Organic Growth Takes Precedence: Cenovus CEO On Potential MEG Acquisition

Table of Contents

Cenovus's Commitment to Organic Growth Strategies

Cenovus Energy, a leading Canadian integrated oil and natural gas company, has clearly articulated its commitment to achieving growth organically. This strategy involves a multifaceted approach, focusing on internal improvements and maximizing the value of existing assets.

Focusing on Operational Efficiency and Cost Reduction

Cenovus is aggressively pursuing operational efficiency and cost reduction to enhance profitability. This involves a range of initiatives aimed at streamlining operations and leveraging technological advancements.

- Technology Integration: Implementing advanced analytics and automation to optimize production processes and reduce downtime.

- Supply Chain Optimization: Streamlining supply chains to reduce procurement costs and improve delivery efficiency.

- Workforce Optimization: Implementing improved training programs and leveraging technology to enhance employee productivity and reduce labor costs.

- Energy Efficiency Projects: Investing in energy-efficient technologies across its operations to lower operational expenses and reduce its carbon footprint.

These cost-cutting measures, combined with a focus on operational efficiency, are expected to significantly improve Cenovus’s profitability and strengthen its financial position, fueling further organic growth.

Capitalizing on Existing Assets and Resources

A core component of Cenovus's organic growth strategy is maximizing the potential of its existing oil sands and conventional oil and gas assets. This involves a comprehensive approach:

- Enhanced Oil Recovery (EOR) Techniques: Implementing advanced EOR techniques to increase production from mature oil sands fields.

- Exploration and Appraisal: Investing in exploration and appraisal activities to identify and develop new reserves within existing licenses.

- Asset Optimization: Optimizing existing production facilities to improve efficiency and increase output. This includes upgrading existing infrastructure and refining processes.

- Strategic Investments: Making strategic investments in technology and infrastructure to support production enhancement and maximize the lifespan of existing assets.

By focusing on asset optimization and production enhancement, Cenovus aims to drive significant growth from its existing resources, reducing reliance on external acquisitions.

Sustainable and Responsible Growth Initiatives

Cenovus’s commitment extends beyond mere profitability. The company is deeply invested in Environmental, Social, and Governance (ESG) factors, integrating sustainability into its organic growth strategy. Key initiatives include:

- Emission Reduction Targets: Setting ambitious targets for reducing greenhouse gas emissions across its operations.

- Water Management: Implementing advanced water management techniques to minimize water consumption and protect water resources.

- Community Engagement: Actively engaging with local communities to foster positive relationships and address societal concerns.

- Renewable Energy Investments: Exploring opportunities to invest in renewable energy projects, diversifying its energy portfolio and reducing its carbon footprint.

This commitment to ESG principles not only aligns with increasing investor demand for sustainable investments but also contributes to long-term value creation.

Assessing the MEG Acquisition Opportunity and its Rejection

While the potential MEG acquisition was considered, Cenovus ultimately decided against it, prioritizing its organic growth strategy. Several factors contributed to this decision:

Why MEG Acquisition Was Not Prioritized

Cenovus's decision to forgo the MEG acquisition was a calculated one, based on a thorough due diligence process that revealed several potential challenges:

- Valuation Concerns: The proposed valuation for MEG Energy was deemed too high compared to Cenovus's assessment of its intrinsic value.

- Integration Challenges: Integrating MEG Energy's operations into Cenovus's existing infrastructure and processes would present significant logistical and operational hurdles.

- Regulatory Hurdles: The acquisition might have faced significant regulatory scrutiny and delays, potentially impacting the overall timeline and cost.

- Strategic Alignment: The strategic fit between Cenovus and MEG Energy was ultimately deemed less compelling than the potential returns from focusing on internal growth initiatives.

These concerns, when weighed against the potential benefits of the acquisition, led Cenovus to conclude that organic growth offered a more promising pathway to long-term value creation.

Alternative Growth Strategies over Mergers and Acquisitions

Instead of large acquisitions, Cenovus is pursuing alternative avenues for growth:

- Joint Ventures: Exploring strategic joint ventures with other energy companies to access new technologies or resources.

- Strategic Partnerships: Developing strategic partnerships with technology providers and service companies to enhance operational efficiency.

- Technological Collaborations: Investing in research and development and collaborating with other entities to develop innovative technologies that boost production and reduce costs.

These approaches offer a more targeted and less risky way to achieve growth, aligning perfectly with Cenovus's commitment to sustainable and responsible development.

Conclusion: The Long-Term Vision for Cenovus's Organic Growth

Cenovus's decision to prioritize organic growth over the MEG acquisition signifies a long-term strategic vision focused on operational efficiency, responsible resource management, and sustainable practices. By focusing on internal improvements, maximizing existing assets, and investing in sustainable initiatives, Cenovus aims to achieve significant growth without sacrificing its commitment to ESG principles. The rejection of the MEG acquisition underscores the company’s belief in the superiority of organic growth for building long-term value. To learn more about Cenovus's sustainable organic growth strategy and its commitment to creating long-term value, visit the Cenovus website. Discover how Cenovus is leading the way in long-term organic growth within the energy sector.

Featured Posts

-

Canada Post Strike Will Customer Loyalty Suffer

May 25, 2025

Canada Post Strike Will Customer Loyalty Suffer

May 25, 2025 -

Technical Glitch Grounds Blue Origin Rocket Launch

May 25, 2025

Technical Glitch Grounds Blue Origin Rocket Launch

May 25, 2025 -

The Rise Of Disaster Betting The Case Of The Los Angeles Wildfires

May 25, 2025

The Rise Of Disaster Betting The Case Of The Los Angeles Wildfires

May 25, 2025 -

New Music Joy Crookes Shares Carmen

May 25, 2025

New Music Joy Crookes Shares Carmen

May 25, 2025 -

17 Celebrities Whose Reputations Imploded Overnight

May 25, 2025

17 Celebrities Whose Reputations Imploded Overnight

May 25, 2025

Latest Posts

-

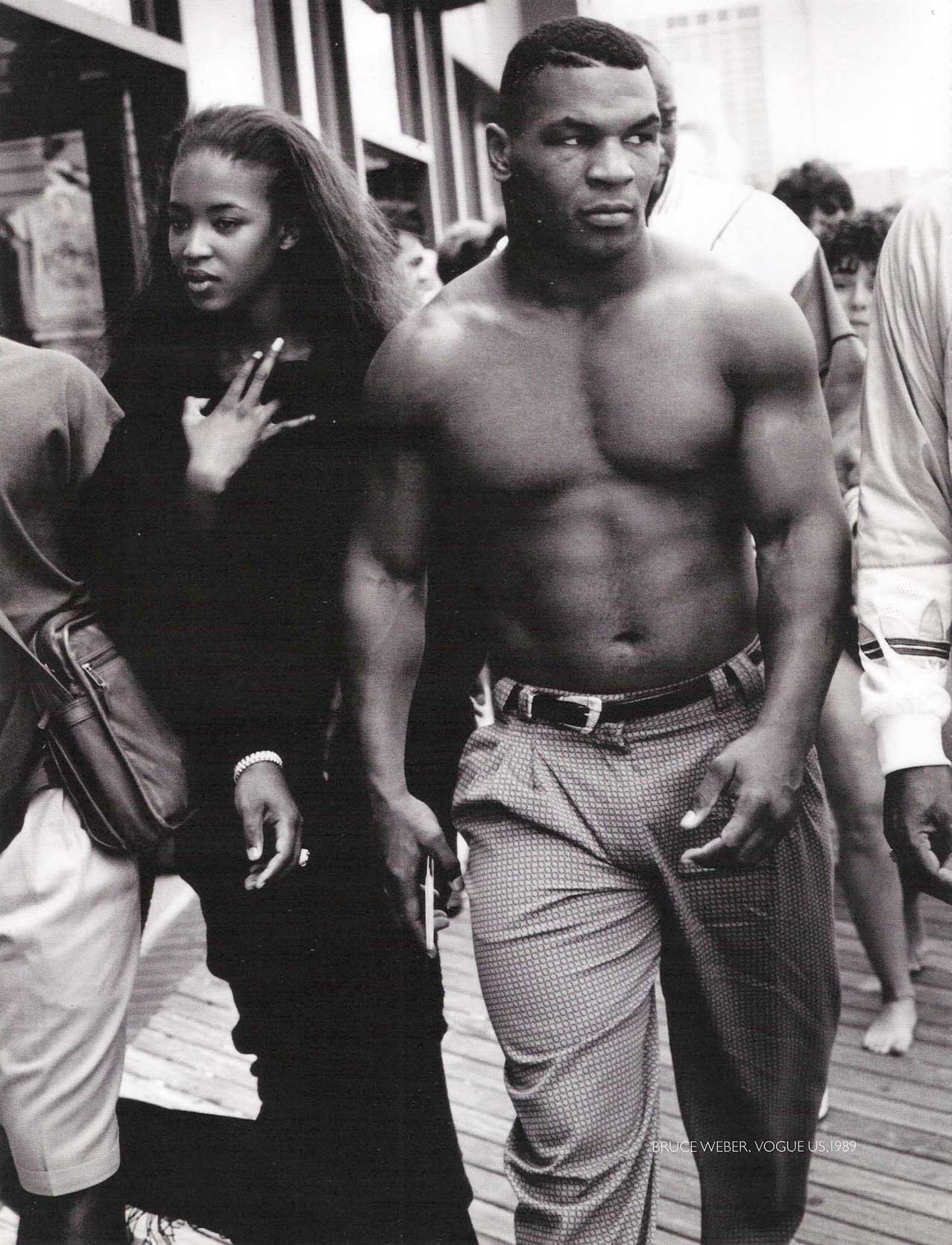

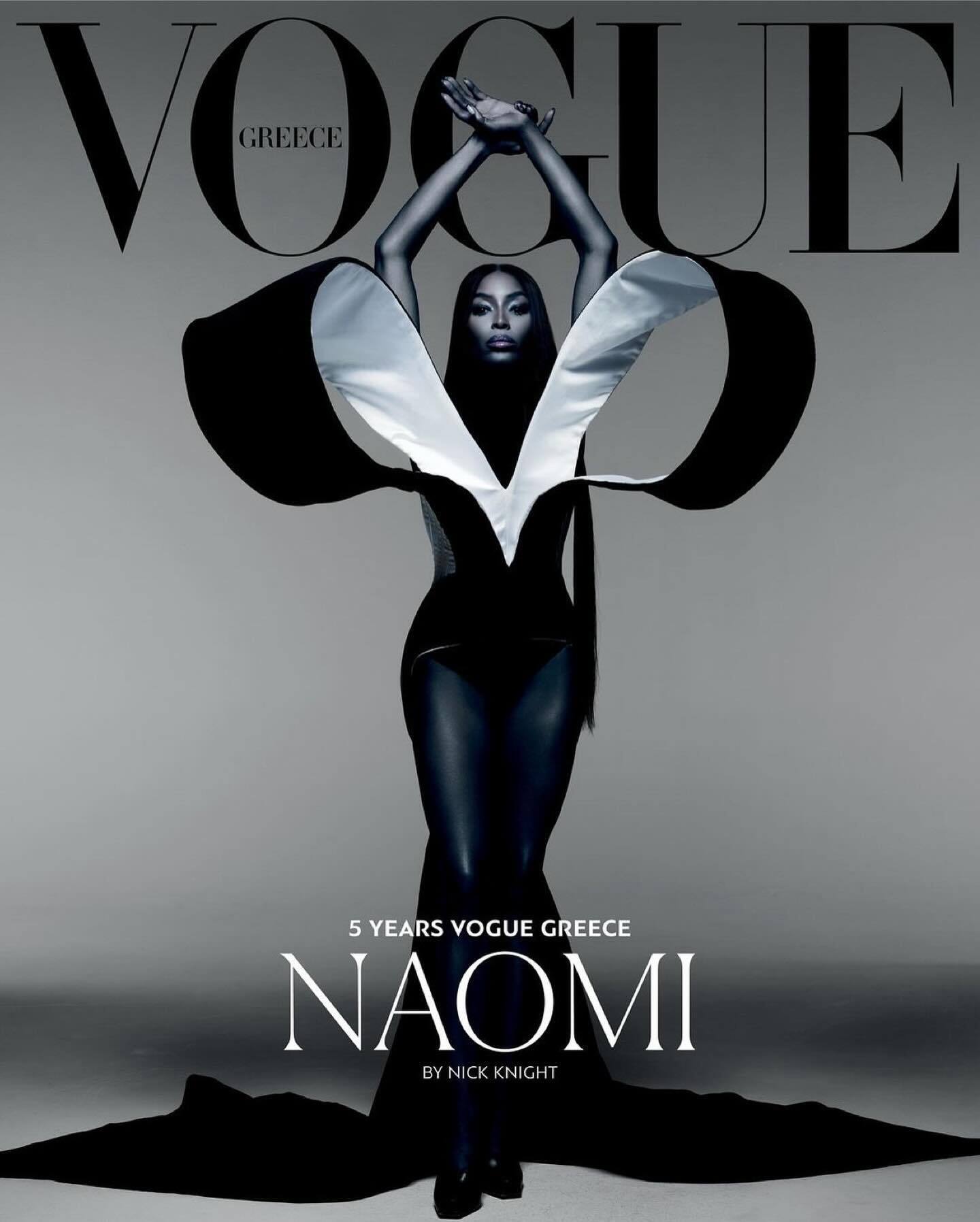

Naomi Kempbell Vrazhaye Vidvertimi Fotografiyami Dlya Glyantsyu

May 25, 2025

Naomi Kempbell Vrazhaye Vidvertimi Fotografiyami Dlya Glyantsyu

May 25, 2025 -

La Veritat Sobre La Relacio D Albert De Monaco I Charlene Una Actriu Al Centre De La Controversia

May 25, 2025

La Veritat Sobre La Relacio D Albert De Monaco I Charlene Una Actriu Al Centre De La Controversia

May 25, 2025 -

Novi Foto Naomi Kempbell Smilivi Ta Vidverti Obrazi

May 25, 2025

Novi Foto Naomi Kempbell Smilivi Ta Vidverti Obrazi

May 25, 2025 -

Fugida D Albert De Monaco La Seva Relacio Amb Charlene En Crisi

May 25, 2025

Fugida D Albert De Monaco La Seva Relacio Amb Charlene En Crisi

May 25, 2025 -

Naomi Kempbell U Vidvertikh Obrazakh Dlya Novogo Glyantsyu

May 25, 2025

Naomi Kempbell U Vidvertikh Obrazakh Dlya Novogo Glyantsyu

May 25, 2025