Pakistan Stock Exchange Portal Down: Volatility And Geopolitical Tensions

Table of Contents

The Immediate Impact of the PSE Portal Downtime

The sudden unavailability of the PSE portal had immediate and significant consequences, impacting trading activities and investor sentiment.

Trading Halts and Investor Anxiety

The downtime resulted in a complete halt to trading, leaving investors unable to buy or sell shares. This unexpected interruption created significant anxiety and uncertainty.

- Financial Losses: Investors potentially missed out on profitable trading opportunities, leading to direct financial losses. The inability to react to market shifts in real-time exacerbated these losses.

- Psychological Impact: The unforeseen disruption severely impacted investor confidence, creating a sense of insecurity and distrust in the market's stability. This psychological impact can be long-lasting, potentially affecting future investment decisions.

- Disruption to Daily Market Operations: The PSE downtime disrupted the normal functioning of the market, affecting not only investors but also brokers, analysts, and other market participants. The ripple effect extended to related financial sectors.

Technical Issues vs. Cyberattacks

The cause of the PSE portal downtime remains under investigation. While technical glitches are a possibility, the severity and duration of the outage raise concerns about a potential cyberattack.

- Robust Cybersecurity: The incident highlights the critical need for robust cybersecurity infrastructure and measures at the PSE to protect against future disruptions. Investing in advanced security systems is paramount.

- Ramifications of a Cyberattack: A deliberate cyberattack targeting the PSE would have far-reaching implications, potentially impacting national security and economic stability. Such an attack could also undermine investor confidence on a global scale.

- Transparent Communication: The PSE needs to maintain transparent communication with investors and stakeholders regarding the cause of the downtime and the steps taken to prevent future occurrences. Openness builds trust and confidence.

The Role of Geopolitical Tensions

The vulnerability of the Pakistani stock market to external geopolitical factors cannot be ignored. Regional instability and global market trends significantly influence investor sentiment and capital flow into the PSE.

Regional Instability and Investor Sentiment

Regional geopolitical tensions, including political instability and strained international relations, directly impact investor confidence in the Pakistani economy.

- Impact of Geopolitical Events: Recent political events and border tensions have created a climate of uncertainty, leading to capital flight and reduced investor interest in the PSE. Specific examples need to be analyzed to fully understand the correlation.

- Negative News Cycles: Negative news cycles, often amplified by social media, can trigger sell-offs and exacerbate market volatility. This highlights the importance of responsible reporting and accurate information dissemination.

- Flight of Foreign Investment: Uncertainty about the political and economic outlook often leads to foreign investors withdrawing their funds, further impacting the PSE’s performance.

Economic Sanctions and Global Market Trends

The interconnectedness of global markets means that economic sanctions imposed on Pakistan or global market downturns can trigger volatility in the PSE.

- Interconnected Global Markets: The PSE is not immune to global market trends. A downturn in major global markets can quickly ripple into emerging markets like Pakistan.

- Impact of International Events: International events, such as changes in interest rates or global inflation, can directly affect investor behavior and investment flows into the PSE.

- Inflation and Interest Rates: Rising inflation and interest rates in global markets can impact investment decisions, influencing the flow of capital into the PSE.

Long-Term Implications for the Pakistan Stock Exchange

The PSE portal downtime and the associated volatility have long-term implications for the future of the stock exchange and the Pakistani economy.

Investor Confidence and Future Investment

Regaining investor confidence is crucial for attracting future investments in the PSE. The recent events have undoubtedly shaken investor trust.

- Loss of Investor Confidence: The downtime and volatility could lead to a significant loss of investor confidence, deterring both domestic and foreign investment. This could hinder long-term growth.

- Strategies to Regain Trust: The PSE needs to implement strategies to regain investor trust, including improved transparency, enhanced cybersecurity measures, and proactive communication.

- Regulatory Improvements: Strengthening regulations and improving market oversight can increase investor confidence and encourage greater participation in the PSE.

Economic Growth and Development

The stability of the PSE is directly linked to the overall economic growth and development of Pakistan. Market instability can have far-reaching economic consequences.

- Stable Stock Market and Economic Progress: A stable and efficient stock market is crucial for economic progress, facilitating capital formation and investment.

- Impact on Foreign Direct Investment (FDI): Market volatility can deter foreign direct investment, hindering economic growth and development. A stable PSE attracts FDI.

- Role of PSE in Economic Growth: The PSE plays a vital role in mobilizing savings, allocating capital, and promoting economic growth. Its stability is paramount.

Conclusion

The recent Pakistan Stock Exchange portal downtime has exposed the vulnerability of the PSE to both internal and external factors. The immediate impact included trading halts, investor anxiety, and potential financial losses. Geopolitical tensions and global market trends further amplified the instability. The long-term implications for investor confidence, future investment, and overall economic growth are significant. The PSE needs to prioritize robust cybersecurity, transparent communication, and regulatory improvements to regain investor trust and ensure the stability of the market.

Call to Action: Stay informed about developments in the Pakistan Stock Exchange and follow reputable news sources for accurate updates. Understanding the risks associated with investing in the Pakistan Stock Exchange during periods of uncertainty is crucial. Careful monitoring of the Pakistan Stock Exchange is essential for informed investment decisions.

Featured Posts

-

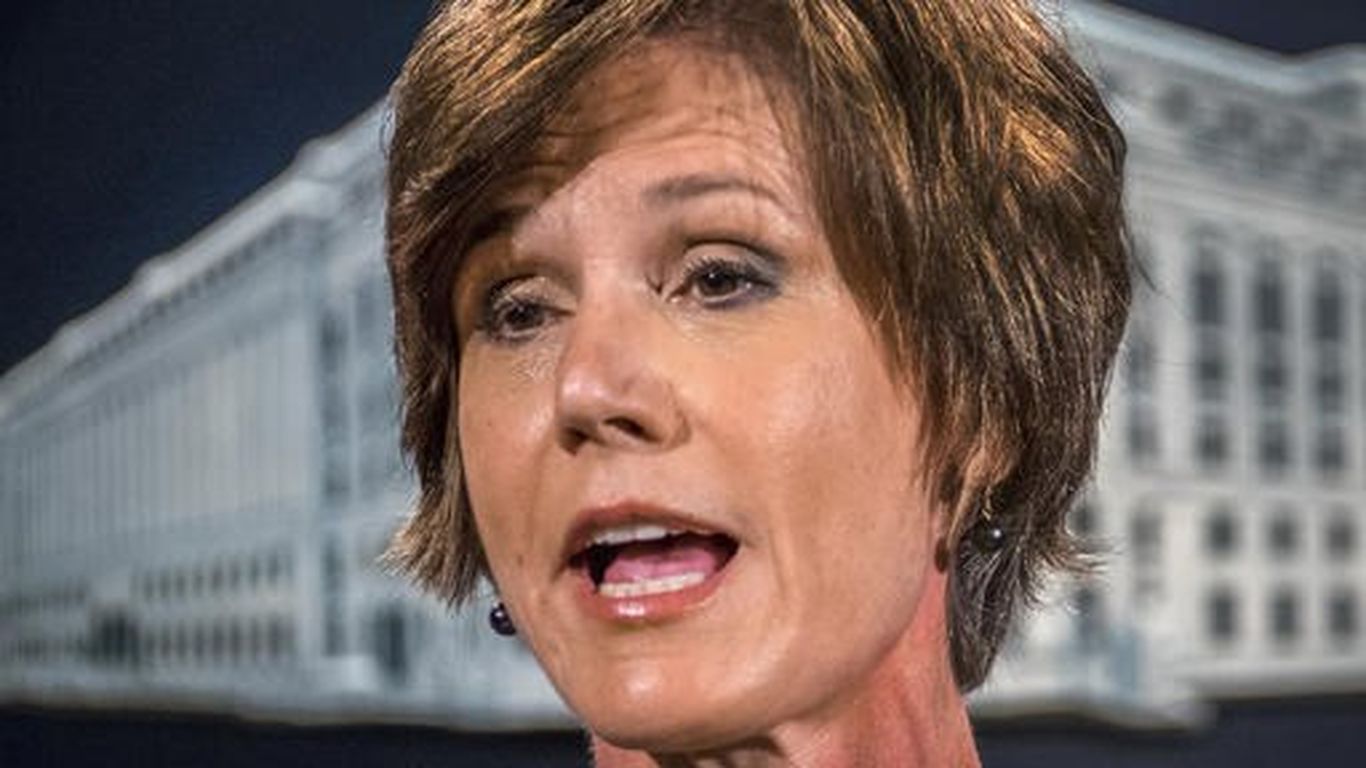

Trump Opponents Face Eerie Threat From Attorney General

May 10, 2025

Trump Opponents Face Eerie Threat From Attorney General

May 10, 2025 -

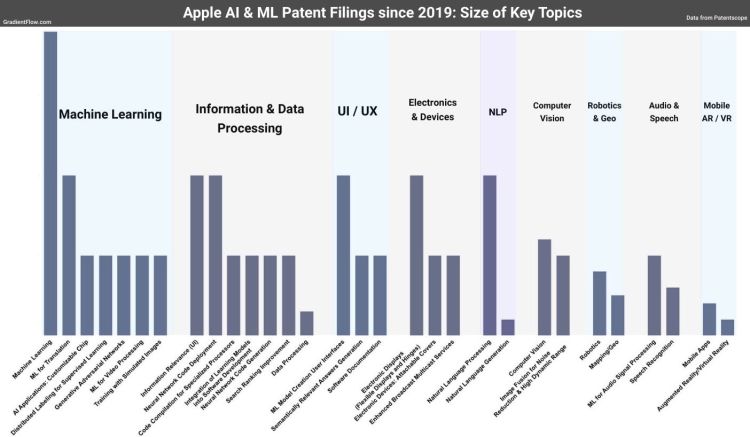

Is Apples Ai Strategy On The Right Path A Critical Analysis

May 10, 2025

Is Apples Ai Strategy On The Right Path A Critical Analysis

May 10, 2025 -

Pirros Comments On Due Process For Us Citizens Sent To El Salvador Prisons

May 10, 2025

Pirros Comments On Due Process For Us Citizens Sent To El Salvador Prisons

May 10, 2025 -

Conseil Metropolitain De Dijon Le Projet De 3e Ligne De Tramway Adopte Apres Concertation

May 10, 2025

Conseil Metropolitain De Dijon Le Projet De 3e Ligne De Tramway Adopte Apres Concertation

May 10, 2025 -

Family Devastated A Brutal Unprovoked Racist Killing

May 10, 2025

Family Devastated A Brutal Unprovoked Racist Killing

May 10, 2025