Options Trading Signals Aussie Dollar Strength Against Kiwi

Table of Contents

Understanding the AUD/NZD Currency Pair and its Dynamics

The AUD/NZD currency pair represents the exchange rate between the Australian dollar and the New Zealand dollar. Understanding its dynamics is crucial for successful options trading. Fluctuations in this pair are influenced by various factors, making it a potentially lucrative but also risky market.

Fundamental Factors Influencing AUD/NZD

Several fundamental factors significantly impact the AUD/NZD exchange rate:

- Interest rate differentials: Differences in interest rates between Australia and New Zealand directly influence the pair. Higher Australian interest rates tend to strengthen the AUD against the NZD, attracting foreign investment.

- Commodity prices: Both Australia and New Zealand are significant commodity exporters. Fluctuations in prices of key exports like gold, iron ore, and agricultural products directly affect their respective currencies and consequently the AUD/NZD rate. A surge in Australian commodity exports, for example, could boost the Aussie Dollar.

- Economic growth and performance indicators: Strong economic growth and positive performance indicators (GDP, employment data, inflation) in Australia relative to New Zealand typically strengthen the AUD. Conversely, weak economic data for Australia could push the AUD/NZD exchange rate downwards.

- Political stability and geopolitical events: Political uncertainty or major geopolitical events in either country can significantly impact investor sentiment and influence the AUD/NZD exchange rate.

Technical Analysis for Identifying Aussie Dollar Strength

Technical analysis provides valuable insights into AUD/NZD price movements and helps identify potential trading opportunities.

- Moving averages: Using moving averages (e.g., 20-day, 50-day) can help identify trends. A bullish crossover (shorter-term MA crossing above a longer-term MA) often signals strengthening AUD.

- Support and resistance levels: Identifying support and resistance levels on price charts helps predict potential price reversals or breakouts. A break above a significant resistance level could signal sustained AUD strength.

- Candlestick patterns: Bullish candlestick patterns (e.g., hammer, engulfing) can confirm upward trends and potential buying opportunities.

- Technical indicators: Indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) can provide additional signals about momentum and potential trend reversals. Overbought conditions (high RSI) might indicate a potential pullback, while a bullish MACD crossover suggests increasing momentum.

- Example charts: Analyzing historical AUD/NZD charts illustrating periods of Aussie dollar strength against the Kiwi can provide valuable learning opportunities. These charts should highlight the interplay of moving averages, support/resistance, and candlestick patterns.

Options Trading Strategies for Profiting from AUD/NZD Strength

Several options trading strategies can capitalize on anticipated AUD strength against the NZD.

Long Call Options

A long call option grants the buyer the right, but not the obligation, to buy the AUD/NZD at a specific strike price before the option's expiration date. If the AUD strengthens as predicted, the call option's value increases, potentially leading to significant profits. However, the risk is limited to the premium paid for the option.

- Risk/reward profile: High reward potential but limited risk (premium paid).

- Example trade setup: Buying a call option with a strike price of 1.0800 and an expiration date of one month, anticipating the AUD/NZD to rise above this level.

Bull Call Spreads

A bull call spread involves simultaneously buying a call option at a lower strike price and selling a call option at a higher strike price, both with the same expiration date. This strategy limits risk and reduces the upfront cost compared to a long call.

- Reduced risk: The maximum potential loss is limited to the net debit paid.

- Example trade setup: Buying a call option at 1.0750 and selling a call option at 1.0900, both expiring in one month.

Covered Call Writing (for those already holding AUD)

If you already hold a long position in AUD, you can write covered call options to generate income while hedging against potential AUD weakness. This involves selling call options on your existing AUD holdings.

- Generating income: Receiving premium income from selling the options.

- Hedging: Partially offsetting potential losses if the AUD weakens slightly.

- Risk profile: Limited upside potential as the maximum profit is capped at the strike price plus premium received.

Risk Management in AUD/NZD Options Trading

Effective risk management is crucial for successful options trading.

Position Sizing

Never risk more capital than you can afford to lose on any single trade. Proper position sizing is paramount to managing risk.

Stop-Loss Orders

Use stop-loss orders to automatically exit a losing trade at a predetermined price, limiting potential losses.

Diversification

Diversify your investments across multiple options strategies and asset classes to reduce overall portfolio risk.

Understanding Leverage and Margin Requirements

Options trading often involves leverage, which amplifies both potential profits and losses. Fully understand margin requirements and the risk of margin calls before engaging in options trading.

Utilizing Options Trading Signals for AUD/NZD

Options trading signals can provide valuable insights, but they should be used cautiously and in conjunction with your own analysis.

Sources of Reliable Options Trading Signals

Numerous sources provide options trading signals. It's crucial to research and evaluate the reliability of each source. Remember to always exercise due diligence. (Note: We do not endorse any specific signal provider.)

Evaluating Signal Accuracy and Reliability

Assess signal accuracy and reliability by examining the provider's track record, methodology, and transparency. Look for providers that clearly outline their approach and provide historical performance data.

Backtesting Signals

Before using any signals, backtest them on historical data to assess their effectiveness and identify potential biases.

Combining Signals with Fundamental & Technical Analysis

Use signals as a supplementary tool to your own fundamental and technical analysis. Don't rely solely on signals for making trading decisions.

Conclusion

Profiting from Aussie dollar strength against the Kiwi using options trading signals requires a comprehensive understanding of the AUD/NZD currency pair, appropriate options strategies, and robust risk management techniques. We've explored long call options, bull call spreads, and covered call writing, emphasizing the importance of careful position sizing, stop-loss orders, and diversification. Remember that utilizing options trading signals should complement, not replace, your own fundamental and technical analysis. Backtesting signals and evaluating the reliability of your sources is essential.

Ready to capitalize on the potential of the AUD/NZD currency pair? Start exploring options trading signals today and learn how to effectively manage your risk while maximizing potential profits. Remember to conduct thorough research and consider consulting a financial advisor before making any investment decisions relating to Aussie dollar or Kiwi options trading. Successful options trading requires discipline, knowledge, and a well-defined risk management plan.

Featured Posts

-

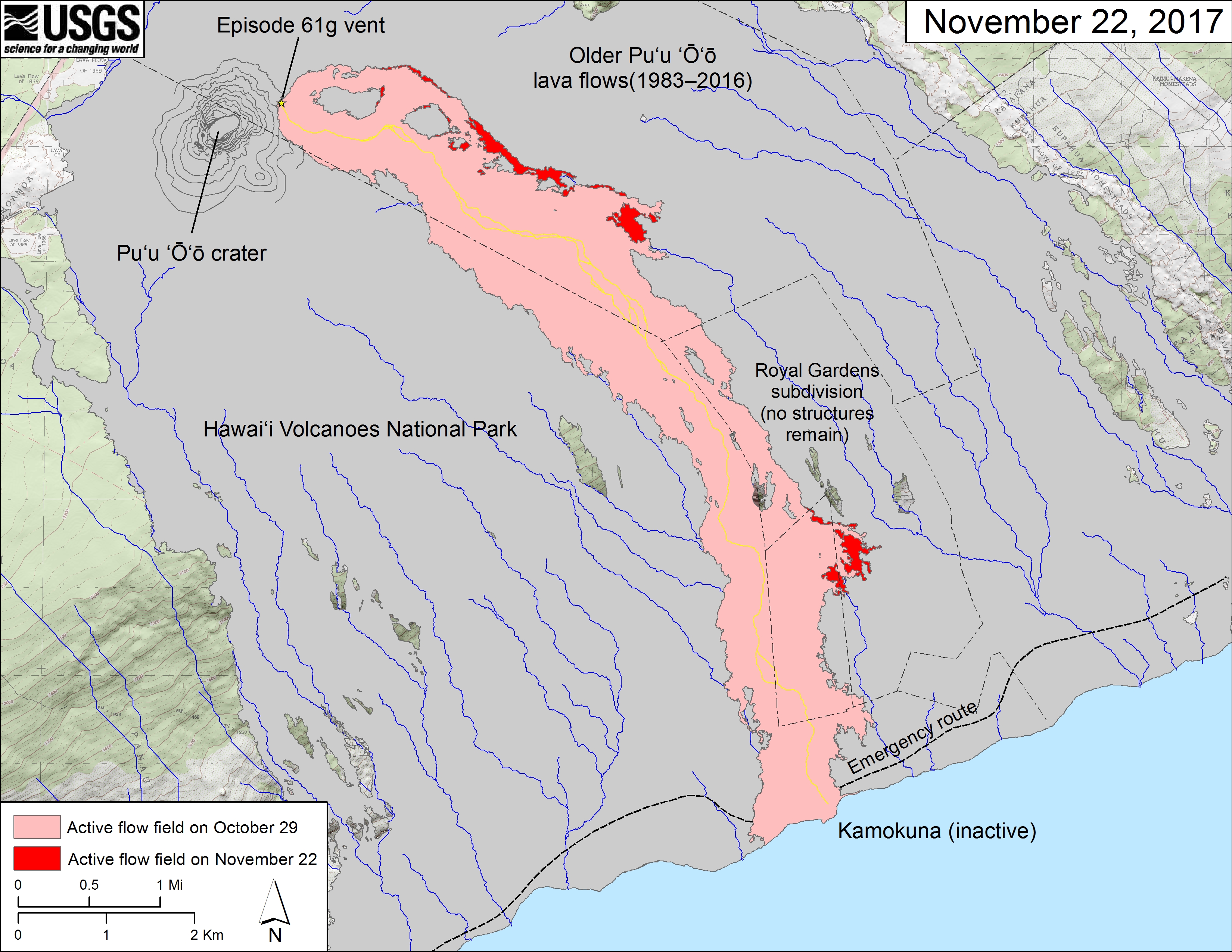

Rare Kilauea Eruption Volcanic Activity Unlike Anything Seen In Decades

May 06, 2025

Rare Kilauea Eruption Volcanic Activity Unlike Anything Seen In Decades

May 06, 2025 -

Papal Name Selection Tradition Symbolism And The Next Popes Name

May 06, 2025

Papal Name Selection Tradition Symbolism And The Next Popes Name

May 06, 2025 -

From Scatological Data To Engaging Podcasts The Power Of Ai

May 06, 2025

From Scatological Data To Engaging Podcasts The Power Of Ai

May 06, 2025 -

What Warren Buffetts Successes And Failures Teach Us About Investing

May 06, 2025

What Warren Buffetts Successes And Failures Teach Us About Investing

May 06, 2025 -

Fox News Faces Defamation Lawsuit From Trump Supporter Ray Epps Over Jan 6 Coverage

May 06, 2025

Fox News Faces Defamation Lawsuit From Trump Supporter Ray Epps Over Jan 6 Coverage

May 06, 2025

Latest Posts

-

White Lotus Casting Patrick Schwarzeneggers Response To Nepotism Criticism

May 06, 2025

White Lotus Casting Patrick Schwarzeneggers Response To Nepotism Criticism

May 06, 2025 -

Schwarzenegger Joins Guadagninos Film Details On The New Role

May 06, 2025

Schwarzenegger Joins Guadagninos Film Details On The New Role

May 06, 2025 -

Nepotism Debate Patrick Schwarzeneggers White Lotus Casting Sparks Discussion

May 06, 2025

Nepotism Debate Patrick Schwarzeneggers White Lotus Casting Sparks Discussion

May 06, 2025 -

Cybercriminal Accused Of Millions In Office365 Account Hacks

May 06, 2025

Cybercriminal Accused Of Millions In Office365 Account Hacks

May 06, 2025 -

Patrick Schwarzenegger Lands Key Role In Luca Guadagninos New Film

May 06, 2025

Patrick Schwarzenegger Lands Key Role In Luca Guadagninos New Film

May 06, 2025