Operation Sindoor Fallout: Sharp Decline In KSE 100 Index

Table of Contents

The Immediate Impact of Operation Sindoor on Investor Sentiment

Operation Sindoor, a [brief, neutral description of Operation Sindoor and its relevance to the market, e.g., a government crackdown on illegal financial activities], triggered a wave of uncertainty and fear among investors. The immediate reaction was a significant loss of confidence in the market, leading to a sharp decline in the KSE 100 index. This "Operation Sindoor Fallout" manifested in several ways:

- Sharp decline in trading volume: Trading activity plummeted as investors adopted a wait-and-see approach, fearing further negative developments. [Insert data: e.g., Trading volume decreased by X% on [Date] compared to the previous week.]

- Significant sell-offs across various sectors: Panic selling ensued, with investors rushing to liquidate their holdings to minimize potential losses. This resulted in widespread declines across various sectors of the KSE 100.

- Increased volatility and uncertainty: The market experienced heightened volatility, with significant price swings reflecting the uncertainty surrounding the long-term implications of Operation Sindoor.

- Flight to safety: Investors moved their funds into safer, less risky assets, such as government bonds or international markets, further contributing to the sell-off in the KSE 100. [Insert data: e.g., The KSE 100 index fell by Y% within the first [Number] days of Operation Sindoor's announcement.] Source: [Cite a reputable financial news source].

Sector-Specific Analysis: Which Sectors Were Hit Hardest?

The Operation Sindoor Fallout did not impact all sectors equally. Certain industries felt the repercussions more acutely than others.

- Banking sector: The banking sector experienced a significant decline due to concerns about potential regulatory changes and increased scrutiny following Operation Sindoor. [Insert data on percentage drop and specific banking stocks].

- Energy sector: The energy sector, sensitive to global oil prices and investor sentiment, also suffered a considerable downturn. [Insert data on percentage drop and specific energy stocks]. Fluctuations in global energy markets exacerbated the negative impact of the Operation Sindoor fallout.

- Technology sector: The technology sector, known for its sensitivity to investor sentiment shifts, experienced a decline, although perhaps less dramatic than some other sectors. [Insert data on percentage drop and specific technology stocks].

Long-Term Implications and Potential Recovery Scenarios

The long-term impact of the Operation Sindoor Fallout on the Pakistani economy remains uncertain. Several factors will determine the speed and nature of any market recovery.

- Government response and policy adjustments: The government's response to the market turmoil and any policy adjustments aimed at restoring investor confidence will play a crucial role in shaping the future trajectory of the KSE 100.

- Investor confidence rebuilding strategies: Efforts to rebuild investor confidence, such as transparent communication and addressing concerns about regulatory uncertainty, are essential for market recovery.

- Global market conditions and their impact on Pakistan: Global economic conditions and their impact on foreign investment flows into Pakistan will significantly influence the KSE 100's performance.

Despite the decline, opportunities may exist for astute investors who can identify undervalued assets and navigate the market volatility effectively.

Comparative Analysis: KSE 100 Performance vs. Regional Markets

Comparing the KSE 100's performance to other regional stock market indices provides valuable context for understanding the extent of the Operation Sindoor Fallout.

- Comparison with Indian stock markets: [Insert comparison data and analysis, including charts if possible, showing the relative performance of KSE 100 vs. Indian indices].

- Comparison with other South Asian markets: [Insert comparison data and analysis, including charts if possible, showing the relative performance of KSE 100 vs. other South Asian indices].

- Analysis of global market influences: [Analyze the influence of global market trends on the KSE 100 performance, comparing it to global market indices].

Conclusion: Navigating the Aftermath of Operation Sindoor Fallout on the KSE 100

The Operation Sindoor Fallout resulted in a significant and immediate decline in the KSE 100 index, primarily driven by decreased investor confidence and uncertainty about the future. The impact varied across sectors, with some experiencing steeper declines than others. The long-term consequences depend heavily on government actions, investor sentiment recovery, and global market conditions. Navigating this volatility requires careful analysis, understanding the specific sector impacts, and a proactive approach to risk management. To stay informed about the ongoing "Operation Sindoor Fallout" and its impact on the KSE 100 index, subscribe to our newsletter, follow market updates, and always seek professional financial advice before making investment decisions related to the KSE 100 index decline and the broader market impact of Operation Sindoor.

Featured Posts

-

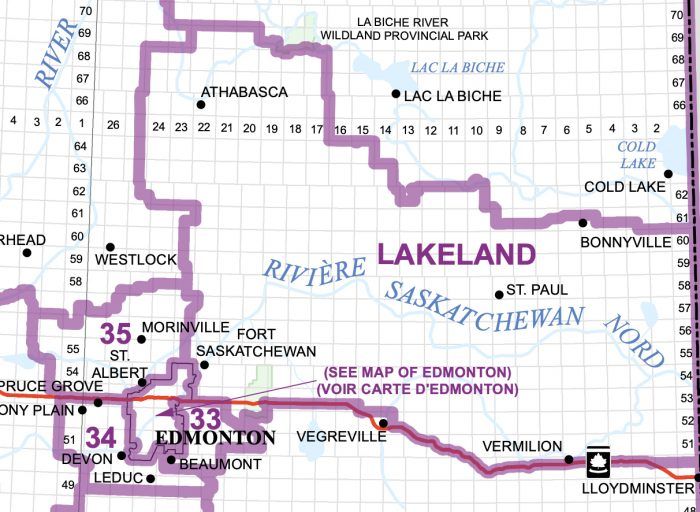

Analyzing The Effects Of Federal Riding Changes On Edmonton Area Voters

May 10, 2025

Analyzing The Effects Of Federal Riding Changes On Edmonton Area Voters

May 10, 2025 -

Dakota Johnson Y Sus Bolsos Hereu El Favorito De Las Influencers

May 10, 2025

Dakota Johnson Y Sus Bolsos Hereu El Favorito De Las Influencers

May 10, 2025 -

New Details Emerge Leaked Photos Of The Microsoft And Asus Xbox Handheld

May 10, 2025

New Details Emerge Leaked Photos Of The Microsoft And Asus Xbox Handheld

May 10, 2025 -

New Program Offers Technical Skills Training To Transgender People In Punjab

May 10, 2025

New Program Offers Technical Skills Training To Transgender People In Punjab

May 10, 2025 -

La Cite De La Gastronomie Et Les Defis D Epicure A Dijon

May 10, 2025

La Cite De La Gastronomie Et Les Defis D Epicure A Dijon

May 10, 2025