Onex Completes WestJet Stake Sale To Foreign Airlines

Table of Contents

The Details of the WestJet Stake Sale

Onex Corporation, a leading Canadian private equity firm, finalized the sale of a significant portion of its ownership in WestJet Airlines. While the exact percentage remains subject to regulatory filings and final confirmations, reports suggest a substantial stake change, significantly altering the airline's ownership structure. The acquiring entity is a consortium of foreign airlines, primarily focused on expanding their North American presence and network connectivity. Though the specific names and proportions might not be publicly available immediately following the transaction, we can expect further disclosures as regulatory requirements are met. The total value of the transaction is substantial, reflecting WestJet's position in the Canadian aviation market and its future growth potential. The official announcement, released on [Insert Official Announcement Date], confirmed the completion of the deal.

- Transaction Completion Date: [Insert Date]

- Share Percentage Sold: [Insert Percentage, or "To be confirmed"]

- Financial Details (e.g., purchase price per share): [Insert Details, or "To be disclosed"]

- Regulatory Approvals Obtained: [List relevant regulatory bodies and approvals]

Onex's Rationale Behind the Sale

Onex's decision to sell its WestJet stake is likely driven by a combination of strategic factors. A key consideration is maximizing return on investment (ROI). After years of ownership and guidance, selling at a favorable market point allows Onex to realize substantial profits and reinvest in other promising ventures. Furthermore, this divestiture may align with Onex's broader portfolio diversification strategy, reducing reliance on a single sector and mitigating potential risks associated with the airline industry's volatility.

- Portfolio Diversification Strategy: Reducing exposure to the airline industry to balance investment risk.

- Capital Allocation for Other Investments: Freeing up capital for new opportunities across different sectors.

- Market Conditions and Industry Trends: Capitalizing on favorable market conditions for airline asset sales.

- Long-Term Growth Prospects for Onex: Focusing resources on other investments with potentially higher returns.

Implications for WestJet Airlines

The change in ownership will undoubtedly impact WestJet's operations and strategic direction. The involvement of foreign airlines could lead to increased international connectivity, opening up new flight routes and potentially enhancing WestJet's global reach. However, there is also potential for changes in management, corporate strategy, and possibly even service offerings. The effect on WestJet's employees remains to be seen, with the possibility of both opportunities and challenges arising from the shift in ownership and potential integration with the foreign airline partners.

- Changes in WestJet's Corporate Strategy: Potential adjustments to marketing, operations, and overall business direction.

- Impact on Flight Routes and Expansion Plans: New routes and international partnerships could be introduced.

- Potential for Increased International Connectivity: Greater access to global networks through partnerships.

- Effect on WestJet's Customer Experience: Potential improvements or changes in services, loyalty programs, and customer support.

Broader Implications for the Canadian Aviation Industry

The Onex Completes WestJet Stake Sale has wider ramifications for the Canadian aviation industry. Increased foreign ownership could intensify competition, potentially leading to lower airfares for consumers. It also signals the attractiveness of the Canadian market to international investors and could stimulate further foreign investment in the sector. Conversely, there might be concerns regarding job security and the influence of foreign policies on Canadian aviation.

- Increased Competition in the Canadian Market: A more competitive environment could benefit consumers with more choices and potentially lower fares.

- Impact on Airfares and Travel Costs: Potential for both price reductions and price increases depending on market dynamics.

- Attractiveness of Canada for Foreign Airline Investment: The deal could attract more foreign investment in the Canadian airline industry.

- Long-Term Impacts on Canadian Aviation Jobs: Potential for job creation and job displacement depending on integration strategies and consolidation.

Conclusion

The sale of Onex's WestJet stake to foreign airlines represents a significant development in the Canadian aviation sector. This transaction has profound implications for WestJet's future direction, the competitive landscape of the Canadian airline industry, and broader economic considerations. Understanding the details of this deal, including the rationale behind it and its potential consequences, is crucial for stakeholders across the board. To stay updated on the latest news and analysis regarding this pivotal transaction and further developments in the Onex Completes WestJet Stake Sale, bookmark this page and regularly check for updates.

Featured Posts

-

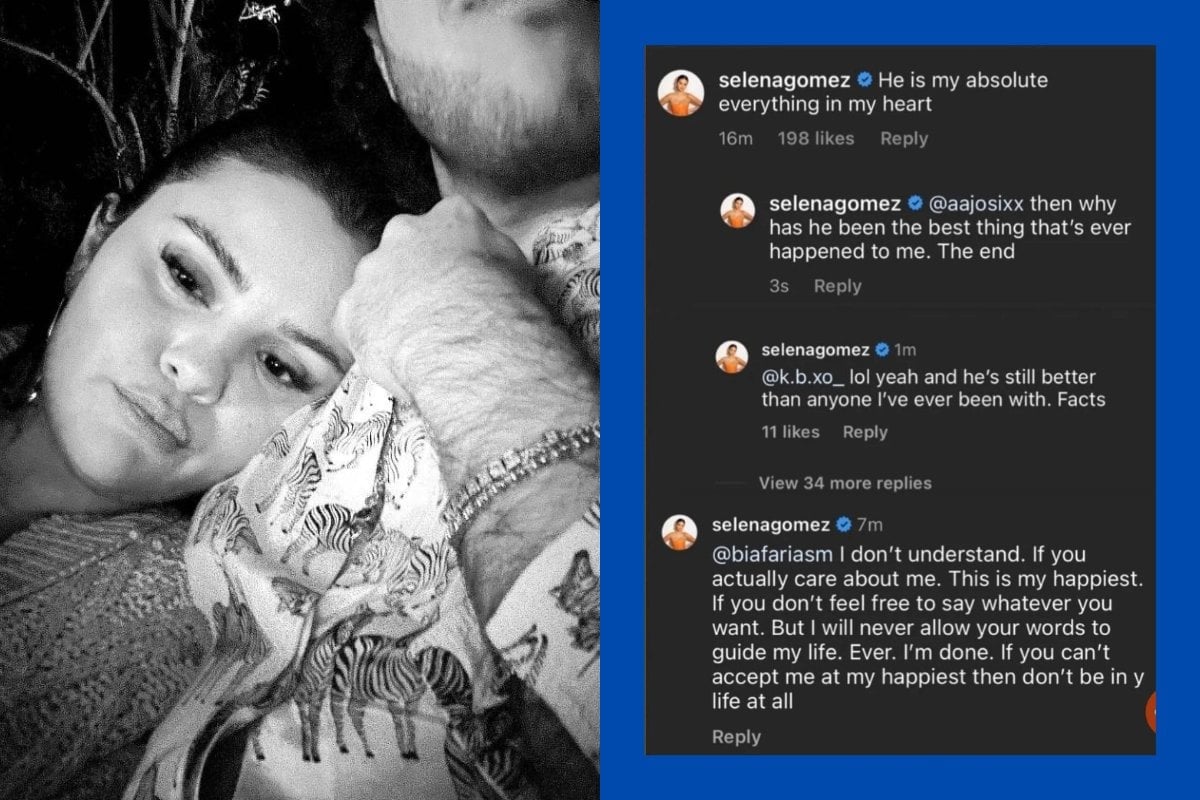

Did Benny Blanco Cheat Selena Gomez Fans React To Theresa Marie Rumors

May 12, 2025

Did Benny Blanco Cheat Selena Gomez Fans React To Theresa Marie Rumors

May 12, 2025 -

Fan Demand Henry Cavill As Wolverine In Marvels World War Hulk Film

May 12, 2025

Fan Demand Henry Cavill As Wolverine In Marvels World War Hulk Film

May 12, 2025 -

Movie Title Review Anthony Mackies Surprisingly Good Performance

May 12, 2025

Movie Title Review Anthony Mackies Surprisingly Good Performance

May 12, 2025 -

Analyzing The Humor In Grown Ups 2

May 12, 2025

Analyzing The Humor In Grown Ups 2

May 12, 2025 -

Pritchards Sixth Man Award A Milestone For The Boston Celtics

May 12, 2025

Pritchards Sixth Man Award A Milestone For The Boston Celtics

May 12, 2025

Latest Posts

-

Eric Antoine Paternite Et Nouvel Amour Apres La Separation

May 12, 2025

Eric Antoine Paternite Et Nouvel Amour Apres La Separation

May 12, 2025 -

Le Bonheur Retrouve Pour Eric Antoine Un Bebe Avec Sa Nouvelle Compagne

May 12, 2025

Le Bonheur Retrouve Pour Eric Antoine Un Bebe Avec Sa Nouvelle Compagne

May 12, 2025 -

Audiences Tv Le Bilan De La Roue De La Fortune Presentee Par Eric Antoine Sur M6

May 12, 2025

Audiences Tv Le Bilan De La Roue De La Fortune Presentee Par Eric Antoine Sur M6

May 12, 2025 -

3 Mois Apres Eric Antoine Et La Roue De La Fortune Ont Ils Trouve Leur Public Sur M6

May 12, 2025

3 Mois Apres Eric Antoine Et La Roue De La Fortune Ont Ils Trouve Leur Public Sur M6

May 12, 2025 -

Eric Antoine Et Sa Nouvelle Compagne L Arrivee De Leur Bebe

May 12, 2025

Eric Antoine Et Sa Nouvelle Compagne L Arrivee De Leur Bebe

May 12, 2025