Pakistan's $1.3 Billion IMF Bailout: Review Amidst Regional Tensions

Table of Contents

The Conditions of the Pakistan IMF Bailout

The Pakistan IMF Bailout is contingent upon Pakistan implementing a series of stringent conditions designed to restore macroeconomic stability. These conditions encompass fiscal reforms, structural adjustments, and currency devaluation, demanding significant changes to the nation's economic policies.

-

Fiscal Consolidation Measures: The IMF demands substantial fiscal consolidation, including comprehensive tax reforms targeting increased revenue collection and a reduction in government spending. This involves tackling tax evasion, broadening the tax base, and potentially implementing new taxes. Significant cuts in government subsidies, particularly on energy, are also expected.

-

Structural Reforms: The bailout agreement mandates substantial structural reforms across various sectors. These reforms aim to enhance governance, improve the efficiency of state-owned enterprises (SOEs), and boost the energy sector's performance. This could include privatization of SOEs, deregulation of certain industries, and investments in renewable energy sources.

-

Currency Devaluation: A key condition is the devaluation of the Pakistani Rupee. While aimed at boosting exports and reducing the current account deficit, this measure will likely lead to increased inflation and higher import costs, impacting the affordability of essential goods for ordinary citizens.

-

Social Safety Nets: Although austerity measures are unavoidable, the IMF usually incorporates some provisions for social safety nets to mitigate the impact of reforms on vulnerable populations. These measures might include targeted subsidies for the poor or unemployment benefits.

Potential Benefits of the Pakistan IMF Bailout

Despite the challenges, the Pakistan IMF Bailout holds the potential for several positive outcomes, offering a pathway to economic stability and future growth.

-

Rupee Stabilization and Inflation Reduction: Successful implementation of the bailout's conditions could stabilize the Pakistani Rupee, curbing runaway inflation and making imports more manageable.

-

Improved Access to International Capital Markets: Demonstrating commitment to reforms and fiscal responsibility could improve Pakistan's creditworthiness, unlocking access to international capital markets for future investment and development.

-

Economic Growth Spurred by Reforms: Structural reforms, if effectively implemented, could improve the efficiency of the economy, leading to long-term economic growth and increased investment.

-

Reduced Risk of Sovereign Debt Default: The bailout provides much-needed liquidity, reducing the immediate risk of a sovereign debt default, a catastrophic event that could cripple the economy.

Short-Term Economic Relief and Debt Sustainability

The immediate injection of funds offers short-term relief, enabling Pakistan to meet its immediate financial obligations and alleviate pressure on its foreign exchange reserves. However, the long-term sustainability of Pakistan's debt hinges on successful implementation of the IMF's structural reforms and achieving sustainable economic growth.

Challenges and Risks Associated with the Pakistan IMF Bailout

The Pakistan IMF Bailout is not without significant challenges and risks. The austerity measures demanded by the IMF could have profound social and political consequences.

-

Potential Social Unrest: Austerity measures, including reduced subsidies and potential job losses due to SOE reforms, could spark widespread social unrest and political instability.

-

Political Opposition: The conditions imposed by the IMF might face strong political opposition, potentially hindering implementation and jeopardizing the bailout's success.

-

Uncertainty Surrounding Reform Implementation: The success of the bailout is heavily reliant on the effective and timely implementation of the agreed-upon reforms. Any delays or failures could undermine the entire program.

-

Geopolitical Risks: Regional instability, including tensions with neighboring countries like India and Afghanistan, poses significant risks to Pakistan's economic recovery and could negatively impact the bailout's effectiveness.

The Geopolitical Context of the Pakistan IMF Bailout

The ongoing geopolitical tensions surrounding Pakistan significantly influence its economic situation and the IMF's involvement. Regional instability diverts resources from development, impacting investor confidence and potentially undermining the success of the bailout. The IMF's engagement is therefore intertwined with the broader geopolitical landscape.

Long-Term Sustainability and Economic Outlook for Pakistan

The long-term economic outlook for Pakistan post-bailout remains uncertain, depending heavily on the successful implementation of the IMF's conditions and the broader geopolitical context.

-

Economic Growth Projections: Successful reforms could lead to modest economic growth in the medium to long term, but significant challenges remain.

-

Sustainability of Reforms: The long-term sustainability of the implemented reforms depends on the commitment of the Pakistani government and its ability to address underlying structural issues within its economy.

-

Risks to Long-Term Stability: Political instability, corruption, and external shocks could undermine long-term stability, even with IMF support.

-

Alternative Economic Strategies: Exploring alternative, perhaps more domestically-focused, economic strategies could help reduce reliance on external assistance in the future.

Conclusion

The Pakistan IMF Bailout presents a crucial juncture for Pakistan's economy. While it offers a lifeline and the potential for short-term stability and long-term growth, its success hinges on the effective implementation of stringent conditions and the mitigation of significant risks. The geopolitical context adds further complexity, highlighting the need for a holistic approach that addresses both economic and political challenges. Effective implementation of the agreed-upon reforms, combined with tackling underlying structural issues, is crucial for achieving long-term economic stability. For further insights and analysis on the implications of the Pakistan IMF Bailout, stay updated with reputable financial news sources and continue to follow the evolving economic situation in Pakistan. Understanding the complexities of the Pakistan IMF Bailout is crucial for comprehending the future trajectory of the Pakistani economy.

Featured Posts

-

Stock Market Today Sensex And Niftys Current Performance And Key Trends

May 09, 2025

Stock Market Today Sensex And Niftys Current Performance And Key Trends

May 09, 2025 -

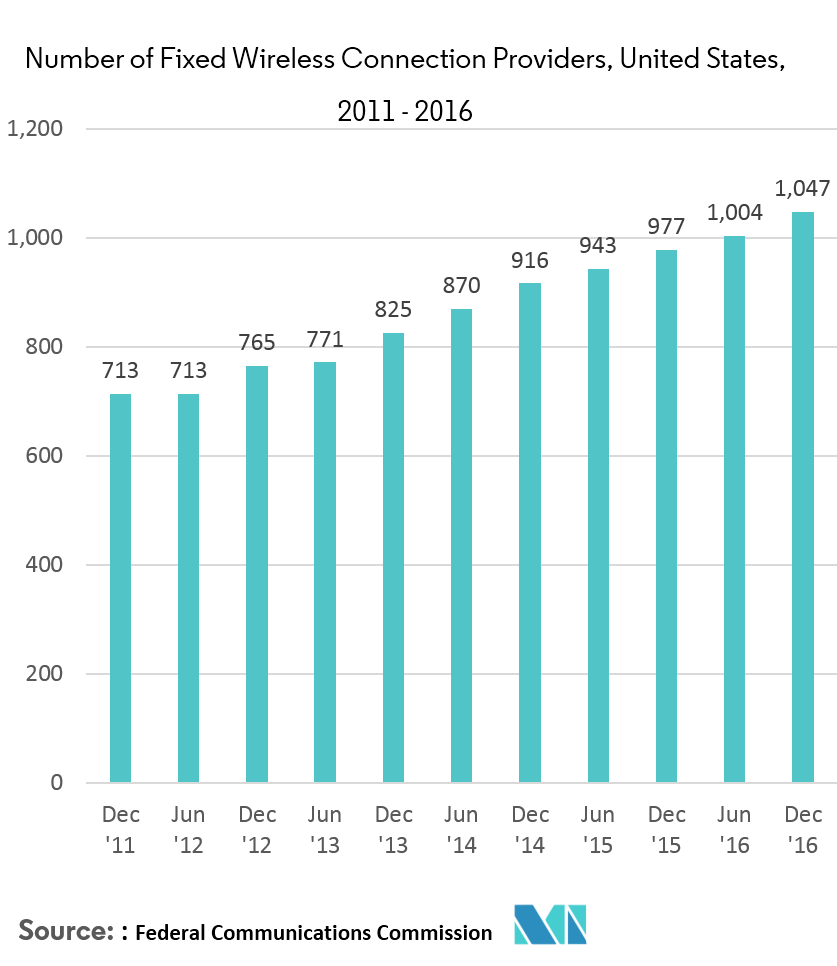

The Expanding Wireless Mesh Networks Market A 9 8 Cagr Forecast

May 09, 2025

The Expanding Wireless Mesh Networks Market A 9 8 Cagr Forecast

May 09, 2025 -

Uk Arrest Polish Woman Julia Wandelts Madeleine Mc Cann Claim Investigated

May 09, 2025

Uk Arrest Polish Woman Julia Wandelts Madeleine Mc Cann Claim Investigated

May 09, 2025 -

Hlm Barys San Jyrman Alttwyj Blqb Dwry Abtal Awrwba

May 09, 2025

Hlm Barys San Jyrman Alttwyj Blqb Dwry Abtal Awrwba

May 09, 2025 -

Bayern Munich Vs Inter Milan Match Preview And Prediction

May 09, 2025

Bayern Munich Vs Inter Milan Match Preview And Prediction

May 09, 2025