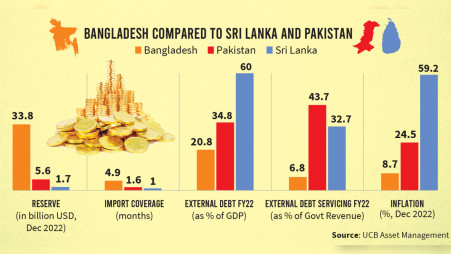

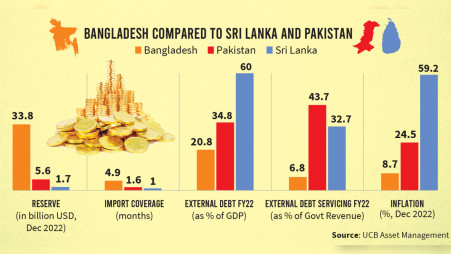

Pakistan, Sri Lanka, Bangladesh Pledge To Strengthen Capital Market Ties

Table of Contents

Enhanced Regional Investment Flows

This initiative aims to significantly increase cross-border investment within South Asia. The enhanced capital market ties will facilitate a smoother flow of capital across borders.

-

Specifics: The plan includes reducing bureaucratic hurdles, streamlining regulatory frameworks, and improving information sharing mechanisms. This will involve simplifying investment procedures, reducing documentation requirements, and promoting greater transparency across the markets. A key component will be the development of a more sophisticated and efficient cross-border settlement system.

-

Benefits: Increased capital flows will lead to a diversification of investment portfolios for individual nations, fostering a more robust and resilient regional economy. This will reduce reliance on single sources of investment and increase the overall stability of the financial systems involved.

-

Examples: Easier access to equity markets across borders will allow businesses to raise capital more easily. Smoother processes for bond issuance and trading will create new opportunities for investors. Finally, joint investment ventures will facilitate collaboration and knowledge sharing between businesses in the three countries. The increased liquidity and access to a wider range of investment opportunities will attract both domestic and international investors.

Fostering Economic Growth and Development

This collaboration promises to accelerate economic growth in all three nations through increased capital mobility. The improved capital market ties will unlock significant opportunities for economic advancement.

-

Specifics: Access to a larger pool of capital can fuel critical infrastructure development projects, stimulate private sector growth across various industries, and create much-needed jobs. This includes improvements in transportation, energy, and technology infrastructure.

-

Benefits: Improved living standards, reduced poverty, and enhanced competitiveness in the global market are all anticipated outcomes of this initiative. This interconnectedness will foster innovation and economic diversification.

-

Examples: Investment in renewable energy projects will drive sustainable development. Development of advanced technologies will increase productivity and competitiveness. Expansion of small and medium-sized enterprises (SMEs) will generate employment and economic activity. This will lead to improved standards of living for citizens across all three nations.

Strengthening Regulatory Cooperation and Harmonization

The pledge includes a commitment to harmonizing regulatory frameworks to create a more unified and efficient capital market. This will require significant cooperation and coordination between regulatory bodies.

-

Specifics: This involves aligning accounting standards, investor protection regulations, and market oversight mechanisms. This will ensure a consistent and transparent regulatory environment. The goal is to create a level playing field for all participants.

-

Benefits: Reduced compliance costs for businesses will encourage increased investment and economic activity. Increased transparency and investor confidence will attract more capital into the region. Easier integration of markets will stimulate growth and economic cooperation.

-

Examples: Joint initiatives to combat market manipulation will safeguard investor interests. Enhanced cross-border supervisory cooperation will strengthen regulatory oversight. Sharing of best practices will improve the efficiency and effectiveness of regulatory frameworks. This harmonization will improve the overall efficiency and attractiveness of the regional capital markets.

Attracting Foreign Direct Investment (FDI)

The strengthened capital market ties will significantly improve the region's attractiveness to foreign investors. This will lead to greater economic integration with the global economy.

-

Specifics: A larger, more integrated market with reduced risks and streamlined regulations is a major draw for FDI. Improved investor protection and transparency will boost investor confidence.

-

Benefits: Increased capital inflow will provide funding for development projects. Technology transfer will enhance productivity and innovation. Job creation will alleviate unemployment and improve living standards.

-

Examples: Targeted initiatives to attract investors in specific sectors, such as renewable energy or technology, will promote strategic development. Promotional campaigns highlighting the region's potential will attract investors’ attention. Joint investment forums will facilitate networking and collaboration between investors and businesses.

Conclusion

The pledge by Pakistan, Sri Lanka, and Bangladesh to strengthen their capital market ties represents a pivotal step towards fostering regional economic integration and growth. By enhancing investment flows, harmonizing regulations, and attracting FDI, this initiative promises significant benefits for all three nations. The strengthened collaboration on capital market ties will not only boost economic prosperity but also solidify the region’s position on the global economic stage. This commitment marks a turning point towards a more vibrant and interconnected South Asian economy, underscoring the importance of regional cooperation in achieving sustainable development. Learn more about the opportunities presented by these strengthened capital market ties and explore how your business can benefit from the enhanced regional investment landscape.

Featured Posts

-

Walmarts Best Elizabeth Arden Skincare Deals

May 09, 2025

Walmarts Best Elizabeth Arden Skincare Deals

May 09, 2025 -

3 000 Babysitting Bill Turns Into 3 600 Daycare Bill A Cautionary Tale

May 09, 2025

3 000 Babysitting Bill Turns Into 3 600 Daycare Bill A Cautionary Tale

May 09, 2025 -

Aprel 2025 V Permi I Permskom Krae Vozmozhny Snegopady I Ponizhenie Temperatury

May 09, 2025

Aprel 2025 V Permi I Permskom Krae Vozmozhny Snegopady I Ponizhenie Temperatury

May 09, 2025 -

The Impact Of Elon Musks Decisions On Dogecoin And Tesla Stock

May 09, 2025

The Impact Of Elon Musks Decisions On Dogecoin And Tesla Stock

May 09, 2025 -

Young Thugs Back Outside Anticipation Builds For Upcoming Album Release

May 09, 2025

Young Thugs Back Outside Anticipation Builds For Upcoming Album Release

May 09, 2025