Oil Prices And Airline Profits: A Turbulent Relationship

Table of Contents

The Direct Impact of Fuel Costs on Airline Profitability

Jet fuel constitutes a significant portion of an airline's operating costs, often second only to labor. Even minor increases in oil prices translate into substantial added expenses, directly impacting profitability margins. Airlines with less fuel-efficient fleets are particularly vulnerable to these price swings. The impact of jet fuel price volatility on the bottom line cannot be overstated. Effective cost management is paramount for airline success in this environment.

- Rising oil prices necessitate increased ticket prices or reduced services to maintain profitability. This delicate balancing act requires careful consideration of passenger demand elasticity.

- Airlines employ various strategies to mitigate fuel cost increases, including fuel hedging and route optimization. These strategies aim to minimize exposure to price shocks.

- Fuel efficiency improvements through aircraft modernization can lessen the impact of price volatility. Investing in newer, more fuel-efficient planes is a long-term strategy to reduce the sensitivity to oil price changes.

Hedging Strategies and Risk Management in the Face of Oil Price Volatility

To mitigate the risks associated with fluctuating oil prices, airlines often employ hedging strategies using financial instruments like futures contracts. This involves locking in future fuel prices at a predetermined rate, offering a degree of protection against unexpected spikes. However, fuel hedging isn't without its own complexities and potential downsides. Effective risk management is essential.

- Hedging can be effective in protecting against price increases but can also limit potential gains if prices fall. This is a key consideration in the decision-making process.

- The effectiveness of hedging strategies depends on accurate market forecasting and risk assessment. Sophisticated analytical tools and expert knowledge are crucial.

- Improperly executed hedging can lead to significant financial losses for airlines. Careful planning and understanding of market dynamics are therefore vital.

The Impact of Oil Prices on Passenger Demand and Airfare

Oil price increases often influence consumer behavior and travel patterns. Higher airfare resulting from increased fuel costs can deter passengers, especially price-sensitive travelers, impacting overall passenger demand. This creates a complex interplay between fuel prices, airfare, and airline revenue. Understanding these dynamics is crucial for effective revenue management.

- Higher airfares can reduce the number of passengers, especially on leisure routes. Airlines need to analyze the impact of price increases on different market segments.

- Airlines may strategically adjust routes and flight frequencies based on projected demand. This requires accurate forecasting and agile operational adjustments.

- Economic conditions and broader global events also influence passenger demand independently of oil prices. Airlines must consider the wider economic context when making pricing and capacity decisions.

The Role of Technological Advancements in Fuel Efficiency

Technological advancements in aircraft design and engine technology continuously improve fuel efficiency. Airlines investing in newer, more fuel-efficient aircraft are better positioned to withstand oil price shocks. This also aligns with the growing industry focus on sustainability. This represents a significant long-term investment in mitigating the impact of oil price volatility.

- Investing in new aircraft is a significant capital expenditure but offers long-term cost savings. The return on investment needs careful consideration.

- Lighter materials and improved aerodynamic designs contribute to fuel efficiency. Continuous innovation is key to reducing fuel consumption.

- The shift towards sustainable aviation fuels (SAFs) also plays a critical role in reducing reliance on traditional jet fuel and lowering carbon emissions.

Conclusion

The relationship between oil prices and airline profits is undeniably complex and volatile. Understanding the direct impact of fuel costs, the role of hedging strategies, and the influence on passenger demand are crucial for navigating this turbulent landscape. By implementing effective risk management techniques, investing in fuel-efficient technology, and closely monitoring market trends, airlines can strive for improved profitability even amidst fluctuating oil prices. Staying informed about changes in oil prices and their effect on airline profits is vital for anyone involved in or interested in the aviation industry. Understanding the intricacies of this relationship is key to success in this dynamic sector.

Featured Posts

-

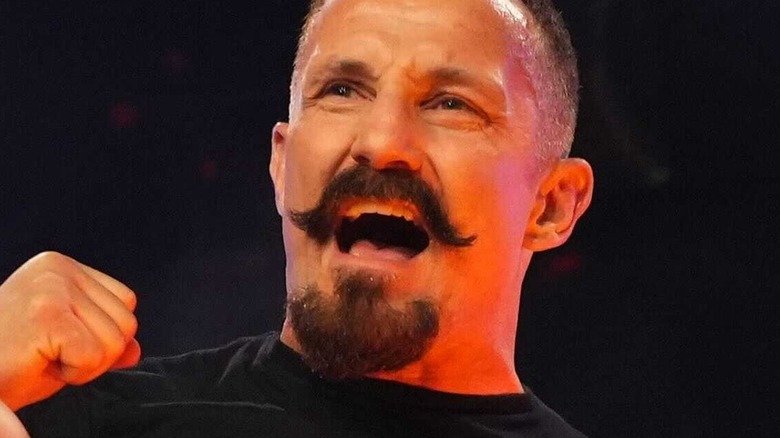

Bobby Fish Joins Mlw Battle Riot Vii

May 03, 2025

Bobby Fish Joins Mlw Battle Riot Vii

May 03, 2025 -

Illyuziya Krasivoy Zhizni Realnost Raboty Eskortnits V Moskve

May 03, 2025

Illyuziya Krasivoy Zhizni Realnost Raboty Eskortnits V Moskve

May 03, 2025 -

Macron Intensifie La Pression Sur Moscou Nouvelles Sanctions A Venir

May 03, 2025

Macron Intensifie La Pression Sur Moscou Nouvelles Sanctions A Venir

May 03, 2025 -

Reform Uks Perilous State Five Key Challenges

May 03, 2025

Reform Uks Perilous State Five Key Challenges

May 03, 2025 -

Find England Vs Spain Womens Match On Tv Channel Kick Off Time

May 03, 2025

Find England Vs Spain Womens Match On Tv Channel Kick Off Time

May 03, 2025

Latest Posts

-

Loyle Carner Announces Dublin 3 Arena Concert

May 03, 2025

Loyle Carner Announces Dublin 3 Arena Concert

May 03, 2025 -

3 Arena Hosts Loyle Carner Get Your Tickets Now

May 03, 2025

3 Arena Hosts Loyle Carner Get Your Tickets Now

May 03, 2025 -

Loyle Carner To Play 3 Arena Dublin Concert Details

May 03, 2025

Loyle Carner To Play 3 Arena Dublin Concert Details

May 03, 2025 -

New Loyle Carner Album On The Horizon Fatherhood Glastonbury And More

May 03, 2025

New Loyle Carner Album On The Horizon Fatherhood Glastonbury And More

May 03, 2025 -

Loyle Carner 3 Arena Concert Date Tickets And More

May 03, 2025

Loyle Carner 3 Arena Concert Date Tickets And More

May 03, 2025