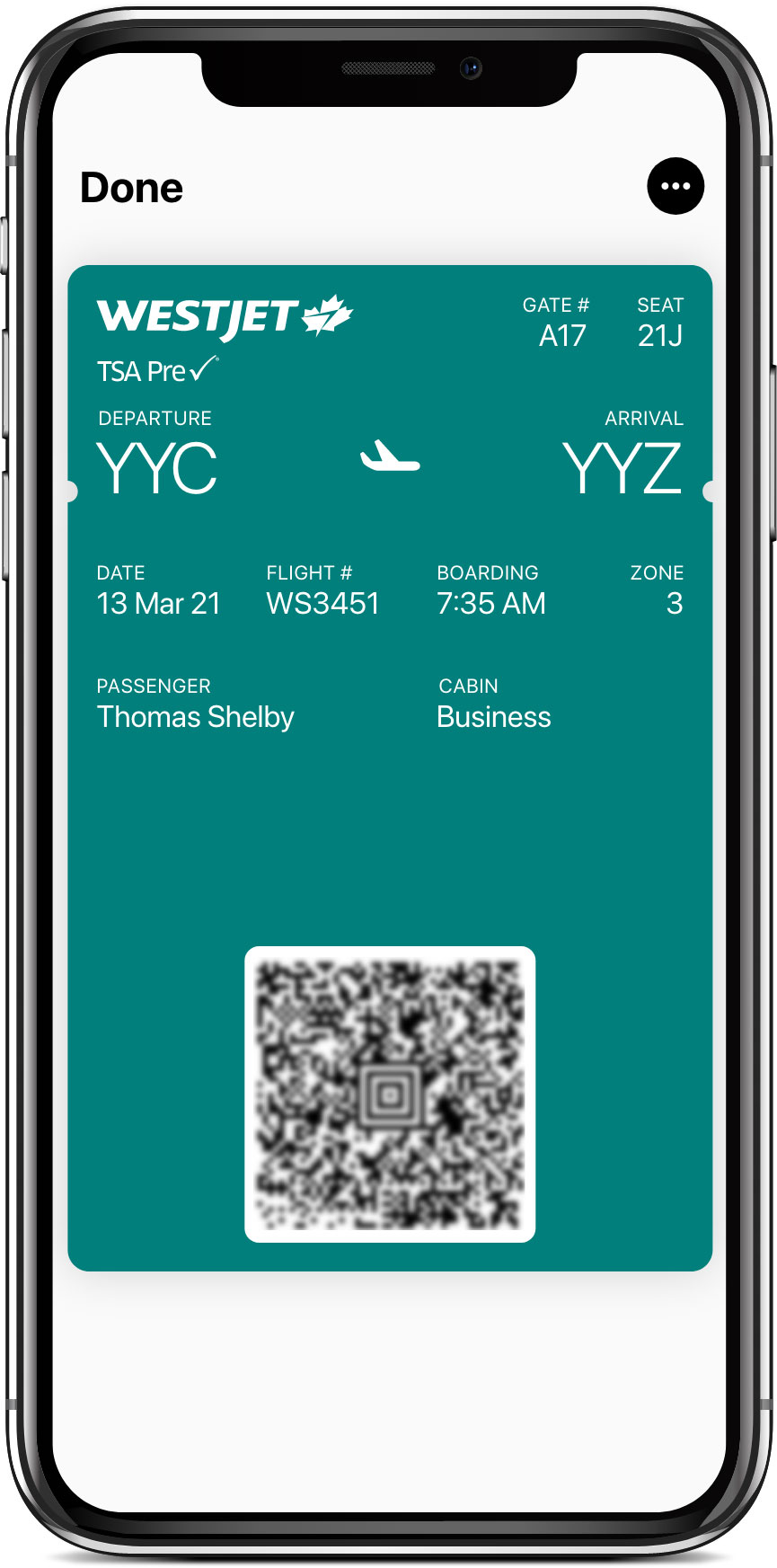

Onex's WestJet Investment: A Successful Exit Strategy

Table of Contents

Onex's Initial Acquisition of WestJet

The Investment Thesis

Onex's acquisition of WestJet in 2019 stemmed from a well-defined investment thesis. They recognized WestJet's significant potential within the Canadian airline market, seeing an opportunity to enhance operational efficiency and unlock substantial value. Their strategic goals included improving profitability, expanding market share, and ultimately maximizing returns for their investors.

- Market opportunity analysis: Onex identified significant growth potential in the Canadian airline industry, particularly in the low-cost carrier segment.

- WestJet's competitive landscape: Analysis revealed opportunities to improve WestJet's competitive positioning against Air Canada and other rivals.

- Identification of undervalued assets: Onex believed WestJet's assets were undervalued, presenting an attractive entry point for a private equity investment.

Acquisition Structure and Financing

The acquisition of WestJet was a complex transaction involving a significant amount of leverage. Onex structured the deal to minimize upfront equity contributions while maximizing the use of debt financing.

- Leverage used: A substantial portion of the purchase price was financed through debt, leveraging WestJet's existing assets and cash flow.

- Equity contribution: Onex made a significant, but proportionally smaller, equity contribution compared to the overall deal size.

- Debt financing sources: A combination of bank loans, high-yield bonds, and other debt instruments were used to fund the acquisition.

Growth and Value Creation Under Onex Ownership

Operational Improvements and Efficiency Gains

During Onex's ownership, WestJet underwent significant operational improvements designed to boost profitability. These initiatives targeted cost reduction, optimized routes, and enhanced customer experiences.

- Cost-cutting measures: Streamlining operations, negotiating better deals with suppliers, and reducing overhead costs contributed significantly to improved margins.

- Route optimization: Analyzing flight data and passenger demand led to adjustments in route scheduling, maximizing efficiency and load factors.

- Fleet modernization: Investing in newer, more fuel-efficient aircraft reduced operating costs and improved environmental performance.

- Improved customer service initiatives: Enhanced customer service training and technological investments aimed at improving passenger satisfaction.

- Enhanced loyalty programs: Upgrades to WestJet's loyalty program helped retain customers and attract new ones.

Strategic Acquisitions and Expansions

While Onex's primary focus was on organic growth, they also explored strategic acquisitions to complement WestJet's existing operations.

- Examples of smaller airlines or related businesses acquired: Although no major acquisitions were made, Onex explored opportunities to bolster WestJet's presence in specific markets or service segments.

- Expansion into new markets: While no major geographic expansion occurred under Onex, they focused on strengthening WestJet's presence within existing markets.

Management and Leadership

Onex placed significant emphasis on strong management and leadership. They worked closely with WestJet's management team to implement their strategic initiatives.

- Changes in leadership: While there weren't significant leadership overhauls, Onex ensured the executive team had the necessary skills and experience to execute their growth strategy.

- Key management appointments: Onex may have brought in external expertise in specific areas to supplement existing management capabilities.

- Impact of management on operational improvements: The effective collaboration between Onex and WestJet's management team was crucial to the success of the operational improvements.

The Exit Strategy: Sale to Indigo Partners

Timing the Sale

Onex timed the sale of WestJet to Indigo Partners strategically, taking advantage of favorable market conditions and achieving an optimal valuation.

- Market conditions: The timing coincided with a period of relative stability and growth in the airline industry, creating a favorable environment for a sale.

- Competitor activity: Onex likely monitored competitor activity to ensure they secured the best possible price for WestJet.

- Achieving optimal valuation: The sale price reflected the significant value creation achieved during Onex's ownership, maximizing their return on investment.

Negotiation and Deal Structure

The sale to Indigo Partners involved complex negotiations and a carefully structured agreement.

- Key terms of the agreement: The agreement detailed the purchase price, payment terms, and any conditions precedent to closing the deal.

- Sale price: The sale price reflected the increased value of WestJet resulting from Onex's operational improvements and strategic initiatives.

- Considerations of regulatory approvals: Securing necessary regulatory approvals from the Canadian government was a crucial element of the successful transaction.

Return on Investment (ROI)

Onex's investment in WestJet yielded a significant return on investment, exceeding their initial expectations.

- Total return: The total return encompassed capital appreciation and any dividends received during ownership.

- Multiple on invested capital (MOIC): This metric measures the multiple of the original investment that Onex realized upon the sale.

- Internal rate of return (IRR): This metric reflects the annualized rate of return generated by the investment over its holding period.

Conclusion

Onex's investment in WestJet showcases a successful private equity exit strategy, demonstrating the importance of a well-defined investment thesis, effective operational improvements, strategic timing, and skillful negotiation. By focusing on enhancing operational efficiency, strategically expanding WestJet's market reach, and capitalizing on favorable market conditions, Onex achieved a substantial return on its investment. This case study provides valuable lessons for other private equity firms looking to replicate this success with their own investments. Learn more about successful private equity exits by exploring further case studies on the Onex WestJet investment and other similar transactions.

Featured Posts

-

Increased Risk For Indy 500 Drivers In 2025

May 12, 2025

Increased Risk For Indy 500 Drivers In 2025

May 12, 2025 -

Grand Slam Delight Jamaica Observers Coverage

May 12, 2025

Grand Slam Delight Jamaica Observers Coverage

May 12, 2025 -

Can Adam Sandler Bridge Americas Political Divide

May 12, 2025

Can Adam Sandler Bridge Americas Political Divide

May 12, 2025 -

15 Years Later Jessica Simpsons Comeback Performance And Its Impact

May 12, 2025

15 Years Later Jessica Simpsons Comeback Performance And Its Impact

May 12, 2025 -

El Peculiar Obsequio De Uruguay A China Estrategia Para Fortalecer El Sector Ganadero

May 12, 2025

El Peculiar Obsequio De Uruguay A China Estrategia Para Fortalecer El Sector Ganadero

May 12, 2025

Latest Posts

-

The Netherlands Approach To Asylum Seekers Low Security Detention And Geographic Restrictions

May 12, 2025

The Netherlands Approach To Asylum Seekers Low Security Detention And Geographic Restrictions

May 12, 2025 -

Sylvester Stallone And Michael Caine A Study In Contrasting Film Roles

May 12, 2025

Sylvester Stallone And Michael Caine A Study In Contrasting Film Roles

May 12, 2025 -

Marjolein Fabers Ribbon Gate Inspired Mural Unveiling At Amsterdam Cafe For Kings Day

May 12, 2025

Marjolein Fabers Ribbon Gate Inspired Mural Unveiling At Amsterdam Cafe For Kings Day

May 12, 2025 -

Kings Day In Amsterdam New Mural Honors Marjolein Fabers Ribbon Gate Design

May 12, 2025

Kings Day In Amsterdam New Mural Honors Marjolein Fabers Ribbon Gate Design

May 12, 2025 -

The Impact Of Enhanced Border Security Fewer Arrests More Rejected Arrivals

May 12, 2025

The Impact Of Enhanced Border Security Fewer Arrests More Rejected Arrivals

May 12, 2025