Palantir Stock Q1 Earnings: Government And Commercial Business Trends

Table of Contents

Government Contracts and Revenue Growth

Analyzing Government Sector Performance

Palantir's government business remains a cornerstone of its revenue generation. Increased government spending on national security and defense continues to fuel growth in this sector. The company's ability to provide advanced data analytics and AI-powered solutions to complex challenges is a major driver of this success.

- Specific contract wins: While specifics are often confidential due to national security concerns, the Q1 report indicated significant new contract awards and extensions across various government agencies.

- Percentage increase in government revenue year-over-year: The reported year-over-year growth in government revenue showcased a robust performance, exceeding expectations for many analysts. Specific figures were released in the official earnings report.

- Key government clients: Palantir continues to serve a range of key government clients, including agencies involved in national security, intelligence, and defense. The diversification of its client base within the government sector helps mitigate risk.

- Geographical distribution of government contracts: The company's government contracts are geographically diverse, reducing reliance on any single region and demonstrating the global demand for its solutions.

The influence of geopolitical factors and emerging defense technologies, such as AI-driven threat detection and predictive analytics, is significantly increasing government demand for Palantir's platform. This positions the company for continued growth in this sector.

Commercial Business Expansion and Key Partnerships

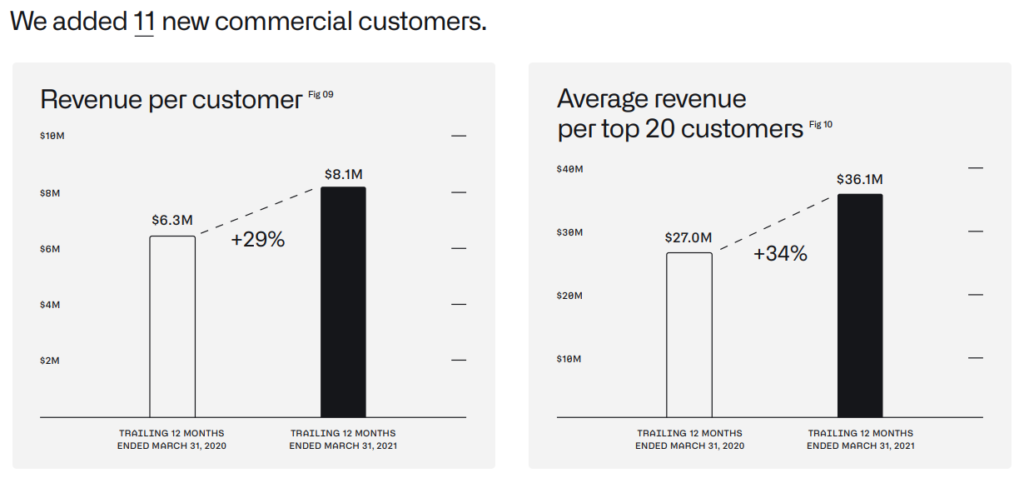

Growth in the Commercial Sector

While the government sector remains a major revenue stream, Palantir's expansion into the commercial market is crucial for long-term growth and diversification.

- Examples of new commercial clients acquired: The Q1 earnings report highlighted the acquisition of several significant clients across various sectors, signifying progress in penetrating new markets. Specific examples were included in the earnings call transcript and press release.

- Specific industries targeted (e.g., healthcare, finance): Palantir is strategically targeting high-growth sectors like healthcare, finance, and energy, where its data analytics platform can deliver significant value.

- Revenue growth in the commercial sector: The reported revenue growth in the commercial sector, while perhaps not as dramatic as the government sector, indicated positive momentum and the effectiveness of Palantir's commercialization strategy.

- Details on key partnerships and collaborations: Palantir is forging strategic partnerships with major technology players and industry leaders to broaden its reach and enhance its platform's capabilities. These alliances contribute to its expanding commercial footprint.

Palantir faces challenges in the competitive commercial market, including overcoming the perception of complexity and high costs associated with its platform. However, the company's strategic focus on specific high-value industries and its growing network of partnerships are mitigating these challenges.

Profitability and Financial Performance Metrics

Analyzing Key Financial Indicators

Beyond revenue growth, evaluating Palantir's overall financial health is crucial for understanding its long-term prospects. This involves analyzing key financial indicators beyond revenue.

- Profit margin: While profitability remains a key focus for Palantir, the Q1 report might show a mixed picture reflecting investments in growth and expansion.

- Operating expenses: Operating expenses provide insights into the company’s cost structure and efficiency.

- Cash flow: Positive cash flow is essential for sustaining operations and future investments. The Q1 report highlighted the company's cash position.

- Debt levels: The level of debt influences the company's financial flexibility.

- Earnings per share (EPS): EPS is a key metric for assessing the profitability of the company on a per-share basis.

- Guidance for future quarters: The company’s guidance on future quarters provides insights into its expected financial performance and its outlook on future growth.

Increased investments in research and development are essential for maintaining Palantir's technological edge. While this might impact short-term profitability, it's a critical investment for long-term growth and competitiveness. Investor reactions to the reported financials were mixed, reflecting both optimism about the long-term potential and concern about near-term profitability.

Future Outlook and Predictions for Palantir Stock

Market Sentiment and Stock Price Predictions

Predicting Palantir's future stock performance involves analyzing various factors.

- Analyst ratings and price targets: Analyst ratings and price targets offer a consensus view on Palantir's future stock valuation, although these predictions vary widely.

- Impact of macroeconomic factors: Broader economic trends can significantly affect Palantir's performance, particularly the government sector's budget allocation.

- Potential for future contract wins: The pipeline of potential government and commercial contracts is a significant factor influencing future growth.

- Competitive landscape analysis: Analysis of competitors and their strategies will help assess Palantir's position and potential future market share.

Palantir's long-term potential hinges on its ability to maintain growth in both government and commercial markets. Its advanced data analytics platform and AI capabilities position it well for continued growth, but challenges remain in terms of competition and profitability.

Conclusion

Palantir's Q1 earnings report presents a complex picture, highlighting both successes and challenges. Growth in government contracts remains a significant driver of revenue, but the commercial sector's expansion is critical for long-term sustainability. While certain financial metrics reflect promising progress, challenges remain in maintaining profitability and navigating a competitive landscape. Investors should closely monitor future earnings reports and analyze both government and commercial market trends to make informed decisions about Palantir stock. Understanding these dynamics is crucial for assessing the long-term viability and investment potential of this significant player in the data analytics and AI industry. Stay informed about future analyses on Palantir's stock performance to make well-informed investment choices.

Featured Posts

-

Prognozy Na Matchi Ligi Chempionov Polufinaly I Final 2024 2025

May 09, 2025

Prognozy Na Matchi Ligi Chempionov Polufinaly I Final 2024 2025

May 09, 2025 -

Representative Ocasio Cortez Slams Fox News For Trump Bias

May 09, 2025

Representative Ocasio Cortez Slams Fox News For Trump Bias

May 09, 2025 -

Sensex Live 100 Points Higher Nifty Above 17950 Market Analysis

May 09, 2025

Sensex Live 100 Points Higher Nifty Above 17950 Market Analysis

May 09, 2025 -

Tham Kich Tien Giang Bao Mau Bao Hanh Tre Em He Luy Va Giai Phap

May 09, 2025

Tham Kich Tien Giang Bao Mau Bao Hanh Tre Em He Luy Va Giai Phap

May 09, 2025 -

Chute Mortelle A Dijon Un Jeune Ouvrier Decede Apres Une Chute Du 4e Etage

May 09, 2025

Chute Mortelle A Dijon Un Jeune Ouvrier Decede Apres Une Chute Du 4e Etage

May 09, 2025