Palantir Stock: Buy The Dip After 30% Fall?

Table of Contents

Understanding Palantir's Recent Stock Decline

The recent 30% drop in Palantir stock price can be attributed to several converging factors. The broader tech sell-off, fueled by concerns about rising interest rates and inflation, has significantly impacted growth stocks like Palantir. Additionally, investors are scrutinizing the company's profitability and revenue growth, leading to some uncertainty.

- Market correction impacting growth stocks: The overall market downturn has disproportionately affected high-growth companies like Palantir, which often trade at higher valuations. This PLTR stock analysis highlights the susceptibility of growth stocks to market corrections.

- Concerns about profitability and revenue growth: While Palantir demonstrates strong revenue growth, concerns remain about its path to sustained profitability. Investors are carefully assessing the company's operational efficiency and its ability to translate revenue into profits.

- Increased competition in the big data analytics market: The big data analytics market is becoming increasingly competitive, with established players and new entrants vying for market share. This intensifies the pressure on Palantir to maintain its competitive edge and secure new contracts.

- Impact of geopolitical events: Geopolitical uncertainty and potential disruptions to global supply chains can also influence investor sentiment towards technology companies like Palantir, impacting the PLTR stock performance.

Analyzing Palantir's Long-Term Potential

Despite the recent stock price decline, Palantir possesses significant long-term potential. Its core business focuses on providing advanced data analytics and artificial intelligence (AI) solutions to both government and commercial clients. This dual-market approach provides a degree of diversification and resilience.

- Strong government contracts and partnerships: Palantir maintains substantial contracts with government agencies, providing a stable revenue stream and a strong foundation for future growth. These government partnerships often involve long-term commitments, mitigating short-term market fluctuations.

- Growing commercial client base: Palantir is actively expanding its commercial client base, demonstrating its ability to adapt and compete in a broader market. This expansion signifies a potential for increased revenue diversification and less reliance on government contracts.

- Innovation in big data analytics and artificial intelligence: Palantir continues to invest heavily in research and development, pushing the boundaries of big data analytics and artificial intelligence. This commitment to innovation is crucial for maintaining a competitive edge in a rapidly evolving technological landscape.

- Potential for disruptive technologies: Palantir's technology has the potential to disrupt various industries, creating new opportunities for growth and expansion. Its advanced data analytics capabilities could revolutionize sectors like healthcare, finance, and supply chain management.

Evaluating the Risk vs. Reward of Investing in Palantir

Investing in Palantir stock at its current price presents a classic high-risk, high-reward scenario. While the potential for significant gains is undeniable, given the company's innovative technology and growth potential, the stock's volatility necessitates a careful risk assessment.

- High risk, high reward investment: PLTR stock is inherently volatile, reflecting the risks and uncertainties associated with growth stocks in the technology sector. This volatility also presents opportunities for significant returns.

- Volatility inherent in growth stocks: Investors should understand that growth stocks like Palantir are generally more volatile than established, mature companies. This volatility is a double-edged sword, capable of delivering substantial gains but also significant losses.

- Potential for significant gains if the company meets expectations: If Palantir successfully executes its strategic plans and meets or exceeds market expectations, the potential for substantial returns is significant. This depends on their ability to navigate competitive pressures and maintain their growth trajectory.

- Importance of diversification in your portfolio: Diversification is crucial when investing in volatile stocks like Palantir. It's recommended to spread your investments across different asset classes to mitigate potential losses. This PLTR risk assessment emphasizes the importance of a well-diversified portfolio.

Comparing Palantir to Competitors

Palantir operates in a competitive landscape, facing competition from established players like Databricks and Snowflake, as well as emerging startups. However, Palantir possesses unique strengths that differentiate it from its rivals.

- Comparison with companies like Databricks, Snowflake, etc.: While competitors offer similar big data analytics solutions, Palantir's focus on complex government contracts and its proprietary technology gives it a unique position in the market. This competitive analysis highlights Palantir's niche strengths.

- Palantir's unique selling propositions (USPs): Palantir's platform's user-friendliness, its strong government relationships, and its ability to handle extremely large and complex datasets provide a crucial competitive advantage. This is particularly valuable for government and enterprise clients who require sophisticated data security and analysis.

- Competitive landscape analysis: The big data analytics market is dynamic and competitive. However, Palantir's unique offerings and focus on specific niche markets give it a fighting chance to maintain its market share and continue growing.

Conclusion

Should you buy the dip in Palantir stock? The decision hinges on your personal risk tolerance and investment objectives. While Palantir’s long-term potential is undeniable, given its innovative technology, strong government contracts, and expanding commercial reach, the stock’s inherent volatility presents a substantial risk. The current PLTR stock price, following a 30% decline, might present a buying opportunity for high-risk investors who believe in the company's future, but thorough due diligence and a well-diversified investment strategy remain crucial. Conduct thorough research and consider consulting a financial advisor before making any investment decisions regarding Palantir stock (PLTR).

Featured Posts

-

From Wolves Reject To European Champion The Rise Of A Football Star

May 10, 2025

From Wolves Reject To European Champion The Rise Of A Football Star

May 10, 2025 -

Transgender Voices Impact Of Trump Administration Policies

May 10, 2025

Transgender Voices Impact Of Trump Administration Policies

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban A Comprehensive Analysis

May 10, 2025

The Impact Of Trumps Transgender Military Ban A Comprehensive Analysis

May 10, 2025 -

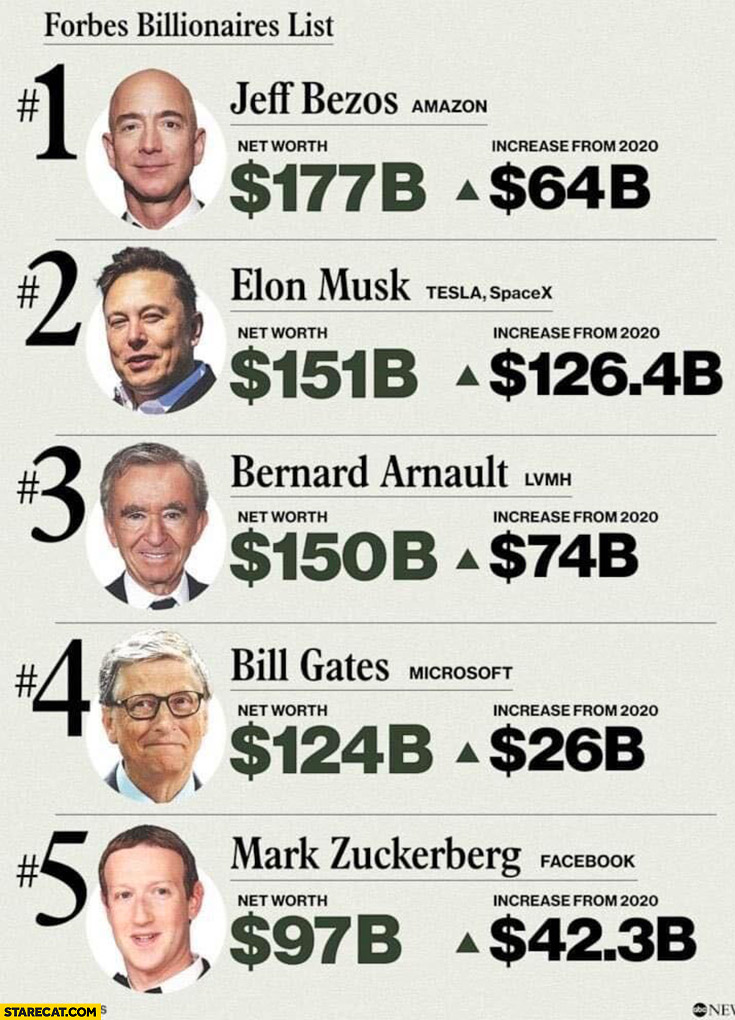

Trumps Tariffs 174 Billion Hit To Top 10 Billionaires Net Worth

May 10, 2025

Trumps Tariffs 174 Billion Hit To Top 10 Billionaires Net Worth

May 10, 2025 -

La Fires Fuel Housing Crisis Landlord Price Gouging Claims Investigated

May 10, 2025

La Fires Fuel Housing Crisis Landlord Price Gouging Claims Investigated

May 10, 2025