Pakistan's Stock Market Plunge: Website Outage Highlights Growing Instability

Table of Contents

The Immediate Impact of the PSX Website Outage

The PSX website outage, occurring during a period of already heightened market volatility, amplified the panic and uncertainty. The disruption caused immediate and significant problems: trading halts prevented investors from buying or selling shares, leading to a freeze in market activity. The inability to access real-time information further fueled investor anxiety and panic selling. This lack of transparency exacerbated the situation, making it difficult to assess the true extent of the market's decline.

- Estimated financial losses due to the outage: While precise figures are difficult to ascertain immediately, the losses are likely substantial, impacting both individual investors and institutional players. The inability to execute trades during a period of sharp decline resulted in significant unrealized losses.

- Impact on foreign investor confidence: The outage, coupled with the broader market decline, severely damaged foreign investor confidence. This is likely to lead to further capital flight and increased reluctance to invest in the Pakistani market.

- Reactions from leading financial analysts and experts: Leading financial analysts have expressed deep concern, highlighting the vulnerability of the PSX's infrastructure and the need for improved regulatory oversight. Many experts predict further volatility in the short term.

- Government response to the outage and its causes: The government’s initial response focused on investigating the causes of the outage and assuring investors of their commitment to market stability. However, the long-term effectiveness of their response remains to be seen.

Underlying Economic Factors Contributing to the Stock Market Plunge

The PSX website outage was merely a symptom of deeper, more systemic issues plaguing Pakistan's economy. The recent Pakistan Stock Market plunge is inextricably linked to a confluence of factors:

- Political instability and its influence on investor sentiment: Political uncertainty creates an environment of risk aversion, deterring both domestic and foreign investment. The lack of clear policy direction further erodes confidence.

- Currency devaluation and its effect on market valuation: The devaluation of the Pakistani Rupee against major currencies has reduced the value of assets denominated in rupees, leading to a decline in market capitalization.

- Inflation and its impact on consumer spending and business confidence: High inflation erodes purchasing power, dampening consumer demand and reducing business confidence, further impacting market performance.

- Rising interest rates and their effect on borrowing and investment: Increased interest rates make borrowing more expensive, discouraging investment and potentially leading to loan defaults.

- External debt pressures and their contribution to market volatility: Pakistan's significant external debt burden creates vulnerabilities and susceptibility to external shocks, further destabilizing the market.

The Role of Foreign Investment and Capital Flight

Foreign investment plays a crucial role in the Pakistani economy. The recent decline in the Pakistan stock market has been significantly impacted by foreign investor withdrawals.

- Statistics on foreign investment outflow: Data on foreign investment outflow needs to be sourced from reliable financial news outlets to provide concrete figures.

- Reasons for foreign investor concern: Foreign investors are concerned about the political and economic instability, the currency devaluation, and the potential for further losses.

- Impact on the Pakistani Rupee: The outflow of foreign capital has put further pressure on the Pakistani Rupee, exacerbating the existing economic challenges.

Government Response and Potential Solutions

The Pakistani government is facing immense pressure to stabilize the market and restore investor confidence.

- Government's emergency measures to address the crisis: The government has announced several measures, including possible interventions to support the market and address the root causes of the instability. Details of these measures should be sourced from official government releases and reputable news sources.

- Economic reforms being implemented: Structural economic reforms are crucial for long-term stability, addressing issues like fiscal deficits, improving governance, and attracting foreign investment.

- Effectiveness of proposed solutions and potential long-term effects: The effectiveness of these measures will depend on their implementation and the government's commitment to long-term structural reform.

- International aid or support being sought: Seeking international financial assistance may be necessary to alleviate the debt burden and support economic recovery.

Long-Term Implications for Pakistan's Economy

The consequences of this Pakistan Stock Market plunge could have far-reaching effects:

- Impact on economic growth: The market downturn will likely lead to a slowdown in economic growth, impacting various sectors and potentially increasing unemployment.

- Social and political consequences: Economic hardship can lead to social unrest and political instability, further compounding the challenges.

- Potential for recovery and future stability: The potential for recovery depends on the government's ability to implement effective reforms, restore investor confidence, and address the underlying economic issues.

Conclusion:

The Pakistan Stock Market plunge, worsened by the PSX website outage, reveals a critical juncture in Pakistan's economic trajectory. The underlying factors – political instability, currency devaluation, inflation, and external debt – demand immediate and comprehensive solutions. The government's response and ability to restore investor confidence will be crucial in determining the nation's economic future. Staying informed about the evolving situation and the government's response is vital. Continue to monitor developments related to the Pakistan Stock Market plunge and its variations for a clearer understanding of the long-term impacts and potential recovery strategies.

Featured Posts

-

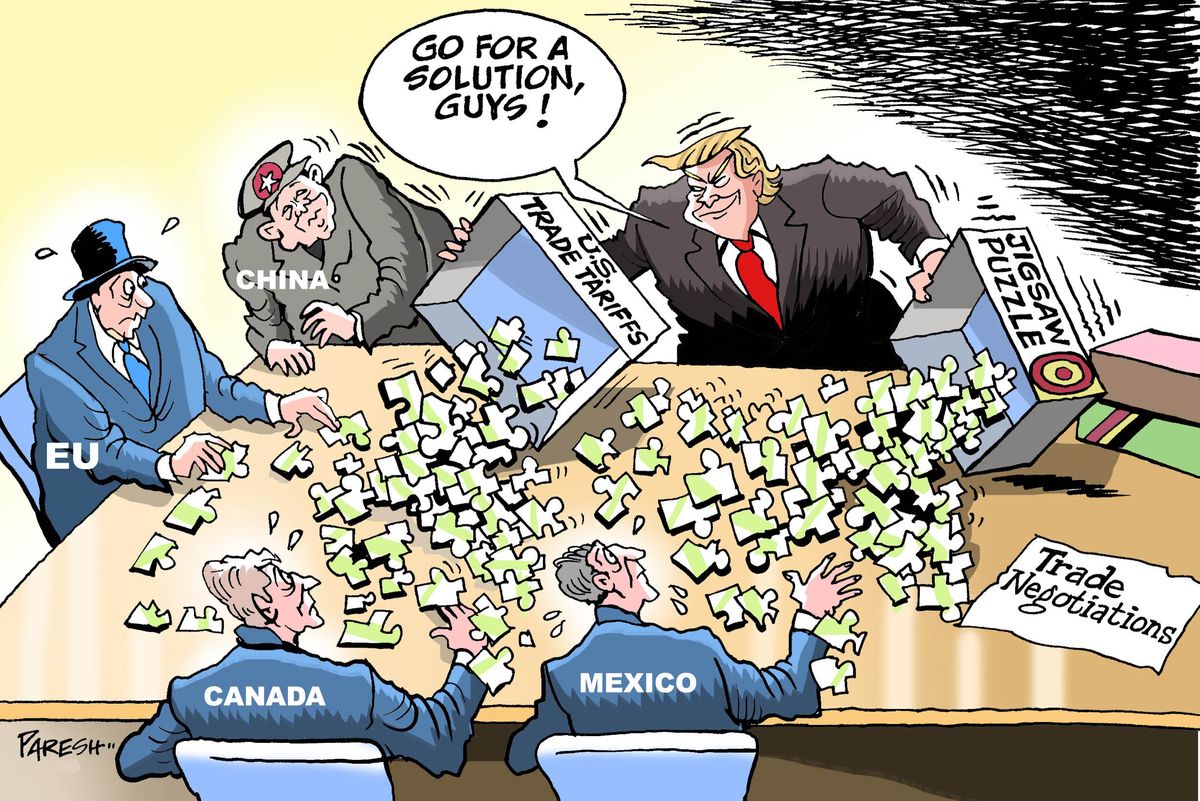

Eus Response To Us Tariffs French Minister Advocates For Further Action

May 10, 2025

Eus Response To Us Tariffs French Minister Advocates For Further Action

May 10, 2025 -

Imf Review Of Pakistans 1 3 Billion Package Tensions With India And Other News

May 10, 2025

Imf Review Of Pakistans 1 3 Billion Package Tensions With India And Other News

May 10, 2025 -

Growth Opportunities Pinpointing The Countrys Hottest Business Areas

May 10, 2025

Growth Opportunities Pinpointing The Countrys Hottest Business Areas

May 10, 2025 -

Invest Smart A Map Of The Countrys Top Business Hot Spots

May 10, 2025

Invest Smart A Map Of The Countrys Top Business Hot Spots

May 10, 2025 -

Dijon Agression Au Lac Kir Trois Blesses Graves

May 10, 2025

Dijon Agression Au Lac Kir Trois Blesses Graves

May 10, 2025