Palantir Stock: Buy Or Sell? A Detailed Market Evaluation

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir operates primarily through two core platforms: Gotham and Foundry. Gotham, designed for government agencies, focuses on national security and intelligence applications. Foundry, its commercial platform, targets large enterprises across various sectors. These platforms provide data integration, analytics, and operational efficiency tools.

-

Target Markets: Gotham's success is largely tied to its strong presence in the government sector, securing substantial long-term contracts. Foundry, on the other hand, is focused on expanding its presence in the commercial market, targeting financial services, healthcare, and other data-intensive industries. This diversification is key to Palantir's long-term growth strategy.

-

Revenue Growth and Drivers: Palantir has demonstrated consistent revenue growth, driven by increased adoption of its platforms. Key drivers include the increasing demand for data analytics solutions across both government and commercial sectors, the growing need for efficient data management, and Palantir's ability to secure large, multi-year contracts.

-

Key Revenue Aspects:

- Government Contracts: These contracts provide revenue stability, although they can be subject to budgetary fluctuations and political changes.

- Commercial Adoption: The growth rate of commercial contracts is a crucial indicator of Palantir's long-term success and potential for diversification.

- Recurring Revenue: Palantir's transition to a recurring revenue model, through software licenses and support services, improves predictability and enhances long-term profitability.

- Geographic Diversification: Expanding into new geographic markets reduces reliance on specific regions and mitigates risk.

Financial Performance and Valuation

Analyzing Palantir's financial performance requires examining key metrics such as revenue growth, profit margins, and cash flow. While Palantir has shown impressive revenue growth, its path to sustainable profitability is a key consideration for investors.

-

Key Financial Metrics: Investors should focus on the revenue growth rate, operating margins, free cash flow generation, and the overall trajectory of profitability. A careful analysis of these metrics provides insights into the financial health and sustainability of Palantir's business.

-

Valuation Analysis: Comparing Palantir's valuation (e.g., Price-to-Earnings ratio or P/E ratio) to its competitors in the big data analytics market is essential. This comparison helps assess whether Palantir is overvalued or undervalued relative to its peers.

-

Specific Financial Considerations:

- P/E Ratio: A comparison of Palantir's P/E ratio with competitors like Snowflake or Databricks provides a benchmark for valuation.

- Revenue Growth Sustainability: Analyzing the sustainability of Palantir's revenue growth is crucial in assessing its long-term prospects.

- Debt Levels: Investors should examine Palantir's debt levels and their potential impact on the company's financial health.

- Free Cash Flow: The generation of free cash flow is a key indicator of a company's financial strength and ability to invest in future growth.

Competitive Landscape and Market Position

Palantir operates in a competitive market dominated by other big data analytics companies. Understanding Palantir's competitive advantages and disadvantages is crucial in evaluating its long-term market share and profitability.

-

Key Competitors: Palantir faces competition from established players like AWS, Snowflake, and Databricks, each offering different strengths and focusing on various market segments.

-

Competitive Advantages & Disadvantages: Palantir's strengths lie in its proprietary technology, strong relationships with government agencies, and its focus on complex data integration and analytics. However, its high pricing and dependence on large contracts represent potential weaknesses.

-

Market Share & Trends: The increasing adoption of cloud-based data analytics platforms and the growing competition pose challenges to Palantir's market share. Analyzing market trends and their impact on Palantir's position is vital for investment decision-making.

Growth Prospects and Future Outlook

Palantir's future prospects depend on its ability to execute its strategic initiatives and capitalize on the long-term growth potential of the big data and analytics market. However, significant risks and uncertainties remain.

-

Strategic Initiatives: Palantir's growth plans involve expanding into new markets, investing heavily in research and development, and potentially pursuing strategic partnerships or acquisitions.

-

Market Potential: The big data and analytics market is expected to experience significant growth in the coming years, presenting opportunities for Palantir.

-

Risks & Uncertainties: Geopolitical factors, increased competition, and the potential for regulatory changes represent significant risks that could impact Palantir's business.

Risks and Considerations for Investors

Investing in Palantir stock involves significant risks. Understanding these risks and developing a risk management strategy is essential for informed investment decisions.

- Potential Risks:

- Valuation Risk: The risk of Palantir's stock being overvalued relative to its fundamentals.

- Competition Risk: The risk of losing market share to competitors.

- Regulatory Risk: The risk of facing increased regulatory scrutiny or changes in government regulations.

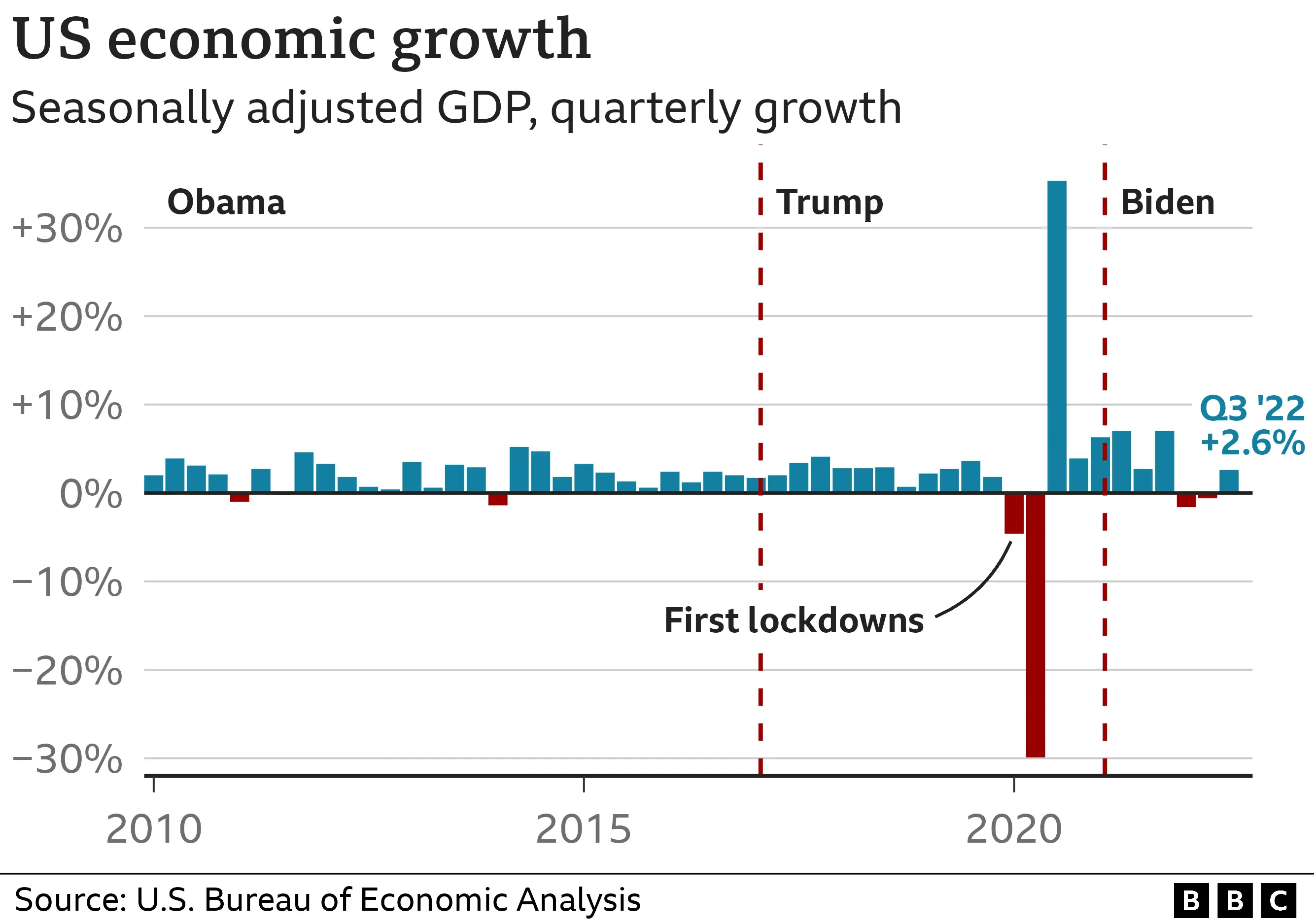

- Economic Risk: The risk of reduced demand for Palantir's services due to economic downturns.

Conclusion

This detailed evaluation of Palantir stock provides a comprehensive overview of the factors influencing its performance. While Palantir presents significant growth potential in the rapidly expanding big data and analytics market, investors should carefully consider the inherent risks involved before making any investment decisions. Ultimately, whether to buy, sell, or hold Palantir stock depends on your individual investment strategy, risk tolerance, and long-term outlook. Conduct thorough due diligence and consult with a financial advisor before making any investment decisions regarding Palantir stock. Remember to regularly review your investment in Palantir stock and adjust your strategy based on market changes and the company's performance.

Featured Posts

-

Analyzing The Trump Presidency A Focus On May 8th 2025 Day 109

May 09, 2025

Analyzing The Trump Presidency A Focus On May 8th 2025 Day 109

May 09, 2025 -

Stricter Uk Visa Rules Addressing Work And Student Visa Abuse

May 09, 2025

Stricter Uk Visa Rules Addressing Work And Student Visa Abuse

May 09, 2025 -

Young Thug Vows Fidelity To Mariah The Scientist In Leaked Snippet

May 09, 2025

Young Thug Vows Fidelity To Mariah The Scientist In Leaked Snippet

May 09, 2025 -

Jayson Tatums Journey From Grooming To Confidence To Coaching Success

May 09, 2025

Jayson Tatums Journey From Grooming To Confidence To Coaching Success

May 09, 2025 -

Metas 168 Million Whats App Spyware Settlement What It Means For Users And The Company

May 09, 2025

Metas 168 Million Whats App Spyware Settlement What It Means For Users And The Company

May 09, 2025