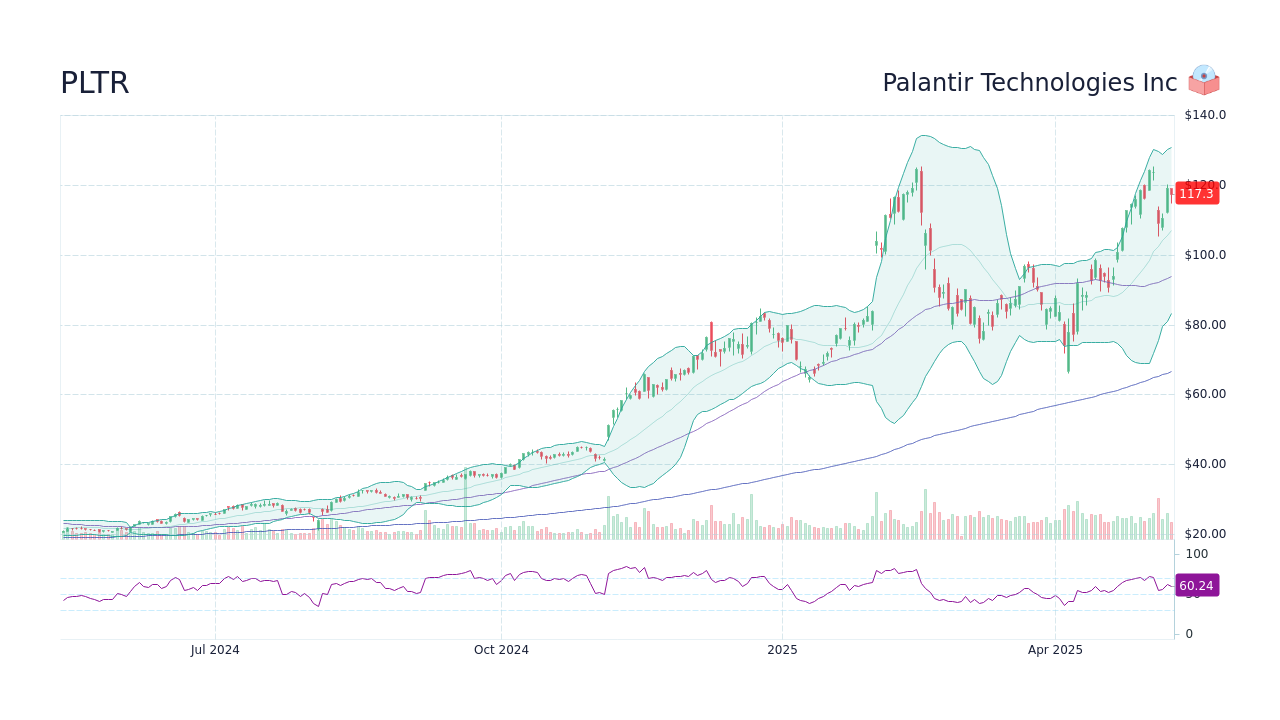

Palantir Stock Forecast Revised: A Deep Dive Into The Market Shift

Table of Contents

Analyzing Palantir's Recent Performance and Financial Health

Understanding Palantir's current financial health is crucial for any accurate Palantir stock forecast. We'll examine key performance indicators (KPIs) and assess the balance between government contracts and commercial growth.

Revenue Growth and Key Performance Indicators (KPIs)

Palantir's recent financial reports paint a mixed picture. While revenue growth has been positive, the pace has varied. Let's examine some key data points:

- Year-over-Year (YoY) Revenue Growth: Analyzing the YoY growth percentage reveals the company's overall growth trajectory. A consistent increase suggests strong performance, while slowing growth warrants closer examination.

- Net Income: Profitability is key. Tracking net income helps investors understand Palantir's ability to generate profits from its operations. A positive and growing net income is a positive sign.

- Operating Margin: The operating margin indicates Palantir's efficiency in managing its operations. An improving operating margin signals increased profitability.

Comparing these figures to previous quarters and analyst expectations provides valuable context. Significant deviations from expectations can impact the Palantir stock price and should be factored into any forecast. Analyzing Palantir financials requires a thorough understanding of these metrics.

Government Contracts and Commercial Growth

Palantir's revenue stream is diversified across government contracts and commercial clients. The balance between these two sectors impacts its overall financial health and future prospects:

- Revenue Breakdown: Understanding the percentage of revenue derived from each sector is essential. A heavy reliance on government contracts might introduce vulnerability to budget cuts or policy changes.

- Contract Renewals: The successful renewal of existing government contracts is crucial for revenue stability. A high renewal rate suggests strong client satisfaction and a lower risk profile.

- Commercial Market Expansion: Palantir's success in expanding its commercial client base indicates its ability to adapt to different market needs and potentially increase revenue diversification.

A successful Palantir stock forecast needs to account for the dynamic interplay between these two crucial revenue streams.

Assessing the Impact of Macroeconomic Factors

Macroeconomic factors significantly influence the Palantir stock price and investment attractiveness. Understanding these factors is vital for a reliable Palantir stock forecast.

Inflation and Interest Rate Hikes

Rising inflation and interest rates create headwinds for many businesses, including Palantir:

- Investor Sentiment: High inflation and interest rates can negatively affect investor sentiment, leading to a decrease in stock valuations.

- Valuation Multiples: Increased interest rates can lower the present value of future earnings, impacting valuation multiples used in stock pricing models.

- Government and Commercial Spending: Higher interest rates can curb government and commercial spending, potentially reducing demand for Palantir's services. This is a critical aspect to consider for any Palantir stock prediction.

Investors should also assess alternative investment opportunities with potentially higher returns given the current macroeconomic environment.

Geopolitical Uncertainty and its Influence

Geopolitical instability can significantly impact Palantir's business and stock performance:

- Global Uncertainty: Events such as the war in Ukraine introduce uncertainty into global markets, making it difficult to predict future demand for Palantir's services.

- Supply Chain Disruptions: Geopolitical events can disrupt global supply chains, potentially affecting Palantir's operational costs and profitability.

- Increased Demand: Conversely, some geopolitical events could increase demand for Palantir’s data analytics and security solutions, especially from governmental clients.

Understanding these geopolitical risks and opportunities is crucial for a comprehensive Palantir stock forecast.

Revised Palantir Stock Price Prediction and Valuation

Based on the analysis above, we can now offer a revised Palantir stock price prediction.

Methodology and Assumptions

Our revised Palantir stock forecast utilizes a combination of valuation models, including discounted cash flow (DCF) analysis and comparable company analysis. Our assumptions include:

- Revenue Growth Rates: We project future revenue growth based on historical trends, considering macroeconomic factors and Palantir's expansion plans.

- Profitability Margins: We project future profitability margins based on historical trends and anticipated cost management strategies.

- Discount Rate: The discount rate reflects the risk associated with investing in Palantir stock and is influenced by prevailing interest rates and market conditions.

It is crucial to understand that these are assumptions, and the actual outcomes might deviate. Our Palantir stock price prediction has limitations inherent to financial forecasting.

Target Price and Potential Upside/Downside

Based on our analysis, our revised target price for Palantir stock is [Insert Target Price Range Here]. This represents a [Percentage] increase/decrease from the current price.

- Upside Potential: The upside potential depends on factors such as faster-than-expected revenue growth, successful expansion into new markets, and improved profitability.

- Downside Risk: Downside risks include slower-than-expected revenue growth, increased competition, and adverse macroeconomic conditions. This range reflects a probability-weighted assessment of these potential outcomes.

Conclusion: The Future of Palantir Stock: A Refined Forecast

This revised Palantir stock forecast highlights the importance of considering both Palantir's financial performance and the evolving macroeconomic and geopolitical landscape. While the company demonstrates potential for growth, significant risks remain. The target price range reflects the inherent uncertainty in forecasting future stock performance. Our key takeaways emphasize the need for continuous monitoring of Palantir financials, the impact of macroeconomic factors, and the company’s ability to navigate geopolitical uncertainties.

Stay informed on the evolving Palantir stock forecast by conducting your own research and regularly reviewing updated financial reports and market analyses. Remember, this forecast is for informational purposes only and should not be considered financial advice. Make informed investment decisions based on your own due diligence and risk tolerance. Continue your research on Palantir stock and stay updated on the latest developments to make sound investment choices.

Featured Posts

-

Ai In The Public Sector The Implications Of Palantirs Nato Agreement

May 10, 2025

Ai In The Public Sector The Implications Of Palantirs Nato Agreement

May 10, 2025 -

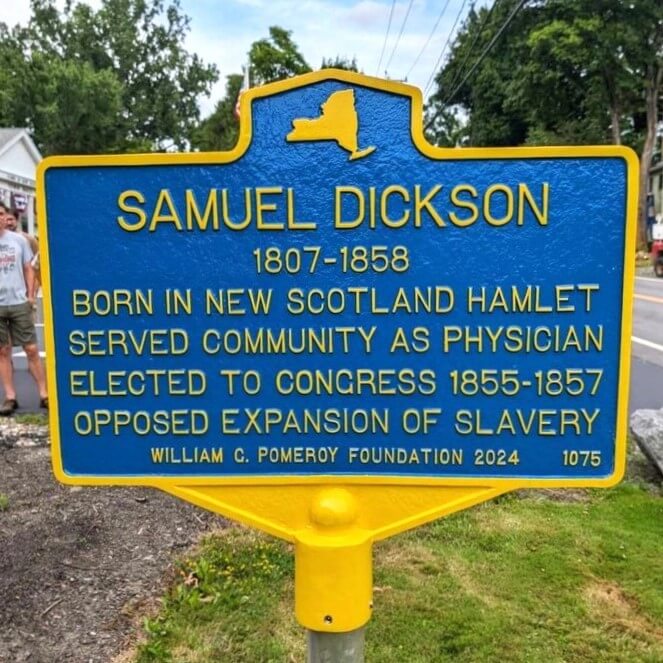

Samuel Dickson A Canadian Lumber Barons Legacy

May 10, 2025

Samuel Dickson A Canadian Lumber Barons Legacy

May 10, 2025 -

Pam Bondi On Epstein Diddy Jfk And Mlk Documents Release Imminent

May 10, 2025

Pam Bondi On Epstein Diddy Jfk And Mlk Documents Release Imminent

May 10, 2025 -

Dijon Vehicule Lance Contre Un Mur Rue Michel Servet Le Conducteur Se Denonce

May 10, 2025

Dijon Vehicule Lance Contre Un Mur Rue Michel Servet Le Conducteur Se Denonce

May 10, 2025 -

Edmonton Nordic Spa Development Rezoning Green Light

May 10, 2025

Edmonton Nordic Spa Development Rezoning Green Light

May 10, 2025