Ontario Budget: Key Changes To Manufacturing Tax Credits Explained

Table of Contents

The Ontario budget has unveiled significant changes to manufacturing tax credits, impacting businesses across the province. This article provides a comprehensive overview of these key changes, explaining their implications for manufacturers and offering guidance on how to leverage these incentives. We'll delve into the specifics of the updated program, ensuring you understand how these changes affect your bottom line and future planning. This guide will help you navigate the updated Ontario Manufacturing Tax Credits (OMTC) and other relevant programs.

Key Changes to the Ontario Manufacturing Tax Credit (OMTC)

The Ontario Manufacturing Tax Credit (OMTC) has undergone significant revisions. Previously, the OMTC offered a relatively static credit rate with specific eligibility criteria. The latest budget, however, introduces several key changes designed to boost the competitiveness of Ontario's manufacturing sector.

-

Specific percentage changes in the credit rate: The budget increased the credit rate from [Previous Rate]% to [New Rate]%, a significant boost for many manufacturers. This increase is intended to stimulate investment and growth within the sector.

-

Modified eligibility criteria: The eligibility criteria have been tweaked. While previously focused on [Previous Eligibility Criteria], the updated OMTC now includes [New Eligibility Criteria]. This expansion aims to support a wider range of manufacturing activities and businesses.

-

New sectors added or removed from eligibility: [List specific sectors added or removed, explaining the reasoning behind the change]. This targeted approach reflects the government's priorities in supporting specific areas of growth within the manufacturing sector.

-

Clarification on qualifying expenditures: The definition of "qualifying expenditures" has been clarified to provide greater transparency and reduce ambiguity for applicants. This clarification encompasses [Explain the specific changes in qualifying expenditures].

Impact on Small and Medium-Sized Enterprises (SMEs)

The changes to the OMTC have a particularly significant impact on Small and Medium-Sized Enterprises (SMEs).

-

Targeted initiatives for smaller manufacturers: The increased credit rate directly benefits SMEs, providing them with increased competitiveness and resources for expansion and modernization.

-

Examples of how the changes benefit SMEs: SMEs can leverage the increased tax credit to invest in new equipment, upgrade technology, hire skilled workers, and expand their operations. This can lead to increased productivity, improved efficiency, and ultimately, greater profitability.

-

Potential challenges SMEs might face: Smaller manufacturers might face challenges in navigating the application process, particularly with the updated criteria and requirements. Lack of internal expertise in tax credits could also be a hurdle.

-

Resources available to help SMEs: The Ontario government offers various resources and support programs specifically designed to assist SMEs in accessing and utilizing manufacturing tax credits. These resources include [List specific resources, like websites, workshops, or consulting services].

Changes to the Investment Tax Credit and Other Relevant Programs

In addition to the OMTC, the Ontario budget also made changes to other relevant tax credits. For example, the Investment Tax Credit for manufacturing equipment has been [Explain the changes; e.g., increased, maintained, or decreased].

-

Significant modifications to other relevant tax credits: [Detail changes to other relevant credits, such as R&D tax credits or other relevant provincial programs.]

-

Synergy between different manufacturing tax credits: The changes to multiple credits create a potential synergy, allowing manufacturers to maximize their tax benefits by strategically combining different programs. Careful planning and expert advice can help businesses optimize their use of these various incentives.

Navigating the Application Process for Ontario Manufacturing Tax Credits

Applying for Ontario manufacturing tax credits requires careful attention to detail and adherence to specific procedures.

-

Key deadlines and submission requirements: The deadline for applications is typically [Insert Deadline], and it's crucial to submit all necessary documentation by this date. Late submissions may result in delays or rejection.

-

Necessary documentation: Applicants will need to provide detailed financial statements, supporting documentation for qualifying expenditures, and other relevant information as specified in the program guidelines.

-

Resources and support available: The Ontario government provides resources on its website to guide businesses through the application process. Seeking advice from tax professionals or consultants specialized in government incentives can significantly improve the chances of a successful application.

Future Outlook and Implications for Ontario Manufacturing

The long-term implications of these tax credit changes are significant for the Ontario manufacturing sector.

-

Impact on investment and job growth: The enhanced tax credits are anticipated to stimulate investment in the sector, leading to increased production capacity, improved competitiveness, and ultimately, job creation.

-

Competitiveness against other provinces or countries: The changes aim to improve Ontario's competitiveness against other provinces and countries that offer similar manufacturing incentives.

-

Predictions for the future of manufacturing tax incentives: The government's commitment to supporting the manufacturing sector through tax incentives suggests a continued focus on these programs in the years to come. Regular monitoring of updates and changes is crucial for businesses to remain informed and adapt their strategies accordingly.

Conclusion:

The Ontario budget's revisions to manufacturing tax credits present both opportunities and challenges for businesses. Understanding the specific changes detailed above—including modifications to the OMTC and other relevant programs—is crucial for leveraging these incentives effectively. Careful consideration of eligibility criteria, application procedures, and the long-term implications for your business is vital.

Call to Action: Stay informed about the latest changes to Ontario’s manufacturing tax credits and optimize your business strategy by exploring available resources and seeking professional advice to maximize your benefits. Don't miss out on the opportunities presented by the updated Ontario Manufacturing Tax Credits—plan ahead and take advantage!

Featured Posts

-

Nhl Potvrdzuje Svetovy Pohar V Roku 2028

May 07, 2025

Nhl Potvrdzuje Svetovy Pohar V Roku 2028

May 07, 2025 -

Analisis Del Desempeno De Las Laguneras En El Torneo De Simone Biles

May 07, 2025

Analisis Del Desempeno De Las Laguneras En El Torneo De Simone Biles

May 07, 2025 -

Third Ldc Future Forum Building Resilience In Least Developed Countries

May 07, 2025

Third Ldc Future Forum Building Resilience In Least Developed Countries

May 07, 2025 -

Explanation For Zendayas Sisters Potential Absence From Her Wedding

May 07, 2025

Explanation For Zendayas Sisters Potential Absence From Her Wedding

May 07, 2025 -

Jenna Ortegas Snl 50 Appearance Fans React To Sabrina Carpenter Shoutout

May 07, 2025

Jenna Ortegas Snl 50 Appearance Fans React To Sabrina Carpenter Shoutout

May 07, 2025

Latest Posts

-

Saturday Night Lives Impact On Counting Crows Career

May 08, 2025

Saturday Night Lives Impact On Counting Crows Career

May 08, 2025 -

How Saturday Night Live Launched Counting Crows To Mainstream Success

May 08, 2025

How Saturday Night Live Launched Counting Crows To Mainstream Success

May 08, 2025 -

The Impact Of Saturday Night Live On Counting Crows Success

May 08, 2025

The Impact Of Saturday Night Live On Counting Crows Success

May 08, 2025 -

Counting Crows Snl Performance A Career Defining Moment

May 08, 2025

Counting Crows Snl Performance A Career Defining Moment

May 08, 2025 -

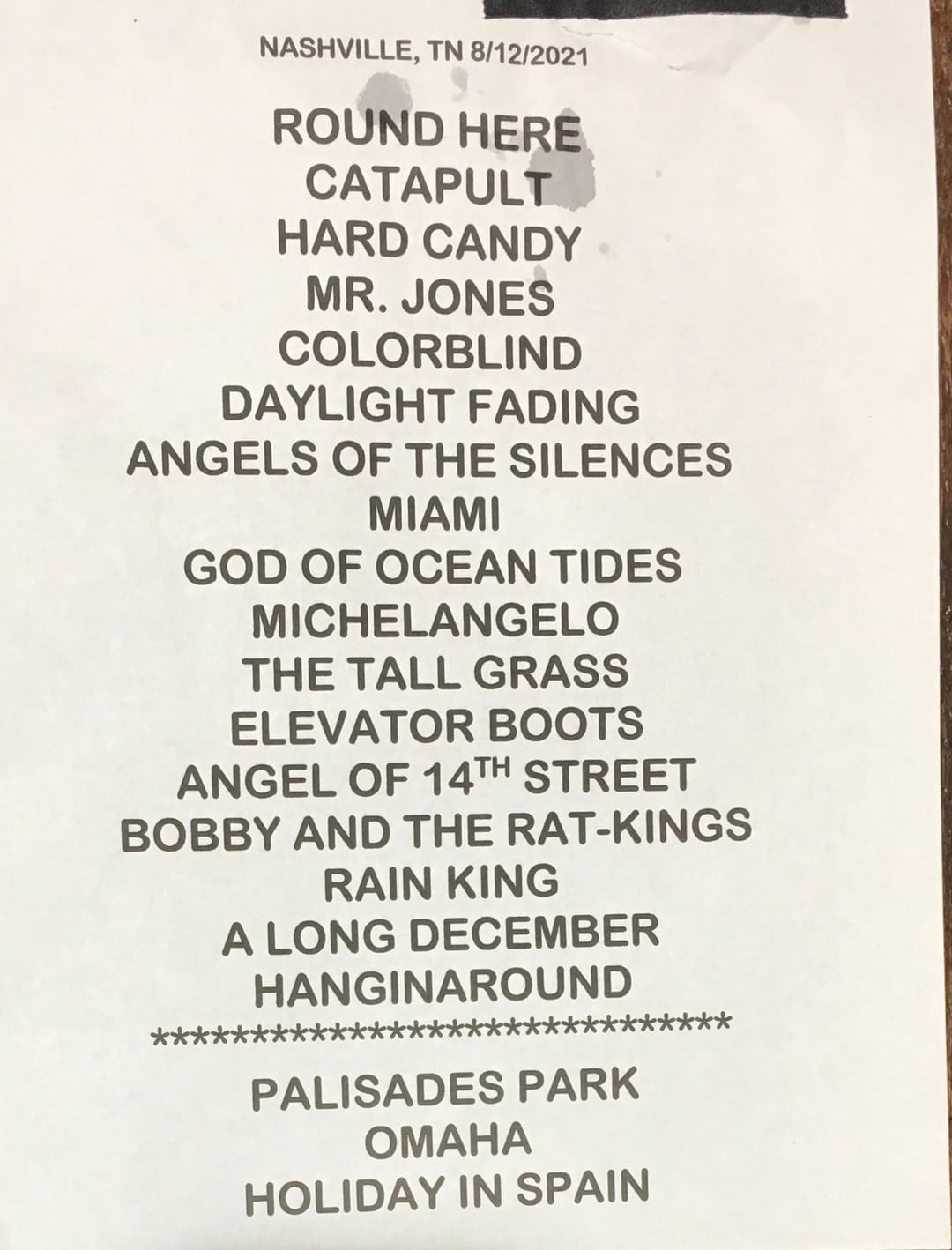

Anticipated Counting Crows Setlist 2025 Tour Dates And Songs

May 08, 2025

Anticipated Counting Crows Setlist 2025 Tour Dates And Songs

May 08, 2025