Omada Health IPO Filing: Details On The Andreessen Horowitz-Backed Digital Health Company

Table of Contents

Omada Health, the leading digital health company backed by the prominent venture capital firm Andreessen Horowitz, is poised for its Initial Public Offering (IPO). This momentous event signifies a major milestone not only for Omada Health but also for the burgeoning digital health sector. This article provides an in-depth analysis of the key details unveiled in Omada Health's IPO filing, covering its business model, financial performance, and future outlook within the competitive telehealth landscape.

Omada Health's Business Model and Target Market

Chronic Disease Management as a Core Offering

Omada Health's core offering centers around the management of chronic and preventable conditions, primarily focusing on type 2 diabetes and prediabetes. Their approach leverages the power of telehealth technology, providing remote patient monitoring and personalized coaching to improve patient outcomes. This comprehensive strategy includes:

- Remote Patient Monitoring: Continuous data collection via wearable devices and integrated apps allows for proactive intervention and personalized care.

- Personalized Programs: Tailored interventions and support based on individual needs and progress. These often incorporate educational materials, behavior modification techniques, and medication adherence support.

- Human Coaching: Certified health coaches provide ongoing support and motivation, fostering patient engagement and adherence to treatment plans.

- Improved Outcomes and Reduced Costs: By proactively managing chronic conditions, Omada aims to reduce hospitalizations, emergency room visits, and overall healthcare costs, thereby adding value to both patients and healthcare systems.

Key Partnerships and Integrations

Omada Health's success is significantly fueled by strategic partnerships with key players in the healthcare ecosystem. These include:

- Employers: Offering corporate wellness programs to improve employee health and reduce healthcare expenses.

- Health Plans: Integrating Omada's programs into existing health plan benefits to expand access and improve patient care.

- Healthcare Providers: Collaborating with physicians and other healthcare professionals to ensure seamless integration into existing care pathways.

These collaborations are crucial for expanding market reach and providing holistic, comprehensive care. The platform also relies on successful integrations with various wearable technologies and electronic health record (EHR) systems to facilitate data exchange and improve patient care coordination.

Competitive Landscape Analysis

Omada Health operates within a dynamic and competitive digital health market. Key competitors include other telehealth platforms offering chronic disease management programs, weight loss solutions, and diabetes prevention initiatives. However, Omada differentiates itself through:

- Proven Track Record: Demonstrated success in improving patient outcomes and cost savings.

- Data-Driven Approach: Leveraging robust data analytics to personalize interventions and optimize program effectiveness.

- Established Market Position: Strong brand recognition and a significant existing customer base.

- Strong Investor Backing: The support of Andreessen Horowitz and other prominent investors demonstrates confidence in the company's potential.

Financial Performance and Growth Prospects

Revenue Growth and Key Financial Metrics

Omada Health's IPO filing reveals significant revenue growth and positive financial indicators, demonstrating a healthy and sustainable business model. Key metrics to watch include:

- Revenue Growth Rate: Analyzing the year-over-year growth in revenue generated from various service offerings.

- Customer Acquisition Cost (CAC): Understanding the cost-effectiveness of acquiring new customers and maintaining profitability.

- Customer Churn Rate: Assessing the retention rate of existing clients and the effectiveness of engagement strategies.

- Net Income/Profitability: Examining the company's profitability and ability to generate positive cash flow.

Investment Highlights from Andreessen Horowitz and Other Investors

The substantial investment from Andreessen Horowitz and other notable investors underscores their confidence in Omada Health's potential for growth and profitability. This backing highlights:

- Validation of Business Model: The investment validates the effectiveness of Omada Health's approach to chronic disease management through telehealth.

- Financial Strength: Securing significant funding demonstrates the company's strong financial position and ability to scale its operations.

- Future Growth Potential: Investors are betting on Omada Health's potential to capture a significant share of the growing digital health market.

Future Growth Strategies and Market Opportunities

Omada Health's future growth plans involve:

- Expanding into New Therapeutic Areas: Exploring opportunities to address additional chronic conditions beyond diabetes.

- International Expansion: Expanding its reach to new geographical markets to tap into global demand for digital health solutions.

- Developing New Technologies and Services: Investing in innovative technologies and services to enhance patient engagement and improve outcomes.

- Strategic Acquisitions: Exploring acquisitions to enhance its technology, expand its market reach, or add new capabilities to its platform.

Risks and Challenges Associated with the IPO

Market Competition and Technological Disruption

The digital health landscape is highly competitive, with new entrants and technological advancements constantly emerging. Omada Health faces risks related to:

- Competition from established players and emerging startups: Maintaining a competitive edge requires continuous innovation and adaptation.

- Rapid technological change: Staying ahead of the curve and adopting new technologies is crucial for long-term success.

Regulatory Compliance and Data Privacy Concerns

Compliance with evolving healthcare regulations and maintaining robust data privacy protocols are critical. Potential challenges include:

- HIPAA compliance: Adhering to stringent regulations related to the security and privacy of protected health information (PHI).

- Data breaches: Protecting sensitive patient data from cyber threats and unauthorized access.

Dependence on Key Partnerships and Technology

Omada Health's success hinges on strong partnerships and reliable technology. Potential risks include:

- Partner instability: Reliance on key partners introduces risks related to their financial stability and ability to deliver.

- Technology disruptions: Failures or limitations in technology could disrupt operations and impact patient care.

Conclusion

Omada Health's IPO filing offers valuable insights into a promising player in the digital health arena. Its innovative approach to chronic disease management, combined with strong investor backing, positions the company for significant growth. While challenges and risks are inherent, Omada Health's established market presence, data-driven approach, and focus on improving patient outcomes suggest a positive outlook. Stay informed about the Omada Health IPO and its potential impact on the future of digital health. Learn more about Omada Health's groundbreaking work and consider how their Initial Public Offering could shape the future of chronic disease management. Keep up-to-date on all the Omada Health IPO news and analysis.

Featured Posts

-

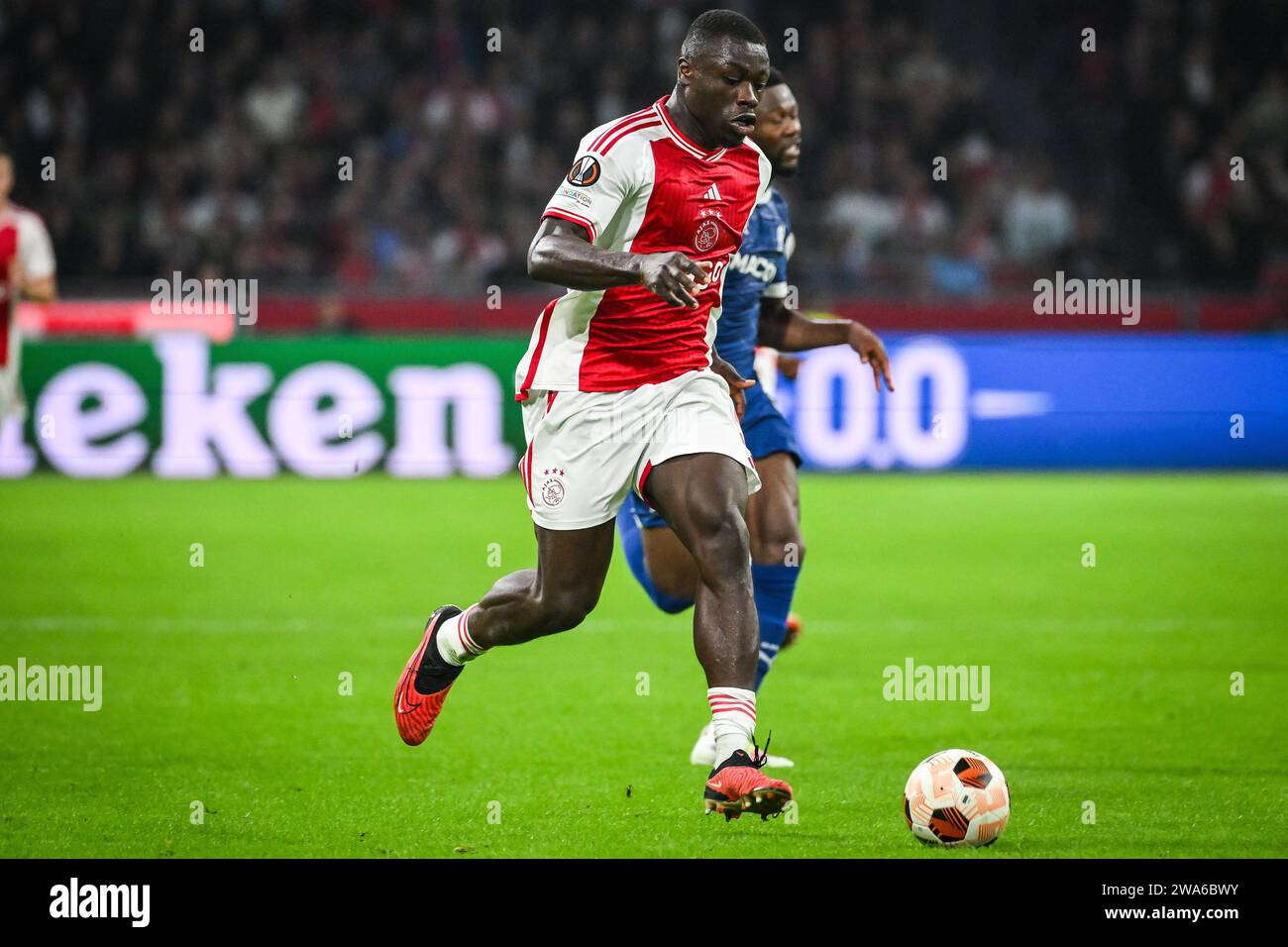

Europa League Preview Brobbeys Strength A Key Asset For Ajax

May 10, 2025

Europa League Preview Brobbeys Strength A Key Asset For Ajax

May 10, 2025 -

Tech Billionaires And The Trump Inauguration A 194 Billion Loss And Counting

May 10, 2025

Tech Billionaires And The Trump Inauguration A 194 Billion Loss And Counting

May 10, 2025 -

Strands Nyt Crossword Answers February 15 2024 Game 349

May 10, 2025

Strands Nyt Crossword Answers February 15 2024 Game 349

May 10, 2025 -

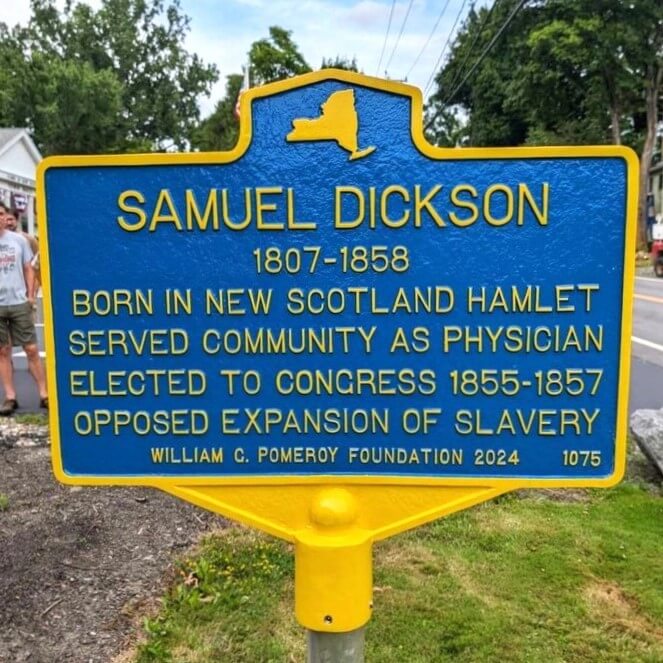

Samuel Dickson A Canadian Lumber Barons Legacy

May 10, 2025

Samuel Dickson A Canadian Lumber Barons Legacy

May 10, 2025 -

Hollywood Shutdown Wga And Sag Aftra Strike Impacts Film And Television

May 10, 2025

Hollywood Shutdown Wga And Sag Aftra Strike Impacts Film And Television

May 10, 2025