Palantir Stock: Assessing The 30% Drop And Future Potential

Table of Contents

Analyzing the 30% Drop in Palantir Stock

The sharp decline in Palantir's stock price isn't attributable to a single cause but rather a confluence of macroeconomic factors, company-specific challenges, and overall investor sentiment.

Macroeconomic Factors

The broader market downturn significantly impacted Palantir Stock. Several macroeconomic headwinds contributed to this:

- Rising Interest Rates: The Federal Reserve's aggressive interest rate hikes to combat inflation have increased borrowing costs for companies, impacting growth and investor confidence in technology stocks, including Palantir. This has led to a general sell-off across the tech sector, dragging down Palantir Stock along with it.

- Inflation Concerns: Persistent high inflation erodes purchasing power and dampens consumer spending, leading to reduced demand for many products and services, impacting the overall economic outlook and negatively impacting Palantir Stock's valuation.

- General Tech Stock Sell-Off: The tech sector has experienced a significant correction in recent months, with many high-growth technology companies seeing their stock prices decline substantially. Palantir Stock, being a growth stock in the technology sector, has unfortunately been caught in this broader sell-off. This can be seen by comparing the performance of Palantir Stock against the Nasdaq Composite Index.

These macroeconomic factors created a challenging environment for Palantir and contributed significantly to the drop in its stock price.

Company-Specific Challenges

Beyond macroeconomic headwinds, Palantir faces internal challenges impacting its performance and stock value:

- Growth Rate Deceleration: Palantir's revenue growth has slowed compared to previous years, raising concerns among investors about its ability to maintain its high growth trajectory. This deceleration can be partially attributed to the end of the pandemic-driven surge in demand for its services.

- Competition in the Data Analytics Market: Palantir operates in a highly competitive market with established players like AWS, Google Cloud, and Microsoft Azure. These competitors offer similar data analytics solutions, putting pressure on Palantir's pricing and market share.

- Profitability Concerns: Palantir is still striving for sustained profitability. While revenue is growing, the company's operating margins remain under pressure, causing investor concern about its long-term financial sustainability.

- Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts. While these contracts provide stability, over-reliance on them can make the company vulnerable to changes in government spending priorities and procurement processes.

Investor Sentiment and Market Reaction

Negative investor sentiment, fueled by the factors mentioned above, has significantly impacted Palantir Stock.

- Analyst Ratings Downgrades: Several financial analysts have downgraded their ratings on Palantir Stock, citing concerns about growth prospects and profitability. These downgrades further fueled the sell-off.

- Social Media Sentiment: Social media platforms have seen a surge in negative sentiment toward Palantir Stock, contributing to the overall negative market perception.

- Negative News Articles: Several news articles highlighted Palantir's challenges, contributing to a negative narrative that influenced investor decisions. The media often focuses on negative aspects, potentially exaggerating the challenges faced by Palantir Stock.

Evaluating Palantir's Long-Term Potential

Despite the recent drop, Palantir possesses several strengths and has implemented growth strategies that suggest long-term potential.

Strengths and Competitive Advantages

Palantir holds several key advantages in the data analytics market:

- Strong Government Contracts: Palantir maintains strong relationships with various government agencies, providing a stable revenue stream and establishing its reputation for handling sensitive data.

- Proprietary AI Technology: Palantir's Foundry platform leverages proprietary AI and machine learning technologies, offering advanced data analytics capabilities that differentiate it from competitors.

- Growing Commercial Customer Base: While government contracts are important, Palantir is actively expanding its commercial customer base, diversifying its revenue streams and reducing dependence on government spending.

- Focus on Large Enterprise Clients: Palantir targets large enterprises with complex data needs, leading to higher-value contracts and strong customer relationships.

Growth Strategies and Future Outlook

Palantir is actively pursuing various growth strategies:

- New Product Development: Continuous innovation and the launch of new products and features on its Foundry platform are vital to maintaining a competitive edge and attracting new customers.

- Expansion into New Markets: Palantir is actively expanding into new industries and geographical regions to broaden its market reach and capture new growth opportunities.

- Strategic Partnerships: Collaborations with other technology companies can expand Palantir's capabilities and reach a wider audience.

- International Growth: Expanding into international markets offers significant opportunities for revenue growth.

Financial Projections and Analyst Opinions

Financial analysts offer a mixed outlook on Palantir's future performance. While some are optimistic about the company's long-term potential, others express concerns about its ability to achieve profitability and sustainable growth. Their forecasts provide a range of estimates for revenue growth, earnings per share (EPS), and price targets. It's crucial to consider these varying perspectives when assessing Palantir Stock. Refer to reputable financial news sources for the most up-to-date analyst projections.

Conclusion

The 30% drop in Palantir Stock reflects a combination of macroeconomic headwinds and company-specific challenges. While concerns about growth rate deceleration and profitability remain, Palantir's strengths – including its strong government contracts, proprietary technology, and growing commercial customer base – suggest long-term potential. The company's growth strategies, including new product development and market expansion, offer promising avenues for future growth. However, the overall outlook for Palantir Stock remains mixed, and investors should carefully consider all available information before making any investment decisions. Conduct thorough due diligence and consult with a financial advisor before making any investment decisions related to Palantir Stock. The future of Palantir Stock depends on a number of factors, and understanding the risks and potential rewards is crucial for informed investing.

Featured Posts

-

Vu Viec Bao Mau Tat Tre Em Tien Giang De Xuat Giai Phap Phong Ngua Bao Luc Tre Em

May 09, 2025

Vu Viec Bao Mau Tat Tre Em Tien Giang De Xuat Giai Phap Phong Ngua Bao Luc Tre Em

May 09, 2025 -

Bondi Announces Historic Fentanyl Seizure What It Means

May 09, 2025

Bondi Announces Historic Fentanyl Seizure What It Means

May 09, 2025 -

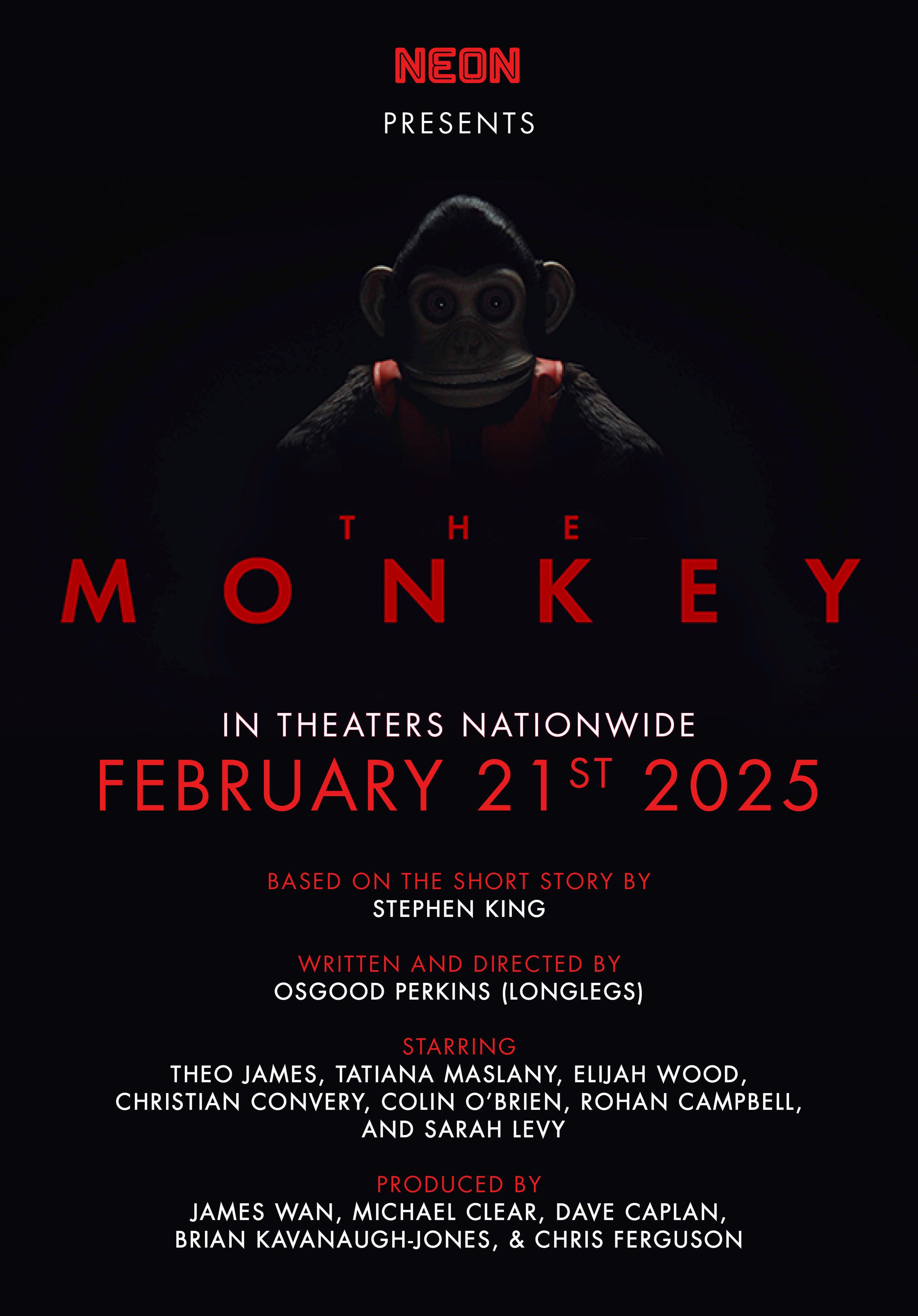

2025 A Potential Banner Year For Stephen King Despite The Monkey Film

May 09, 2025

2025 A Potential Banner Year For Stephen King Despite The Monkey Film

May 09, 2025 -

Madeleine Mc Cann Case Parents Receive Threats Police Investigating

May 09, 2025

Madeleine Mc Cann Case Parents Receive Threats Police Investigating

May 09, 2025 -

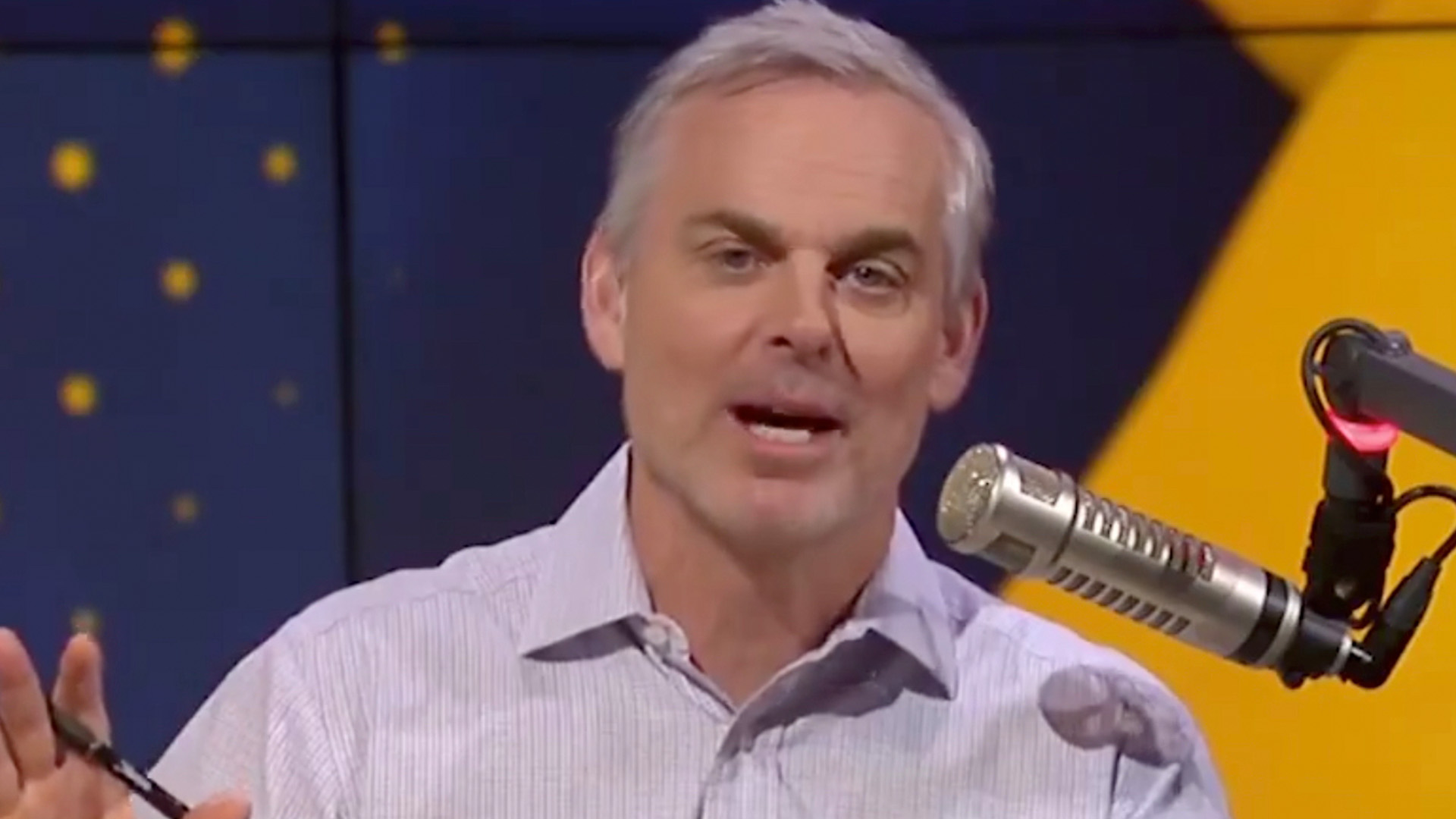

Colin Cowherd Remains Critical Of Jayson Tatum A Deeper Look At The Argument

May 09, 2025

Colin Cowherd Remains Critical Of Jayson Tatum A Deeper Look At The Argument

May 09, 2025