, can be considerable. The uncertainty surrounding future interest rates can create significant stress for homeowners.

For example, consider the significant interest rate increases Canada experienced in 2022. Homeowners who locked into 10-year mortgages earlier might now be facing significantly higher monthly payments than anticipated, highlighting the risk of long-term rate lock-in.

The Appeal of Flexibility and Shorter-Term Mortgages

Shorter-term mortgages, typically 5-year terms in Canada, offer a compelling alternative due to their inherent flexibility. This flexibility appeals to many Canadians who prioritize adaptability in their financial planning.

- Better rate opportunities: Renewing a mortgage every 5 years provides more frequent opportunities to secure better interest rates, taking advantage of market fluctuations.

- Financial flexibility: A shorter-term mortgage offers greater financial flexibility to manage unexpected expenses or changing financial circumstances. This adaptability is crucial for many homeowners.

- Faster debt repayment: If interest rates decrease, shorter-term mortgages allow homeowners to refinance at a lower rate, potentially accelerating debt repayment.

The predictability of a 5-year mortgage term contrasts sharply with the uncertainty associated with a 10-year term, especially given the volatility of Canadian mortgage rates. The ability to reassess the financial situation and adjust accordingly every five years offers a sense of control and security many homeowners value.

Limited Awareness and Understanding of 10-Year Mortgages

Another factor contributing to the low uptake of 10-year mortgages is a lack of awareness and understanding among Canadian homeowners regarding their benefits and drawbacks. The complexities surrounding mortgage terms often overshadow the potential long-term advantages.

- Limited marketing: Marketing and promotion of 10-year mortgage options are often limited compared to shorter-term offerings.

- Lack of clear information: Many homeowners lack clear information about the long-term financial implications of choosing a 10-year versus a 5-year mortgage.

- Complexity of terms: The terms and conditions surrounding 10-year mortgages can be complex, deterring potential borrowers from exploring this option.

Improved consumer education, perhaps through government initiatives or more transparent mortgage broker services, is crucial to address this information gap. Clearer explanations of the potential benefits and risks could encourage wider adoption of 10-year mortgages among those for whom it's financially suitable.

The Role of Housing Market Volatility

The fluctuating Canadian housing market significantly influences mortgage choices. Uncertainty surrounding property values plays a crucial role in the decision-making process.

- Uncertainty about future property values: Homeowners might be hesitant to commit to a 10-year mortgage if they anticipate potential changes in property values that could affect their ability to manage their mortgage.

- Need to sell: The possibility of needing to sell their property before the end of a 10-year term adds another layer of complexity and uncertainty. Breaking a mortgage early can lead to substantial penalties.

- Market trends: Overall market trends and economic forecasts also influence homeowner decisions, leading to a preference for shorter-term, more adaptable mortgage options.

The interconnectedness of the housing market, the economy, and interest rates further complicates the decision, making the flexibility of shorter-term mortgages more appealing to many Canadians.

Rethinking Your Approach to 10-Year Mortgages in Canada

In summary, Canadians' preference for shorter-term mortgages like 5-year terms stems from several interconnected factors: fear of rising interest rates and rate lock-in, the appeal of flexibility and shorter-term mortgage options, limited awareness and understanding of 10-year mortgages, and the influence of housing market volatility. While these factors highlight the risks associated with 10-year mortgages, it's crucial to acknowledge the potential benefits: rate certainty and the potential for lower overall interest costs if rates remain stable or fall.

Before dismissing 10-year mortgages entirely, carefully consider your long-term financial goals. Understanding the nuances of different mortgage terms – including 5-year mortgages and 10-year mortgages – will help you make the best choice for your individual circumstances. Consult with a mortgage professional to assess your personal financial situation and determine the most suitable mortgage term for your needs.

Featured Posts

-

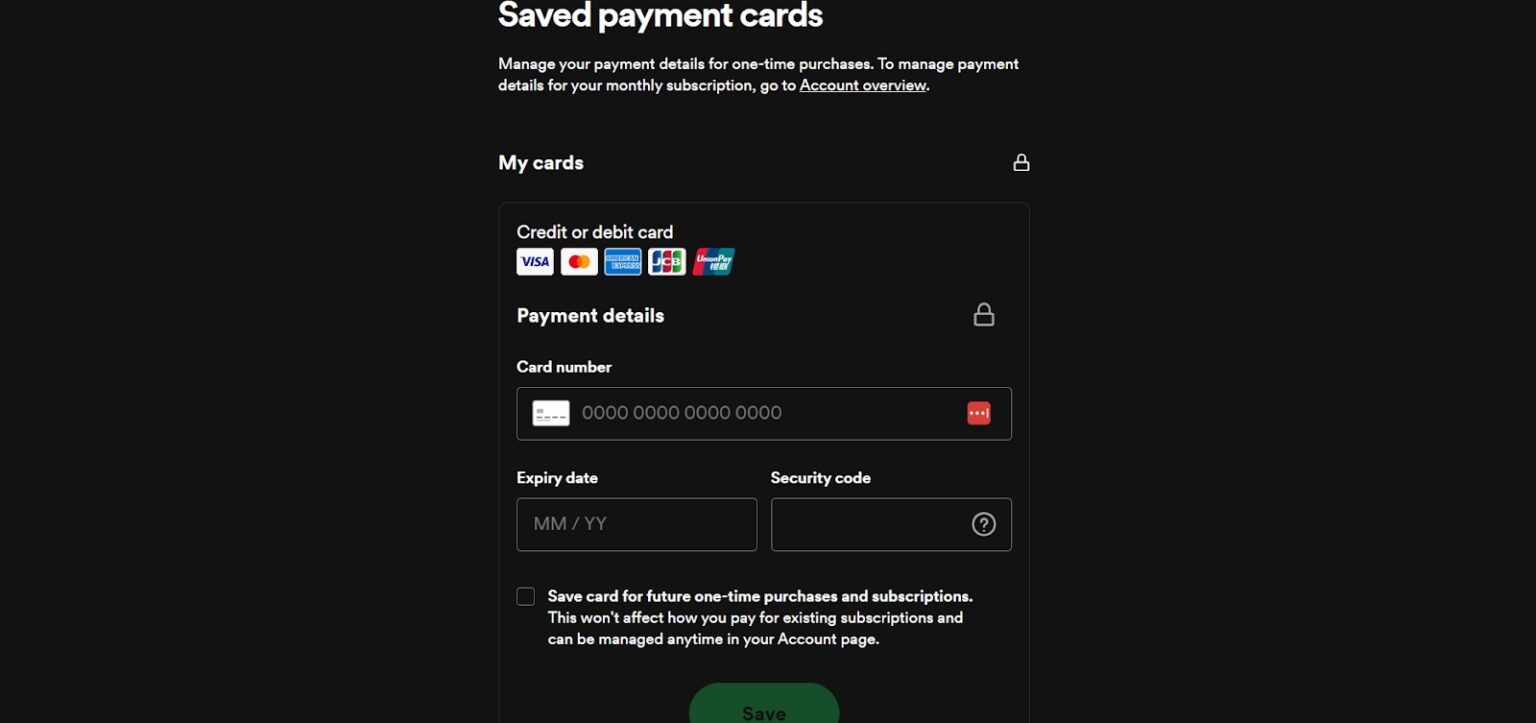

New Spotify Payment Methods On I Phone How To Pay Your Way

May 04, 2025

New Spotify Payment Methods On I Phone How To Pay Your Way

May 04, 2025 -

Nhl Stanley Cup Playoffs What To Expect In The First Round

May 04, 2025

Nhl Stanley Cup Playoffs What To Expect In The First Round

May 04, 2025 -

Harvards Tax Exempt Status Presidents Strong Warning Against Revocation

May 04, 2025

Harvards Tax Exempt Status Presidents Strong Warning Against Revocation

May 04, 2025 -

Fox Sports Coverage Of The Indy Car Series What To Expect

May 04, 2025

Fox Sports Coverage Of The Indy Car Series What To Expect

May 04, 2025 -

Bryce Mitchell Calls Out Jean Silva For Profanity At Ufc 314 Press Conference

May 04, 2025

Bryce Mitchell Calls Out Jean Silva For Profanity At Ufc 314 Press Conference

May 04, 2025

Latest Posts

-

Indy Car And Fox A Partnership For The Future Of Motorsports

May 04, 2025

Indy Car And Fox A Partnership For The Future Of Motorsports

May 04, 2025 -

Analysis Of Emma Stones Popcorn Butt Lift Inspired Dress At Snl

May 04, 2025

Analysis Of Emma Stones Popcorn Butt Lift Inspired Dress At Snl

May 04, 2025 -

Indy Cars 2024 Season A Look At Foxs Broadcast Plans

May 04, 2025

Indy Cars 2024 Season A Look At Foxs Broadcast Plans

May 04, 2025 -

Emma Stones Snl Appearance Dress Design And Online Reactions

May 04, 2025

Emma Stones Snl Appearance Dress Design And Online Reactions

May 04, 2025 -

Fox And Espn Standalone Streaming Services Arrive In 2025

May 04, 2025

Fox And Espn Standalone Streaming Services Arrive In 2025

May 04, 2025