Palantir Stock: Buy, Sell, Or Hold? A Detailed Evaluation

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir Technologies operates primarily through two platforms: Gotham, focused on government contracts, and Foundry, targeting the commercial sector. Understanding these revenue streams is crucial for assessing Palantir stock's potential.

Government Contracts

Palantir has historically relied heavily on government contracts for a significant portion of its revenue. This reliance presents both opportunities and challenges for long-term growth.

- Percentage of revenue from government contracts: While Palantir is actively diversifying, government contracts still constitute a substantial portion of their overall revenue. Analyzing the exact percentage year-over-year is key to understanding this aspect of Palantir stock's performance.

- Recent contract wins and losses: Tracking recent contract wins and losses provides valuable insights into Palantir's ability to secure and retain government business. Analyzing these trends helps predict future revenue streams.

- Potential risks associated with government funding cycles: Government funding can be unpredictable, subject to political changes and budget constraints. This volatility introduces risk to Palantir stock's stability. Understanding the potential impact of these cycles is essential.

- Keyword variations: Palantir government contracts, Palantir revenue sources, government spending on data analytics, Palantir Gotham platform.

Commercial Sector Growth

Palantir's expansion into the commercial sector is a critical factor in determining the long-term viability of Palantir stock. Success in this area is vital for reducing reliance on government contracts.

- Key commercial clients: Identifying key commercial clients reveals the breadth and depth of Palantir's reach within the private sector. The reputation and financial stability of these clients impact investment risk.

- Growth in commercial revenue: Monitoring the year-over-year growth of commercial revenue is essential for gauging the success of Palantir's commercial strategy. This is a critical factor for assessing the future of Palantir stock.

- Challenges faced in the commercial market: Competition in the commercial data analytics market is fierce. Understanding the challenges Palantir faces in acquiring and retaining clients in this sector is crucial.

- Keyword variations: Palantir commercial clients, Palantir commercial growth, Palantir private sector, Palantir Foundry platform.

Data Analytics and Platform as a Service (PaaS)

Palantir's core technology, its data analytics platforms, provides its competitive advantage. Understanding its unique selling propositions is critical for evaluating Palantir stock.

- Unique selling propositions: Palantir's platforms offer unique capabilities in data integration, analysis, and visualization. Identifying these key differentiators is crucial in understanding Palantir's competitive edge.

- Technological innovation: Palantir's ongoing investment in research and development indicates its commitment to staying ahead of the competition. Assessing their innovation pipeline helps predict future growth.

- Competition in the data analytics market: The data analytics market is crowded with established players. Understanding the competitive landscape and Palantir's position within it is crucial for evaluating Palantir stock.

- Keyword variations: Palantir Foundry, Palantir Gotham, data analytics software, Palantir technology, Palantir platform.

Financial Performance and Valuation

Analyzing Palantir's financial performance and valuation is critical for making an informed investment decision about Palantir stock.

Revenue Growth and Profitability

Historical and projected financial performance dictates the future potential of Palantir stock.

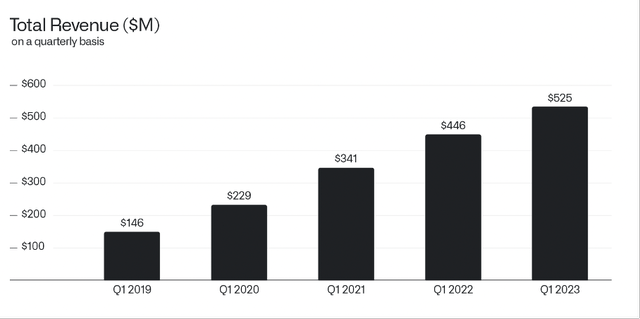

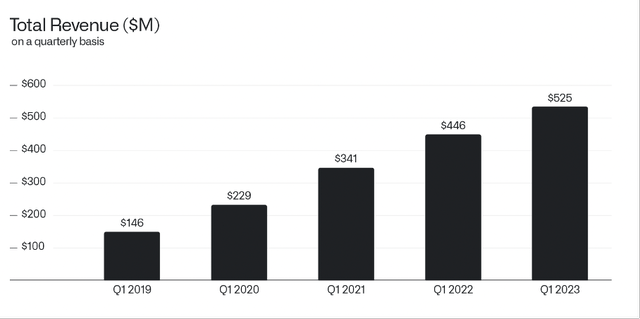

- Year-over-year revenue growth: Analyzing year-over-year revenue growth reveals the trajectory of Palantir's business. Consistent growth is a positive sign for investors.

- Profitability margins: Examining profitability margins provides insights into the efficiency of Palantir's operations and its ability to generate profits.

- Debt levels: Understanding Palantir's debt levels helps assess its financial health and risk profile. High debt levels can pose a risk to the company's stability.

- Keyword variations: Palantir financial statements, Palantir earnings, Palantir stock price, Palantir profitability.

Stock Valuation and Price-to-Earnings Ratio (P/E)

Comparing Palantir's valuation to its competitors and industry benchmarks is crucial for making informed investment decisions.

- Current stock price: The current stock price reflects the market's perception of Palantir's value.

- P/E ratio: The price-to-earnings ratio (P/E) helps determine if the stock is overvalued or undervalued relative to its earnings.

- Comparison with industry peers: Comparing Palantir's valuation to that of its competitors provides context and helps assess whether the stock is fairly priced.

- Keyword variations: Palantir stock valuation, Palantir P/E ratio, Palantir stock price prediction, Palantir stock analysis.

Risks and Challenges

Investing in Palantir stock involves understanding inherent risks and potential challenges.

Competition and Market Saturation

The data analytics market is highly competitive, posing significant challenges to Palantir's growth.

- Key competitors: Identifying Palantir's key competitors helps understand the competitive landscape and the potential for market share erosion.

- Market share analysis: Analyzing Palantir's market share and its growth trajectory provides insights into its competitiveness.

- Potential for disruption: The data analytics market is dynamic, with potential for disruptive technologies to emerge and challenge Palantir's position.

- Keyword variations: Palantir competitors, data analytics competition, Palantir market share, Palantir competitive advantage.

Geopolitical Risks

Palantir's operations are susceptible to geopolitical events and regulatory changes.

- Dependence on specific regions: Understanding Palantir's dependence on specific regions highlights potential risks associated with geopolitical instability or sanctions.

- Impact of international relations: Changes in international relations can significantly impact Palantir's business, especially its government contracts.

- Potential for sanctions: The potential for sanctions or trade restrictions can negatively impact Palantir's operations and profitability.

- Keyword variations: Palantir geopolitical risk, Palantir international expansion, Palantir sanctions, Palantir regulatory risk.

Future Outlook and Growth Potential

Evaluating Palantir's future prospects is critical for assessing Palantir stock's long-term investment potential.

Growth Strategies and Innovation

Palantir's continued investment in research and development, strategic partnerships and expansion into new markets will determine its future success.

- New product launches: Analyzing new product launches and their market acceptance indicates Palantir's innovation and ability to adapt to market demands.

- Expansion into new markets: Evaluating Palantir's expansion into new markets and its success in these areas is essential for assessing its long-term growth potential.

- Strategic partnerships: Strategic partnerships can provide Palantir with access to new technologies, markets, and resources. Analyzing the impact of these partnerships is crucial.

- Keyword variations: Palantir future growth, Palantir innovation, Palantir strategic initiatives, Palantir new products.

Long-Term Investment Potential

Assessing the long-term investment prospects of Palantir stock requires careful consideration of the company's growth potential and associated risks.

- Potential for long-term growth: Based on its technology, market position, and growth strategies, evaluate the potential for long-term growth.

- Risks versus rewards: Weighing the potential rewards against the inherent risks is essential for determining whether Palantir stock aligns with your risk tolerance.

- Investment recommendations: Based on your analysis, formulate a personal recommendation: buy, sell, or hold Palantir stock. Remember, this is not financial advice; conduct thorough research before making any investment decisions.

- Keyword variations: Palantir long-term outlook, Palantir investment strategy, Palantir stock forecast, Palantir stock buy or sell.

Conclusion

This detailed evaluation of Palantir stock highlights its strengths and weaknesses. While its innovative technology and growing commercial presence offer potential, significant risks remain, particularly concerning its reliance on government contracts and intense competition. Whether to buy, sell, or hold Palantir stock ultimately depends on your individual risk tolerance and investment horizon. Conduct thorough due diligence and consider seeking professional financial advice before making any investment decisions regarding Palantir stock. Remember to carefully analyze the factors discussed above before making your own informed decision on whether to buy, sell, or hold this intriguing technology stock.

Featured Posts

-

Treiler Materialists Ntakota Tzonson Pedro Paskal Kai Kris Evans Se Romantiki Komodia

May 09, 2025

Treiler Materialists Ntakota Tzonson Pedro Paskal Kai Kris Evans Se Romantiki Komodia

May 09, 2025 -

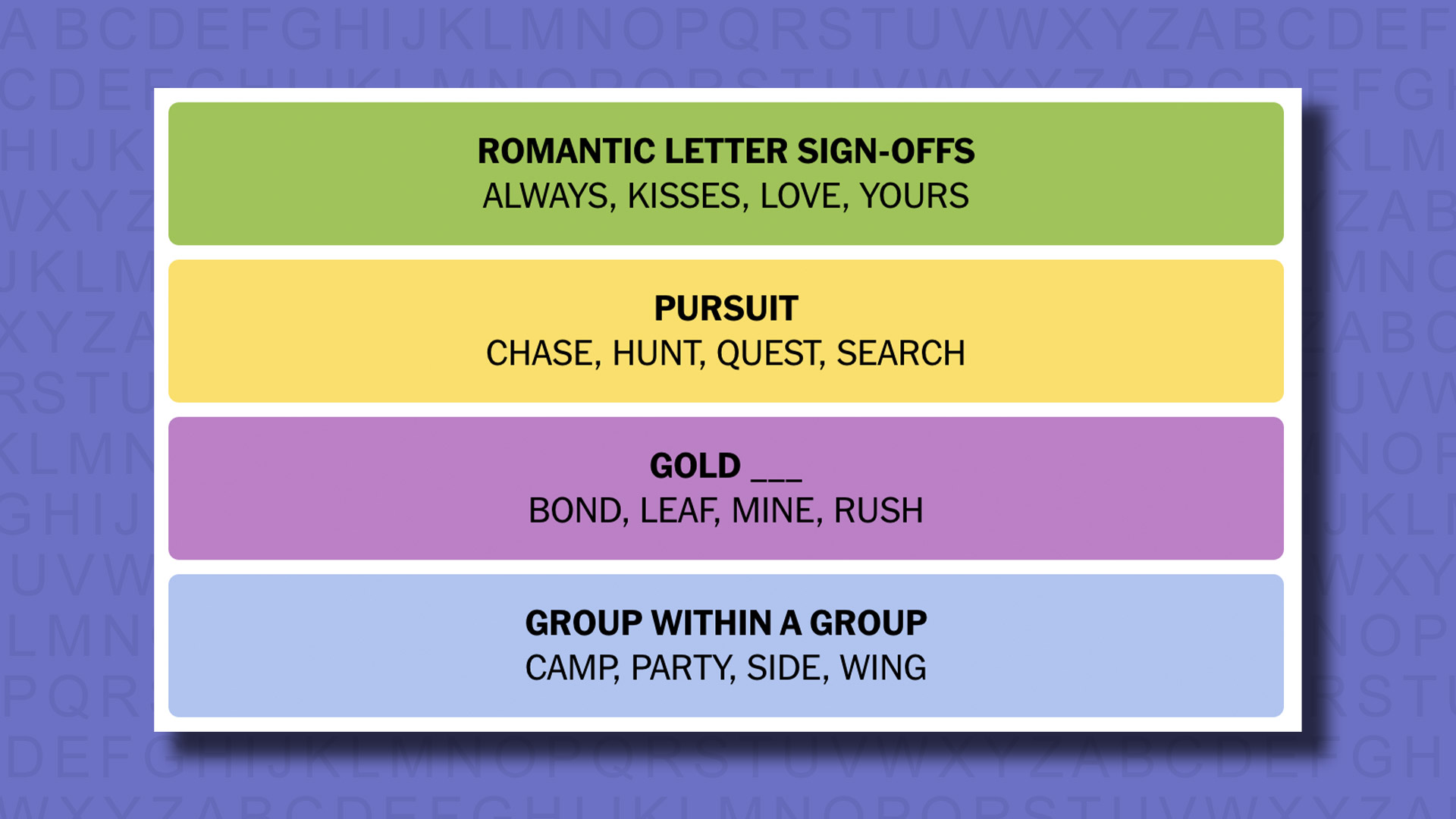

Nyt Strands Game 374 Hints And Solutions For Wednesday March 12

May 09, 2025

Nyt Strands Game 374 Hints And Solutions For Wednesday March 12

May 09, 2025 -

Broadcoms V Mware Acquisition A 1 050 Price Hike For At And T

May 09, 2025

Broadcoms V Mware Acquisition A 1 050 Price Hike For At And T

May 09, 2025 -

Jayson Tatum Grooming Confidence And His Coach A Full Circle Moment

May 09, 2025

Jayson Tatum Grooming Confidence And His Coach A Full Circle Moment

May 09, 2025 -

National 2 Victoire De Concarneau A Dijon 0 1 28eme Journee

May 09, 2025

National 2 Victoire De Concarneau A Dijon 0 1 28eme Journee

May 09, 2025