Organic Growth Strategy Leads Cenovus CEO To Dismiss MEG Bid

Table of Contents

Cenovus's Organic Growth Strategy: A Detailed Look

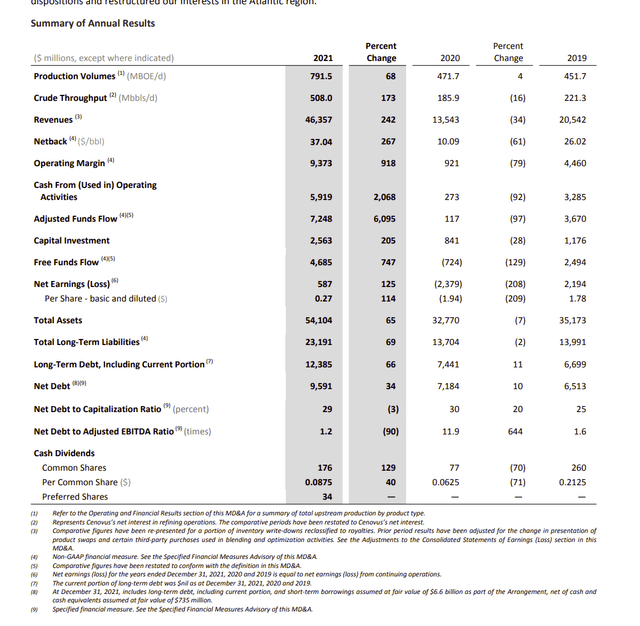

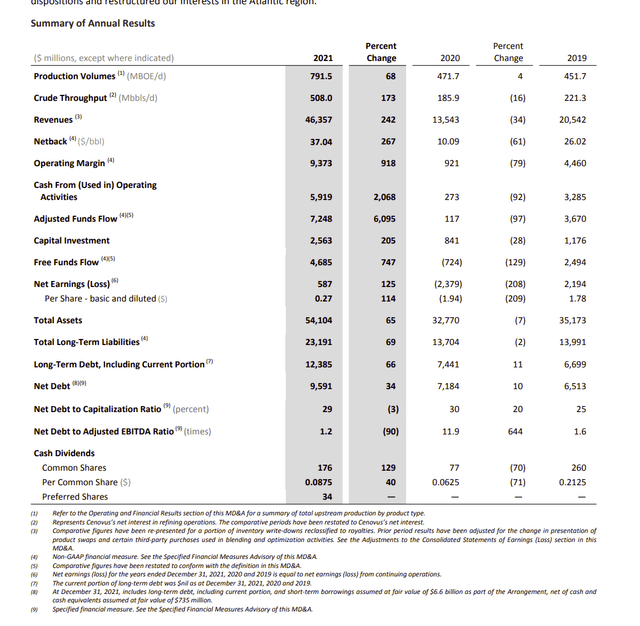

Cenovus's rejection of the MEG bid underscores their belief that internal growth offers superior long-term value compared to external acquisitions. Their organic growth strategy is multi-faceted, focusing on several key areas:

Focus on Core Assets and Operational Efficiency

Cenovus's current strategy centers on maximizing production and profitability from its existing assets. This involves meticulous asset optimization and a relentless pursuit of operational efficiency. They've implemented various cost-cutting measures and operational improvements, leading to significant financial gains.

- Successful Projects and Financial Benefits:

- Implementation of advanced drilling techniques leading to a 15% increase in oil production in the [Specific Area] oil sands.

- Streamlining operational processes resulting in a 10% reduction in operating costs across their [Specific Area] facilities.

- Successful implementation of predictive maintenance programs minimizing downtime and maximizing asset lifespan.

These improvements underscore Cenovus’s dedication to operational efficiency, asset optimization, and cost reduction, ultimately enhancing production enhancement.

Sustainable and Responsible Growth Initiatives

Cenovus recognizes the importance of Environmental, Social, and Governance (ESG) factors in long-term success. Their commitment to sustainability is evident in their investments in renewable energy exploration and carbon reduction technologies.

- Sustainability Goals and Achievements:

- Investment in carbon capture and storage (CCS) technology to reduce greenhouse gas emissions.

- Commitment to achieving net-zero emissions by [Year].

- Active participation in community development initiatives in regions where they operate.

This commitment to ESG, carbon reduction, and renewable energy reflects their vision of responsible growth.

Technological Advancements and Innovation

Technological innovation is a cornerstone of Cenovus's organic growth strategy. They leverage cutting-edge technology to improve efficiency and boost production.

- Technological Investments and Impact:

- Adoption of advanced analytics and artificial intelligence for predictive maintenance and optimization.

- Investment in enhanced oil recovery (EOR) techniques to increase production from mature fields.

- Implementation of automation technologies to reduce operational costs and enhance safety.

This focus on technology, innovation, and digital transformation is integral to their organic growth strategy.

Why Cenovus Rejected the MEG Bid: An Analysis of the Decision

Cenovus's rejection of MEG's bid wasn't impulsive; it was a calculated decision based on rigorous financial analysis and strategic considerations.

Financial Considerations

The proposed acquisition price was deemed insufficient compared to the projected value of Cenovus's organic growth strategy. Internal projections indicated that their current path would generate significantly higher returns on investment (ROI) over the long term. Furthermore, a large acquisition carries inherent financial risks, including integration challenges and potential debt burdens.

Strategic Alignment and Synergies (or Lack Thereof)

An in-depth analysis revealed that the MEG acquisition might not align perfectly with Cenovus's long-term strategy and corporate goals. Potential synergies between the two companies appeared limited, suggesting that the benefits of an acquisition might not outweigh the costs and risks. A focus on internal growth, however, allows Cenovus to control its trajectory and maintain focus on its existing core competencies.

Impact of the Decision on the Energy Sector

Cenovus's decision has had a noticeable impact on the energy sector.

Market Reaction and Investor Sentiment

The market reacted positively to Cenovus's decision, indicating confidence in their organic growth strategy. Investor sentiment towards Cenovus remained strong, while MEG’s stock price experienced a temporary dip. This highlights the market's growing acceptance of long-term, sustainable growth strategies in the energy industry.

Implications for Future Acquisitions in the Industry

Cenovus's choice has important implications for future mergers and acquisitions (M&A activity) within the energy sector. It suggests that companies are increasingly prioritizing internal growth and strategic alignment over rapid expansion through acquisitions. This shift reflects a growing focus on sustainable and responsible business practices.

Conclusion: Organic Growth: Cenovus's Path Forward

Cenovus's decision to reject MEG's bid and focus on an organic growth strategy is a calculated move based on a comprehensive evaluation of financial projections, strategic alignment, and long-term value creation. Their commitment to operational efficiency, technological innovation, and sustainable practices positions them for continued success. This approach demonstrates the potential of a well-executed organic growth strategy to deliver superior returns in the long run. Learn more about how Cenovus's organic growth strategy is shaping the future of the energy industry.

Featured Posts

-

Limited Time Offer 70 Off Gucci Handbags Sneakers Hats And Sunglasses At Gilt

May 27, 2025

Limited Time Offer 70 Off Gucci Handbags Sneakers Hats And Sunglasses At Gilt

May 27, 2025 -

Saint Ouen Inquietudes Des Parents Face A La Proximite D Un Point De Deal Et D Une Ecole Maternelle

May 27, 2025

Saint Ouen Inquietudes Des Parents Face A La Proximite D Un Point De Deal Et D Une Ecole Maternelle

May 27, 2025 -

Bryd Aljzayr Yeln En Ntayj Msabqt Altwzyf Telymat Llmrshhyn Almqbwlyn

May 27, 2025

Bryd Aljzayr Yeln En Ntayj Msabqt Altwzyf Telymat Llmrshhyn Almqbwlyn

May 27, 2025 -

B C Shopping Mall Development Billionaire Seeks Hudsons Bay Partnership

May 27, 2025

B C Shopping Mall Development Billionaire Seeks Hudsons Bay Partnership

May 27, 2025 -

Exploring Wonder Park Attractions Shows And More

May 27, 2025

Exploring Wonder Park Attractions Shows And More

May 27, 2025

Latest Posts

-

Savvato 10 5 Plires Programma Tileoptikon Ekpompon

May 30, 2025

Savvato 10 5 Plires Programma Tileoptikon Ekpompon

May 30, 2025 -

Ti Na Deite Sto Savvato 10 Maioy Odigos Tileoptikon Metadoseon

May 30, 2025

Ti Na Deite Sto Savvato 10 Maioy Odigos Tileoptikon Metadoseon

May 30, 2025 -

Kyriakatiko Tileoptiko Programma 11 5

May 30, 2025

Kyriakatiko Tileoptiko Programma 11 5

May 30, 2025 -

Olokliromenos Odigos Tileorasis Gia To Savvato 10 5

May 30, 2025

Olokliromenos Odigos Tileorasis Gia To Savvato 10 5

May 30, 2025 -

Ti Na Deite Stin Tileorasi Kyriaki 11 Maioy

May 30, 2025

Ti Na Deite Stin Tileorasi Kyriaki 11 Maioy

May 30, 2025