Palantir Stock Before May 5th: Wall Street's Prediction And What It Means For Investors

Table of Contents

Wall Street's Predictions for Palantir Stock Before May 5th

The overall sentiment surrounding Palantir stock before May 5th is cautiously optimistic, leaning slightly towards bullish. While there's no unanimous agreement among analysts, many anticipate a positive movement in the stock price, driven by expectations of strong Q1 2024 earnings and the potential for significant new contract announcements.

Several reputable firms have published their price targets and ratings. For example, while specific details change rapidly, [insert link to Goldman Sachs report if available, otherwise remove this example and any similar examples, replacing with actual links as they become available] Goldman Sachs may have issued a [rating - e.g., buy, hold, sell] rating with a price target of [price]. [Insert link to Morgan Stanley report, if available; again, remove and replace with actual links]. Morgan Stanley might have a similar rating and target, though discrepancies often exist among analysts' forecasts.

- Expected price movement before May 5th: A moderate upward trend is anticipated by many analysts, though the magnitude varies greatly depending on the specific catalyst.

- Reasons behind the predictions: The predictions are primarily based on the anticipation of Palantir's upcoming earnings report, which is expected to showcase continued revenue growth, particularly in the government and commercial sectors. Further, the potential announcement of substantial new contracts could significantly boost investor confidence.

- Potential catalysts impacting stock price: Positive catalysts include exceeding earnings expectations and securing major contracts with large government or commercial clients. Negative catalysts could include missing earnings targets, disappointing contract wins, or a broader market downturn impacting the technology sector.

Analyzing the Factors Influencing Palantir's Stock Price

Several fundamental and technical factors influence Palantir's stock price. Understanding the interplay between these factors is crucial for accurate prediction.

Key Fundamental Factors:

- Recent financial performance: Analyzing Palantir's recent revenue growth, profitability margins, and overall financial health is critical. Strong financial performance generally translates to higher stock prices.

- New product launches and technological advancements: Palantir's ongoing innovation in data analytics and AI-driven solutions is a key driver of its future growth. Successful new product launches can positively impact investor sentiment.

- Government contracts and their impact: A significant portion of Palantir's revenue comes from government contracts. Securing new large-scale contracts is crucial for sustained growth and can significantly influence the stock price.

- Competition in the data analytics market: Palantir faces competition from other established players in the data analytics market. Analyzing the competitive landscape is important for understanding Palantir's market share and future growth potential.

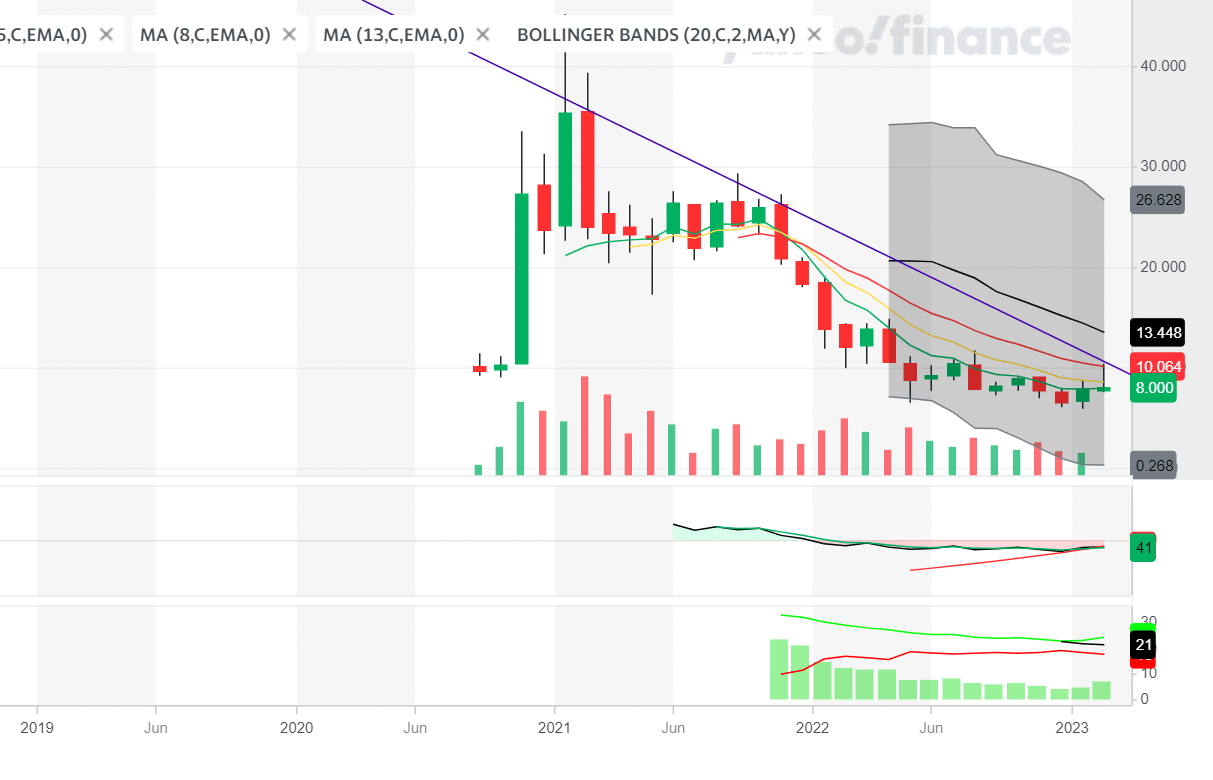

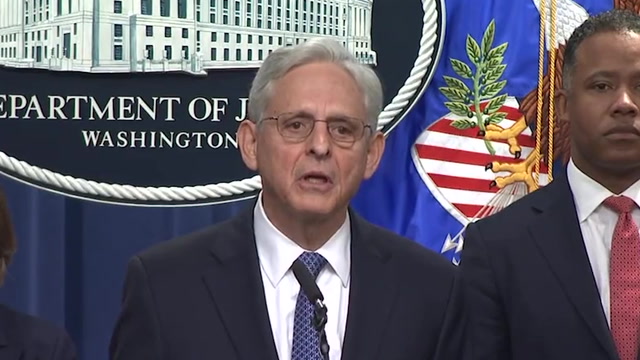

Key Technical Factors:

-

Chart patterns and technical indicators: Analyzing chart patterns, such as moving averages (e.g., 50-day, 200-day), Relative Strength Index (RSI), and other technical indicators can help identify potential support and resistance levels, predicting future price movements.

-

Trading volume and volatility: High trading volume often indicates strong investor interest, which can lead to price fluctuations. High volatility suggests a greater potential for significant price swings.

-

Support and resistance levels: Identifying these key levels on the chart can help investors gauge potential price reversals or breakouts.

-

Interplay between fundamental and technical analysis: Fundamental analysis assesses the intrinsic value of Palantir, while technical analysis focuses on price trends and patterns. Combining both approaches provides a more comprehensive perspective on potential price movements.

-

Significant news or events: Any unexpected news, such as a major contract award or a regulatory change, could significantly impact Palantir's stock price before May 5th.

Risk Assessment and Investment Strategies

Investing in Palantir involves inherent risks. The stock price can be volatile, influenced by market sentiment, macroeconomic conditions, and company-specific news.

Potential Investment Strategies:

-

Buy and hold strategy: This long-term strategy involves buying Palantir shares and holding them for an extended period, regardless of short-term price fluctuations. This strategy suits investors with a high risk tolerance and a long-term investment horizon.

-

Short-term trading strategy: This strategy involves buying and selling Palantir shares frequently to profit from short-term price movements. This strategy is riskier but can yield higher returns if executed successfully. Requires significant market knowledge.

-

Dollar-cost averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of the stock price. This approach mitigates risk by reducing the impact of volatility.

-

Benefits and drawbacks: Each strategy has its advantages and disadvantages. Buy and hold is less time-consuming but exposes the investor to greater long-term risk. Short-term trading requires significant market knowledge and time commitment but offers the potential for quick profits. Dollar-cost averaging reduces risk but may yield lower returns in a continuously rising market.

-

Portfolio diversification: Diversifying your portfolio by investing in other assets, such as bonds or other stocks, can help mitigate the risk associated with investing in a single stock like Palantir.

-

Thorough due diligence: Always conduct thorough research and consider seeking advice from a qualified financial advisor before making any investment decisions.

Alternative Investment Options in the Data Analytics Sector

Investors seeking diversification within the data analytics sector may consider alternatives like Snowflake (SNOW) or Datadog (DDOG). Snowflake offers cloud-based data warehousing solutions, while Datadog focuses on monitoring and analytics for cloud-scale applications. Each offers different strengths and weaknesses compared to Palantir, presenting diverse investment opportunities. Thorough research is necessary to evaluate their suitability for your portfolio.

Conclusion

Predicting Palantir's stock price before May 5th involves analyzing various factors, including Wall Street's predictions, the company's fundamental performance, and prevailing market trends. While analysts generally hold a cautiously optimistic outlook, significant uncertainty remains. Careful risk assessment and diversification are crucial. Before making any investment decisions regarding Palantir stock before May 5th, conduct your own thorough research and consider consulting with a financial advisor. Remember, understanding Wall Street's predictions for Palantir stock is only one piece of the puzzle. Careful analysis and informed decision-making are crucial for successful investing.

Featured Posts

-

International Transgender Day Of Visibility 3 Ways To Be A Better Ally

May 10, 2025

International Transgender Day Of Visibility 3 Ways To Be A Better Ally

May 10, 2025 -

Melanie Eiffel L Influence Maternelle Sur La Reussite De Gustave Eiffel A Dijon

May 10, 2025

Melanie Eiffel L Influence Maternelle Sur La Reussite De Gustave Eiffel A Dijon

May 10, 2025 -

Remembering Americas First Nonbinary Person A Life Cut Short

May 10, 2025

Remembering Americas First Nonbinary Person A Life Cut Short

May 10, 2025 -

Car Dealers Renew Fight Against Electric Vehicle Mandates

May 10, 2025

Car Dealers Renew Fight Against Electric Vehicle Mandates

May 10, 2025 -

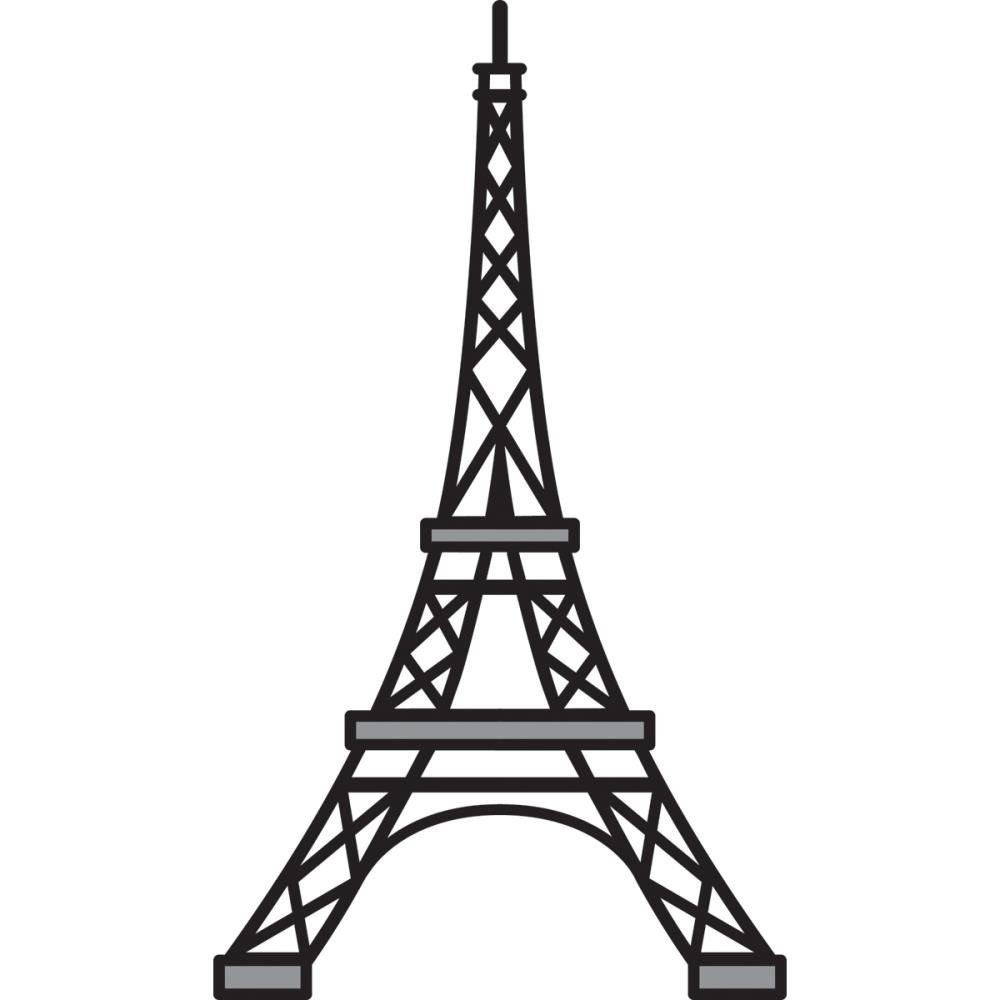

Why Is The Us Attorney General On Fox News Daily A More Important Question Than The Epstein Case

May 10, 2025

Why Is The Us Attorney General On Fox News Daily A More Important Question Than The Epstein Case

May 10, 2025